TUI shares (LON:TUI) are down 75% from where they were 5 years ago, made even worse by Covid. But, as soon as the pandemic faded, the masses were on the move again. They fly, cruise and hop from city to city. The urge to travel has never been greater. So, is now a good time to buy TUI shares?

In the summer of 2022, TUI, one of Europe’s largest tour operator, reported 12.9 million of bookings – 91 percent of the pre-pandemic levels. The company is optimistic in its latest business update back in September, saying that “we continue to see a trend towards a higher share of short-term bookings for Winter and strong pricing, confirming solid customer demand for holiday travel.”

Seemingly, the travel industry is getting back to its feet after a disastrous 24 months. Or, has it? Investors are not so sure.

Is TUI a good investment in the long term?

If you can wait it out for a good few years, maybe. But, clearly we are going into a downswing and we wouldn’t know in advance where TUI’s floor is. Better to wait and see.

Chartwise, TUI’s share price is no higher than it was back in May 2020. The stock keeps sliding back down despite bullish updates from the company. There is a divergence somewhere and the bears seem to be winning the argument.

In the post-pandemic era, travel stocks should be a ‘no brainer’ buy. Everyone is going on vacation. That should bring in much-needed profits to travel firms. That’s the logic anyway. But in reality, the pandemic hole was so deep that travel firms required a good few years to fill it. The war in Ukraine and the cost-of-living crisis cut short this bull run.

TUI, a company that merged with TUI AG in 2004, saw its shares peak in early 2021 and has not recovered since. A 1.1 billion euros rights issue (Oct 2021) strengthened its balance but investors are betting on a regression in the international travel business. A deep recession looms. The ability to travel – not want – has diminished greatly.

When is the best time to buy TUI shares?

The best time to buy TUI shares is during a recession. Why? Because the valuation for the stock will be dirt cheap.

But aren’t we in a recession yet? No, at least not technically confirmed by statistical agencies. However, it does to feel like the UK economy is in one already. Spending is muted; forecasts for 2023 are pulled down; and few businesses are confident to invest heavily. In fact, businesses are pausing and reviewing big investments and hiring, particular the tech sector.

Is now the best time to buy TUI? Only if you can afford to wait and have more capital to buy more on a further decline. If not, it might be better to wait until the bottom is in before committing.

Is the TUI share price overvalued or undervalued at the moment?

The valuation of a company these days is very dynamic. Investors are right to question: How can a company (like TUI) be worth 50% more in a month? The valuation band is too wide to instill any confidence.

This means that investors have no idea what the ‘correct’ valuation of a company is at the moment. Important factors are now determined at a macro level. When Mr Market is overly bearish, it will mark down companies severely regardless of its fundamentals.

