In the world negative interest rates, minus 0.5% does not seem that bad.

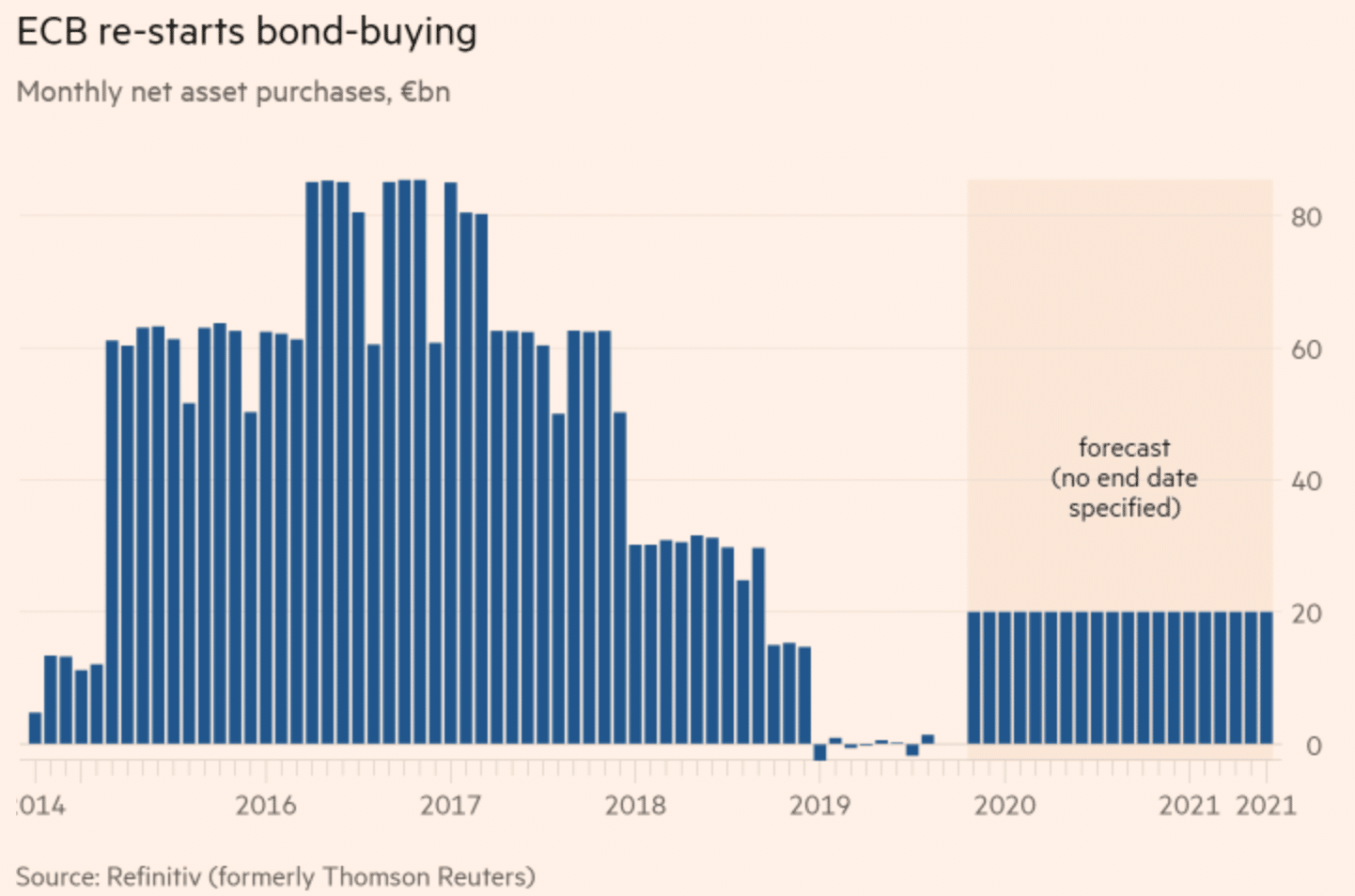

On Thursday, the European Central Bank (ECB) lowered the interest rate on the deposit facility by 10 basis points to minus 0.50%. The central bank also re-started the quantitate easing (QE) asset purchase program by buying €20 billion of sovereign bonds as from 1 November.

