Old FAANGs fade away while new FAANGs emerge

The last decade saw the rise and rise of tech-led FAANGs (short for Facebook, Amazon, Apple, Netflix, Google). But things are changing. The unexpected Ukrainian war and fast-rising interest rates have led to a new group of FAANGS – in Fuel, Agriculture, Aerospace, Nuclear, Gold. Here we look at the case for buying in to these new sectors.

“There are decades,” observed Lenin, “where nothing happens. And there are weeks where decades happen“.

The last week of February certainly proved Lenin right. The invasion of Ukraine, once thought improbable, swept away many of our wrong assumptions.

The unexpected geopolitical violence resulted in a furious leap in commodity prices. This then triggered a surge in inflation (how to invest during inflation). In turn, central banks have no choice but to hike rates at a faster pace. The next Fed meeting may see the first 50bps (0.5%) hike in decades. Coupled with a powering-down China due to covid lockdowns, investors are battered by these unexpected developments.

We are in uncharted territory here. Previous macro conditions have already changed beyond recognition. The days of low rates and good growth are vanishing fast. Replacing them are higher capital costs, deepening supply chain problems and lumpy economic activities.

Not so long ago, investors worshipped tech stocks, primarily the FAANGs , a group of hyper-growing and quasi-monopolistic tech behemoths. As the world evolves, the sentiment towards these elite stocks has cooled considerably.

Take Netflix (US:NFLX). The company lost 70% of its value in just five months because of slowing subscribers growth. Facebook (US:FB) fared little better; its share price slumped by 50%. Years of share price appreciation count for nothing when their share prices nosedived to multi-year lows.

As these old FAANGs fade away, investors are pivoting to a group of new FAANG stocks and ETFs – in a bet that the new geopolitical conditions will favour these sectors. These new industries are: Fuel, Agriculture, Aerospace, Nuclear, and Gold.

What are these new FAANGs?

The new FAANG are concentrated in the material sectors. A war between two large nations has deep consequences, more so when these two countries export vast quantities of food, energy, and raw materials to the rest of the world. The modern economy needs these commodities to function and grow.

Let’s take a look at each of these new FAANG.

Fuel

The world is on the cusp of a transport revolution. The Ukraine war is hastening this process. How? By accelerating the shift away from ICE (internal combustion engine) vehicles.

High oil and gas energy prices will spur innovation in alternative technologies that use less hydrocarbon. For example, in the next decade or so, most automakers will stop producing petrol or diesel cars. Replacing them are battery-powered cars. The looming change will be dramatic.

For busses, electric and hydrogen-driven vehicles are starting to be delivered this year. While hydrogen railways (‘Hydrails’) are slowly being introduced into the market. As for planes, hydrogen-powered prototype engines are already under construction. Airbus announced in February that it is testing hydrogen fuel on A380, the largest of the commercial aircrafts. Taken together, it is clear that modern transport as we know it will be rendered obsolete sooner than expected.

Investing in these new sectors is imperative for investors.

The only problem is identifying ‘winners’ in this sector. The current two leaders – Tesla(NASDAQ:TSLA) and BYD (US:BYDDY) – have rallied thousands of percent during 2012-22. Searching for the next Tesla will not be easy. There will be hits and misses.

However, we can look beyond EV stocks. For example, apart from automakers, charger installers could be a growth sector. Wallbox(US:WBX), Blink Charging (US:BLNK), and Chargepoint Holdings (US:CHPT) are just some of the newer companies engaging in this area that supply chargers to the transport system.

In the UK, there are a few hydrogen companies in the LSE, such as ITM (UK: ITM) and Clean Hydrogen (UK:CPH2). These stocks can be volatile, simply because they are new.

What about the current oil sector? Should we not invest in them as oil prices stay elevated? Yes and no. Yes because oil firms are raking it. Even Warren Buffett is betting on Occidental Petroleum (US:OXY). Over the next year, oil majors’ excess profits will attract further buying, especially as the tech market weakens. You may have some exposure here for their dividends and buybacks.

