Forex trading is becoming increasingly popular. With new trading platforms and apps making it easy to access the global forex market, many retail traders are giving it a go.

Can you make money trading forex? Absolutely. That said, making money from forex trading isn’t as easy as some people make it out to be.

To help those interested in learning more about forex, we’ve put together this guide. Here, we cover:

- The basics of forex

- How to make money trading forex

- Whether it’s possible to make money with forex

- Tips for more profitable forex trading

- The risks of forex

- How to start trading forex

- How to find the best forex trading platforms

We also answer frequently-asked questions in relation to forex trading.

What Is Forex Trading?

At its core, forex trading is the process of buying and selling currencies such as the British pound, the US dollar, the Japanese yen, and the euro.

Often called ‘currency trading’, it involves buying one currency while simultaneously selling another, with the aim of profiting from movements in the currencies.

In the past, forex trading was mainly carried out by large financial institutions. However, today, it’s very popular with retail traders thanks to advances in technology.

To trade forex, you need an account with a forex broker. You can find information on the best UK forex brokers here at Good Money Guide.

What Are the Advantages of Forex Trading?

Forex trading has a number of advantages over other forms of trading. Advantages include:

- Low capital requirements: Today, you can start trading forex with a very small amount of money. You don’t need to be wealthy to get started.

- Leverage: Most forex brokers allow you to use leverage when you trade. This enables you to trade with more money than you have in your account.

- Flexibility: The forex market is open 24 hours a day, five days a week. So, you can trade on your own schedule. You can also trade from anywhere as long as you have a computer/smartphone and an internet connection.

How to Make Money Trading Forex

Making money from forex is quite simple in theory. All you need to do is predict whether a currency is set to strengthen or weaken against another currency.

Of course, in reality, it’s a bit more complicated than this. Here’s what you need to do:

The first step is to decide what currency pair you want to trade. An example of a currency pair is GBP/EUR. This reflects the number of euros to one British pound.

Then, you need to decide whether the price of the ‘base’ currency (the first currency in the pair) is going to strengthen or weaken against the ‘counter’ currency (the second currency in the pair) and make the appropriate trade.

If you think that the base currency is set to gain against the counter currency, you buy the currency pair. However, if you believe that the base currency is set to weaken against the counter currency, you sell the pair.

For instance, if you expect the British pound to strengthen against the euro, you buy GBP/EUR. If you expect the British pound to fall against the euro, you sell GBP/EUR.

Your profit (or loss) from the trade will depend on whether your prediction was right, and when you close the trade. Profits in forex are measured in ‘pips’. In a currency pair that is priced to four decimal places such as the GBP/EUR, a pip is a price movement of 0.0001.

So, if you were to buy GBP/EUR at 1.1000 and you closed the trade at 1.1005, your profit would be five pips. How much this would be worth in monetary terms would depend on how much capital was risked on the trade and the amount of leverage you used. If you were betting £10 a pip, your profit would be £50.

Bear in mind that as a forex trader, you are not going to get every trade right. In fact, you could be lucky to get 50% of your trades right. However, by running your winners and cutting your losses you could potentially still make a profit even if you were only right 50% of the time.

The best forex traders, and by ‘best’ I mean professional and institutional forex traders that manage billion-dollar hedge funds, make money by having robust trading strategies that are based on effective post-execution trade management.

Can You Make Money Trading Forex?

Plenty of people make money trading forex. If you’re a disciplined trader and stick to a proven forex strategy, it’s definitely possible to generate attractive returns.

However, it’s important to understand that trading the forex markets successfully isn’t easy. Ultimately, it can take years to develop a successful strategy and generate consistent profits, and many people lose money while they’re learning how to trade. Just look at the disclaimers on popular forex trading websites. Forex.com says that 72% of retail investor accounts lose money on its platform while at IG, the figure is 75%.

So, when you see forex traders on social media showing off their luxury cars and watches, and claiming that they make millions every year trading forex 10 minutes a day from a beach in Thailand, you should take this with a grain of salt. Most forex traders are not living this lifestyle. In fact, according to some sources, up to 95% of people that try forex trading end up losing money.

The Risks of Forex Trading

As for the risks of forex trading, there are two main ones to be aware of.

The first is volatility risk. There are many factors that can influence a currency’s strength (interest rates, inflation, economic data, political stability, etc.) and currencies can swing around wildly at times.

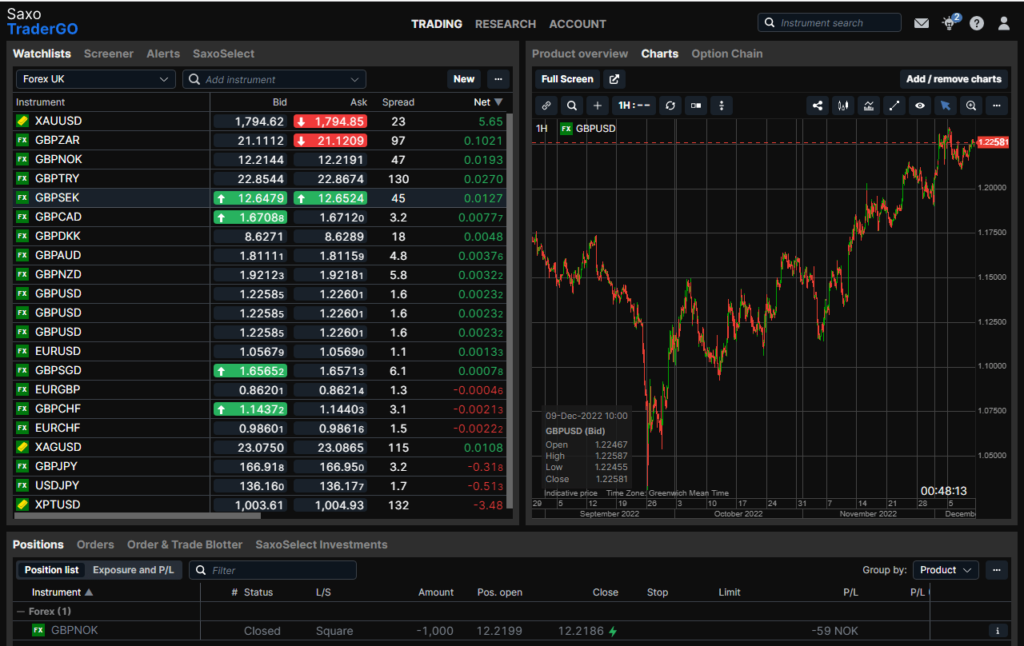

This was illustrated in the second half of 2022, around the time of the disastrous UK ‘mini-budget’, when the British pound fell from a rate of around 1.1730 to the US dollar to a rate of just 1.0330 in the space of just a few weeks. That represented a move of around 1,400 pips.

While this volatility can create excellent trading opportunities, it can also lead to large losses if you are positioned incorrectly. If a trade moves against you, losses can rack up quickly. If you do not have enough capital in your account to cover potential losses, your broker may automatically close your trades.

The other main risk in forex trading is leverage risk. While leverage is a powerful tool that can enhance your gains, it can also magnify your losses. If you use a substantial amount of leverage on a trade, even a small price movement in the wrong direction can result in major losses.

It’s worth pointing out that there are a number of risk management strategies that can help minimise losses when trading forex. These include:

- Position sizing: When trading forex, it’s sensible to avoid risking more than 2% of your trading capital on any single trade. By keeping position sizes small, you can reduce the risk of blowing up your whole account.

- Using stop losses: Stop losses help minimise trading losses by closing out losing positions before you rack up large losses.

- Using leverage sensibly: Leverage can be dangerous. By using it sensibly, you can minimise catastrophic losses.

Tips for More Profitable Forex Trading

If your goal is to generate consistent profits from forex trading, here are some tips:

- Develop a strategy: Before you start trading, take some time to develop a trading strategy. The way professional forex traders make money is by having an effective strategy. Typically, the pros run their winners and cut their losses.

- Create a set of trading rules: Develop rules for maximum position sizes, entry points, exit points, and stop losses. These rules will help you maintain discipline when trading and reduce your risk.

- Focus on risk management: The best forex traders put a lot of focus on risk management. This minimises their losses and gives them a better chance of success.

- Practise with a demo account: Many forex platforms offer demo accounts. These can be a good way to practise trading forex when you are starting out as your capital is not at risk.

Is getting it right half the time in Forex trading enough?

Potentially, read Art of Execution, it’s a fantastic book by Lee Freeman-Shor who managed around $2bn at Old Mutual. Over 7 years he gave 45 of the world’s top investors between $25m and $150m to invest in their best ideas. Turns out that most of these ideas were wrong.

But and this is a big BUT. Even though most of their trading ideas lost money, overall, the investors made a profit. How so? Well, read the book, and you’ll thank me for it. It’s only 200 pages. We also covered this when we wrote about how to find out what the hedge funds are shorting.

Simon Savage was quoted in the FT recently saying that a GLG manager with a 50% success rate is considered a good stock picker.

- Related guide – Best brokers for shorting shares.

The above two examples are about stock trading, but it translates to forex trading. The way professional currency traders make money is by having an effective forex trading strategy. This strategy is basically to run your profits and cut your losses – the only way to successfully trade.

How Do You Become a Professional Forex Broker?

Becoming a professional forex trader takes time and effort. There are no shortcuts. To become a professional forex trader, you will most likely have to spend years developing and perfecting a forex trading strategy that can generate consistent profits.

You will also need to build up a large amount of capital to trade. Let’s say you were able to generate a return of 10% per month on your capital (that’s a very good return). To obtain an income of £5,000 per month, you would need capital of £50,000.

Getting Started with Forex Trading

If you want to try your hand at forex trading, here’s how to go about getting started:

- First, learn as much as possible about forex trading and develop a trading strategy. Here, think about the currencies you will trade, how you will place trades, and how you will manage risk.

- Then, find a reputable forex broker. Good Money Guide can help you with this as we compare forex platforms, highlighting the strengths and weaknesses of each platform. Once you have selected a broker that is right for you, open an account.

- Finally, deposit funds into your account and start trading.

Making Money with Forex Trading – FAQs

It can be. If you have a robust trading strategy, it is definitely possible to generate profits. Generating consistent profits can take time, however. Research shows that a lot of new traders lose money.

The answer to this depends on your strategy. There are certainly risks involved with forex trading. These include volatility risk and leverage risk. However, these risks can be minimised by keeping position sizes small, using stop losses, and using leverage sensibly.

If you are really good at forex trading, it is possible to make a living from it. However, there are not many traders who achieve this. Making a living from forex requires a combination of knowledge, experience, discipline, and skill.

The income of forex traders varies. Some traders make a lot of money, while others make little or generate losses. In theory, however, there is no limit as to how much you can earn from trading forex.

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognized as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.

You can contact Ed at edward@goodmoneyguide.com