Moreover, the ECB states that the ‘reinvestments of the principal payments from maturing securities purchased under the APP will continue, in full, for an extended period of time…and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.’ These are strong reassurances.

The future ECB APP plan looks like this:

Source: Financial Times

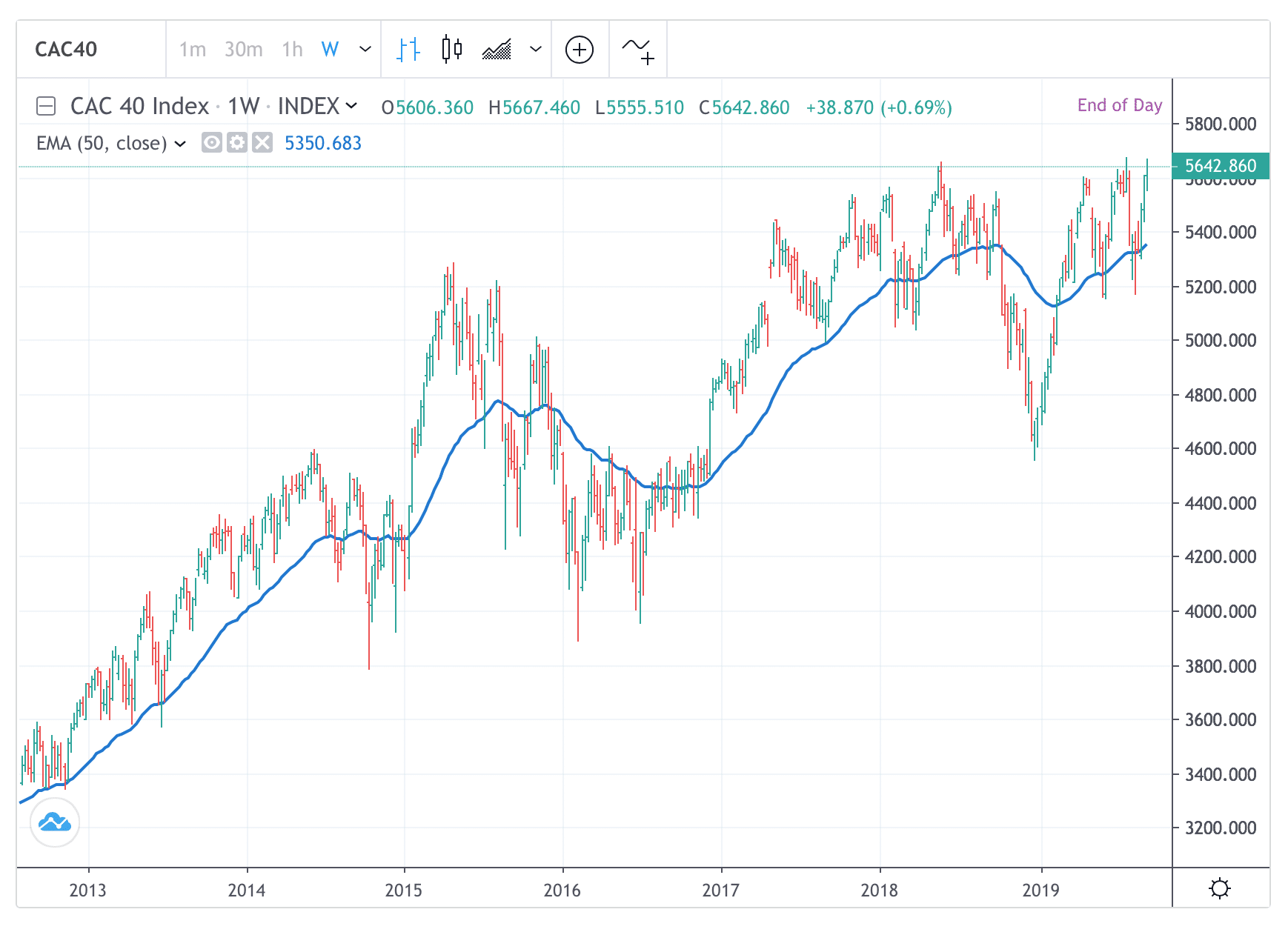

Judging from the reaction of market instruments, this ECB stimulus is stronger than what the market had hoped for. European equity markets rose; while the Euro rebounded significantly off its intraday lows. Some equity indices, like the French CAC 40 Index, are even on the brink of cyclical bull market highs.

This index has been flirting with the 5,600 resistance for some time without success. The latest monetary jolt from the ECB may propel the index into an upside breakout (see below). The index’s intermediate resistance is pencilled in at the psychological round number level at 6,000.

