Freetrade Plus launches with stop losses and limit orders

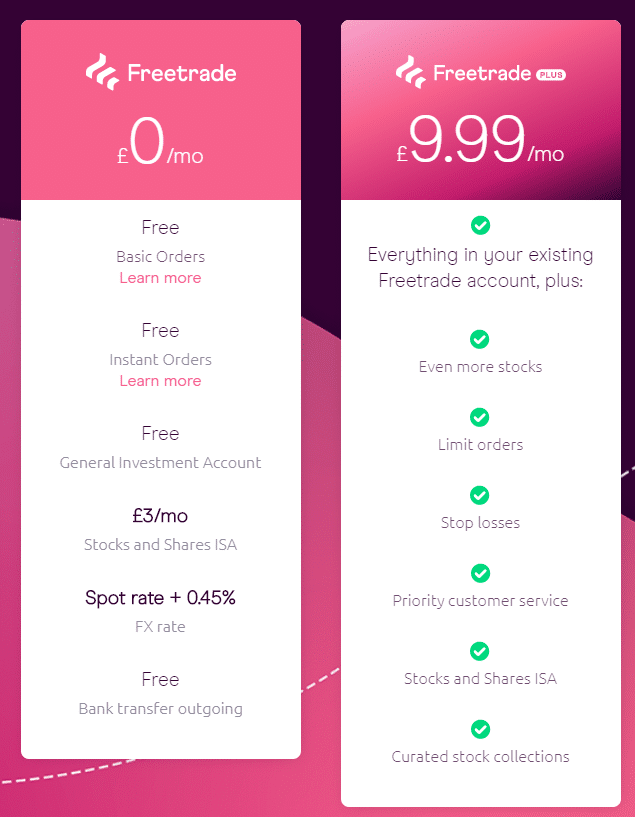

Freetrade has launched its new enhanced trading service called Freetrade Plus. Building on its existing approach to low cost and free online trading the broker has introduced a premium service which offers additional trading functionality for a fixed monthly fee of just £9.99.

The service will provide the customer with access to limit and stop-loss orders and the new service will also allow users to trade a much wider range of equity issues.

What can you invest in with Freertrade Plus

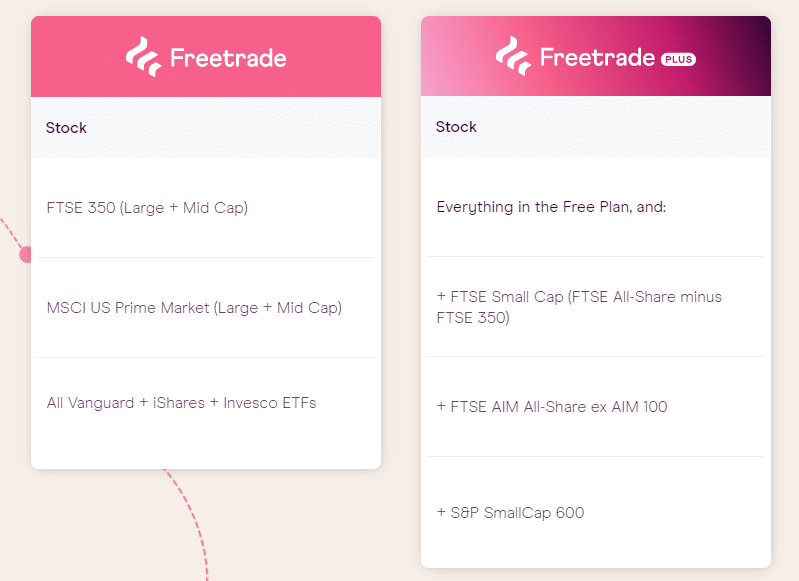

The Freetrade stock universe is going to expand dramatically for all users to encompass the FTSE 350 constituents, the FTSE AIM 100 stocks, the MSCI US Prime Market constituents, iShares, Vanguard and Invesco ETFs plus IPOs SPAC’s and other popular large-cap companies,

Freetrade Plus users will also be able to access the S&P Small-Cap 600 stocks, the FTSE All-Share and AIM All-shares lists and all other available ETFs.

Freetrade will look to introduce more international equities to its available markets for the Plus service over time.

Freetrade Plus will offer additional customer support between 6.00 AM and midnight UK time and the subscriptions will be charged and debited monthly.

How does Freetrade Plus compare to other brokers?

That £9.99 per month fee compares very favourably with the likes of Hargreaves Lansdown who charge £11.95 per trade but who offer a wider range of asset to their customers. However, it might look expensive when compared to Trading 212 ‘s commission-free offer that already encompasses 2500 stocks.

The new offer from Freetrade is an improvement but its not a game-changer per sae, as such two questions come to mind.

Firstly how many new customers will Freetrade attract to the Plus service? Secondly how many of its existing 200,000 customer base will it be able to upsell to? That matters because if 10% take up the offer that could generate an additional marginal income of almost £2.40 million per annum for Freetrade

That being the case might we expect to see Freetrade expand its premium offerings further over time? The proof of that pudding will be found in the overall take-up rate of the new service.

That in turn will feed directly into Freetrades valuation and any future fundraising via crowdfunding or venture capitalists. When the firm last raised cash, back in May, the implied valuation of the business stood at £140 million.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

You can contact Darren at darrensinden@goodmoneyguide.com