If the recent volatility in gold prices worries you and you don’t want to get involved in trading gold, but still want to potentially profit from it. A slightly safer alternative is to invest in Gold. It may seem difficult to invest in Gold, but it’s actually quite easy to buy gold online. In this guide, we explain the three different ways to invest in gold, their risks, and how to buy gold for your portfolio.

Best Brokers For Buying Gold Shares & ETFs in the UK

| Name | Logo | GMG Rating | Customer Reviews | Annual Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews |

Annual Fees 0% - 0.25% |

Dealing Commission £3.50 - £5 |

See Offers Capital at risk

AJ Bell Reviews |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

Annual Fees 0% - 0.45% |

Dealing Commission £5.95 - £11.95 |

See Offers Capital at risk

Hargreaves Lansdown Reviews |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

Annual Fees 0.4% – 0.08% |

Dealing Commission £1 – 0.08% |

See Offers Capital at risk

Saxo Reviews |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

Annual Fees £0 |

Dealing Commission £3 |

See Offers Capital at risk

Interactive Brokers Reviews |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

Annual Fees £0 - £96 |

Dealing Commission £0 |

See Offers Capital at risk

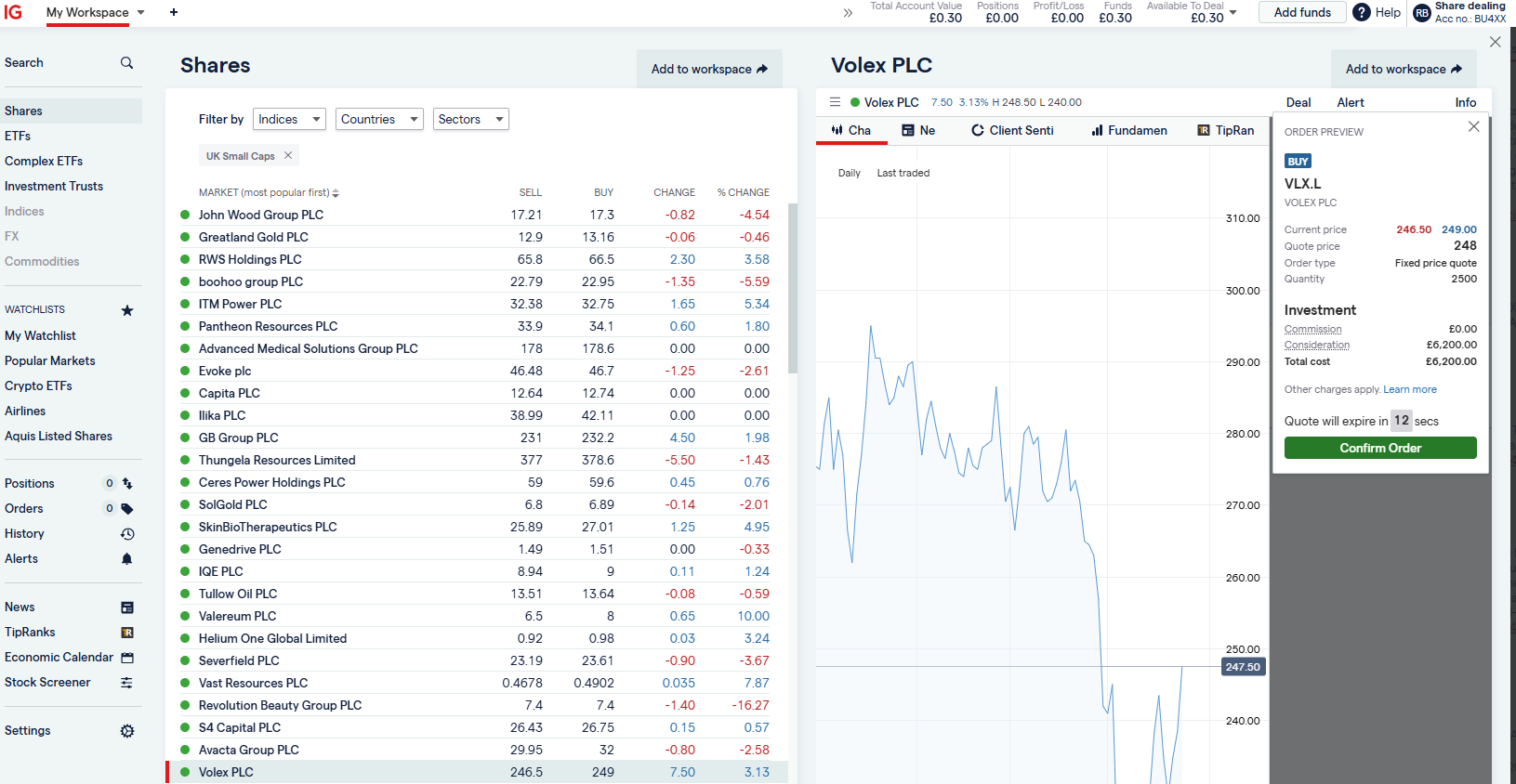

IG Reviews |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

Annual Fees £59.88 |

Dealing Commission £3.99 |

See Offers Capital at risk

interactive investor Reviews |

Features:

|

|

How do you buy Gold in the UK?

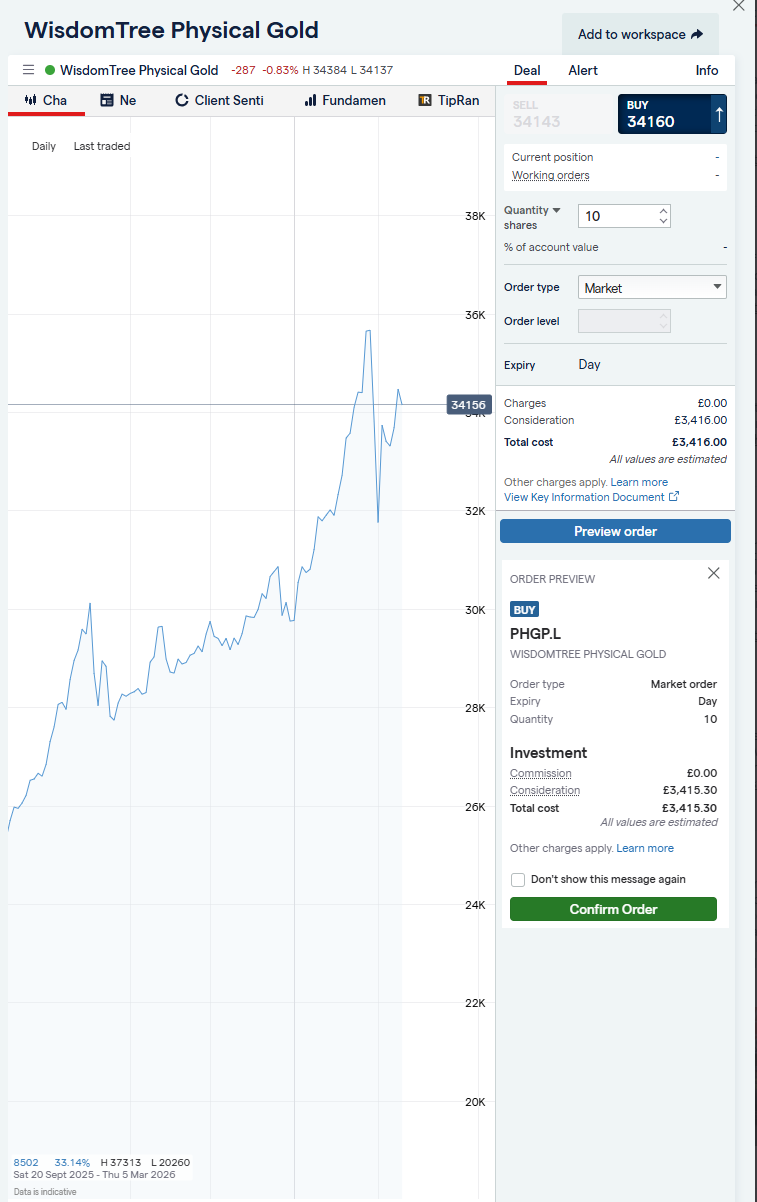

The easiest way to invest in Gold in the UK is to buy a Gold ETF like PHGP through a stockbroker like AJ Bell, IG or Interactive Brokers.

