The how, where, and why of clean energy investing

“The Stone Age,” observed Saudi oil minister Sheik Ahmed Zaki Yamani in the seventies, “didn’t end for lack of stone, and the oil age will end long before the world runs out of oil.”

Time is running out for Oil

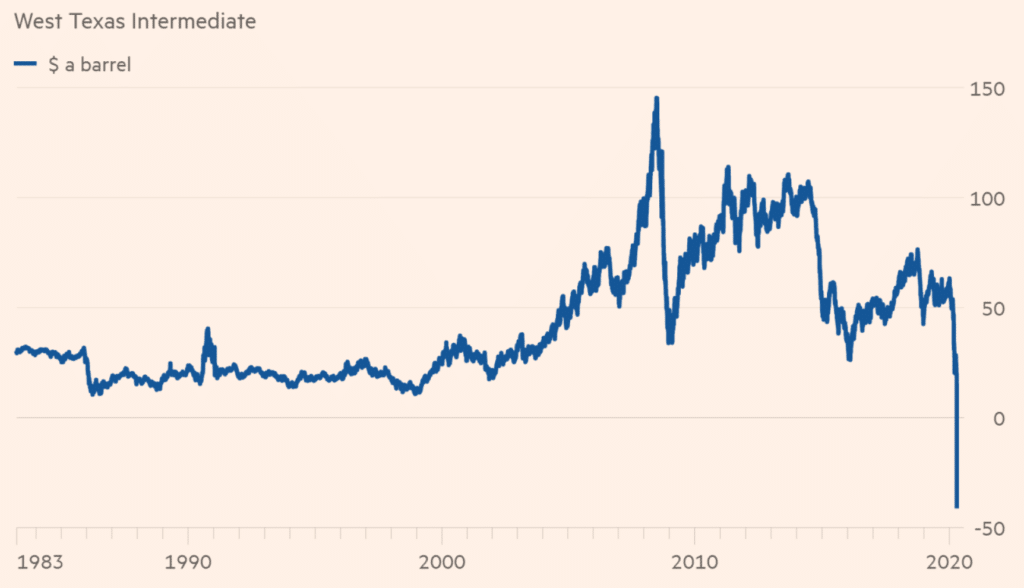

This famous quote, oft-used but unappreciated, is becoming reality. If there is one chart to remember during the once-in-a-century pandemic, a candidate would be the WTI Crude Oil, which settled on April 20 at $-37.63! Yes, you read that right, minus thirty-seven US dollars (see below). Commodities seldom venture below zero. When they do, it signals that market is severely distorted by exogenous events. A ‘sudden stop’ in the global economic activity last April broke oil prices as the oil glut spiked. Nobody want to hold oil, however cheap. The ‘Black gold’ lost its lustre completely.

Due to climate change and the drive to reduce pollution, a transition into a low-carbon world is now taking place now before our very eyes. In turn, crude oil’s demise is spinning the investment industry upside down. Investors should not ignore this trend.

Source: Financial Times

Exxon Mobil booted out of Dow Jones Industrials after 82 years

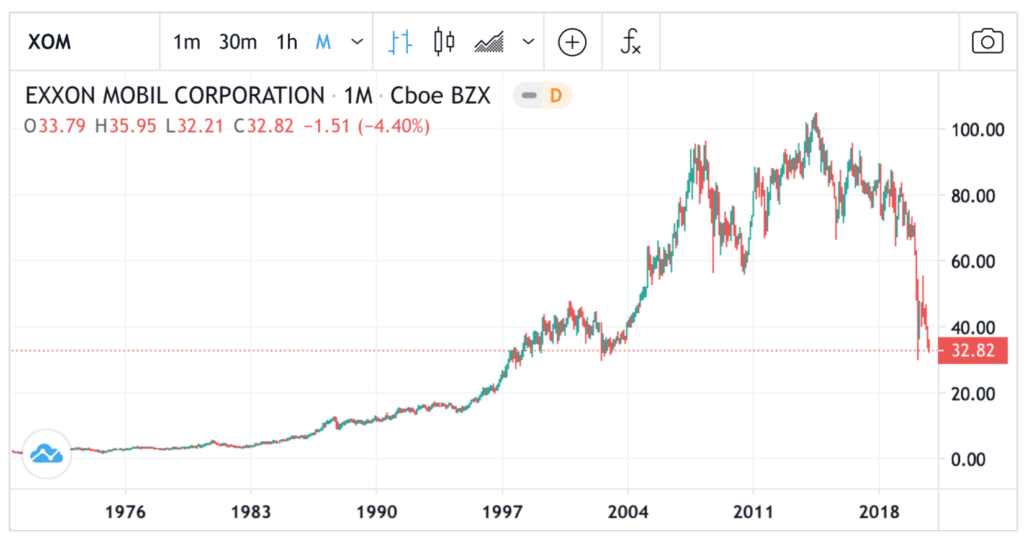

As late as second quarter of 2015, ExxonMobil (XOM) was the third-largest public companies in the world. Originally one of the Seven Sisters of the global oil industry, its annual revenue totalled hundreds of billions. History, however, counts for nothing in markets. What matters is investor expectation.

Here, investors are holding a dim view of Exxon’s future, whose share price has fallen back into the pandemic lows again. At $30, Exxon’s stock prices are no higher than they were back in 1997, 23 years ago (see below). So negative is its future that a recent reconfiguration of the Dow Jones Industrial Index in August saw the oil firm kick out of the index after 82 years. Its replacement? A software stock.

Meanwhile, in the UK, both BP (BP.) and Royal Dutch Shell (RDSA/B) are crashing into new multi-decade lows too. Institutional investors holding these two heavyweights are nursing heavy capital losses. Gone are the rich, stable dividends. Their oil and gas assets are being written off by the billions. Debt is piling up. BP’s Looney recently told investors that they need to expect lower returns from future projects. There is a sense of doom on the sector.

