Instability in Hong Kong and Argentina is scaring even more capital into haven assets. On Monday stocks declined; while Gold and US Treasury bonds rose. The latter is on the cusp of surging to new all-time highs.

Last I checked, the 10-year Treasury bond yield now flashed a remarkably low level of just 1.6%. The same yield, just ten months earlier, fetched 3.2%. In other words, long-maturity US bond yields have basically halved.

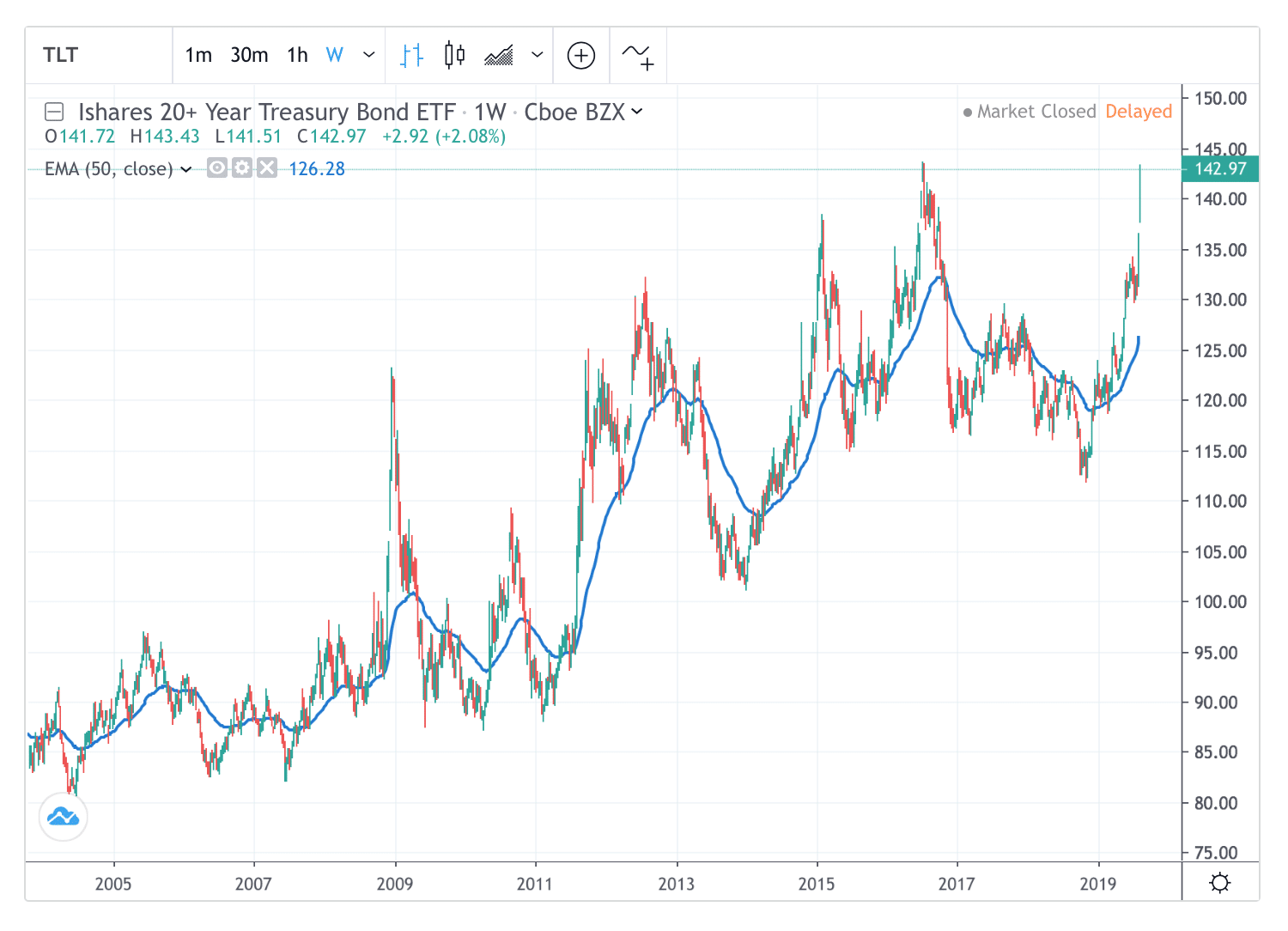

Looking at the Treasury Bond ETF (TLT), the bull run from 120 is continuing strongly. For several times during March-April this year, I have written about buying these bonds just in case the stock market rally paused and reversed. This trade is proving to be a lucrative one given how far bonds have rallied in the last five months.

For TLT, the 2016 peak is now being tested and challenged. Strong upward momentum suggests a good chance of taking out these prior peaks.