There are three main ways to buy gold:

- Physical gold

- Gold-related company shares

- Gold ETFs

The Wall Street Journal has recently reported that as the world falls out of love with Cryptocurrency, more people than ever are searching for “how to trade gold”. So, in this guide, we explain the different ways to speculate on the gold price, the risks involved in trading gold. Plus how to profit from gold tax-free and what moves the gold markets.

In the days before computers were invented, gold could only be traded physically. You had to buy and sell gold bars, coins or jewellery. (As a historical note: during the Great Depression, US citizens couldn’t even own gold legally!)

But all this has changed. Today’s hyper-connected economy has accelerated the trading of the yellow metal. First, gold was delinked from the US Dollar in 1971. This created movements in the gold price. Second, the invention of gold futures popularised gold trading. More recently, the arrival of gold exchange-traded funds (ETFs) further excited gold investors.

Buying Physical Gold

The best way to buy physical gold is to invest in gold bars or coins through dealers like StoneX Bullion or BullionVault and store them in secured places (eg bank vaults, with annual charges of course). There is an active market for these precious metal assets in the UK.

The problem with trading physical gold is friction: Storage costs, wide spreads and unfavourable commissions. Not to mention security. And unlike stocks, there is no dividends from owning gold bars.

Buying Gold-Related Company Shares

Precious metal stocks are another way to gain exposure to gold. Many junior mining companies prospect for gold (exploration) but these companies are fairly risky. For more conservative investors, mature gold miners – miners that already have productive mines – are a better bet. These gold companies are listed on stock exchanges where any investors can buy their shares. The US has the biggest gold stock sector in the world, followed by Canada and Australia. These two countries have tremendous mineral resources and have developed a vibrant mining industry.

On the London Stock Exchange, there is a relatively small gold industry. The largest is Fresnillo (FRES), a £6 billion silver miner. Other smaller players are Centamin (CEY), Acacia (ACA), Hochschild Mining (HOC).

Buying Gold ETFs

Exchange Traded Funds (ETFs) that contain assets that track the gold price such as:

- ETFS Gold (LSE:PHGP) or ETFS Silver (LSE:PHAG)

- In the US: Gold (US:GLD) or Silver (US:SLV). Other choices include IAU

ETFs are popular because they are easily tradeable. You buy and sell ETFs like stocks.

Now, apart from physical gold ETFs, there is a suite of gold miner ETFs. These ETFs buy and hold a variety of companies engaging in gold mining activities. The VanEck Gold Miner ETF (GDX) is one of the largest ETFs specialises in holding a portfolio of gold miners. Asset under management totalled $13 billion spread over 49 stocks, including Newmont (US:NEW), Barrick Gold (US:Gold) and Franco Nevada (US:FNV). These are mature miners.

The junior version of GDX is the VanEck Junior Gold Miner (GDXJ), which tend to hold the more speculative miners.

However, a note to remember is this: Precious metal stocks and gold prices may not move exactly. Inexperienced investors tend to assume they move together. So when gold rallies they pile into miners. This is incorrect. At times, gold and gold miners may not even trend in the same direction. Stocks could vastly outperform or underperform the underlying metal – and vice versa. Consequently, many view gold stocks, particularly junior miners, as a ‘high beta’ bet on gold.

Saxo Markets, for example, offers a wide range of Gold ETFs. Note there will be an annual management fee for these ETFs and some will be US Dollar denominated.

The SPDR Gold Shares ETF (GLD), one of the oldest ETFs in the market.

The instrument holds physical gold. According to its latest factsheet (April 2024), the size of the fund is valued at a decent $63 billion.

Did you know, in 2011 this gold fund was once the world’s largest ETF, beating SPY? Of course, after a decade of equity bull run since, S&P 500 (SPY) has amassed assets of $497 billion. Imagine what will happen to gold prices if this gold fund were to quadruple its assets….

Why is gold such a popular investment?

Gold is a popular investment because it’s widely seen as a safe-haven asset that tends to hold its value during inflation, market crashes and geopolitical uncertainty.

It has a long history as a store of wealth, isn’t tied to any single government or currency, and is often used to diversify portfolios when stocks and bonds look risky. Investors also like gold because central banks hold and buy it, which reinforces its credibility as a global reserve asset.

When interest rates fall or money supply rises, gold often attracts demand as a hedge against currency debasement. In short, it offers psychological and financial protection when confidence in the wider financial system weakens.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.