Yesterday saw one of the most important monetary acts this year. The Fed chair, Jerome Powell, announced that the central bank would resume purchases of short-term Treasury bonds in order to bolster its balance sheet. This follows after weeks of shortages in the short-term fund market.

‘I want to emphasise,’ stressed Mr Powell, ‘that growth of our balance sheet for reserve management purposes should in no way be confused with the large-scale asset purchase programmes that we deployed after the financial crisis.’

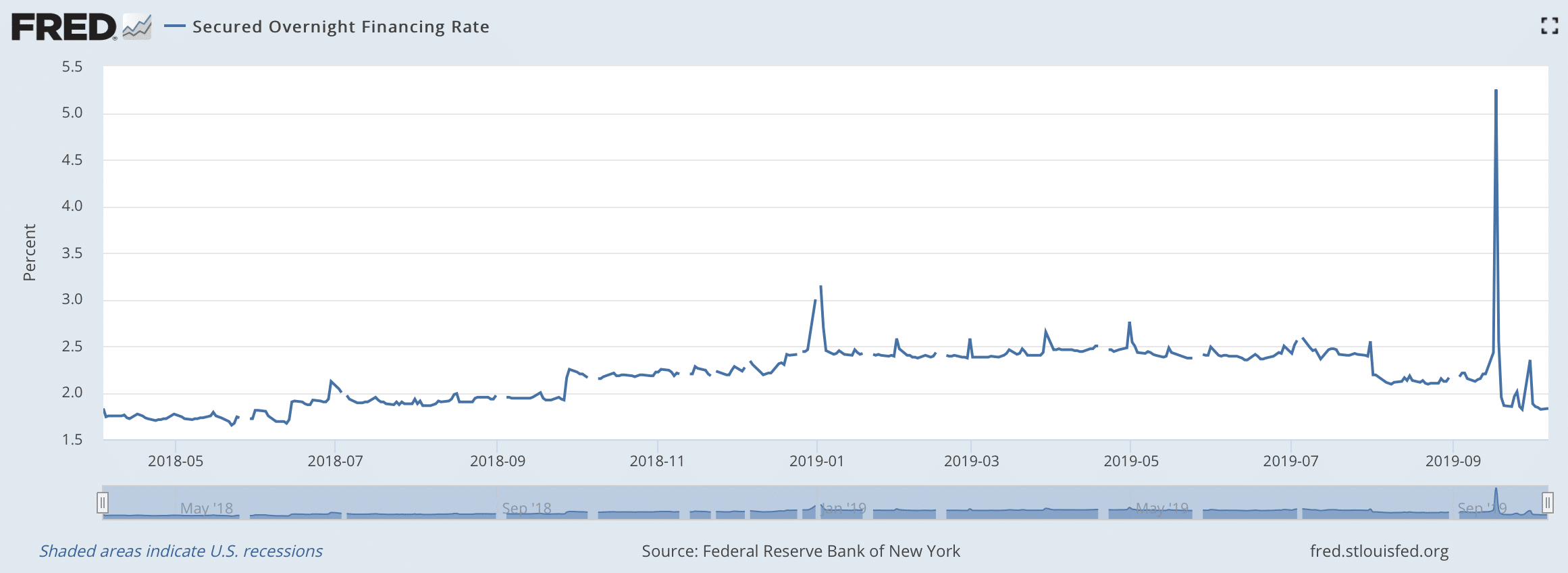

In addition, the NY Fed pumped billions more in the system to alleviate shortages of the dollar. Authorities want to calm down short-term borrowing rates which spiked last month (see an example below).

