Facebook & Instagram are officially the biggest social media networks for financial scammers, according to official Police data

- Our investigation has found that consumers lost £214 million to financial scams on social media in the last five years, according to official police data analysed

- Facebook has overtaken Instagram as the home of social media financial scams, while fraud on TikTok rose 63% last year

- Instagram users reported 828 scams to police in 2024 – down from 1,563 the year before, while there were 1,411 reports of fraud on Facebook

- Facebook users reported losing £28 million in one year, with Instagram losses next largest at £11 million

- Facebook took nearly three years to take down a financial scam he reported

- An AI-generated video claiming to be from the host of the Good Money Guide podcast scammed users into joining a WhatsApp group to make dodgy investments

- We advise investors to be wary of social media adverts that lead to WhatsApp investing scams, and to rely on trusted sources of information

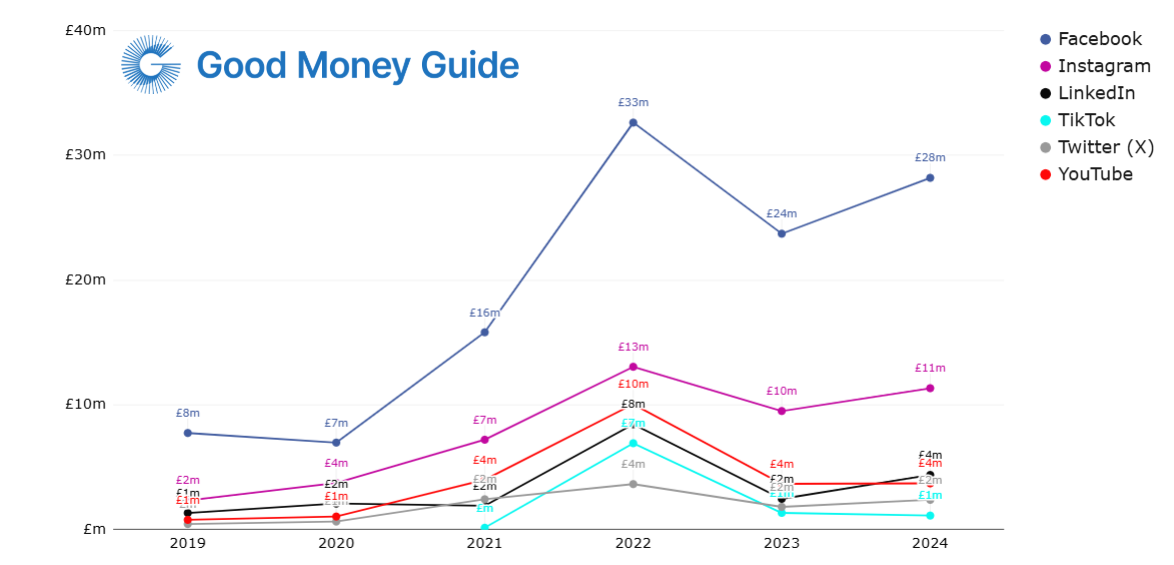

Our exclusive investigation from Police data from Action Fraud has revealed that UK consumers have lost £214 million to financial scams on social media in the last five years[1], as shown in the Good Money Guide’s Scam Index 2025.

Source: Good Money Guide / Data From Action Fraud (data tables available on request)

Facebook has overtaken Instagram as the worst place for social media financial scams, with the platform seeing 1,411 reports to police in 2024, compared with 828 on Instagram – which had the highest frequency of complaints for the previous four years.

Losses at Facebook were £28 million in 2024, with Instagram next highest at £11 million, revealing the freedom of information request submitted to Action Fraud by Good Money Guide. Despite LinkedIn seeing the fewest reports of fraud compared with other social media channels, its users were hit by the highest losses per scam – at more than £40,000 lost per report.

Scams are growing fastest on TikTok, with reports growing 63% in 2024 compared with the year before.

Table: Police reports and financial losses in 2024

| Platform | 2024 | Reports | Average loss per case in 2024 | Average loss per case in 2023 | % change |

| £4,380,274 | 108 | £40,558 | £15,168 | 167% | |

| £28,183,063 | 1,411 | £19,974 | £6,080 | 229% | |

| £2,387,093 | 123 | £19,407 | £16,684 | 16% | |

| YouTube | £3,706,553 | 260 | £14,256 | £11,367 | 25% |

| £11,331,391 | 828 | £13,685 | £13,217 | 4% | |

| TikTok | £1,126,623 | 193 | £5,837 | £13,996 | -58% |

| Total | £51,114,997 | £2,923 | £17,487 | £11,211 | 56% |

Source: Action Fraud / Good Money Guide

The problem of financial scams on social media has soared since 2019, with losses to fraud now four times higher.

Losses saw a dramatic peak in 2022, but despite falling back in 2023, they continue on their upward trajectory.

You can see the Good Money Guide Podcast host Michael Hewson, discussing how he was closed from footage of the Podcast on BBC Breakfast.

We have experienced first-hand the difficulty in tackling fraud on social media. It took Facebook some 1,024 days to remove one scam advert he reported.

Another scam on Facebook he reported recently involves a fake AI-generated video claiming to be from Good Money Guide podcast host Michael Hewson. The video directs victims to a WhatsApp group where they are encouraged to hand over money for ‘investing’.

The problem of social media financial scams is not going away – and it’s time that someone held the platforms responsible. UK consumers have lost more than £214 million to scams in the last five years alone, and the channels are not taking the problem seriously.

It took almost three years for Facebook to remove a fraudulent advert I flagged, and it’s depressing to think how many victims were suckered in during that time. It’s time that the regulators started fining social networks for their profits-over-protection attitude that allows these scam adverts to be shown.

If you’re looking to invest, make sure you’re dealing with a trustworthy, FCA-regulated company and do plenty of careful research before you take the plunge. There is never an urgency to investing, and if you feel under any pressure, or if something looks too good to be true, it probably is.

Notes: An FOI request was submitted to the National Fraud Intelligence Bureau regarding scam reports to Action Fraud that relate to social media platforms that mention ‘trading’, ‘investing’, ‘stocks’, ‘crypto’, or ‘broker’ for the last 5 years. The full Freedom of Information request is available upon request. Action Fraud is the reporting centre for residents in England, Wales or Northern Ireland. Scotland has a separate system, and those figures are not included in this data.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.