Will the second half of 2021 be as exciting as the first six months?

We look ahead and highlight some of the essential macro trends and potentially profitable market themes for our readers.

1. Will inflation continue to surprise?

The global economy is continuing to emerge from lockdown. As a result, demand is running ahead of supply and causing bottlenecks in a wide variety of industries.

Transport is a key problem. Shipping containers, for example, are in short supply. Even more spectacular is the persistent rise in shipping rates (see below).

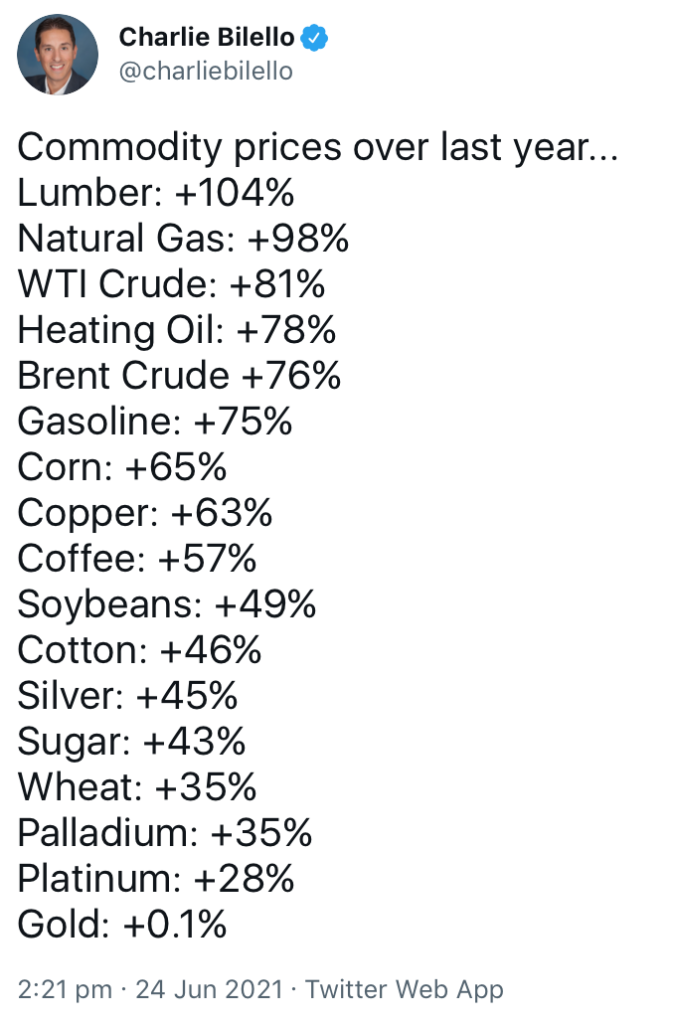

This will impact supply chains all over the world, from consumer goods to food. Input costs will soar, especially as more shops open in the six next months. Note, too, that raw commodity prices like food and industrial metals are significantly higher than they were a year ago. These will fuel upward pressure on inflation figures later this year.

Source: BIMCO

2. Will the economic recovery accelerate?

The more infectious Indian variant (now called ‘Delta variant’) is causing a spike in cases around the around. In the UK, this is now the dominant strain. For some countries, this variant is accelerating the spread of the pandemic.

The good thing is, the UK is racing to fully vaccinate the population by the end of summer (32 million already vaccinated as of 28 June). The government has targeted 19 July as the day to end most social restrictions. This will further boost the local economy.

Meanwhile, the US and Europe are intensifying the vaccination process. Industrial and service activities are picking up in many developed nations, and will probably continue to do so into the summer. The World Bank predicts that ‘the global economy is poised to stage its most robust post-recession recovery in 80 years in 2021.‘ Economic progress will be strong but uneven across countries.

3. Will the Fed taper?

For most investors, the background economic trends are positive but secondary. What is more important is what the Fed will do in this environment. Will the Fed taper its $120 billion QE sooner than expected?

The Fed chair Jerome Powell has recently affirmed (27 Jun) that “we at the Fed will do everything we can to support the economy for as long as it takes to complete the recovery.”

This means no drastic change and certainly no premature tightening of the accommodative monetary policy. Yes, there might be some rate rises some time down the road but these will be mild and limited.

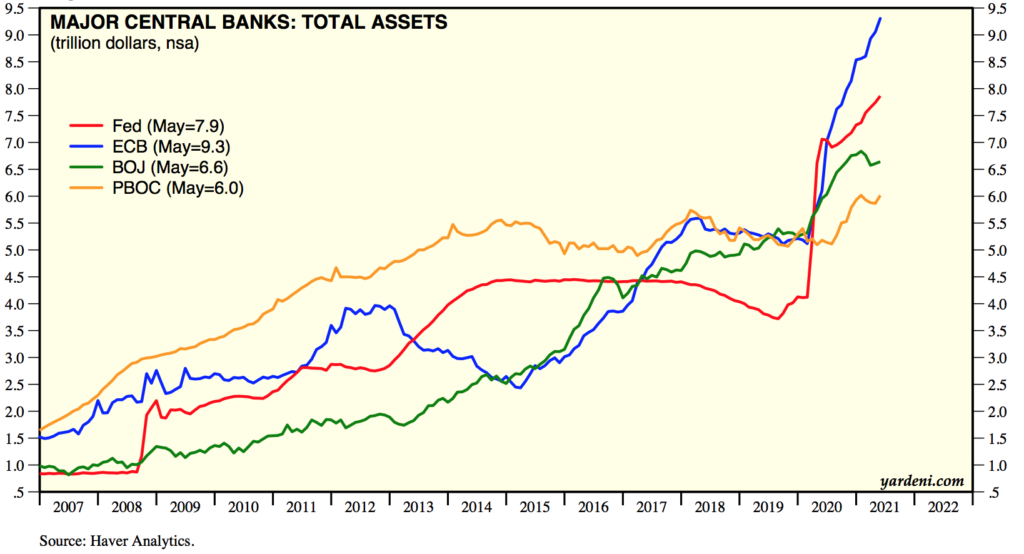

If the Fed assumes the currently high inflation is ‘transitory’, other central banks will adopt the same approach. Thus major central banks are likely to run highly reflationary policies for the rest of this year. This means policy rates are likely to stay low and balance sheets huge (see below). Real interest rates will stay negative.

Source: Yardenic.com

Five Market Themes to Watch

Given the above economic outlook, what market themes should we look at? Here we highlight five interesting sector for the second half of 2021, including commodity stocks, green economy, bonds, ‘Meme’ stocks and Big Tech.

1/ Will the commodity-sensitive stocks rally extend?

Diversified miners did very well over the past 6-8 months, primarily due to the significant uplift in commodity prices. Iron Ore, steel, copper and coal – all performed superbly. Unsurprisingly, stocks like Rio Tinto (RIO) and BHP (BHP) had soared in the past nine months.

The question now is whether these uptrends will continue into 2022. The sector outlook is certainly more bullish than, say, October 2020. But at current prices, these expectations are mostly baked in. Should commodity prices pull back, these miners may do so too. Certainly, miners’ long-term trends are bullish, but wait for a pullback to add and a rally to trim.

However, not all miners delivered positive returns. Precious metals miners – such as Fresnillo (FRES) – are sinking because of falling gold and silver prices. Particularly striking is gold’s slump, because we’re often told to buy gold and silver when inflation is rising. This rule is seemingly broken, as you can see from the performances of various commodities below.

Source: Twitter

One theory is that Bitcoin is now supplanting gold’s inflation-hedge property. The debate (video here) between Michael Saylor and Frank Giustra on gold versus bitcoin is fascinating and must be watched. Bitcoin’s limited supply at 21 million means the crypto asset appears to be a better store of value than gold.

Technically we would like to see gold prices stabilise further before thinking about buying the metal (via UK Gold ETF with ticker SGLN).

2/ Green sectors to rebound?

One of the most exciting developments in the market these days is renewable energy. Electric vehicles, alternative energies, batteries sectors – both in the US and China – attracted plenty of investor attention.

The first quarter of 2021 saw Tesla (TSLA) rocket to a $700 billion valuation. But prices soon consolidated as long-term investors took profit. Other stocks in the sector like BYD (BYDDF), Nio (NIO), XPeng (XPEV), Li Auto (LI) have also experienced a boom-bust cycle over the past year. Whilst many of them have rebounded sharply, its uncertain whether these stocks will surpass their 2021 highs.

Perhaps investors are moving on the infrastructure stocks serving the electric vehicle markets, such as Blink Charging (BLNK) or Chartpoint (CHPT).

In the UK, WisdomTree has backed a Battery Solutions ETF (VOLT, US$) geared for ‘battery and energy storage solutions‘. Prices are looking to make new high following a consolidation (see below).

Overall, the green economy is set to expand in the coming quarters as the world tackles climate change. Watch to buy iShares Clean Energy (ICLN), FirstTrust Wind ETF (FAN) or Invesco Solar ETF (TAN) to bet on a pivot to a greener economy.

3/ What about those ‘Meme’ stocks?

Will we see another run of ‘Meme’ stocks later this year? The drama surrounding GameStop (GME) evoked strong emotions from the retail community and I doubt retail participation is over in this bull market. r/WallStreetBets are still active and liquidity is plentiful. Another episode of speculative rally is always on the table.

Look at AMC (AMC). Prices have soared in recent weeks as traders piled in. Bed Bath and Beyond (BBBY) is another one. You can check out of the list of MEME stocks on this interesting website (www.memestocks.org)

However, to profit from these excesses, risk management is essential. Appropriate position sizes and stop losses are critical to portfolio longevity. Leveraged trading must only be used judiciously because prices are so volatile.

4/ Bonds – still worth buying?

Treasury bonds plummeted in the first quarter of 2021 as investors anticipated the rise in inflation. After a rebound, are bonds still worth buying? Yes and no.

Yes if the yields are right – and only for a limited time period. The market often behaves in ways different to expectations. Higher inflation data recently did not result in a further rise in bond yields. On the contrary, yields dropped. This caught many funds by surprise. Therefore when bonds are being sold (or bought) indiscriminately, there is a trade to be had.

Over the long term, bonds “are not the place to be” as cautioned by Warren Buffett recently. Investors not only “earn a negative return on trillions of dollars of sovereign debt“, the real return (nominal minus inflation) is even lower.

5/ ‘Peak Tech’?

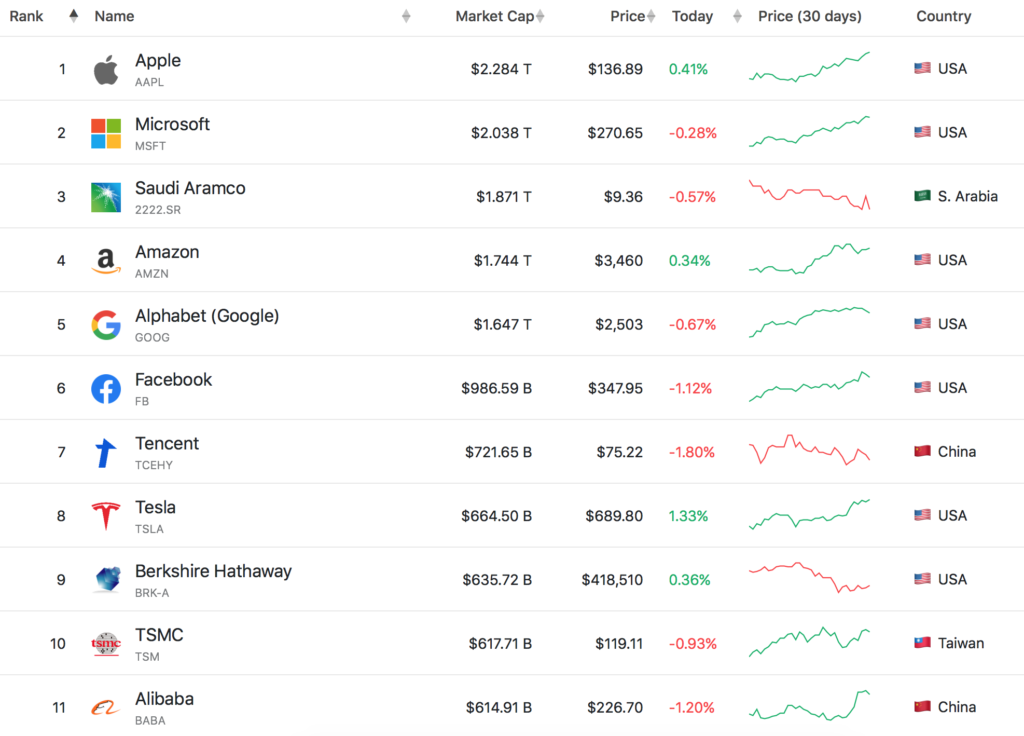

One of the biggest market trends of the past decade was the rise of tech stocks. Apple (AAPL), Amazon (AMZN), Google (GOOG), Microsoft (MSFT) and, more recently, Facebook (FB) (also collaboratively known as FAANG) – have all broken the $1 trillion market cap barrier.

If you look across the world, the top 10 largest companies are mostly tech firms (see below). Even Berkshire Hathaway (BRKA) has a $100 billion position in Apple.

Many are wondering: Have we reached ‘Peak Tech’? Indeed, the digital dominance of a handful is simply unsustainable over the long run. Regulatory crackdown is in the offing.

But the market has a different take. For one, the business positions of these tech giants are stable and growing, especially with the pandemic still dragging on. For example, Apple’s Q1 net profits was $23bn. Secondly, the margins of these business are huge and predictable. Growth like this are just too good to miss.

Therefore, these tech companies may continue to be good investments in the foreseeable future, although their recent rallies may lead to consolidations over the near term.

Source: companiesmarketcap.com

The information contained in this website is for informational purposes only and does not constitute financial advice. The material does not contain (and should not be construed as containing) investment advice or an investment recommendation, or, an offer of or solicitation for, a transaction in any financial instrument.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com