CMC Markets’ profit shot up to an estimated £51 million in the first half of the 2025 financial year, or the six months to the end of September, from a loss in the same period of the year before.

In an unaudited trading update, the firm stated that the gains were driven by “sustained levels of client trading activity” and growth in its B2B business.

Net operating income for the period is expected to rise by 45% year on year to £180 million from £123 million.

The firm also expects to report operating costs, excluding one-off charges, to fall by around 7% to £113 million from £122 million in the first half of the 2024 financial year.

In the update, CMC Markets also noted it had commenced the onboarding of Revolut clients under a partnership agreement announced in June, which has seen the two companies connecting their software platforms.

The number of Revolut clients live and actively trading using CMC’s platform thanks to the partnership has increased steadily.

Under the tie-up, the user interface is delivered directly through the Revolut app, while trading, pricing, account systems, execution and clearing are provided by CMC.

During the reporting period, CMC has also developed its service offering across platforms with the expansion of cash equities and options products.

It is also planning an upcoming launch of cash ISAs in the UK supported by its treasury management division and proprietary technology.

CMC Markets’ audited and official interim results are due to be released on 21 November 2024.

The anticipated CMC Markets’ profit comes after the business faced challenges including a downturn in client activity during the equivalent six month period in the previous year, which it attributed at the time to “subdued market conditions”.

The firm, which listed on the London Stock Exchange in 2016, has offered forex trading services since 1989 and now has over 300,000 active clients trading online.

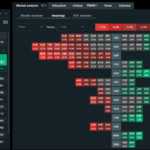

A Good Money Guide CMC review in September noted highlights of the platform included its offering for high-frequency and active traders, supported by an emphasis on technology.

Robin has more than six years of experience as a financial journalist, most of which were spent at Citywire, and covers the latest developments in the investing, trading and currency transfer space. Outside of work, he enjoys reading literature and philosophy and playing the piano.

You can contact Robin at robin@goodmoneyguide.com