Glencore shares have performed well over the last five years, up nearly 50%, with a good dividend yield of 7.68%, but, this year they are down 15%. That’s a lot more than the iShares Bloomberg Roll Select Commodity Strategy ETF, which is only down 5%. In this analysis I look at why Glencore shares are down and if they will recover.

What does Glencore do?

Glencore is a Swiss (headquarter in Zug) commodity giant. Its history dates back to the seventies, when the colourful Marc Rich founded Marc Rich + Co (the precursor of Glencore) and grew the company relentlessly.

By the time the ‘Commodity Supercycle’ began in 2002, Glencore was already a colossus in commodity trading. It was raking in massive profits from buying and selling a wide range of industrial commodities. Its £37 billion public listing in 2011 was Britain’s largest IPO. In 2013, the company merged with Xtrata (a takeover, really) to be one of the biggest commodity traders/producers worth $88 billion.

- Related Analysis: Why is Glencore so cheap?

Commodity exposure

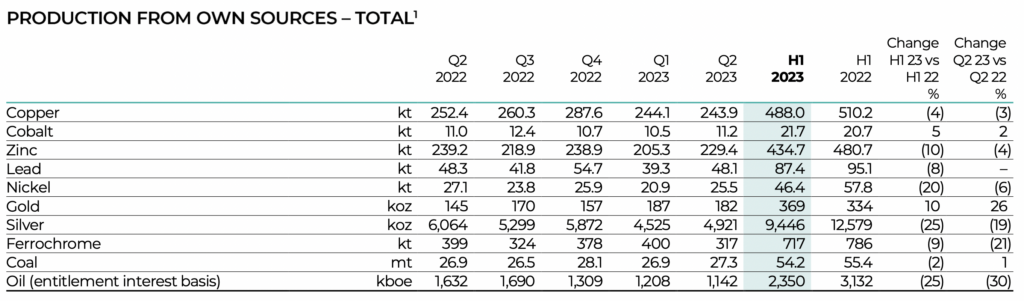

These days, the company produces copper, cobalt, zinc, lead, nickel, gold, silver, and coal. A small tabulated figure of its production figures (half-year report) is shown below:

Source: Glencore (Aug 2023)

What makes Glencore interesting is this: a large section of its commodity portfolio is geared towards metals that underpins the Green Economy. For example, copper is widely used in EV vehicles. With more EV expected to be rolled out, the long-term demand for copper is set to grow this decade.

The £55 billion company is large enough to attract institutional investors. Total 1H revenue topped $107 billion; while net income was more than $4.5 billion.

Why is Glencore share price falling?

Given Glencore’s strong profitability, some have been surprised by its year-to-date share price performance.

From 580p, the mining stock corrected 25 percent to near 400p. While prices did bounce off this psychological support, these rebounds were not convincing and lack strength (see below).

Economic slowdown

Weaknesses in Glencore’s share price are caused by two factors. One, the economic rebound in China this year failed to live up to expectations. This caused investors to revise down the demand for raw commodities.

As such, the base metals sector – including copper and nickel – dropped markedly this year. This reduces Glencore’s profits sharply. For instance, Glencore’s 1H net income of $4.5 billion is a fraction of what they made last year ($12 billion). No wonder investors are concerned.

Sector pressure

Two, the whole commodity equity sector is also under pressure. BHP, Rio Tinto, Anglo American – all saw continuous selling pressure that took them below last year’s peak. Glencore is no different; it can’t escape the from the general sector malaise.

However, Glencore is sufficiently profitable enough to enact a $1.2 billion share buyback recently (to be completed Feb 2024). This may help to insert a floor under its share price. Prices are thus expected for the time being to range bound at 400-480p.

Will Glencore shares recover?

In sum, Glencore operates in a cyclical business. Once the euphoria in commodity metal markets subsided, investors started to rotate out of the general mining sector. For long-term investors, the cyclical decline (and lower share price) is a good catalyst to invest in miners like Glencore.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please ask a question in our financial discussion forum.