Pepperstone, one of Australia’s largest forex trading platforms, with offices across the globe, is launching dedicated coverage of the forthcoming US elections. Pepperstone will provide clients with a dedicated analysis of the election and key events leading up to it.

The next of these is the Vice Presidential debate scheduled for Tuesday, October 1st. When the candidates’ running mates, Messrs Walz and Vance go head to head, to try to win the hearts and minds of the voting public.

The Pepperstone analysis, which is led by their Head of Research, Chris Weston, looks at the headline policies of each Presidential candidate and their possible effect on the markets.

Chris Weston also looks at the use of technical and fundamental analysis of the markets, and how those disciplines can help highlight trading opportunities, in the run-up to polling day, and beyond.

The analysis, which is updated daily, also considers how the election could affect the dollar, US treasury bonds, and commodities such as gold and oil, as well as equity indices and ETFs.

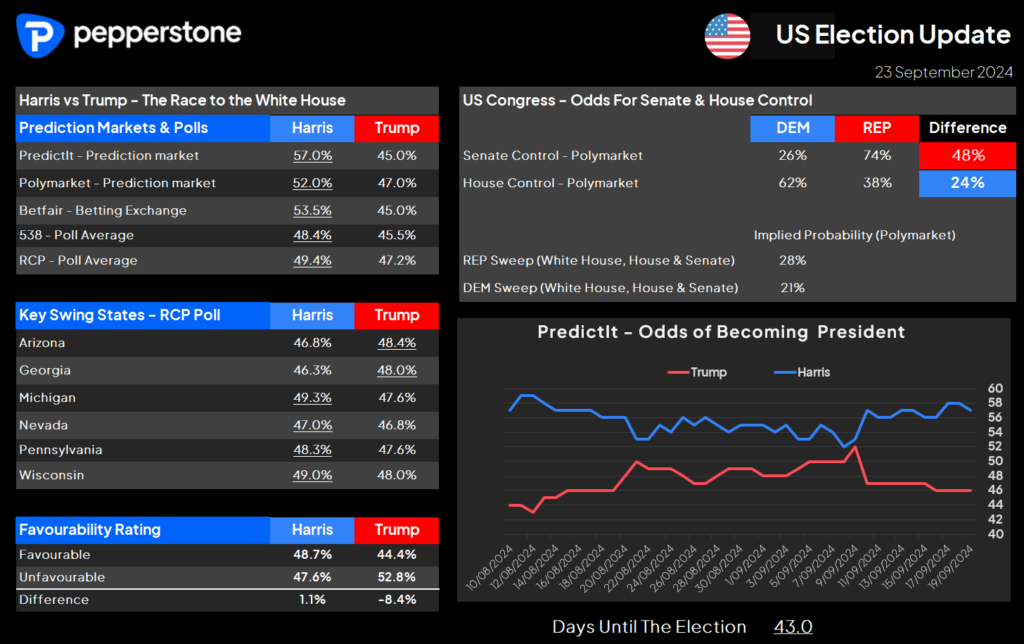

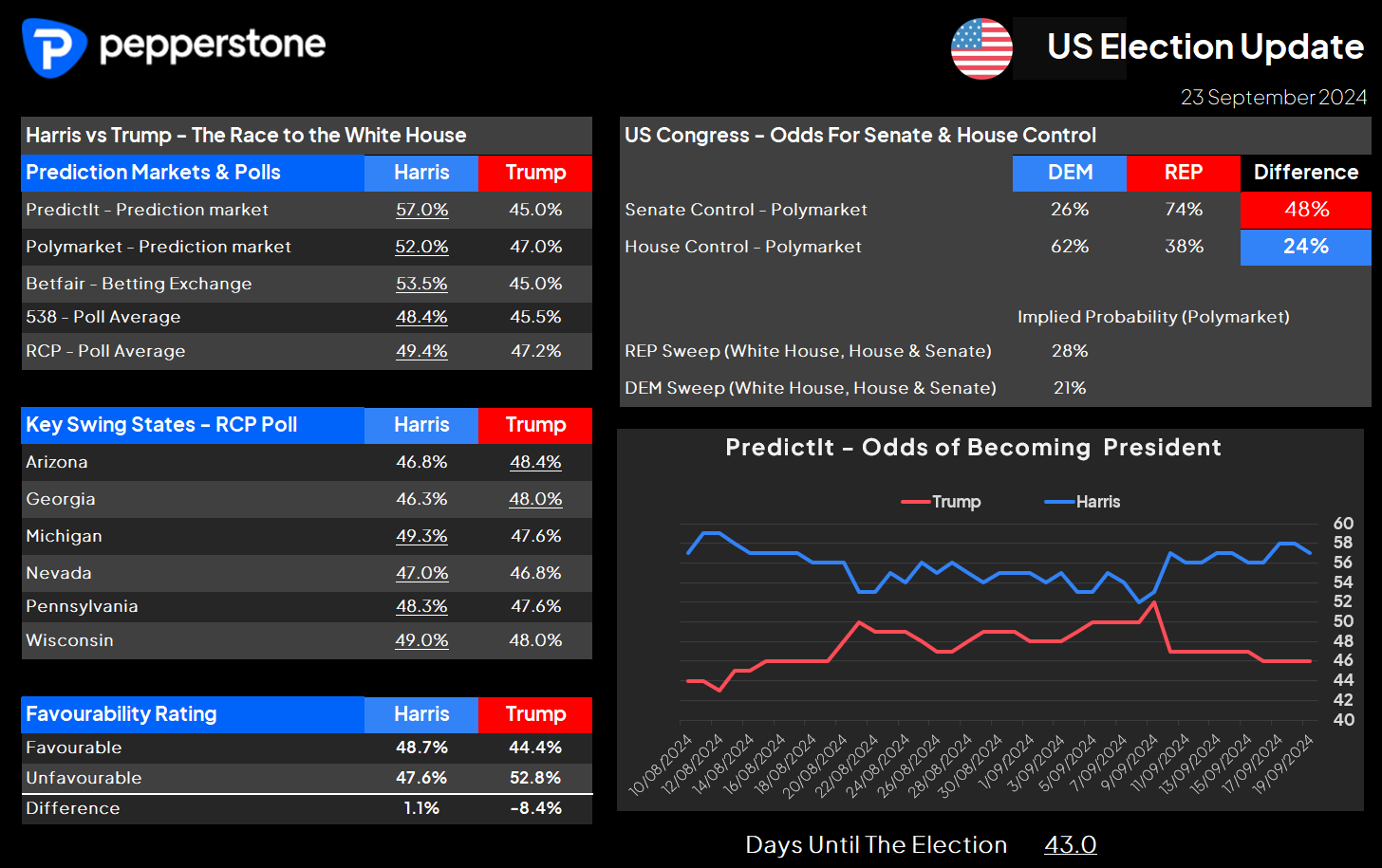

Pepperstone is also offering insight into the performance of pre-voting polls and prediction, or betting markets.

Covering items such as the control of the House and Senate, and the outcome in key swing states, that could help to decide the election.

Prediction markets and polls currently point to a victory for Democrat Kamala Harris, who leads her Republican rival, Donald Trump, by as much as 8.0% points.

Though some polls have a much narrower margin of just 1.10% in favour of the Democrats

Kamala Harris also has a clear lead in the favourability ratings, beating Donald Trump by +3.80%

Swing States are the key battleground in the US election. The seven states contain a relatively small number of votes of the total of 240 million eligible voters in the US, but they are predicted to punch above their weight in terms of the outcome.

The swing states are Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin.

In 2020, Democrat Joe Biden won six out of the seven, with only North Carolina falling to the Republicans.

To win the Presidential election, candidates must secure 270 or more of the so-called Electoral College votes, of which 538 are available.

The Electoral College votes are awarded on a per-state basis for example, Wisconsin has 10 Electoral College votes whilst North Carolina contains 16 and Pennsylvania 19 votes.

The election takes place on November 5th, however, the voting booths are already open in some states, such as Virginia.

In fact, in the 2020 election, as much as 69.0% of all votes cast, were cast early, either in person or mailed in, according to data from MIT and the BBC.

Alongside the Presidential election, some voters will also have the opportunity to voice their opinion on specific state-wide issues with as many as 140 measures being put forward this time out.

Voters will also elect 435 congressmen and women, and decide who gets to occupy 34 seats in the upper house, the Senate.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.