The pound-to-US dollar forecast is an indication of where technical and fundamental analysts think the GBPUSD price may be in the future. You can use these exchange rate forecasts to help you decide if now is the right time to buy Dollars, or if you should wait until the price improves.

| GBPUSD Price | 1 Day Change | 1 Week Change | 1 Month Change | 1 Year Change |

| 1.3482 | -0.57% | -0.57% | -1.43% | 6.08% |

| Name | Logo | Currencies | Min – Max | GMG Rating | User Reviews | CTA | Tag | Feature | Expand |

|---|---|---|---|---|---|---|---|---|---|

|

Currencies 40 |

Min – Max £1 – £1m |

GMG Rating |

User Reviews 4.5

(Based on 217 reviews)

|

#Featured |

Account Types:

|

Wise won “Best Money Transfer App” in the 2025 and 2024 Good Money Guide Awards because of its low costs, simple-to-use app, and range of currencies.

Wise Won Best Money Transfer App in the 2025 Good Money Guide Awards Provider: Wise Verdict: Wise is one of the best (and cheapest) money transfer apps for sending currency abroad since it pioneered peer-to-peer (P2P) low cost international payments. Wise helps people send money abroad for much less than it would cost to do it through a high street bank. It was launched as TransferWise in 2011 as a P2P currency network, but has since grown to provide money transfers to over 15 million customers sending more than £9 billion a month. Is Wise a Good Money Transfer App?

But in a nutshell… Should you use Wise? Yes. Is it cheap? Yes. Is it easy to use? Yes. Is it safe? Yes. Since Wise was founded back in 2011, I’ve followed its progress. There are many firms that shout loudly about wanting to disrupt an industry. But most of the time, it’s marketing hyperbole. However, in Wise’s case, it has disrupted how we send money around the world – by making it cheap and making it easy. The only reason not to use Wise is if you already bank with Starling, as the fees are pretty similar and you probably don’t want another app on your phone if you don’t need it. Truly DisruptiveA few years ago, before Wise was founded, I wanted to send €30 to a friend in Munich. It was an absolute nightmare. I was banking with NatWest, which wanted £20 as a minimum fee for sending the money to a European bank account. Next I tried PayPal – still expensive. So I withdrew €30 in cash from a Euro cash machine in London, put it in an envelope and sent it through the post. The only other option was the inconvenience of visiting a Western Union shop. Thankfully along came TransferWise. It was a boom time for money transfer apps but this one had the best story: it was circumventing “evil” banks by transferring money abroad using P2P networks. If you needed to transfer €30 to Germany, it matched you with someone in Germany who wanted to transfer €30 to England. No need to do any FX, and therefore less in fees to pay. It also had fantastic marketing – for example stripping off to the pants in front of the Bank of England to protest “rip-off” banking charges. It was a stroke of genius, really, as British people love seeing naked people, and hate banks. Of course liquidity gaps need to be filled when there isn’t someone on the other side of your transaction and TransferWise used firms like Currency Cloud (now owned by Visa) to ensure that customers always got the best price. Richard Branson was also an investor. So there you go. Over the years, Wise as grown by being easy to use and charging low fees. How Does Wise Work?Wise offers international money transfers and a multi-currency account with a pre-paid card. You can send 40+ currencies to 160+ countries, and hold 40+ currencies in a Wise account. You can pay into your Wise account by debit card, credit card or bank transfer. If you have funds in a multi-currency account, you can use those to fund a transfer when sending money abroad. And you can choose to lock in a rate for up to 48 hours. Wise says international transfers typically arrive in seconds. Wise matches up buyers and sellers of currency in different countries, rather than physically transferring money internationally. Wise Customer ServiceWe’ve marked Wise down a bit as it doesn’t provide a telephone number. This is fine for small transactions but if you’re sending a large amount of money abroad, you may be better off using a currency broker. Wise does offer a call back service for amounts over £80,000, though. With a broker, you can phone up an account executive or dedicated dealer, who can provide updates on your transfer or help out immediately with any issues. But all in all, Wise customer support, is fairly efficient. Is Wise Safe?Wise is about as safe as you can get for sending small amounts of money abroad. Wise is not a bank – it doesn’t have a banking licence in the UK but is authorised by the Financial Conduct Authority as an “e-money business”, which means funds are ring-fenced but not protected by the Financial Services Compensation Scheme (FSCS). Wise is listed on the LSE (LON:WISE) with at market cap of around £9.6 billion, as at January 2026. That is well up from where it was at its IPO, but even though lots of tech firms listed in 2021, it was a pretty bad time to come to market, and most have performed poorly since then because of overall market conditions and over ambitions venture capitalists wanting a return on their investments. So the stock markets also think Wise is pretty good. Since TransferWise launched, the group has grown to provide money transfers to over 15 million customers sending more than £12 billion a month. It’s a shame it is planning on ditching the London stock markets for the glamour of high valuations in the US. Using a listed app is helpful as you can see how it’s faring financially. If the Wise share price starts to go down, this could indicate potential financial problems and be a sign to switch to a different app. Apps & PlatformWise makes it incredibly easy to transfer money abroad – the app is really simple to use. If you have a large amount of money to send, you’re better off with a currency broker because they can help with market timing and lock in exchange rates with forward contracts and currency options. Plus if you ask nicely and are transferring enough money, a broker might undercut Wise’s exchange rates and fees. Remember, that in FX, everything is negotiable. Wise is also venturing into other products, like multi-currency bank accounts and investing. PricingWise is among the cheapest money transfer apps and it displays the fees clearly on the website and app, but it’s not the absolute cheapest. We found Atlantic Money offering GBP-USD transfers at the interbank rate plus £3. But I suspect that isn’t sustainable and it’s only one corridor, while Wise offers 21 currencies. If you want to know more about Atlantic Money, you can read my interview with the founders, Neeraj Baid and Patrick Kavanagh (who helped build Robinhood), and make up your own mind about the service. Research & AnalysisWise doesn’t really have any currency forecasts, which is fine because exchange rates are hard to predict. But it would be nice to have at least some commentary on the markets. We’ve given Wise a mid-ranking for research and analysis as it does provide lots of excellent guides online and has a good insight tab on the app which can help you see where your account money is being spent. If you want currency forecasts, you can read our regularly updated analysis of whether now’s a good time to buy USD or EUR. Is Wise a Bank?No. The company does not hold a UK banking licence and your balance is not protected by the FSCS. However, like a bank, Wise will pay you interest on your cash balances at arate of 3.32% on GBP, 1.72% on EUR and 3.51% on USD, Wise is primarily a low-cost international money transfer app that allows you to save money when sending money abroad. However, Wise provides some of the features that banks also provide, such as holding and exchanging multiple currencies, and sending and receiving payments. And you can have a multi-currency account with a pre-paid debit card. The firm is authorised as an “e-money” provider, which means your money has some protection but not as much as it would have with a bank. Money in bank accounts is protected by the FSCS guarantee, which covers balances up to £120,000 per eligible person, per bank. Wise lets customers send payments to more than 160 countries and spend internationally with the Wise card. Local bank details are provided for up to 9 currencies including US dollars, pounds sterling and euros. If you are looking for a bank account in the UK, you can see a list of current bank account switching offers here. Pros