Agriculture

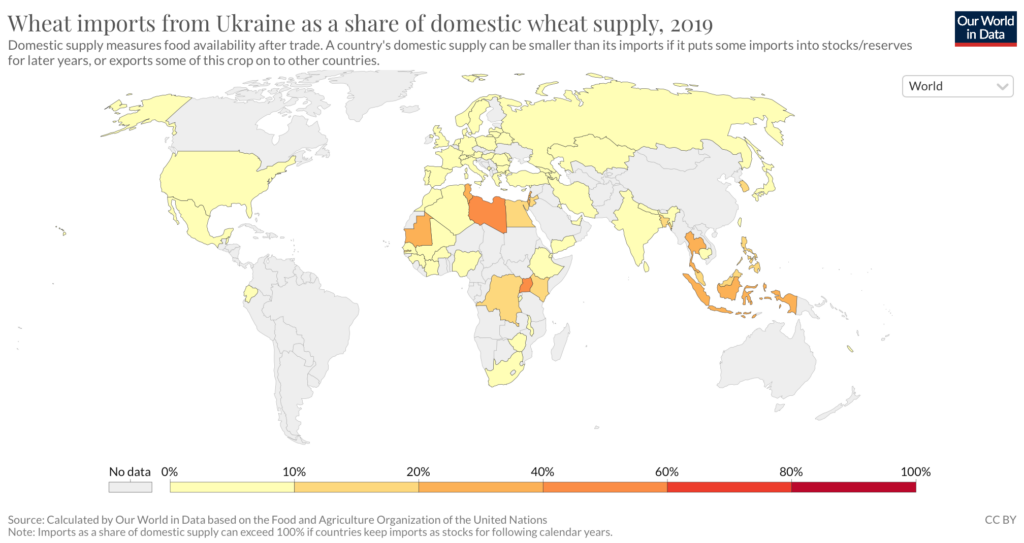

Few realised before the war that Ukraine is the ‘bread basket of Europe’. Its fertile black soil (known as ‘chernozem‘) yielded more crops than most other countries. Among Ukraine’s largest food exports are sunflower oil (42% of world’s production), wheat(8.9%), maize (9%), corn, rapeseed etc. According to some recent statistics (2019), Ukraine is the 6th largest exporter of wheat. Many developing countries (such as Egypt and Indonesia) rely heavily on Ukraine’s food crops (see below). But the war has disrupted these supplies.

“Wheat prices,” predicts the World Bank this week, “are forecast to increase more than 40 percent, reaching an all-time high in nominal terms this year. That will put pressure on developing economies that rely on wheat imports.”

Jim Rogers has been expounding the case for agriculture for years, citing a lack of supply and rising demand for key crops. His long-term outlook has certainly been proven right this year. DB Agriculture (DBA), the $1.8 billion commodity ETF, surged nearly 30% over the past year. As long as the war continues, supply disruption will persist. Ergo, Ffod prices will stay buoyant.

In addition, there is a case for buying agriculture-related sectors, such as farm machineries (such as Deere, US:DE) or fertilisers (CF Industries, US:CF or Mosaic Company, US:MOS). Watch to buy these stocks on setbacks.

Aerospace

One unintended consequence of the war in Ukraine is precipitating Germany to re-arm itself. The country is committed to increase its defence spending by up to E100 billion in the coming year. Tanks, guns, missiles, planes, drones – the whole suite of offensive and defensive capabilities – are now needed to fulfil Europe’s defence needs. After years of low defence spending, this is now a growth sector

And remember, war destroys. As the Ukraine war drags on, western governments will need to make even more weapons to send to Ukraine to defend itself. As such, defense stocks have soared since early March as investors realised that higher defence spending will materialise in the coming years. Upgrading the arsenal by western allies will be good for business.

The CEO of Raytheon (US: RTX), maker of Stinger missiles, anticipated this week that “we remain confident in the long-term outlook for our businesses, supported by the return to travel and growing global defense budgets.“

The UK weapon manufacturer BAE Systems (BA.) rose to multi-year highs in March on the back of higher earnings expectations.

In sum, rising geopolitical tensions will result in more re-armaments by NATO countries. This creates long-term tailwinds for the defense sector. You can diversify into the sector with ETFs like iShares Defense and Aerospace (US:ITA).

