High political drama in Westminster dominates headlines. Yesterday we saw the new prime minister suffer his first commons defeat. The motion to rule out a ‘No Deal’ Brexit progresses with a 27 majority. A general election looms.

Away from the limelight, however, a less-noticed – but equally important – market trend is the stunning drop in UK gilt yields. Last I checked, 10-year yield in the UK trades at 0.38%. Intraday lows during Tuesday’s political drama was 0.34%!

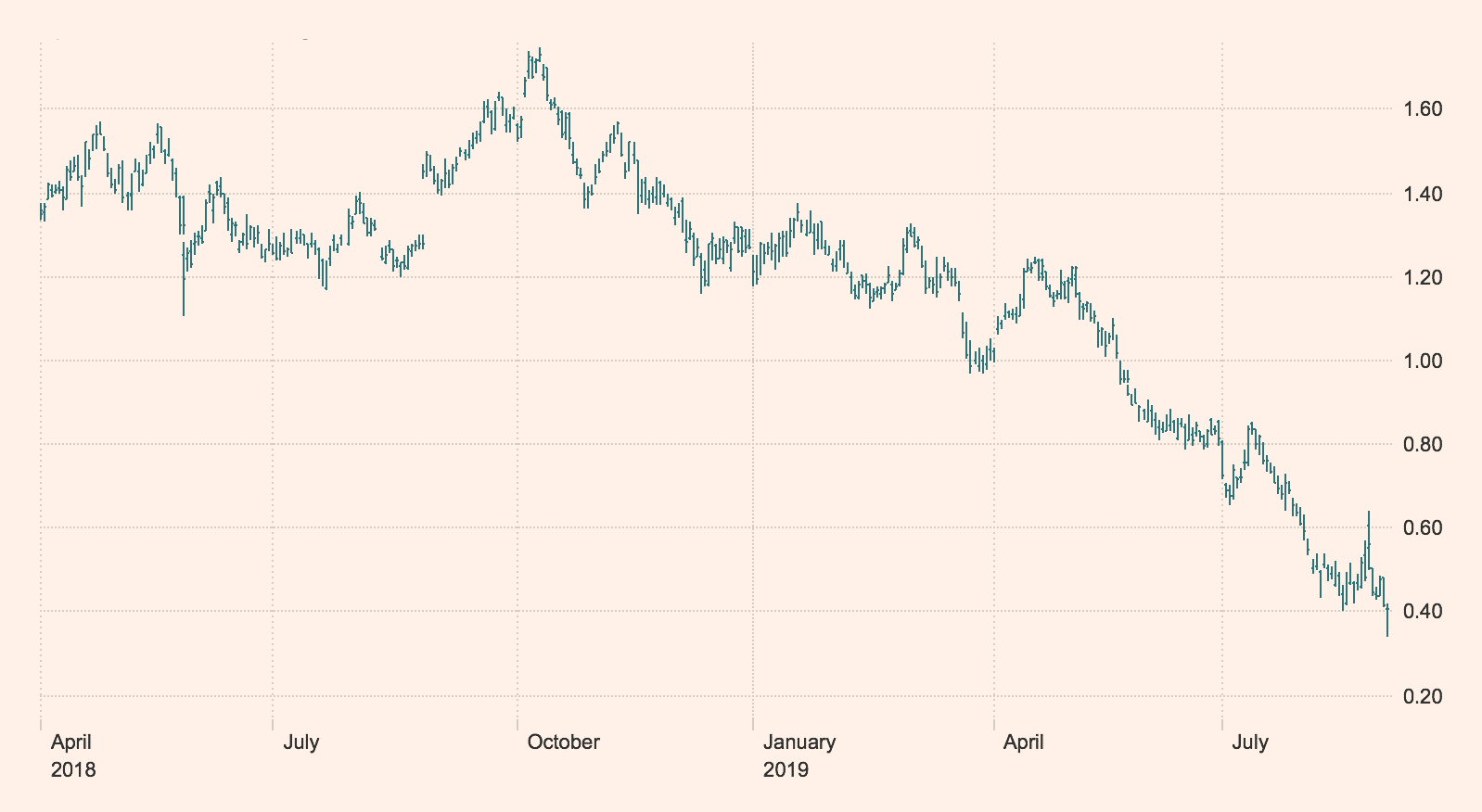

Look at 10-year Gilt yield’s daily chart below. From the 52-week highs near 1.70%, the rate has collapsed into new long-term – and possibly record – lows. While you may point out that bond yields are dropping everywhere in the developed world, but the rate at which UK long-maturity gilt yields are falling is still phenomenal. The yield practically halved in just eight weeks (July-August).