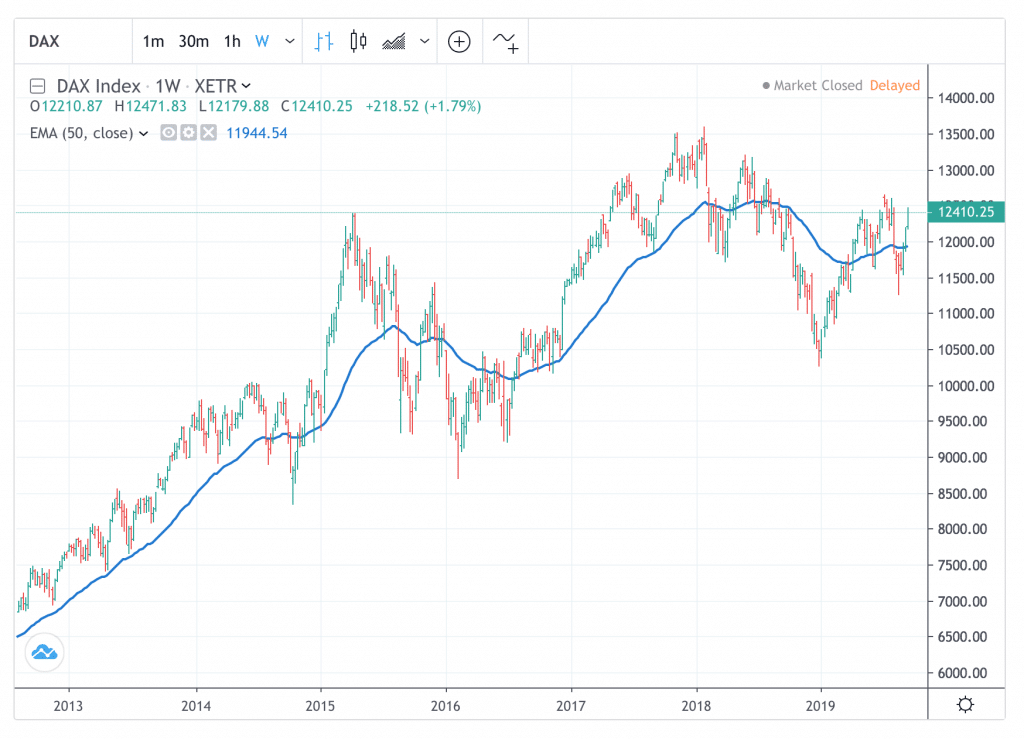

For the German Dax Index, 12,600 will be the first resistance to go. I expect a minor consolidation at this level before the bulls take on the next level at 13,000.

In sum, the ECB has clearly fired the starting gun on monetary easing in the developed world. This will exert increasing pressure on the Fed and the BoE to ‘do something’ to match ECB’s action. This is especially urgent in the UK as Brexit is threatening to wreck havoc on good supplies – and the economy. Also, we are in a ‘new world’ where central banks start to flood market with liquidity even though stock markets are trading close to their bull market highs. So I anticipate new cyclical bull market highs in stock markets, and possibly gold too, in the coming months.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com