It’s just been reported that short interest in FTSE 250 stocks is at it’s highest level since the mini budged. What this means is that people (hedge funds in particular) think the stock market is going to go down. Which for some people is good news, those people are short sellers. Going short means that you profit when stocks or a market goes down instead of up and whilst it may sound complicated it’s actually quite easy. In this guide, we’ll go through how to short stocks, and the risks and potential rewards of shorting the market.

Related short selling guides:

How does short-selling work?

Short selling is speculating that the price of a financial asset will go down rather than up. Short selling is mainly used for trying to profit from falling shares prices, protecting investment portfolios in bear markets and derivatives trading like CFDs, spread betting and futures trading.

When you go short you are selling a stock that you do not own in the hope that it will reduce in value before you buy it back. The principle of shorting stocks is not new, professional traders and hedge funds have been shorting stocks it for years. It works like this:

- Fund A thinks the share price of Vodafone will go down and they want to bet on a drop in the short term (a few months).

- Fund A knows that Fund B has a long term (a few years) position in Vodafone shares.

- Fund A asks to borrow Fund B’s Vodafone shares so they can sell them to someone else.

- Fund B lends Fund A the Vodafone shares and charges 5% of the value as a fee.

- Funds A sells the Vodafone shares on the London Stock Exchange

- A month later Vodafone shares have dropped in price and Fund A buys them back.

- Fund A then gives the shares back to Fund B.

Different ways to “go short”

The main ways to short-sell the market are:

- Financial spread betting – take a bet on a stock

- CFDs – a contract based on the difference between the opening and closing price of your trade

- Inverse ETFs – these are exchange-traded funds that go up when the asset they track goes down

- Options – you can either buy puts or sell calls to speculate on the market going down

Short selling with financial spread betting

For the private spread betting investor, going short it is much simpler as you do not have to go through the process of borrowing stock to sell it. You can just bet a certain amount per point that the shares will go down. Plus, with a financial spread betting profits are tax-free as trades are structured as bets.

To do this, you will need an account with a spread betting broker that will either net the position off against one of their clients that is long or will borrow the stock just like Fund A did in the example above. Then give it back when you close your position.

This example is based on a single trade and the intricacies of a brokers stock lending and borrowing team are much more complex than this.

So for example, if you bet £10 a point (cent) that Deutsche Bank stock (priced at 7.72) moves then you could potentially make £7,720 if it goes to zero. In order to execute the trade you would have to deposit £1,500 in initial margin and make sure you have enough money on your account for daily P&L margin.

Another benefit of shorting as a spread bet is that even though Deutsche Bank trade in Euros you can have a GBP position.

- Further reading – compare the best spread betting brokers here or read our guide to how financial spread betting works

Short selling with CFDs (contracts for difference)

Short selling with a CFD is similar to spread betting in that you trade on margin but instead of betting a £ per point you buy and sell an equivalent amount of CFD instead of selling the shares. Be mindful that you always trade in the currency of the underlying asset so using our DB example, your P&L will be in Euros.

- Further reading: compare the best CFD brokers in the UK here

Short selling by buying a put option

Buying a put option will give you the right to sell a certain amount of stock in Deutsche Bank at set price.

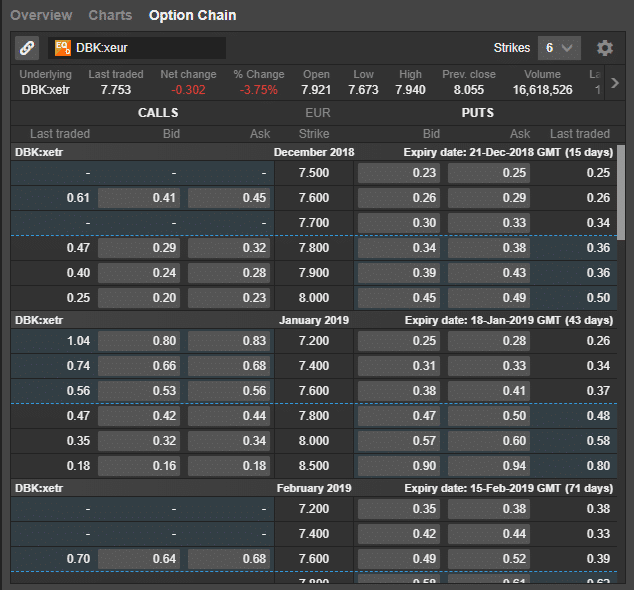

So taking an example from the below options chain on Deutsche Bank shares. If you buy some 7.6 January 2019 put options you will have the right to sell your Deutsche Bank at 7.6 even if the price is trading on the market at 6. Of course, you don’t have to wait till the option expires, you can sell your option position. If the price has moved lower the intrinsic value of the option will have increased from 0.41. However, the closer the option gets to expiry the lower the time value will get.

You can read more about calculating the time value of an option for options trading here.

