-

Jackson Wong PhD

Jackson Wong PhD

- Updated

In this guide, we will explain the best ways to send money to Australia using currency brokers for large amounts and money transfer apps for smaller amounts. Use our comparison of what we think are the best accounts for sending money to Australia to compare how many currencies they offer, what the minimum and maximum transfer sizes are, or if they offer currency forwards and currency options. You can also see how established a company is by comparing when they were founded, how many customers they have and how much money they transfer abroad.

Best ways to send money to Australia from the UK

- Use a currency broker like OFX for large AUD money transfers

- Use a money transfer app like Wise for smaller AUD money transfers

- Never use your bank for AUD money transfers as it is very expensive unless you are with a new fintech bank like Revolut that has discounted exchange rates

| Currency Broker | Number of Currencies | Min Transfer | Forward Contracts | Same Day | Customer Reviews | Get Quote |

|---|---|---|---|---|---|---|

| 40 | £100 | 24 months | ✔️ | 4.9

(Based on 2,604 reviews)

| Request Quote |

| 40 | £100 | 12 months | ✔️ | 4.8

(Based on 912 reviews)

| Request Quote |

| 55+ | £250 | 12 months | ✔️ | 4.4

(Based on 49 reviews)

| Request Quote |

| 30+ | £3,000 | 24 months | ✔️ | 4.7

(Based on 91 reviews)

| Request Quote |

Methodology: We have chosen what we think are the best ways to send money to Australia based on:

- over 17,000 votes in our annual awards

- our own experiences testing the currency brokers

- an in-depth comparison of the money transfer app features that make them stand out compared to alternatives.

- interviews with the international payment company CEOs and senior management

Compare exchange rates for sending money to Australia

Use our Australian Dollar exchange rate comparison tool to request quotes from multiple providers and see how you could save up to 4% on large AUD currency transfers versus using your bank when you send money to Australia.

Please note: The rates displayed in this currency conversion quote tool are supplied to us directly from the currency brokers as a percentage mark-up. Please ensure you read our guide to getting the best exchange rates guide.

History of the Australian Dollar (AUD)

The Australian Dollar is the official currency of Australia. It has been in existence since 1966, and is often known in the market as the ‘Aussie’. AUD is its market abbreviation. When we refer to AUD it is often reference to USDAUD, the Aussie dollar versus US dollar exchange rate.

The currency has been free-floating since the eighties. This means that it is not pegged against another other currency or maintain at a fixed exchange rate. High volatility of the Aussie dollar means that it is one of the most traded currencies in the world.

According to the Bank of International Settlements’ triennial 2019 survey, the Aussie dollar is the fifth most traded currency in the world, ahead of the Swiss Franc and Canadian Dollar. Its turnover is about nearly seven percent of the market total.

AUD derives its volatility from its exposure to the commodity market. Australia is blessed with abundant commodity minerals, including oil, agricultural products, rare earths, uranium and other metals. It exports most of these commodities to other countries. Unsurprisingly, the Aussie Dollar is heavily impacted by commodities.

Researve Bank of Australia is the central bank of Australia. The bank controls the monetary policy of the country which impacts the Australian dollar significantly. One of its key objectives is to maintain the stability of the currency. The nine-member Reserve Bank Board meets 11 times each year, one each month except January, to determine the policy rate (cash rate) and appropriate monetary policy for the country. The policy rate now is at 10 basis points.

Factors that move the Aussie Dollar exchange rate

Foreign exchange is a complicated market as billions of dollars are transacted every day round the clock. Many factors move the foreign exchange market. However, most factors can be aggregated under the three broad categories: 1) Political, 2) Economic, and 3) Monetary. Because of the myriad of market moving factors, at any one time, it is hard to calculate the ‘right’ value of a currency at any time.

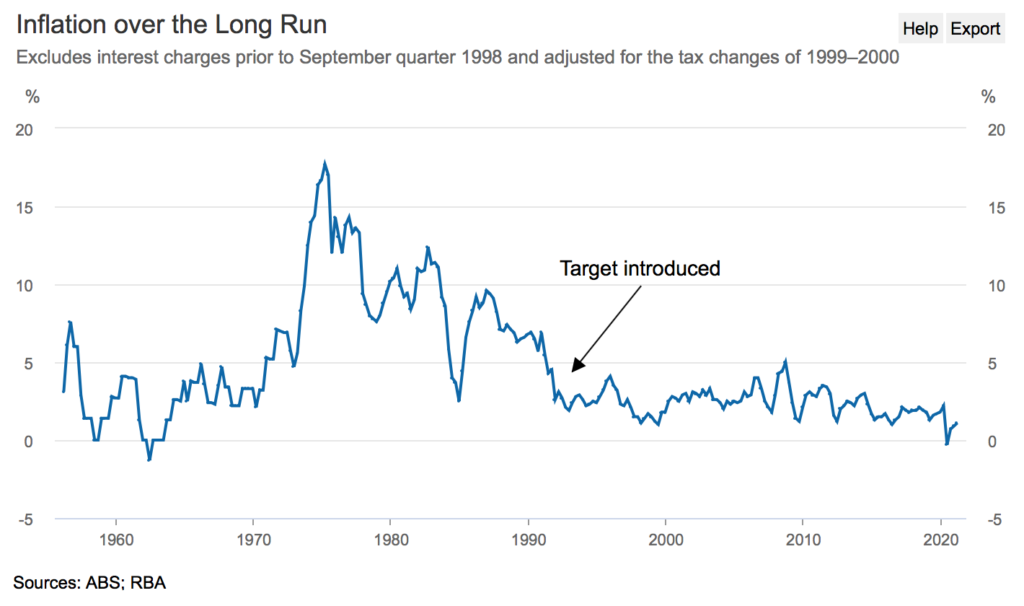

Generally, inflation is one of the most important considerations for investors. The Reserve Bank of Australia has a mandate to hold the country’s inflation at 2-3 percent. If the rate shoots out of this band, it will trigger a reaction from the central bank. Over the last two decades Australia’s inflation rate has been fairly benign (see below).