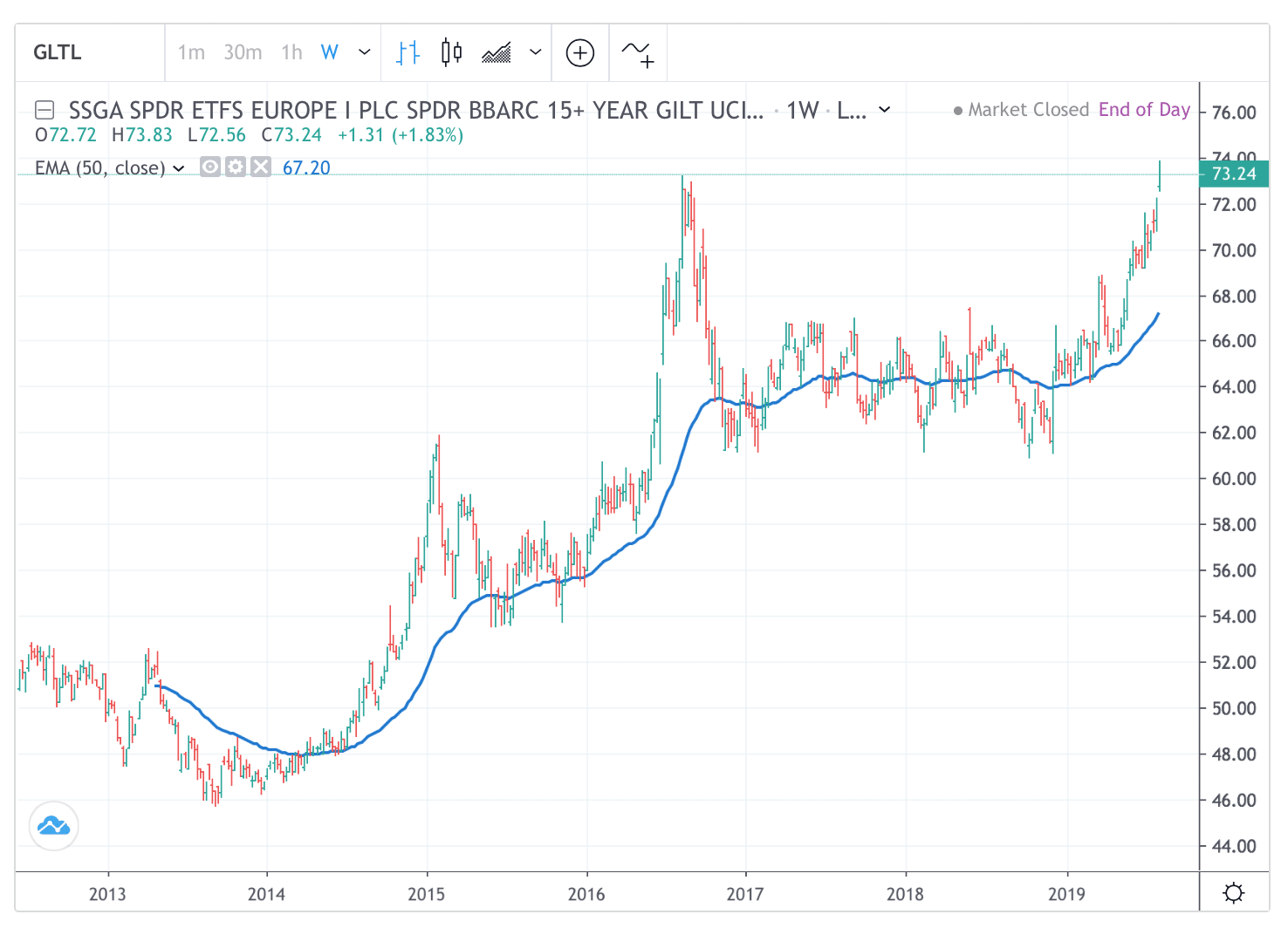

In Europe, the trend here too favours bond bulls. The ETFS Long Gilt ETF (GLTL), for example, is surging to new all-time highs. The current trend started with a breakout at 66 in March. After a consolidation, the uptrend renews with vigour into record territory.

In Europe, the trend here too favours bond bulls. The ETFS Long Gilt ETF (GLTL), for example, is surging to new all-time highs. The current trend started with a breakout at 66 in March. After a consolidation, the uptrend renews with vigour into record territory.

Overall, it is clear that investors are now expecting easier monetary policies ahead, whether the Fed likes it or not. America’s yield curve is now significantly inverted despite the recent 25bps rate cut. This bodes ill for the world economy, as yield curve inversions always anticipate a recession. Hence I would stay bullish on sovereign bonds but would wait for consolidations to add.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com