Launched in 2015, Ethereum is a programmable blockchain technology with smart contract functionality. When people talk about trading Ethereum, they’re actually talking about trading ‘Ether’ – a tradable token designed to fuel the Ethereum ecosystem.

To buy Etherum in the UK you need a cryptocurrency exchange like eToro, Coinbase or Revolut. In this guide, we explain what Etherum is, where to buy it and the risks involved.

Use our comparison table of Ethereum accounts to compare costs and the different ways to buy and sell Ethereum. Please Note: Investing in Ethereum and other cryptocurrencies is very high risk and not regulated by the FCA. There is a very high chance you may lose all your money.

| Cryptocurrency Platform | Good For | Number of Cryptocurrencies | Costs & Fees | Customer Reviews | More Info |

|---|---|---|---|---|---|

| Investors | 120 | 1% | 3.4

(Based on 277 reviews)

| See Offer Capital at risk |

| All-Rounder | 30 | 1.49% | 4.4

(Based on 934 reviews)

| See Offer Capital at risk |

| Beginners | 150 | 3.5% | 3.3

(Based on 3 reviews)

| See Offer Capital at risk |

| Intermediates | 8 | 0.12% to 0.18% | 4.4

(Based on 934 reviews)

| See Offer Capital at risk |

| Pros | 395 | 0.02% – 0.04% | 0.0

(Based on 0 reviews)

| See Offer Capital at risk |

Methodology: We have chosen what we think are the best Ethereum investing accounts based on:

- over 30,000 votes in our annual awards

- our own experiences testing the Ethereum crypto exchange accounts with real money

- an in-depth comparison of the features that make them stand out compared to alternative Ether cryptocurrency exchanges.

- interviews with the ETH crypto exchange CEOs and senior management

eToro: Best for Ethereum Portfolios

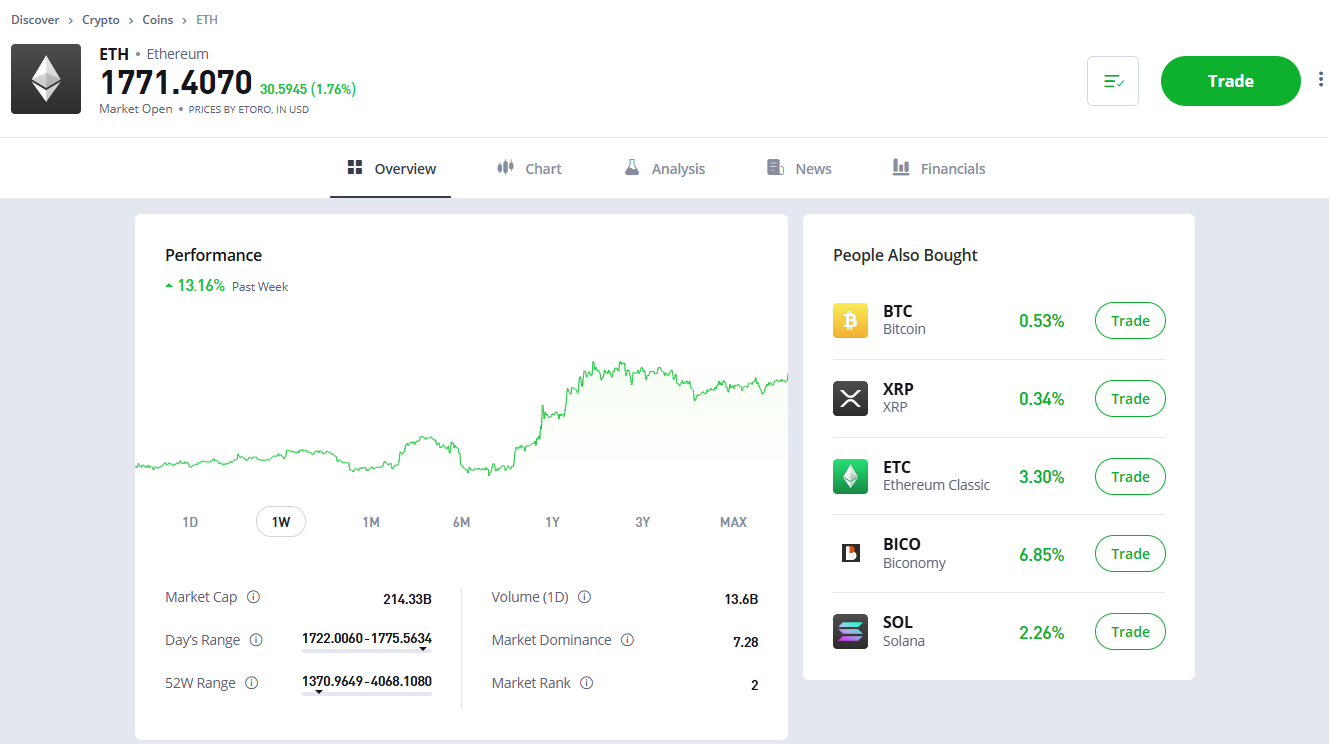

With eToro you can buy and sell Ethereum on their normal investment platform in USD or for advanced crypto investors you can deposit and withdraw crypto on the eToro crypto exchange.

There are no fees when you buy Ethereum on eToro, but you do have to pay to convert your GBP into USD which is the currency ETH is traded in.

You can also set price alerts with the Ether price moes by a certain percentage. Plus, if you don’t want to be fully exposed to Ethereum, you can buy a crypto portfolio that contains the major cryptos like Bitcoin, XRP and XLM.

As eToro is mainly a copy trading platform, when you view the Ethereum page, you can also see a list of eToro traders that are focused on Ethereum and how well they have done in the past.

eToro Cryptocurrency Investing Review: Best Crypto Broker 2025

Account: eToro Cryptocurrency Investing

Description: With eToro you can buy and sell cryptocurrency on their normal investment platform in USD or for advanced crypto investors you can deposit and withdraw crypto on the eToro crypto exchange. Don’t invest unless you’re prepared to lose all the money you invest. This is a high- risk investment and you should not expect to be protected if something goes wrong.

Is eToro good for investing in crypto?

Yes, I’d say that eToro is a good crypto broker as they are they are regulated by the FCA for cryptocurrency activities. I’d say that eToro is better than Binance and Coinbase for crypto trading for the average investor, but for those who want more exotic cryptos and are happy to take on more risk a specialised crypto exchange may be more suitable.