Cons

Overall4.2 |

GBPUSD Forecast Highlights

- GBPUSD surged in recent days to trade at its highest level since 2021

- Main driver for this sudden rally was dollar weakness

- Bullish momentum points to a probe of 1.400; buy some dollars now

How has the Pound performed against the Dollar recently?

Since my last update in early December, GBPUSD has performed strongly.

Part of this bounce came from modest GBP strength; but the bulk of GBPUSD’s rally was driven by sustained dollar weakness.

The rate was loitering beneath 1.350 when greenback sold off steeply and suddenly. As a result, the rate surged to its highest level (around 1.381) in four years (see below).

The dollar has also performed poorly against a range of currencies, from Sterling to Swiss Franc to Norwegian Krone. In other words, GBPUSD’s rally is not an isolated case.

Why is the dollar weak? Many drivers are dragging the currency lower, from geo-political concerns to tariffs impact to momentum selling.

Chartwise, Cable’s recent rally affirmed the multi-year uptrend (from 1.030). If prices manage to climb above 1.400 and beyond, it would erase the entire decline from the pandemic highs established in early 2021. That would be an impressive recovery for GBPUSD.

However, whether prices can decisively break through the long-term resistance at 1.420 is hard to say. The current trend is driven mainly by dollar weakness, which may not sustained in the near/medium term (see discussion below).

For now, the trend points to a higher level (until 1.400), although a temporary reversal back to its previous range is not to be ruled out.

Is it a good time to buy US Dollars with pounds?

Yes, since Sterling is at its strongest level in years.

One pound sterling buys more than 1.35 dollars. If you do need some US dollars in the near term, buy some now.

For the rest, you may want to wait and see if GBP can trend higher into 1.400. The rate’s momentum is modestly bullish and a test of that level is possible.

Will the pound strengthen further against the USD in the first quarter of 2026?

A scary trend is developing in the foreign exchange, in that the USD is dropping like a stone against major currencies.

A quick glance at the Dollar Index shows its sudden fall over the last two weeks of January. The index affirmed the overhead resistance at around 100.0 and slumped to new multi-year lows.

In light of the recent fast-paced development, the US Treasury secretary Bessent has emerged to voice support for the US dollar, stating: “we have a strong dollar policy“.

Does it? The market is not so sure. If I superimpose the current administration’s start date (Jan 2025) on DXY’s chart, you see immediately why the market is not convinced. The index peaked around the time when the Trump presidency began. And the dollar has been swimming in a weak, lethargic state since. So much for the strong dollar comment.

And remember that this persistent Dollar weakness occurred against the backdrop of Fed Funds rate floating in excess of 3.0%.