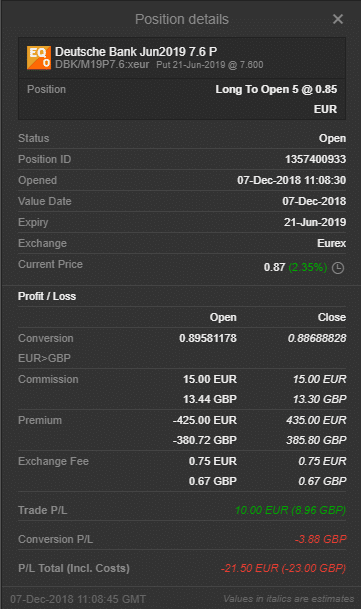

The risk with options is that you lose the premium that you paid and the option expires out of the money worthless. The benefits of shorting via options are that your risk is limited, but they can expire worthless.

An example of a put options order execution ticket below:

Short selling buy selling a call option

This is a very high-risk form of short selling because your losses are unlimited. Unlike buying a call options where your losses are limited to the premium you paid for the options and your potential profits are unlimited. When selling call options (or writing call options) your profit is limited to the price you receive for the call option but your losses are unlimited.

- Further reading: compare the best options trading platforms in the UK here.

Pros & cons of short selling

Benefits of short selling

- Short selling could be suitable for experienced investors who enjoy going against the grain. It is a lucrative activity for successful investigative traders who know what they are doing. There are professional funds that are dedicated to this activity alone.

- Short selling pays off just when you need it. For example, your short-selling activities may net you a fortune during severe bear markets. This gives you a layer of protection on your long-only portfolios.

- Short selling allows you to take more aggressive long activities because you have some downside hedge.

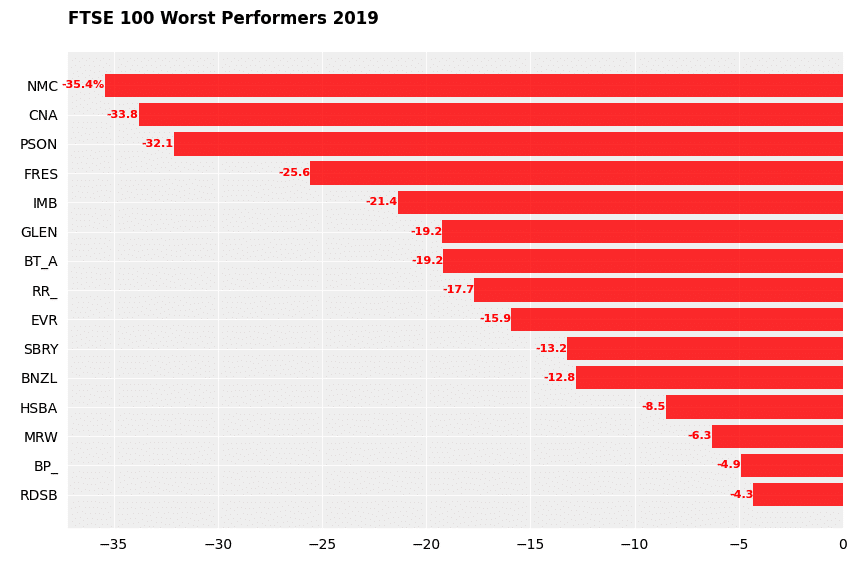

- There are plenty of opportunities for short sellers in the UK. During a relatively steady year (2019), there are many blue-chip FTSE stocks that plummeted in value. For example, Centrica (CNA), Fresnillo (FRES), Glencore (GLEN) all drop by double digits (see below). This created opportunities for short sellers.

When to consider short selling

There are three scenarios where short selling can be considered, speculation, fraud and portfolio protection.

- Related guide: 50 rules for successful trading

Speculative Mania

When stock markets have been rising to stratospheric levels and incredibly expensive valuation, it is ripe for short selling. One instance that comes to mind is the dot-com boom. Many stocks slumped by 99% in the crash that followed. Not to forget is that during the Global Financial Crisis in 2008 many short sellers made a fortune because they bet against the credit bubble. One key thing to bear in mind is that selling a mania requires a near-perfect timing. An expensive stock can become even more expensive before prices turn down.

Undiscovered Fraud

This means that investors are generally unaware of the underlying ill financial health of a company. One recent example in the UK is NMC Health (NMC), a former darling of the stock market. In December of 2019, the company was accused by Muddy Waters – a specialised research outfit that targets financial frauds – for concealing its true debt levels. Initially, the firm rejected these accusations. Then the true picture emerged weeks later and NMC was suspended, but not before its share prices collapsed by 75% from its peak (see below). If you smell something fishy about a stock, stay away. Better still, short sell it.

Bear Markets

During a bear market, most stocks will depreciate. Prices decline as profit outlook turn negative. Valuation of a stock shrinks. This means that the path of least resistance is to the downside, create trends that are favourable to short sellers.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com