Yes, I’d say that eToro is a good crypto broker as they are they are regulated by the FCA for cryptocurrency activities. I’d say that eToro is better than Binance and Coinbase for crypto trading for the average investor, but for those who want more exotic cryptos and are happy to take on more risk a specialised crypto exchange may be more suitable.

2025 Awards: Best Cryptocurrency Broker

Market Access: eToro has quite a diversified range of markets to trade, so if crypto only forms a small part of your investing portfolio (as it should do) you can also invest in other things like UK and US stocks and ETFs.

App & Online Platform: You can withdraw cryptocurrency from eToro instead of keeping it on their trading platform, this is particularly important if you want to keep safe custody of your cryptocurrency so you don’t need to worry about, yet another crypto broker going bust.

Customer Service: Very good, you get an answer pretty quickly if you have any questions and if you accoutn is big enough you’ll get a personal account manager to help with any issues.

Research & Analysis: The social crypto trading feature is what makes eToro stand out. It’s really interesting to see what others are trading and why.

Pricing: There is a downside though to trading crypto through eToro and that’s the fees, they charge 1% commission, But this is still cheaper than Revolut and Coinbase. Generally, eToro is quite an expensive broker for crypto. eToro is expensive for crypto because quite they do at least some vetting before (as their UK MD told me) they add them to the platform, so you have a smaller chance of being caught up in a crypto pump-and-dump scam.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Pros

- 120 cryptocurrencies

- $50 minimum deposit

- 1%* commission on crypto trading

Cons

- General accounts only

-

Pricing

(4)

-

Market Access

(5)

-

App & Online Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(5)

Overall

4.7Revolut: Simple Ethereum account for smaller traders

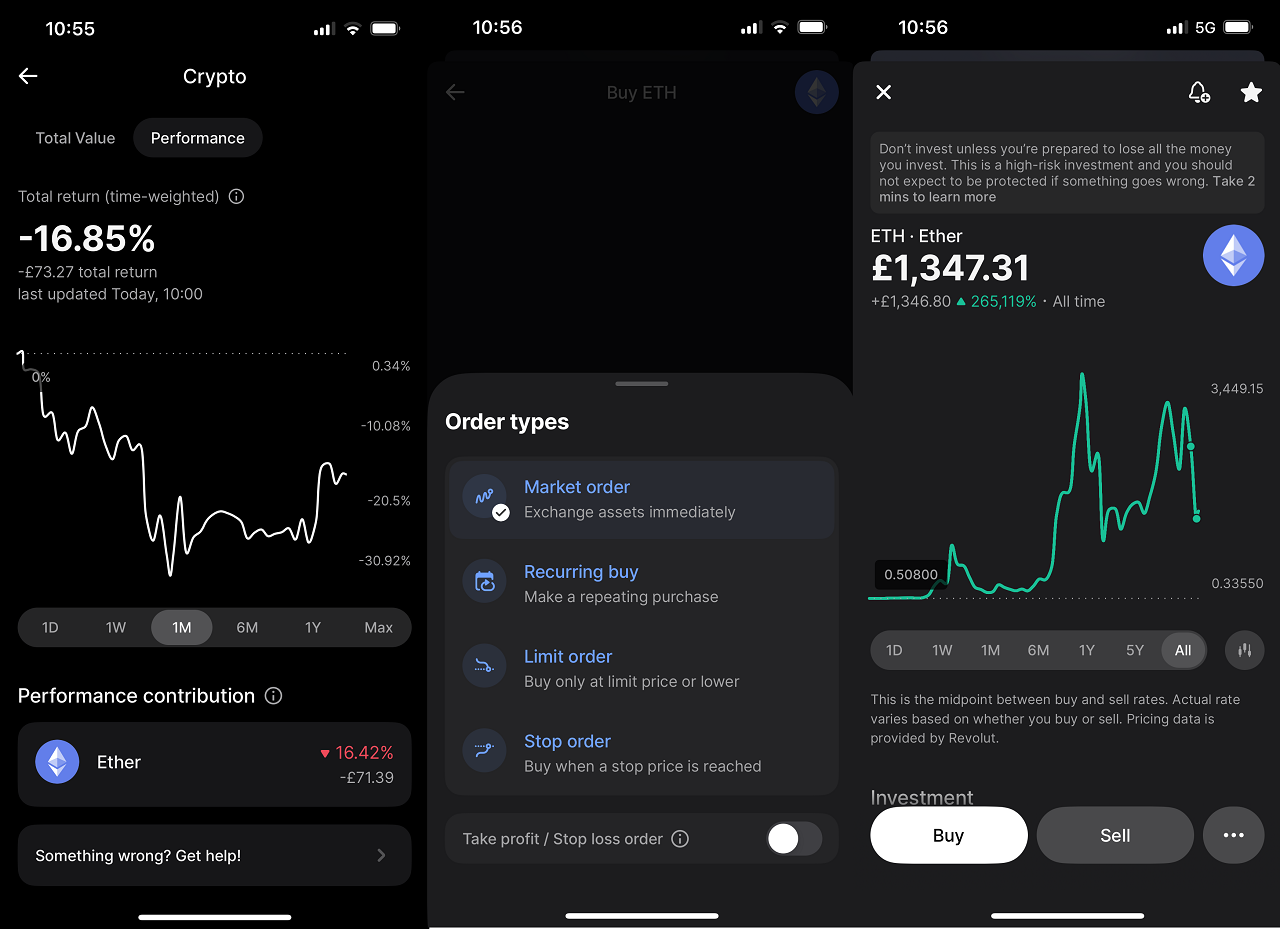

Revolut lets you buy, sell, and send Ethereum and other digital currencies at the touch of a button, with no hidden fees. Revolut’s cryptocurrency service is not regulated by the FCA, other than for the purposes of money laundering. Capital at risk.

Revolut Cryptocurrency Review: Banking and digital assets all in one

Account: Revolut Cryptocurrency Investing

Description: Revolut X lets you trade crypto on a stand alone app. As Revolut is now a bank more than a crypto exchange, its app is a good way to dabble in the crypto markets if you just want to buy a small amount of the most popular cryptocurrencies. Capital at risk

Is Revolut good for cryptocurrency investing?

Revolut is a good choice if you are just dabbling in cryptocurrency and don’t need anything too complicated.