Another factor to consider these days is quantitative easing. In the last policy meeting (1 June), the central bank noted that the ‘economic recovery in Australia is stronger than earlier expected’. As a result, RBA states that ‘at the July meeting the Board will also consider future bond purchases following the completion of the second $100 billion of purchases under the government bond purchase program in September.”

Expectations of these policies are very important. If the market expects higher inflation, lower unemployment or better growth ahead, the currency could appreciate immediately (sometimes within minutes). A better- or worst-than-expected data release often impact the currency.

For Australia, its economy is also tightly coupled with many Asian countries, particularly China. The latter has been importing huge quantities of raw materials from Australia. If commodity prices rise, this will positively impact the Aussie dollar. Look at the USDAUD weekly rate below. The Aussie dollar rallies significantly against the US dollar in 2020 on rising commodity prices. Traders often open positions in the Aussie dollar to bet on the direction of commodities.

Bottom line – The Aussie dollar is dependent on several factors, including interest rates, inflation outlook, quantitative easing, commodity prices, and growth. It is a volatile currency with significant price trends available for traders to bet on.

Live Australian Dollar (AUD) exchange rates

The current best Australian Dollar (AUD) exchange rate versus other G10 currencies is the mid-market price which is:

| Canadian Dollar (CAD) | 0.9645254 |

| European Union Euro (EUR) | 0.597135 |

| Japanese Yen (JPY) | 108.444 |

| New Zealand Dollar (NZD) | 1.17494 |

| Norwegian Krone (NOK) | 6.730544 |

| United Kingdom Pound Sterling (GBP) | 0.5194 |

| Swedish Krona (SEK) | 6.32045 |

| Swiss Franc (CHF) | 0.5442845 |

| United States Dollar (USD) | 0.70857 |

Sending money to Australia FAQ:

The best way to send money to Australia is to use a currency broker.

As well as getting the best exchange rates, if you send money to Australia with a currency broker you also get:

- Expert help and advice to reduce your risk and exposure

- Dedicated account managers every step of the way

- Convert funds online and platform access 24/7

- Same day and forward currency exchange contracts

- Zero service charge, commission or transfer fees

- Transfer money direct to single or multiple beneficiary accounts

When you convert and transfer Australian Dollars (AUD) with a currency broker your fixed exchange should be a maximum of 0.5% from the mid-market for currency transfers. To put this in perspective, banks traditionally charge 3-5% which means that if you are sending £100,000 worth of Australian Dollars (AUD) you could save up to £4,500 with a currency broker versus the banks.

Request a quote to see how much you can save – you’ll find a better Australian Dollar (AUD) exchange rate than by using your bank.

Our comparison tables and Australian Dollar (AUD) exchange rate quote request forms will help you find the best Australian Dollar (AUD) exchange rate. Australian Dollar (AUD) exchange rate comparison tables highlight the key features of currency transfer providers whereas Australian Dollar (AUD) exchange rate quote request forms will make currency brokers compete for your business by offering the best exchange rate.

here are a few tips on getting the best Australian Dollar (AUD) exchange rate:

- Always compare (read our guide to comparing exchange rates here)

- Never go with your bank

- Understand the fees

- Use a currency forward to lock in the current exchange rate

If you think the AUD exchange rate is going to go in your favour you should wait. Or, if you are worried the rate will move against you, it is possible to lock in the current rate for up to a year in advance with a currency forward.

Yes you can send money using PayPal, but it is very expensive. If you are only planning on sending a small amount of money to Australia a money transfer app is much cheaper.

With a currency broker you can send an unlimited amount of money to Australia. Money transfer apps are good for sending under £10,000. Banks are the worst way to send money to Australia because of the high fees.

The three main ways to send money to Australia are:

- Large amounts – currency brokers like Key Currency, Global Reach and OFX

- Medium amounts money transfer apps Like Wise and XE

- Small and cash amounts – wire transfer providers like Western Union (WU)

Yes, the best way to get the currency exchange rate if you want to send money to Australia is to use a currency forward where you buy the currency now by putting down a small deposit and pay the balance when you make the transfer.

Yes. When you transfer funds internationally with your bank you get very little control over the exchange rate. In many cases you will be given the banks default tourist rate which can be as much as 4% from the interbank exchange rate.

You can read more on how to compare exchange rates here.

A currency broker will almost certainly provide exchange rates less than 1% from the interbank rate and for large amounts, you should be able to get a rate of less than 0.5% from the mid-market.

All the currency brokers in our comparison tables offer discounted exchange rates compared to your bank.

The companies in our money transfer comparison tables are all established currency brokers will good reputations that transfer.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the AUD money transfer providers via a non-affiliate link, you can view them directly here: