You can now buy Gilts on Freetrade, the investing app recently acquired by established stock broker IG. The great thing about adding gilts to a portfolio is that they are much lower risk than dealing in shares, and they are income-paying bonds backed by the UK government.

Freetrade also launched UK Treasury bill investing, which are shorter-term investments, while gilts are longer-term investments. Both are issued by the UK government to raise money.

When you buy a gilt, you’re lending money to the government. In return, the government promises:

- Regular dividend payments: also known as a coupon, you’ll get dividends every six months at a known, fixed rate.

- Repayment at maturity: the face value, or nominal amount, of the gilt is repaid on the maturity date.

- For added flexibility, you can hold gilts until their maturity or sell at any time.

But, it’s worth noting that while dividends and repayment at maturity are known, market prices fluctuate. Your return will vary depending on the timing of your trades and market interest rates.

Freetrade Gilt Investing Review: Lend the government money for less

Account: Freetrade Gilt Investing

Description: Freetrade lets you invest in a small range of UK gilts where you can choose from a range of maturities to match your savings timelines and get predictable income in the meantime.

Is Freetrade good for Gilt investing?

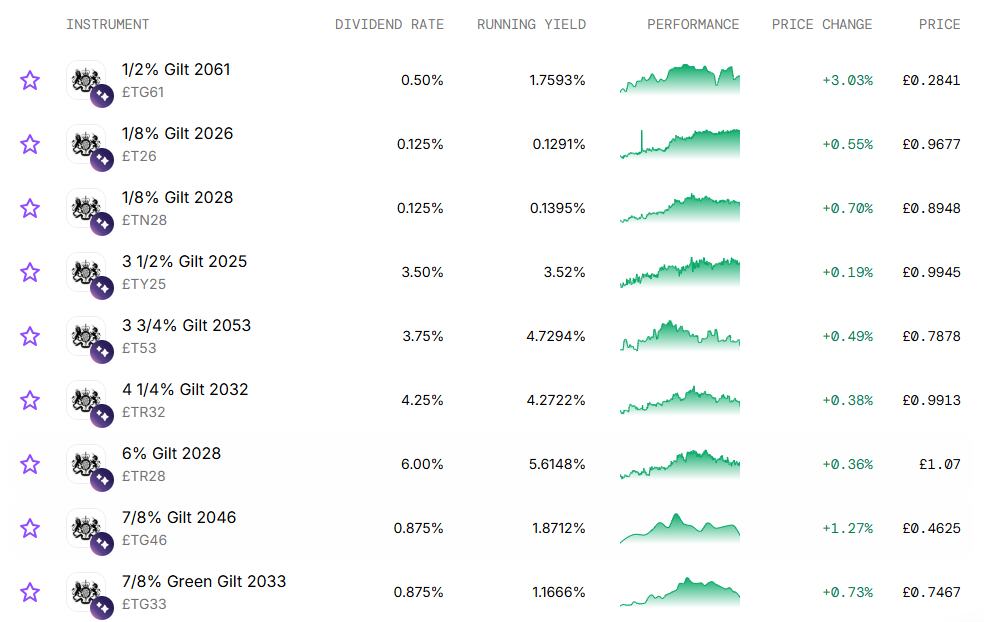

Yes, it’s cheap to invest in Gilts via Freetrade, which are available to Standard and Plus customers in a general investment account, ISA, and SIPP. A sunlike traditional investment platforms like Hargreaves Lansdown there is no commission charged on dealing. But the downside is that there are a limited range of Gilts available (only 9 at the moment) and you must be a paid subscriber or Freetrade to access them.

Pros

- Low dealing commission

- Instant orders

Cons

- Limited range

- Subscribers only

-

Pricing

(5)

-

Market Access

(4)

-

App & Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.6

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.