Market Access:

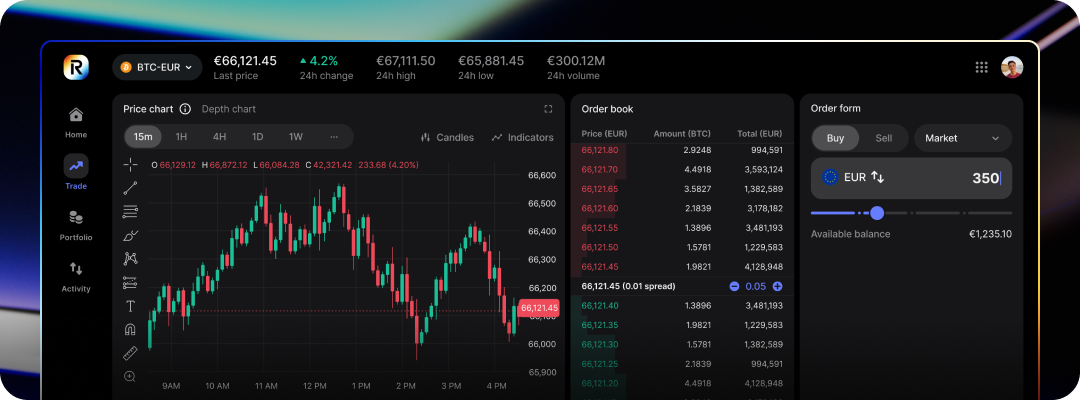

Revolut X lets you trade 400+ pairs to trade in real-time with USD, EUR, or GBP with instant visibility of how your portfolio is performing and decide your next trade with token details and a live order book.

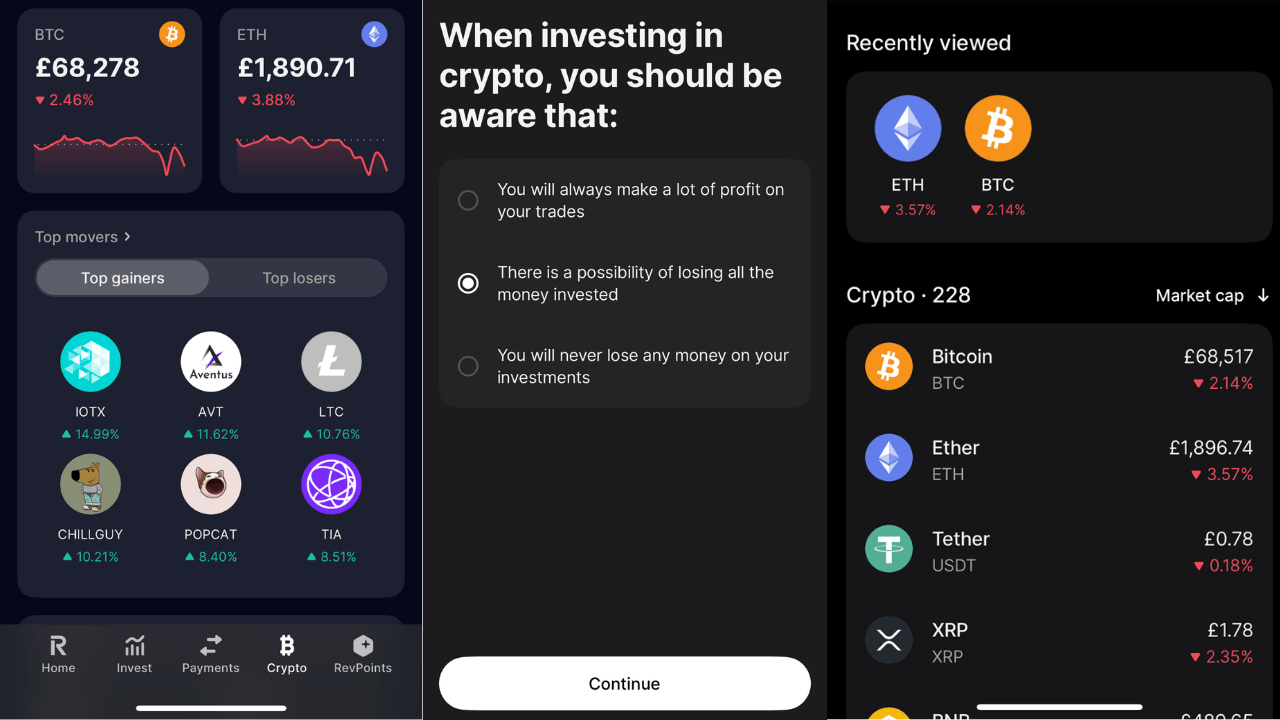

On the baking app you can buy, sell, and send over 228 digital currencies at the touch of a button, with no hidden fees. But, Revolut’s cryptocurrency service is not regulated by the FCA in the same way as investing in the stock market. As you will find out when you take the “how well do you understand crypto” quiz when you try to buy cryptocurrencies on the app.

App & Online Platform: It’s pretty easy to buy crypto on Revolut, it took me about 3 minutes to login, acept the terms and conditions that I may lose all my money and buy some Bitcoin and Ethereum. If you want to know which is best, we’ve just written a guide on Bitcoin versus Ethereum. However, it’s a bit annoying that it’s app only and you can’t use it on a laptop or desktop.

If you are trading crypto on Revolut X it is also available on desktop if you want to see more detailed market analysis. You’ll find technical indicators, TradingView charts, and top-traded, top-gaining, and top market cap coins.

Revolut Fees: Versuse eToro & Coinbase For Crypto

Revolut X does not charge if you are a (taker) selling, but there is a 0.09% charge if you are buying (making). The difference is based on if you are making or taking liquidity from the exchange.

Revolut has recently reduced it’s commission for buying and selling cryptocurrency for trades above £20,000 from 1.49% to 1.29%. From 24 March 2025, Revolut has also removed the minimum trading limit, so you can now make trades below £1.49.

In real-terms that means if you bought £100k worth of Bitcoin it would save you £180 compared to the previous pricing structure. It’s a decent saving. but won’t really make a difference, especially as if you buy £100k of one of the most volatile digital assets in the world the price will probably have changed by that much before you have read your confirmation notification.

Fees are pretty high, if you are just buying a small amount. To test the app, I bought £200 worth of each I was charged a whopping £2.98, which is 1.49%. That’s very high compared to buying share,s which are largely commission-free these days. However, Revolut has recently reduced their crypto commission for trades above £20,000. It’s not as cheap as eToro’s 1%, but it’s certainly a lot cheaper than Coinbase.

