Cryptoassets are considered to be high-risk, speculative investments. They are much higher risk than traditional asset classes such as stocks, bonds, and real estate.

Why Cryptocurrency is a risky investment

The reason cryptoassets are high risk is that they tend to be very volatile. While their prices can rise explosively at times, their prices can also fall dramatically. It’s not unusual to see the price of a cryptocurrency fall by more than 20% in a single day.

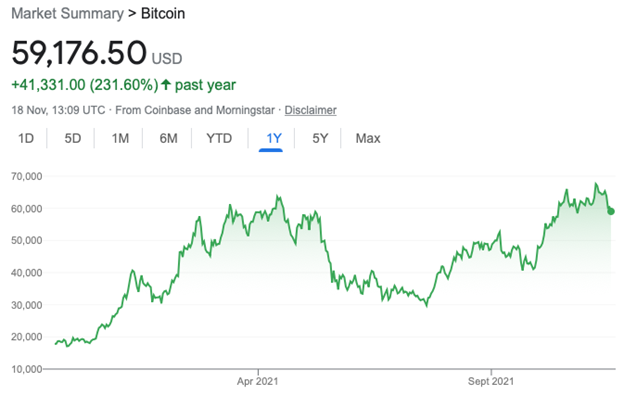

This volatility can be seen in the price of Bitcoin during the first half of 2021. Between January 2021 and April 2021, the price of BTC rose from around $30,000 to above $60,000. However, over the next few months, it then fell back to around $30,000.

High returns, but high risk

Had you invested at the start of 2021 when Bitcoin was trading near $30,000, you could have potentially doubled your money in just a few months. However, had you invested in April near the $60,000 mark, you would have seen your investment halve in value over the next few months.

Given their volatility, financial experts generally recommend not investing more than 5% of your overall investment portfolio in cryptoassets.

It’s worth pointing out that while cryptoassets are risky, studies have shown that they can potentially improve a balanced portfolio’s returns over the long term.

Sharp Ratio Analysis

In 2020, analysts at Fidelity compared the performance of a standard 60/40 equity/bond portfolio with the performance of some 60/40 portfolios that contained a small amount of Bitcoin (1% to 3%).

Fidelity’s analysts found that the portfolios with Bitcoin exposure generated higher returns over the long term than the standard 60/40 portfolio, without a significantly higher level of risk. Interestingly, the portfolios with Bitcoin exposure had a higher Sharpe Ratio than the standard portfolio meaning they delivered better risk-adjusted returns.

| 5-year average return | Annualised volatility | Sharpe Ratio | |

| Balanced 60/40 portfolio | 6.83% | 11.67% | 0.59 |

| Balanced portfolio with 1% Bitcoin | 7.98% | 12.04% | 0.66 |

| Balanced portfolio with 2% Bitcoin | 9.11% | 12.54% | 0.73 |

| Balanced portfolio with 3% Bitcoin | 10.24% | 13.16% | 0.78 |

Source: Fidelity. Returns to 30 September 2020.

This research suggests that cryptocurrency could potentially play a role in a well-diversified investment portfolio.

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognised as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.

To contact Ed, please see his Invesdaq profile.