Recently, Warren Buffett published his widely-anticipated annual letter to shareholders. Easy to read and full of investment gems for ordinary investors, the letter is a must-read for any serious market participant. It contains many investment ideas that can certainly be put to good use. Last year, I talked about his 2019 annual letter here.

Below these are five things I have learned this year from the Oracle of Omaha:

1. The power of retained earnings.

In this year’s letter, Warren started by emphasising the importance of retained earnings. A company may not need to pay dividends if it can reinvest its profits productively in generating future growth. This portion of retained earnings should not be overlooked by investors. Using an example from Berkshire, he pointed that while his firm received $3.8 billion in dividends, the portion of retained earnings is significantly larger, totalling $8.3 billion. If productively deploy, these “retained earnings of our investees are certain to be of major importance in the growth of Berkshire’ value.”

Implicitly, Buffett is asking investors to look for two things: a) Good management that can deploy these retained earnings productively and, b) Industries that are enjoying favourable tailwinds, even if they don’t pay much dividends now. This is because all profits are used for expansion and to create business ‘moat’. Once you have done your homework, watch to buy these companies on ‘sensible prices’, ie, not overpay.

2. Buffett is a huge fan of financial stocks.

This is despite the drastic fall in interest rates over the past decade. According to Berkshire’s disclosure, the firm current owns stakes in American Express (AXP), Bank of America (BAC), Goldman Sachs (GS), US Bancorp (USB), Visa (V), Wells Fargo (WFC) – with a combined market value exceeding $100 billion. What is interesting is that Berkshire diversifies its exposure among commercial banks (BAC/JPM), investment banks (GS), and credit card companies (V). A growing economy will benefit the financial sector.

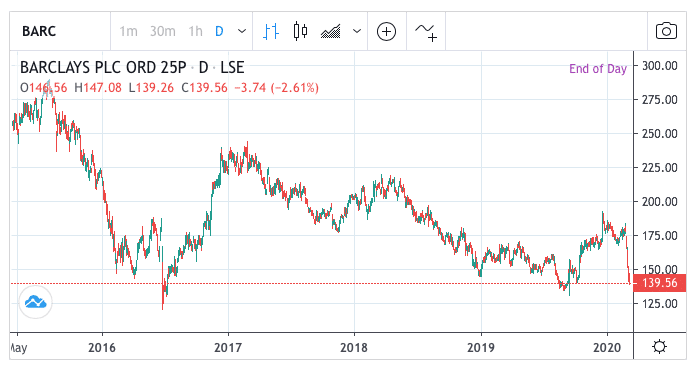

So, should we mimic Buffett’s large financial exposure in Europe, where the banking sector is undergoing a severe bear market? In the UK, for example, Barclays (BARC) is currently trading near its five-year lows, with its annual dividend yield fetching a chunky 6.4% (see below). Faring no better are RBS (RBS, yield 2.9%) and Lloyds (LLOY, yield 6.9%), both of which are trading at the bottom of their multi-year ranges. Surely, there are some value to be picked up here given the recent carnage in stock markets?

3. Forecasting markets is still a fool’s game.

Don’t do it. Warren Buffett has a point. Look at the recent viral epidemic caused by Coronavirus (covid-19). Hardly anyone thought about this possibility back in December. Now, the zoonotic virus is stalling economic activities across Asia. More than 90,000 human beings were infected in a matter of weeks, leading to a completely shutdown of the second largest economy, China – and the collapse of tourism globally. The first Black Swan of 2020 has arrived. And few saw it coming.

Moreover, Warren has a warning for investors: ‘Anything can happened to stock prices tomorrow. Occasionally, there will be major drops in the market, perhaps of 50% magnitude or even greater.” Like Warren, you have to be prepared for this eventuality. He is doing that by hoarding cash to the tune of $128 billion. Ask yourself: Can your portfolio survive a 50% meltdown? If markets do plunge by that magnitude, do you have sufficient resources to buy?

4. Equities will continue to outperform long-term debt.

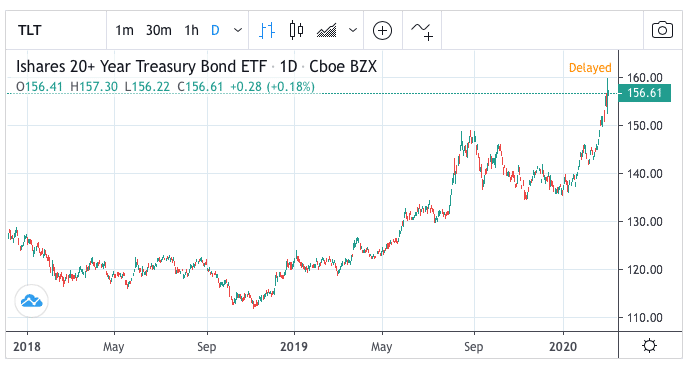

Warren Buffett has no doubt that bonds, in their current elevated levels, will underperform stocks. But this outlook assumes that interest rates and corporate tax rates stay low. The former is likely to do so given that the 10-year US Treasury yield recently breached 1% this week – its lowest level ever. This is due to panic haven buying from the covid-19 epidemic. This led to a price spike in Treasury bonds, such as TLT (see below).

Technically, the rally in gov bonds is now one gigantic momentum trade that depends on more fear. Unless you’re a momentum trader, stay away from the game. Watch to buy stocks on sharp falls.

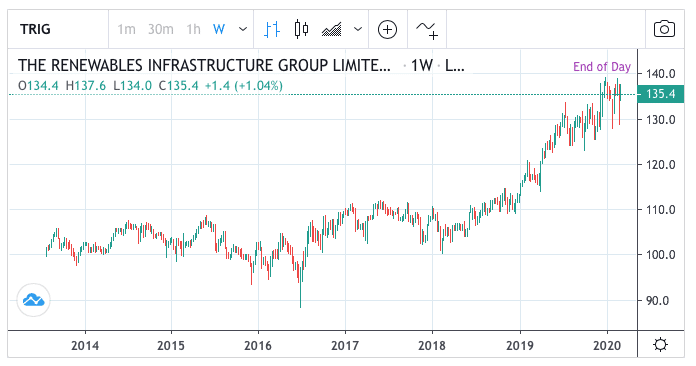

5. Berkshire Hathaway is riding the structural renewable energy trend through wind.

In 2019, Berkshire Hathaway Energy (BHE) and BNSF, Berkshire’s rail operations, earned $8.3 billion. Interestingly, BHE is said to have generated all its electric supply, totalling 25.2 million megawatt-hours (MWh), through wind. This attained self-sufficiency from wind alone is rare among utility providers. Critically, BHE was able to leverage this cheap energy source by supplying electricity to its customers at a competitive rate.

In the UK, there is also a structural trend in using renewable energy. In 2019, 20% of all UK’s electricity came from wind. This percentage is likely to grow over time due to the decarbonisation drive. This may create interesting opportunities in the renewable sector, including Renewable Infrastructure Group (TRIG), John Laing Environmental Asset Group (JLEN) and Greencoat (UKW). These securities are all displaying firm bull trends. Perhaps the recent market correction may present good opportunities to buy.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com