Customer Service: Obviously, there is no phone number (Revolut has far too many customers for a call centre to handle), and no in-app live chat feature, but there are direct links if you need to report any fraud or banking issues.

Research & Analysis: You get access to some fairly standard articles and news feeds on crypto but nothing unique. There are links to the cryptocurrencies official websites and the white papers, so you can do your own more thorough research.

Pros

- Lots of cryptocurrencies

- Small dealing minimums

- Part of the overall service

Cons

- 1.49% commission for base accounts is quite high

- Limited crypto research

- No direcet market access

-

Pricing

(4)

-

Market Access

(4.5)

-

App & Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.3Coinbase: Trade Ethereum On A NASDAQ Listed Exchange

On Coinbase you can buy and sell Ethereum and popular digital currencies, keep track of them in the one place and invest in cryptocurrency slowly over time by scheduling buys daily, weekly, or monthly.

Coinbase Expert Review: Safety in numbers of a listed crypto exchange

Provider: Coinbase

Verdict: Coinbase is a cryptocurrency exchange that lets you buy and sell various cryptocurrencies like Bitcoin, Ethereum, Cardano and Solana. Coinbase was listed on the NASDAQ exchange in 2012 and claims to have over 273 billion assets on account in over 100 countries and process $185 billion in quarterly volume.

Is Coinbase good for Crypto investing?

Coinbase is one of the largest cryptocurrency exchanges and is publically listed on the NASDAQ exchange (COIN). It offers access to large selection of cryptocurrencies that can be traded on it’s crypto exchange or withdrawn to a cryptocurrency wallet.

Pricing: It’s expensive, when Iwas testing the app I bought some Bitcoin to test the app, I was charged over 3% in commission, that’s far more than eToro who at the moment only charge 1%. But having said that, I did double my money as Bitcoin had a bit of a rally after my original review, so it’s not all bad, if it goes up that is…

Market Access: Coinbase offers the most cryptocurrencies compared to other exchanges, which makes them a great venue if you are interested in spreading your risk or looking for more volatile cryptos with a higher risk/reward ratio.

App & Online Platform: No complaints here, just does what it’s supposed to. No stand out features or research though.

Customer Service: Pretty good. I had a question, they answered it. Sorted.

Research & Analysis: No research on the app, but then again, brokers only provide research to get people interested in markets and I don’t think I’ve had a conversion about money in the last 12 months that hasn’t included crypto in some way so no stimulus needed.

One thing I do like about Coinbase though is that it’s a US company listed on the NASDAQ so in theory, if there are any problems with it that should be reflected in the share price.

Why should investors be more cautious when investing in crypto assets with Coinbase

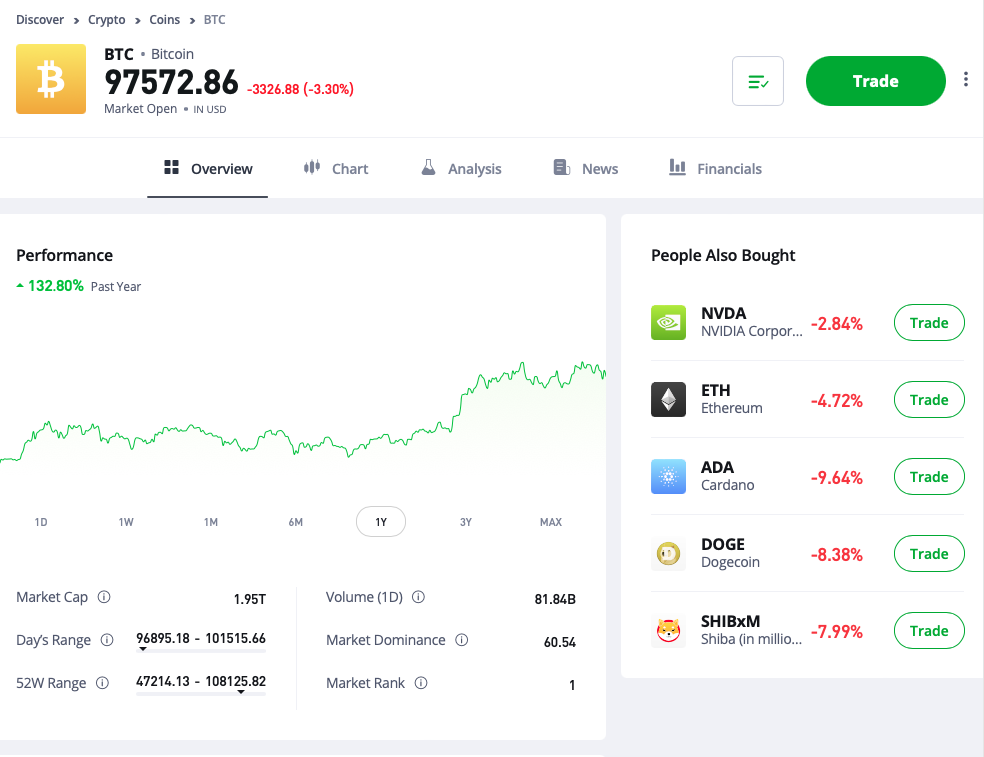

I knew I should have sold when Bitcoin reached $100,000! When I reviewed Coinbase back in July last year, I some bought Bitcoin and Ethereum to test the app, and then forgot all about it. As Bitcoin has reached record highs, it jogged my memory and I was delighted to see when I logged back in that it’s now worth double. But I still think cryptocurrency is an imaginary asset and should be treated with extreme suspicion, here’s why.

I don’t really like crypto as an investment, I think it’s daft. Yes, there is money to be made from crypto, but not necessarily if you are investing in it. Yes, some will make huge amounts from exchanges like Coinbase, and they will be the most vocal about the merits of digital currencies as an asset class. But no, not everyone or even the majority will make money.

However, it it fairly undeniable that Bitcoin is now mainstream and that as major funds start buying it and it becomes easier to trade on regulated stock exchanges it does have a place in most people’s portfolios.

But it’s the hype that is driving crypto prices, rather than the use case. The young though are taking massive risks and dangerously putting all their eggs in one baskets. And most worryingly being heavily influenced by people ramping crypto prices and coins on social media.

The mentality of following the herd is not new, two decades ago when I first started out as a stockbroker it was mining and oil stocks. Companies would raise money on the stock market from people buying new shares to drill a hole in the ground. If they struck gold or “black gold” the share price would go through the roof, but if they didn’t it would be worthless.