Crude oil’s decline has also hit the shale oil industry hard. Chesapeake Energy, once the biggest shale oil producer, filed for bankruptcy on recently (June 28, 2020).

In a low-carbon world, what should investor invest in?

Why alternative energies will grow in the post-oil years

“Nothing is more powerful than an idea whose time has come.” – Victor Hugo

Away from oil, things are looking brighter for investors. In the first quarter of the year, renewable energy provided more than 45% of UK’s total electricity generation. Alternative energies are booming and becoming more prevalent due to:

- Falling costs, e.g. solar

- Falling capital cost of investments due to plummeting borrowing costs

- Political drive to decarbonise the economy

- Quickening pace of innovation

Taken together, it means that non-oil energy sources will continue to drive the economy in the decades ahead. Part of this ‘de-carbonisation’ trend is the capital stampede into renewable stocks, such as wind, solar, and hydro power.

Investors positioning for a low-carbon world

In the UK, some investment trusts are already established players in this sector. The Renewables Infrastructure Group (TRIG) is one such instrument gearing towards solar and wind. Note how quickly its share prices rebounded back in March (see below). John Laing Environmental Assets (JLEN) is another possibility. (see here more on the selection of IT.)

Any stocks associated with the new energy structure is also being chased.

Electric automakers like Tesla (TLSA) and BYD (1211 HK) are going through the roof (see below). Warren Buffett famously took a 10% stake BYD in 2008. His patience has paid off.

Because increased popularity of electric cars, lithium miners such as Albemarle (ALB), FMC (FMC) and Livent (LTHM) also surged. This is because car batteries need these components. But the speculative buying in this niche has receded somewhat. The one lithium stock still exhibiting a long-term bullish chart is Ganfeng Lithium Co (1772 HK), which is trading near new all-time highs. The company is large enough to supply lithium chemicals to Tesla and LG Chem. UK has Bacanora Lithium (BCN) but it is a small player compared to Ganfeng.

Related Guide: How to invest in Stocks: A Quick Guide

Source: IG

Another subsector that is benefitting from the coming end of the Oil Age is hydrogen. So far, the number of automobiles using this technology remains small. But this has not stopped investors from pouring money into hydrogen-related stocks. Plug Power (PLUG) enjoyed an extraordinary boom this year. A proverbial ten-bagger in a year (see below). Others like Bloom Energy (BE), Fuelcell (FCEL) and Ballard Energy (BLDP CN) are too immersed in rallies. In the UK, ITM Power (ITM) have attracted lots of buying interest.

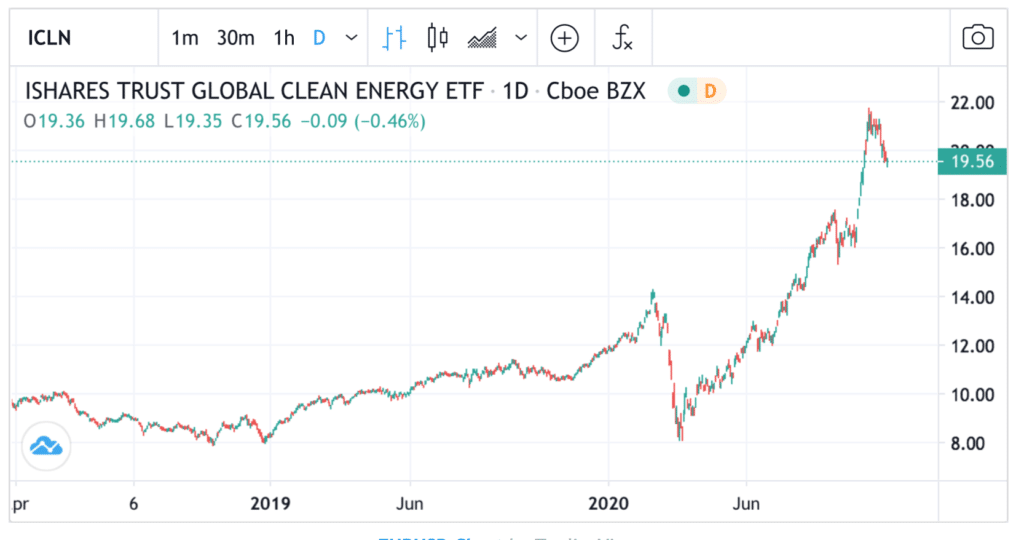

Away from individual stocks, you can buy a portfolio of new energy stocks via ETFs such as iShares Clean Energy (ICLN) and Invest Solar (TAN). Both have about $2 billion in AUM. A quick look at ICLN’s holdings shows that it is a highly diversified fund, which holdings from Meridian Energy (MEL NZ) in NZ to Vestas Wind (VWS DK) in Europe. ICLN is traded in the LSE under the ticker ‘INRG’.

Global X Lithium Miners (LIT) is a fund holding a portfolio of lithium stocks.

Related Guide: How to invest in ETF: A 10-Step Guide

Conclusion

The stock trends between oil stocks and renewables can not be further apart this year. Collectively, new energy sectors are heading north; the old oil stocks south. One is growing, the other shrinking.

Isn’t it too late, you wonder, to chase these hyper-inflated stocks? Yes, it is true. Buying a stock after it has exploded upwards entails a lot of risk. But remember that the world is on the cusp of a big energy transition – one will last for years. Wait patiently for a correction, and when these setbacks come, buy into some of the new energy sectors. The key is to diversify because we will not know which company will ‘make it’ over the long run. So spreading the risk is one way to hedge against the unknown.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com