Reciprocal Tariff Deadline looms…

The clock is ticking down to President Trump’s tariff deadline, which is set to expire on 9 July.

Back in April, days after the so-called Liberation Day, President Trump noted the mayhem in financial markets and quickly paused the imposition of higher tariffs on the rest of the world. The delay was fixed, at the outset, at 90 days.

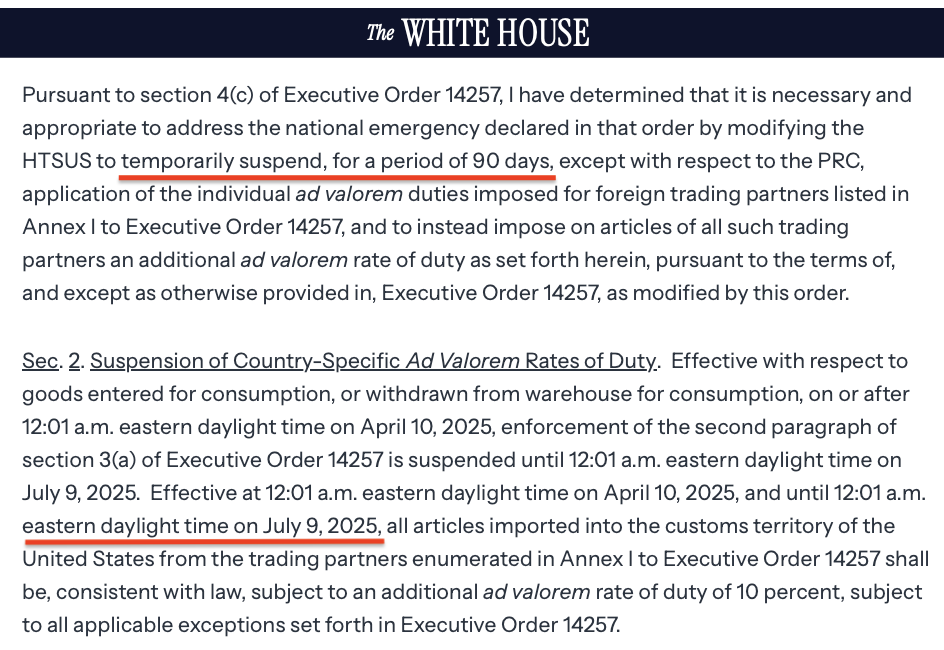

Time flies. Soon, the world will be back at the starting point again as we move into that Trump-mandated deadline. Below is the excerpt from the original Executive Order, dated April 9, stating the duration of the tariff suspension:

Are we, then, back to Liberation Day 2.0? Few know. Would the US administration be tempted to take another roll of the dice and see how higher-tariff rates will pan out this time? Or will the government decide to keep things humming along nicely at the current pace?

Source: Whitehouse.gov (April 9, 2025)

Since the imposition of the tariff delay, US stocks have staged a vigorous and stunning recovery. The monster relief rally seen in all American major equity indices were spectacular and somewhat unexpected.

For example, the US S&P 500 Index (proxied here by $630 billion ETF, SPY) surged nearly 28 percent in less than 90 days (see below). The Nasdaq 100 Index (QQQ) rocketed by more than a third in the same period. Mind you, these are broad indices made up of numerous stocks. Many individual securities have gained far more than these indices.

Sitting at (or near) new all-time highs are Nvidia (NVDA), Palantir (PLTR), Netflix (NFLX), Goldman Sachs (GS), Morgan Stanley (MS), JP Morgan (JPM) – a roster of blue-chip companies.

In particular, the sector leadership remains unchanged: Artificial Intelligence is still leading the market. Investors have continued to pile into AI-related companies as the tech revolution maintains its sharp pace of discoveries. Broadcom (AVGO), for instance, rallied to fresh highs.

Meanwhile, crypto is another sector still in a bullish mode. This is easy to understand. Bitcoin is continuing to trade above the six-figure mark. At $106K per coin, Bitcoin is just a step away from establishing new bull-market highs (see below).

The key trend noted here is that a growing number of companies are starting to ‘stack’ Bitcoins, a la Strategy (MSTR). The underlying reason for these corporate actions is clear: It boosts share prices. See, for example, Meta Planet’s share price after it announced equity-for-Bitcoin swap. Prices simply rocketed.

So, will President Trump risk all these positive and rising asset valuations by ‘tariff shocking’ the market again?

By all logic, the choice is easy to make: Do nothing. Extend the deadline; leave more room to negotiate. Why disturb a roaring bull market and risk inducing an equity correction? The financial pain suffered on all asset holders will be immense. A market rout will heap immediate political pressure on the White House, pressure that only intensifies as long as these negotiations are in limbo. This, then, leads to another TACO announcement.

(Readers can pick up the argument on tariffs from experts like Howard Marks of Oaktree Capital here.)

Furthermore, attention is now switched on the ‘Big Beautiful Bill‘ Act, which is entering into the final phase of frantic negotiation. There isn’t much political bandwidth to deal with multi-country tariffs negotiations right now.

I suspect the market knows this and prices have therefore extended its rally this week. Investors anticipate that the tariff issue will, eventually, be resolved (or kick down the road), in a manner that will not crash prices.

Should we buy into Chindia (China & India) stocks?

While equities in America are surging, other markets are too playing catchups.

Emerging Market, particularly Chindia, is an interesting area these days as investors diversify out of US assets. For example, look at the $16 billion iShares Emerging Market ETF (EEM). Prices have just nudged above the previous rally high at $48 to close at multi-year highs (see below). This appears to complete the base formation.

Why is the fund doing well? One reason is that most of EEM’s top 10 holdings are either Chinese or Indian companies. This gives holders plenty of exposure to those large Chinese tech companies. Recall the ‘DeepSeek’ moment earlier this year. This unexpected catalyst sparked the rise of many Chinese large-cap firms such as Alibaba (BABA).

Moreover, some Chinese EV companies are doing well. Apart from BYD (US:BYDDF), the latest firm riding the growing consumer auto trend is Xiaomi (HK: 1810). The former phone-maker has pivoted successfully into the EV industry. According to the Financial Times last week (£), the “Chinese phone maker touts 200,000 electric SUV orders in 3 minutes.” No wonder its share prices have been rocketing. At US$198 billion in market cap, it is now the world’s 77th largest company.

As an aside, readers may want to take a look at iShares China Large-Cap (FXI).

What about India? The country’s stock market has been rising firmly since the pandemic. You can see the ongoing bull trend from the $8.9 billion iShares MSCI India ETF (US:INDA).

The fund advanced to new all-time highs last year. Following a multi-month correction, the bull trend is resuming and should take out the previous peak near 60. In the UK, you can pick up the JP Morgan India Fund (JII), which is also trading close to its cyclical highs.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.