So, should we expect a continuation of the dollar weakness in the 1Q of 2026? Or should we expect some sort of a trend reversal?

Prediction the dollar’s direction in the near term is really hard because of three factors:

- geopolitical impact on financial flows

- new Fed chair in 2026

- soaring US stock prices

On the first factor, the key theme is ‘de-risking’ from Dollar assets. The frantic search to store assets in hard currencies has accelerated. Witness the soaring price of gold and silver. These metals go ballistic when geo-political uncertainties swelled (1979 and 2011).

Next, Powell’s imminent replacement will bring more uncertainties to the dollar as the US central bank pivots from its monetary current policy.

Lastly, the soaring US stock market is adding a new risk to the dollar in 2026. In the past, when US stocks wobbled the Dollar normally appreciated since it is viewed as a ‘safe haven’ asset. This role is lessening but it has not totally gone away. How will the dollar perform should S&P correct? Few know for sure.

Therefore, I expect the Dollar to come under some selling in the next few months, although an oversold rebound from time to time should not to be ruled out.

For example, GBPUSD may encounter some resistance at 1.400 to retreat back into range.

What is the GBPUSD forecast in weeks, months, and years?

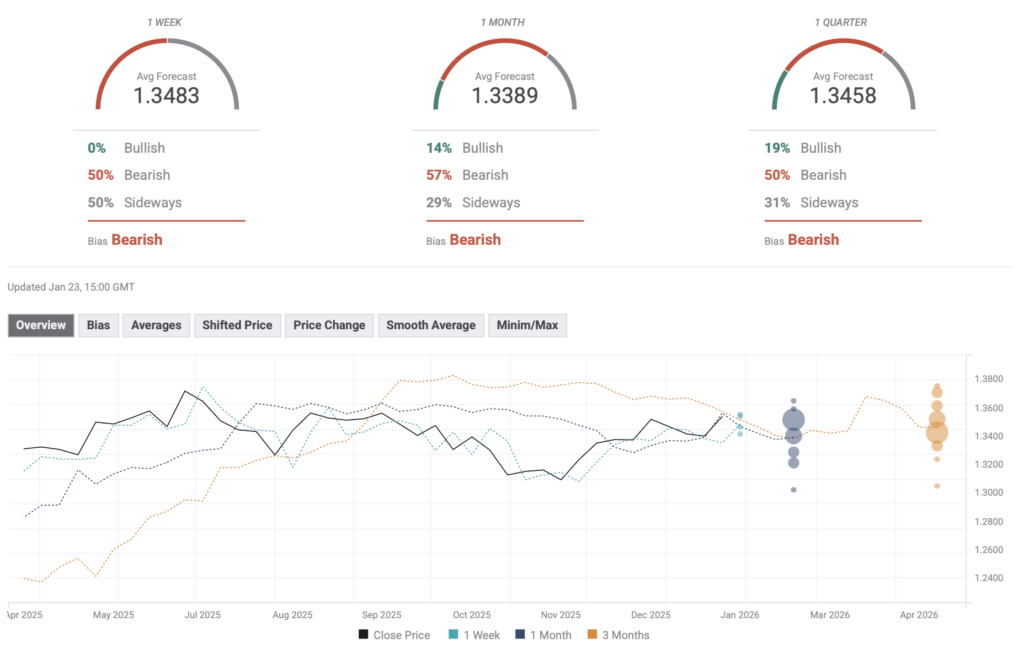

Despite the steeply rising GBPUSD, many brokers are not convinced that it will stay high.

For example, the range of GBPUSD forecasts a month out from this week is still recorded below 1.340 (see below). A quarter away the spread of forecasts expands slightly, but none breached the 1.400 area.

In other words, most analysts were expecting the Dollar to regain some strength, thus pushing the rate back into 1.340-1.360.

Source: fxstreet.com (Jan 2026)

Where is the best place for buying large amounts of US Dollars from Pounds

There are two different ways people buy US Dollars from Pounds

- Through a currency broker – when transferring money abroad

- Through a forex broker – when speculating on the price of currency

You can use this comparison table of currency brokers to see how many currencies they offer, what the minimum USD transfer is and if they offer forwards and currency options as well as when they were established. You can either visit each currency broker individually or use our currency quote comparison tool to request multiple exchange rates.

Or, if you are more interested in trading GBPUSD you can compare forex brokers here.

What is the live GBPUSD exchange rate?

The current GBPUSD exchange rate is $0.74176 which is a change of 0.57% from the previous day’s closing price. Over a week GBPUSD is 0.57%, compared to its change over a month of 1.46% and one year of -5.92%.

GBPUSD exchange rate data is updated every 15 minutes.

Other Forecasts:

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.

Yes, Wise is one of the cheapest and easiest ways to send money abroad. Highly recommended. Wise also won Best Money Transfer App in the 2025 Good Money Guide Awards.

Yes, Wise is one of the cheapest and easiest ways to send money abroad. Highly recommended. Wise also won Best Money Transfer App in the 2025 Good Money Guide Awards.