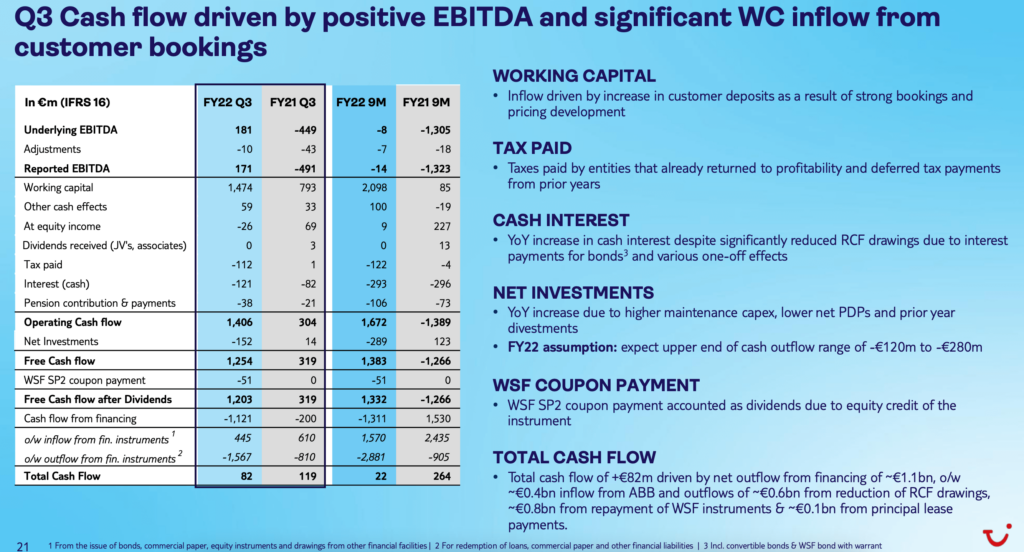

A quick glance at TUI’s last quarter results shows that its revenue, profits and cash flow are relatively stable – at least over the summer. But the market has anticipated that TUI’s future profit level will drop in 2021. Therefore TUI’s share are perhaps ‘overvalued’ at this juncture.

Whether the market is correct at this point I do not know. If the market is too negative, I expect TUI’s share prices to re-rate quickly on a let-up in market pessimism.

Source: TUI AG

Why has TUI’s share price risen recently?

TUI shares had a firm rebound in October and November. This was caused by:

- A counter-trend rally – in the global stock market due to oversold technicals

- New premiership in the UK – which led to a rebound in Sterling, gilts, and UK shares. Note TUI’s share price lows coincided closely with the lows in GBPUSD

- A softening in energy prices – as energy is one of the main input costs in the travel industry

However, after a near 60% rally traders are taking profits. This is leading to a softening of its share price back into the 100-150p range. Major support is noted at 125p.

What is TUI’s share price prediction?

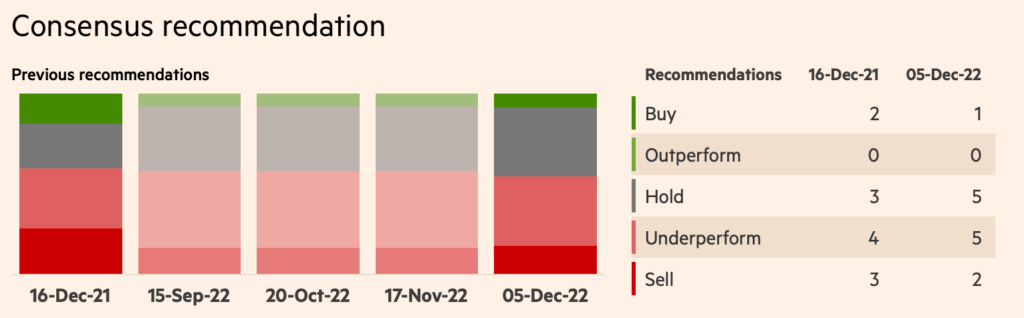

We have yet to see a more bearish broker recommendation on a stock than TUI.

Out of 13 ratings, only 1 is ‘Buy’. The rest are ‘Hold/Underperform/Sell’. The City is uber bearish on TUI, for good reasons.

From a contrarian point of view, are analysts too negative? I am not sure on this – since downward momentum can last for a good few months. The European economy is under immense pressure and could crack in 2023. This is weighing heavily on Tui shares at the moment.

Source: Financial Times

What is the live TUI (LON:TUI) share price?

The current TUI (LON:TUI) share price is 567p which is a change of 3.5 or 0.62% from the last closing price of 567 with 1,863 shares traded giving TUI a market capitalisation of £3,417,037,042. The most recent daily high has been 588.5 and daily low 558. The TUI share price 52 week high has been 687 and the 52 week low 375. Based on the most recent TUI share price opening of 567, the current TUI EPS (earnings per share) are n/a and the PE (price earnings ratio) is n/a.

Pricing data automatically updates every 15 minutes

How to buy shares in TUI (LON:TUI)

To buy shares in TUI (LON:TUI), you need a trading or share dealing account. Follow these three steps if you want to buy shares in TUI:

- Decide if you want to buy TUI shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

How much does it cost to buy TUI (LON:TUI) shares?

Buying one LON:TUI share costs 567p. However, as well as the 567p cost of buying the shares you will also have to pay stamp duty, commission when you buy and sell shares and custody fees for holding your shares on your account. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

Pricing data automatically updates every 15 minutes

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com