Nuclear

Western, particularly European, countries are in a bind. On one hand, they wish to support Ukraine by sanctioning Russian energy exports. On the other, they import a vast quantity of energies from Russia. How do you solve this dilemma?

Western governments need energy from somewhere – and fast. As events show this week, Russia will not hesitate to halt its gas exports in retaliation to western-led sanctions. Poland and Bulgaria are two countries to suffer from Russia’s ‘blackmail’ this week. Immediately, gas prices soared.

source: tradingeconomics.com

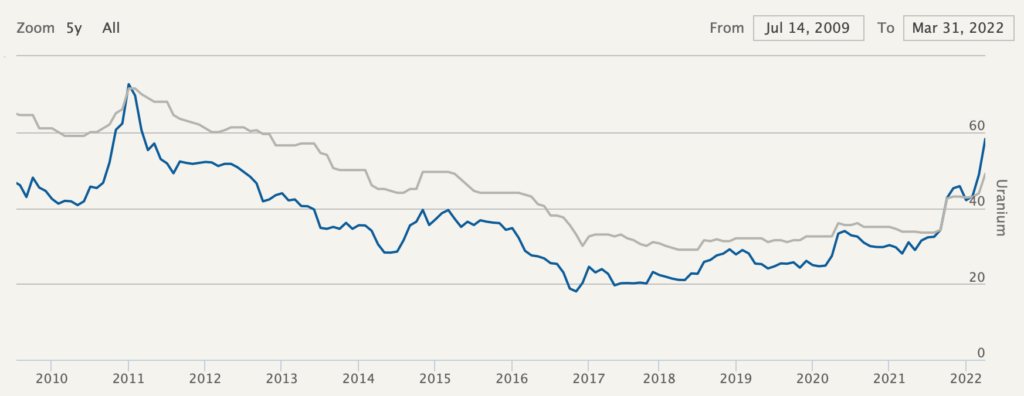

As early as 2020, I identified uranium as a high-reward sector. The reasons were twofold: rising uranium prices and technically-attractive uranium miners. The decade-long bear market precipitated by the Fukushima accident appeared to be ending. Indeed, uranium stocks jumped in 2021.

As the war lengthens, nuclear is one option on the table. Uranium prices have strengthened in recent months as companies anticipate potential supply problems and increased demand from other countries. Prices from Cameco (US:CCO), one of the largest uranium miners in the world, show spot uranium at 10-year high (see below). Even the UK is looking to boost its energy independence with Small Modular Reactors (SMR).

source: Cameco.com

Investors may invest directly in uranium with funds that hold uranium. One good example is Yellow Cake (UK:YCA) plc, a LSE-listed fund that holds about 15.8 million lb of uranium (U3O8). The $740-million company reported this week an increase in its net value in the first quarter by 38%. Interestingly, the company is buying back its own shares when the discount to its the NAV widens above 10%.

For uranium miners, you may look at Global X Uranium (US:URA), a fund that specialises in buying mining companies. The case for buying nuclear is clear, although one has to be remember that this is a cyclical industry with plenty of volatile price moves.

Gold

Gold is understood to be a safe haven asset during geopolitical tensions. That’s why gold prices jumped above $2,000 per ounce in the days following Russia’s invasion of Ukraine.

Gold is also a hedge against inflation. In the seventies, the metal rose 35x to a peak of $800 due to inflation fears. As inflation soared in recent weeks, investors are shifting more capital into gold.

However, will gold be the ultimate inflation hedge? What are the pros and cons of investing in precious metals in 2022?

On the upside, gold is a relatively stable asset that may protect the wealth of your assets. On the downside, it has to compete with other assets, such as property. Rising interest rates may see investors put less capital into precious metals which yield no return apart from capital appreciation (like buying Bitcoin).

Meanwhile, despite the bullish argument for gold, miners are not doing that well. Look at the VanEck Precious Metal Miners ETF (US:GDX) – prices slumped this month to touch multi-week lows.

Therefore, while there is a case for investing in gold, remember to a) keep that position small and b) diversify among gold, silver and miners.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.