Then it was tech stocks, same story, The City filled their boots as it wasn’t really about what the company was worth or even if they made any money, it was about how many people were buying them, and what the perceived future value could be.

Then carbon credits, which although a real thing, crooks in call-centres in Spain basically made up to cold-call and pressure sell investors into buying them on the basis they would be worth more in the future. All very Wolf of Wall Street, it wasn’t even stuffing people into an investment for high commissions it was just lying and stealing money.

- Worried a crypto coin is a scam? Check out our list of the biggest crypto shitcoin disasters.

Next came binary options, which I actually quite liked as they were a form of limited risk short-term bet on the movement of a market. In theory, the perfect way to day trade. The market is either going to do one of two things during the day, go up or go down, so you just placed a bet on what you thought was going to happen and your risk was capped based on your stake. This I felt was slightly safer than CFDs and spread betting because with those your potential losses are unlimited (or were at the time before negative balance protection and leverage caps). Plus one of the major mistakes that traders make is not cutting their losses (another is banking profits too soon).

But the problem with binary options wasn’t the product it was the fact that they were not regulated by the FCA. Reputable firms in the UK did offer them in a regulated environment to their customers, but, then, the carbon credit scammers moved on to binary options, and set up basic platforms without hedging any underlying risk and stuffed punters full of welcome bonuses and “trade ideas”, again just lying and stealing.

So, now that binary options have been banned, where have the scammers gone? Crypto, that’s right. But then, the FCA’s in their ultimate wisdom, decided to ban retail traders in the UK from trading through spread bets and CFDs. Now clearly in some respects, this was a good thing because trading a product on leverage which has price moves of 50% a day is clearly very high-risk and will almost definitely result in high financial losses for the majority of people that trade them. But what happened, was that because the FCA didn’t want to take responsibility for regulating crypto, it was binary options scams all over again. Honestly and with no hyperbole, I have just received a call on my mobile whilst writing this review from a Germany number asking me “how my investments are performing and if I’d heard of crypto”. I get these at least twice a day. I don’t even bother answering my phone anymore.

But, if there is a market, people are going to want to trade it and you just have to look at any analytics to see that crypto is what people want to invest in and trade.

As it becomes a more regulated financial asset, it will become safer to buy and hold, but not nesseicarly as an investement.

The FCA is taking steps to regulate providers to ensure that customers are treated fairly, but you still don’t get FSCA protection.

If you want to buy cryptocurrency you have two options really, you could go with a provider like eToro or Revolut, who are regulated by the FCA for other products or you can go with one of the massive VC backed crypto exchanges.

I used Coinbase, but it isn’t the cheapest though as when I did some test trades the fees were 3.84% for buying Bitcoin and Ethereum compared to eToro’s 1% and Revolut’s 2.5%. Coinbase does offers the most cryptocurrencies to trade though, 150 versus 120 and 30 respectively. Coinbase is at least a public company so you can keep an eye on their finances to see how likely it is they are going to go bust. Coinbase is currently traded on the NASDAQ and at the time of writing worth $14bn, (although the share price is down 85% since they IPO’d in April 2012). eToro and Revolut are still private companies (not for the want of trying to IPO mind).

I’ve traded crypto as a derivative before it was banned (although you can still trade crypto with a professional account), I’ve traded $50m clips of FX, worked £10m positions when trading stock CFDs, but oddly enough, I felt more nervous when depositing £500 into Coinbase to buy some Bitcoin for that review. I even used my secondary bank account, because I did’t want the transaction on my main personal account, just in-case when we came to re-mortgage “the computer says no” because they viewed me as some sort of crypto bro.

I’m still not sure about crypto, but this shouldn’t really be about crypto it’s about Coinbase, after all they are just giving people what they want. They are not forcing anyone to buy crypto (Twitter, Youtube and Instagram do that), they are just making it easy. And it is easy, it’s an incredible piece of tech, like Betfair was to gambling and what the LSE was to share trading, if you want to trade it you can.

But it’s still in it’s infancy as a regulated product and so as an “investor” you are not protected if anything goes wrong. Coinbase say they provide FDIC insurance if someone hacks them and nicks your crypto (up to $250k), but this doesn’t cover you if you get hacked, or Coinbase goes bust.

Unlike buying stocks in the UK where you are covered by the FSCS and shares and investments are held in nominee accounts in a very well-established and highly-regulated banking infrastructure. In the immortal words of Mark Corrigan,

There are systems for a reason in this world, economic stability, interest rates, growth, it’s not all a conspiracy to keep you in little boxes all right.

If you want to have a punt on crypto, you pays your money, you takes your chances, caveat emptor.

Pros

- Wide range of cryptocurrencies

- Publically listed company

- Exchange and withdrawals

Cons

- Very high-risk investment types

- You can lose all your money

- Cryptocurrency still unregulated

-

Pricing

(4)

-

Market Access

(5)

-

App & Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.4Ethereum Explained:

Crypto digital assets are disrupting the current global financial system. Ethereum is a major part of this digital paradigm shift. But what is Ethereum and how can we learn to harness its power? This guide talks about Ethereum, and the risk and rewards of investing in the second-largest crypto network in the world.

What is Ethereum?

Ethereum is an open-source digital platform. Think of it as a network of computers running synchronized software.

While Ethereum is less than 10 years old, it is a significant part of the crypto ecosystem. It is the second-largest crypto after Bitcoin. In fact, Ethereum is so popular these days that the total value of Ethereum tokens is currently worth nearly $300 billion – a market cap higher than all but 25 public companies in the world.

Ethereum was founded in 2014 by Vitalik Buterin (then age 20!) and a group of uber-smart programmers like Wood, Hoskinson, Iorio, and Lubin (see the original Ethereum White Paper here). Since then, the Ethereum system has grown into a major crypto platform.

Ether (ticker: ETH) is the ‘native currency’ of the Ethereum platform and serves, in Vitalik’s words, as the ‘main crypto-fuel of Ethereum’. ETHs are used to pay for transactions on the Ethereum platform. So when we talk about the price of Ethereum, we actually refer to the price of Ether.

Ethereum is a decentralised network of computers (‘nodes’) built upon blockchain. As noted in our Bitcoin Primer, blockchain is a distributed ledger system (DLT). It comprises of a network of hosting nodes where user data is stored. No one controls Ethereum in the traditional way.