Source: FT

The question is: Will UK 10-year plunge to zero? At the current rate yields are falling, I think ‘yes’. In markets, what was previously ‘unthinkable’ can become reality (read: Lehman) when conditions allowed. As Brexit becomes messier, investors have low confidence it will be resolved soon. The drop in Pound Sterling is a reflection of this thought. The drop in gilt yield is another.

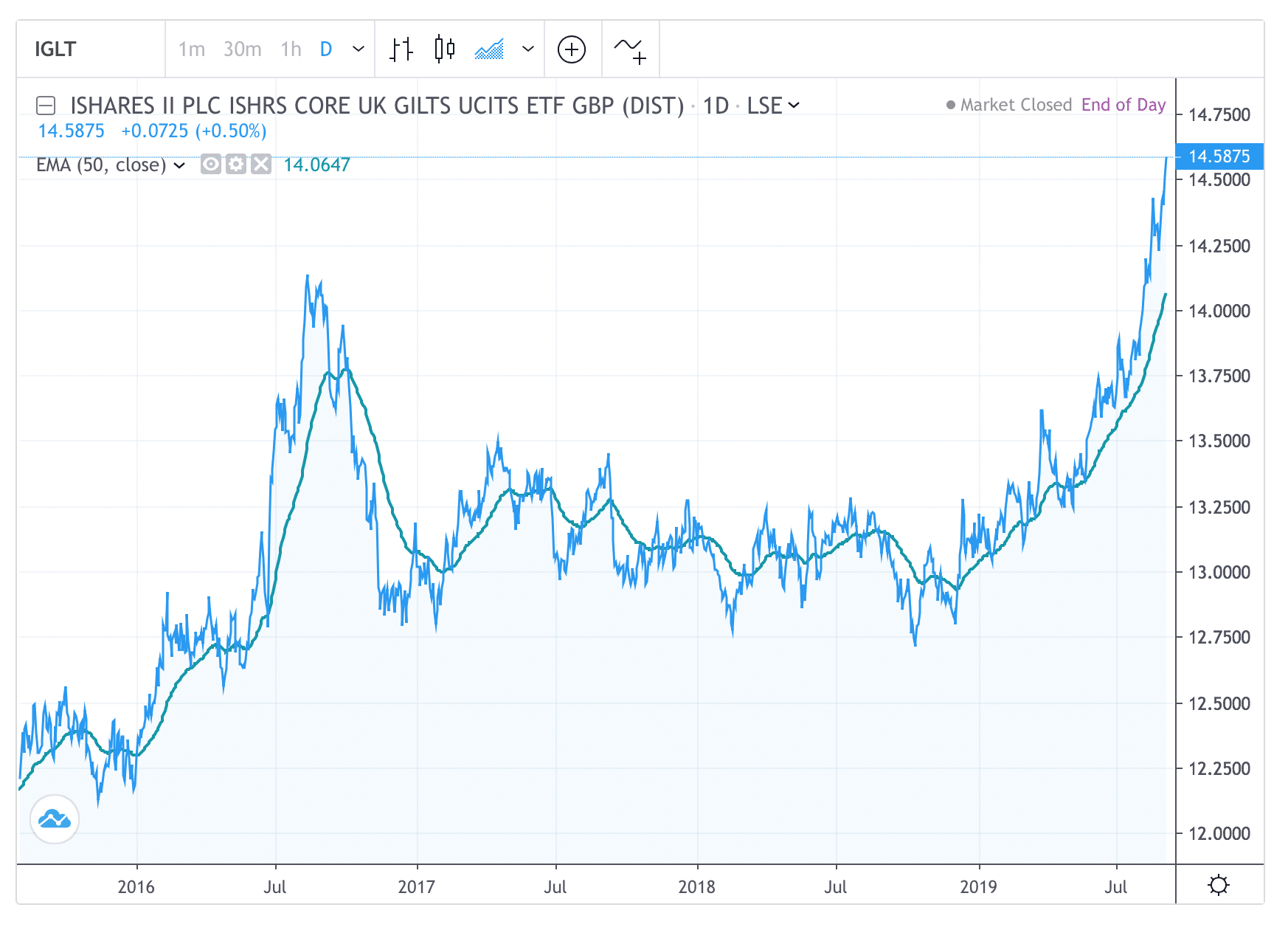

Look at some of the gilt-based exchanged-traded funds. iShares Core Gilts ETF (IGLT) is accelerating the medium-term trend all the way into new highs (see below). This trend remains in full motion.

SPDR 15-year+ Gilt ETF (GLTL, featured chart) also soared to record highs. The current bull trend comes after a lengthy sideways consolidation at 60-66. Momentum favours the bulls.

Overall, gilts are now a significant safe-haven asset for investors. Stay long this asset while the Brexit saga is still rolling on. Trailing stops are recommended to protect some profits.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com