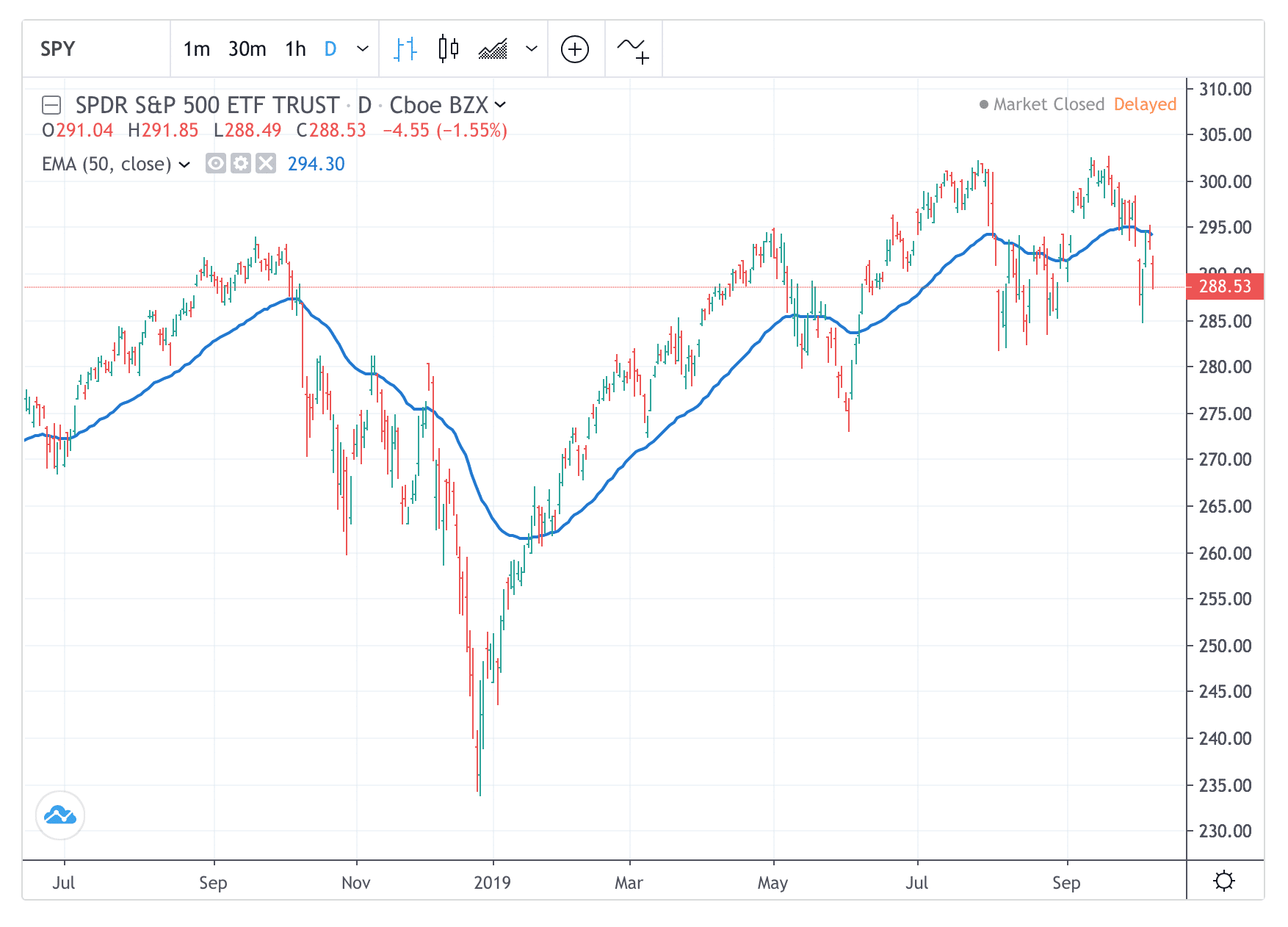

Despite this monetary boost, stock markets continue to sag. In the US, the S&P ETF (SPY) has continued to experience resistance near 295, a level coinciding with the 50-day moving average (see below).

The ETF has been holding the pattern of rising lows, a bullish chart pattern. But this pattern is now under significant pressure on trade jittery, corporate earnings, and fears of a looming recession. Technically, a break below 280 would signal a deeper correction. Other key US indices are holding the same pattern.

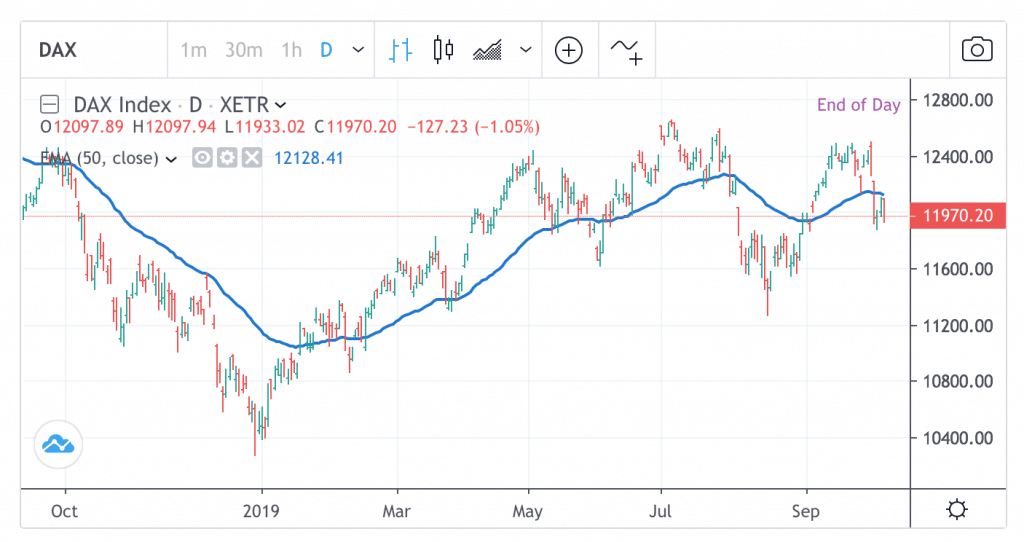

In Europe, stock indices there are under selling pressure. This is primarily driven by a series of poor macro data from that region. Will the slowing economy turn into a recession? That’s the question at the back of every investor mind.

The Dax Index is still some distance beneath its 2018 peak. Nearer term, resistance is strong at 12,400. Economic uncertainties mean most investors will be uncomfortable holding for the long term. Instead they will use rallies to trim positions, thus cementing overhead resistance levels.

For the UK FTSE 100 Index, there is selling levels at 7,400, 7,600, and 7,800, where I note failed breakouts in each level.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com