From the outset, Ethereum was designed to meet challenges outside the core competencies of Bitcoin. It lays the framework so that useful applications can be built on top of it. As more people joined the platform, Ethereum gained from the ‘Network Effect‘ – its success is proportional to the number of users.

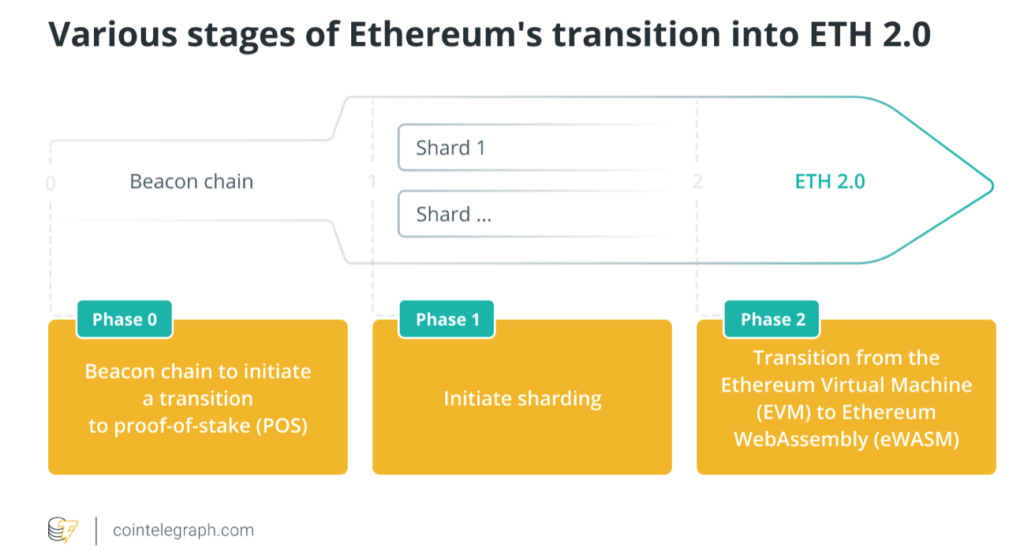

Major upgrades are set to happen in the near future (Beacon Chain) to make the Ethereum platform even more scalable and secure. Ethereum is set to change from ‘Proof of Work‘ (PoW) – whereby miners solved complex puzzles to obtain ‘rewards’ in the form of Ether tokens – to a ‘Proof of Stake’ system. In this system, validators earn tokens by validating contracts on the Ethereum platform. This change is highly complicated because it requires the platform to maintain integrity during the transition.

Source: Cointelegraph.com

What can Ethereum be used for?

Ethereum is a decentralised system that can facilitate cryptographically-verified transactions. So it can be used for a lot of real-life situations.

At its fundamental level, Ethereum supports ‘smart contracts‘ – which, in simplest terms, is a series of computing instructions. These instructions are executed when certain conditions are met. For example, X sends $100 to Y on 16 May 2022 at 10.00am.

Smart contracts are first coded in computing languages, of which the most popular is Solidity (latest version 0.8.13), and then deploy in the Ethereum network.

But where exactly are these smart contracts executed? Typically these instructions are performed on the Ethereum Virtual Machine (EVM) – the environment that executes on each Ethereum node and carries out smart contract instructions (see here for a further explanation of EVM). Once deployed, these smart contract programs are immutable – another word for ‘unchangeable’.

Each node (computer) in the Ethereum network can run these programs and get the same result. Note that these contracts are dormant (like a vending machine). They will be activated when triggers are hit (like someone putting a coin in the vending machine). Since smart contracts are on public domain, anyone can check if the transaction happened.

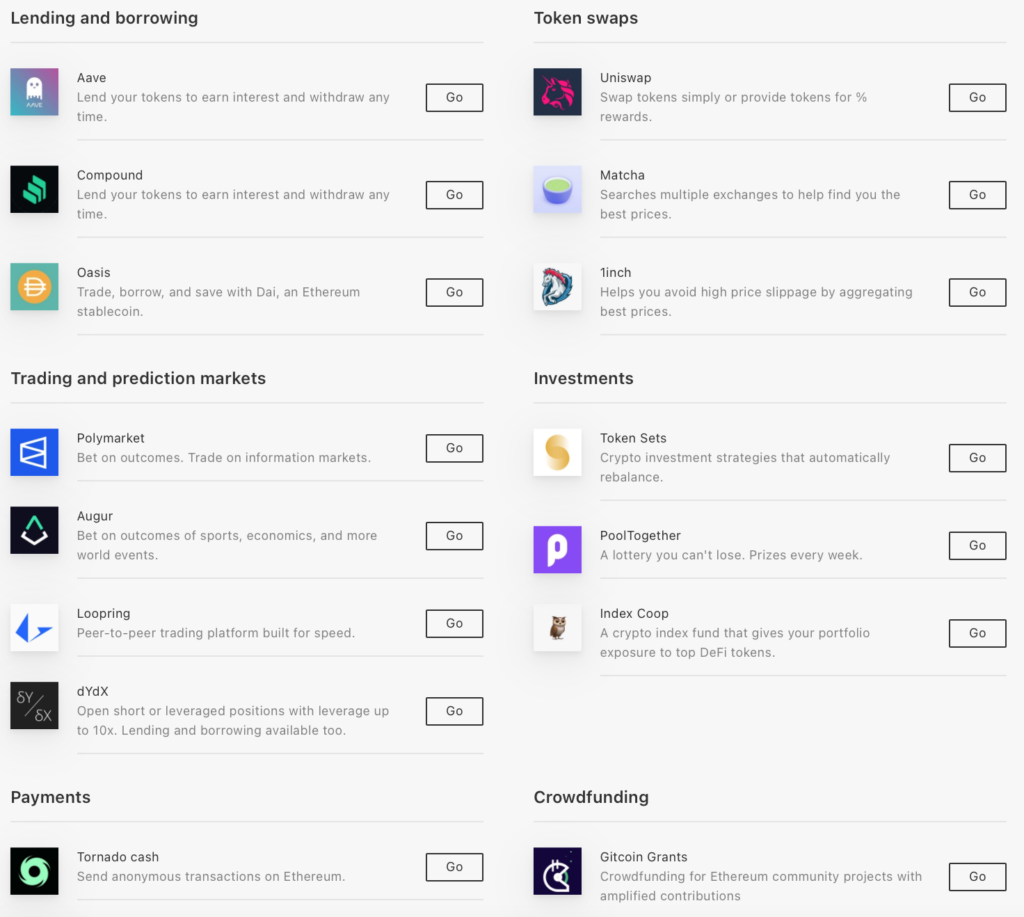

Smart contract platforms like Ethereum are used to build on other applications. According to Ethereum.org, below is a sample of what these codes are used in:

Source: Ethereum.org

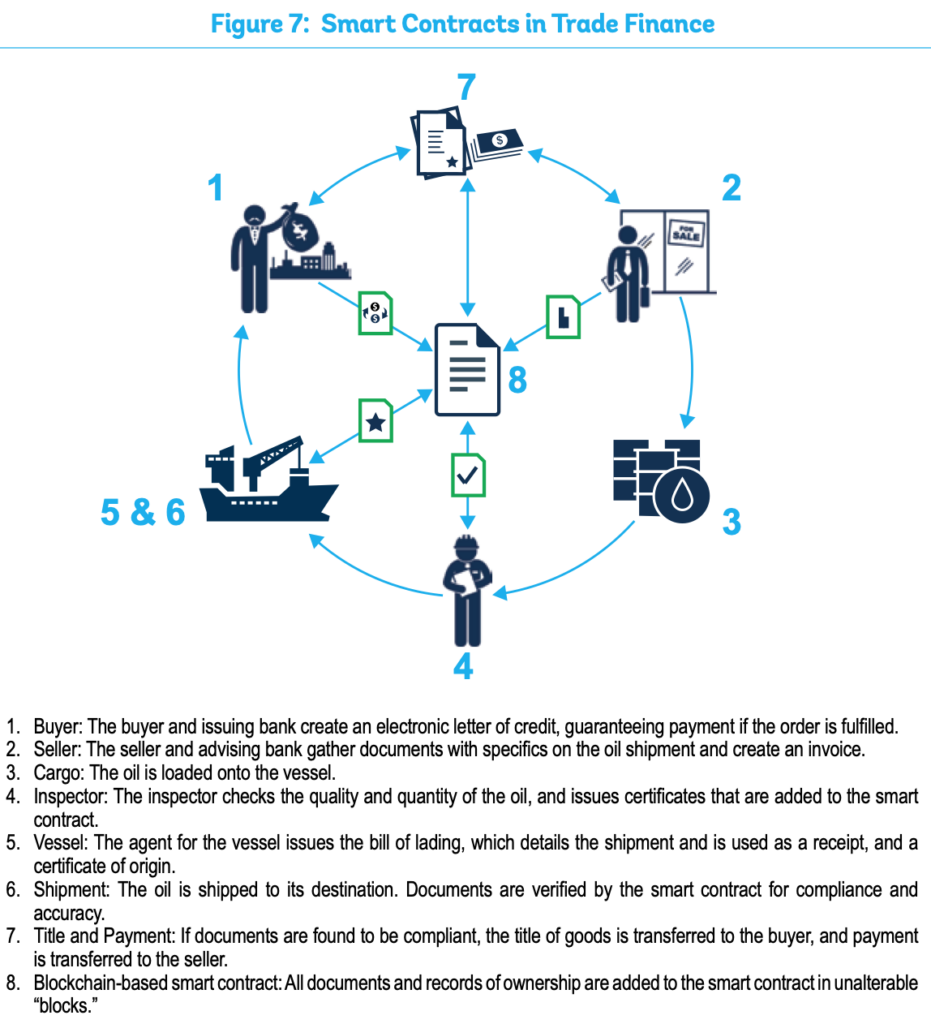

Another real-life example of smart contracts is trade finance. As we all know, international trading is a highly complex process because we need to deal with customs, port authorities, multi-national financing and legal demands.

But with pre-agreed terms and conditions, the process can become easier. Enterprise blockchain platforms like C.rda (corda.net), Hyperledger Fabric (Hyperledger.org/use/fabric), Quorum (consensys.net) have sprung up to capture this market. Once trust is gained on these platforms, more users will join them.

Source: World Bank

Is there a business case for investing in the Ethereum platform?

Definitely. And the potential market is becoming larger by the month.

Businesses can take advantage of the decentralised and immutable nature of the Ethereum platform. Two major uses include:

- Decentralised finance (Defi) – where brokers, middlemen, expensive transfer fees are either eliminated or reduced. Currently, the finance industry is driven by centralised institutions (think central banks and big banks). DeFi emphasises peer-to-peer networks that promotes business transactions through the blockchain technology.

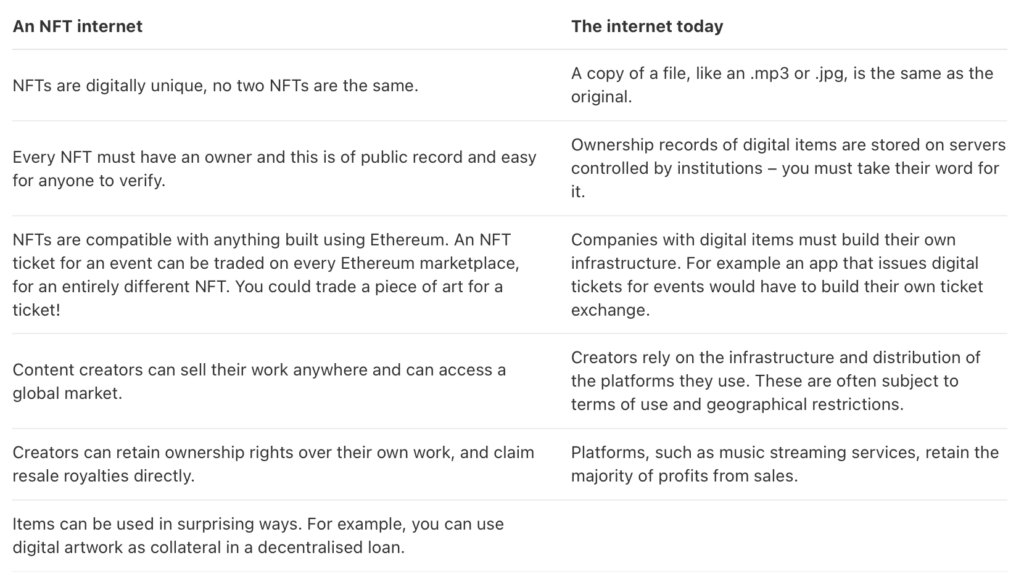

- Non-Fungible Tokens (NFT) – are immutable pieces of data that can be part of a digital art. Promoters of NFT will uses Ethereum to sell unique ownership of ‘valuable’ pieces of items. A comparison of what an NFT is showed below:

Source: Ethereum.org

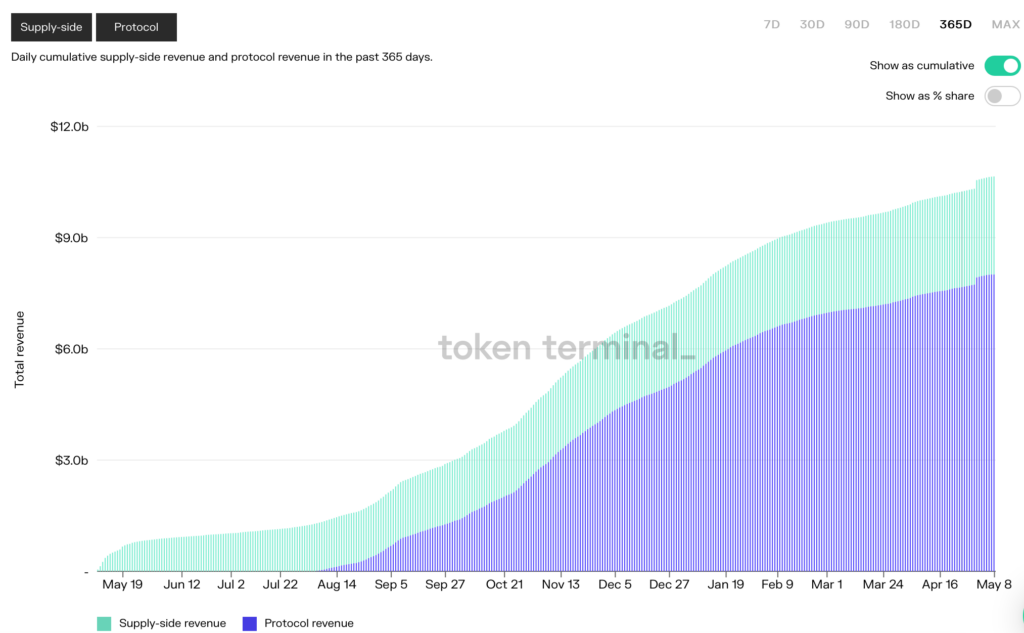

As more users operate on the platform, recurring revenue will rise over the quarters and years. As you can see from this chart, the Ethereum protocol is estimated to have generated $640 million of revenue in the past thirty days alone – with annualised revenue running about in the region of $7-8 billion.

Source: tokenterminal.com

What are the risks involved buying Ether?

Investments always carry risk. It is only a matter of degree. Crypto assets in general are high-risk because they are new, speculative, and volatile.

First, the price of Ethereum is highly correlated with Bitcoin, itself highly correlated with Nasdaq. The reason for this is obvious: The deepening involvement of institutional investors. For better or worse, Bitcoin is now viewed as a ‘macro asset’. As such, its price will swing violently during macro events, such as FOMC meetings. Just recently, Bitcoin and Ethereum prices plunged when the Nasdaq sank. To diversify your tech-heavy equity portfolio by buying BTC and ETH is an illusion.

Second, in contrast to Bitcoin, Ethereum does not have a concrete cap on coin supply. Hence ETH is less attractive in terms of scarcity. Unsurprisingly, Michael Saylor of Microstrategy (MSTR) prefers to buy Bitcoins over Ethereum. Is Ethereum a ‘hard asset’ like Bitcoin? That depends on your perspective. Moreover, Ethereum ‘Whales’ control a significant portion of ETH supply. Note this: The top 100 Ethereum addresses hold nearly 40% of the entire ETH tokens.

Third, Ethereum prices are hugely volatile. Yes, prices rose 50x from its March 2020 lows. But since that $4,800 peak, it lost 50% of its value. Investors who bought during the FOMO phase (Fear of Missing Out) could be sitting on steep losses for some time. In recent days, even some crypto heavyweights issued warnings about a looming crypto winter, such as the billionaire Barry Silbert of Digital Currency Group:

Source: Twitter (Barry Silbert)

Fourth, Ethereum faces competition from other crypto currencies, such as Solana (SOL, market cap $25 billion) and Cardano (ADA, market cap $23 billion). Over time, new competitors will emerge, although it is hard to see what could topple the entrenched Ethereum protocol in the near term.

Lastly, hacking is still an issue. A couple months ago, Ronin Network lost about $600 million to hacking. This is a persistent issue in the industry. Keys to wallets can be lost by users, or stolen, or just mugged in the streets (‘crypto muggings‘).

All in all, even a ‘blue chip’ crypto like Ethereum presents many investment risks. Do not go ‘all in’ at any point. Chances are, you will not capture the bottom of a bear trend.

What are the potential rewards of investing in Ether?

The crypto industry is one of the fastest-growing assets in the world. Thousands of innovators, capitalists, sovereign and banking institutions are flocking into the system to stake a claim on its future output.

After two major epic booms (2017, 2021), many early adopters and businesses have become extremely rich. For example:

- Coinbase (US: COIN) – a major crypto platform, had one of largest IPOs at $80+ billion in 2021

- Binance – owner of Binance, Zhao, was listed as one of the richest billionaires worth $74 billion

- Microstrategy (US:MSTR) – saw its share price soar 10x in 2020/21 when its CEO bought BTC in the billions

- FTX – the 29-year old Sam Bankman-Fried owns the $30 billion enterprise exchange

- Bitcoin Billionaires – Many astute entrepreneurs made a fortune in the crypto around the world as the sector booms

These are just some outstanding examples. Many crypto enterprises are expanding fast globally under the cover, just like the above early pioneers. In the years to come, we will no doubt see new crypto giants emerge from the sector.

The bears will, of course, argue that these fantastic riches (the lowest hanging fruits) have already been picked. Joining the sector now is like starting a social network post Facebook. This will not work as current giants will buy out every emerging competitor on the horizon.

True. But over the long term and certainly over a couple of up-and-down cycles, crypto is still a growing network. Adoption of the network is rising globally. A popular network like Ethereum will continue to flourish because more users are joining it. Just recently $10 billion of Ether tokens are deposited in the network for staking. This is a huge vouch of confidence.

Therefore, the reward for investing part of your portfolio into crypto may be substantial if you play the game right.