The SPDR® FTSE UK All Share UCITS ETF is a market cap weighted tracker that aims to capture the performance of all of the stocks of eligible companies listed on the London Stock Exchange. Encompassing the FTSE 100, 250 and Small cap indices, covering some 98% of the market cap of the UK equity market. To buy this fund you need an ETF investing platform like Hargreaves Lansdown, Interactive Investor or AJ Bell.

About the fund

The ETF which tracks the performance of the FTSE All-Share Index trades under the ticker FTAL and is managed by State Street Global Advisors. The fund has around 574 holdings and a total expense ratio of 0.20%. Turnover in the fund is modest with around 30,000 shares in the ETF, trading on average each day.

Recent performance

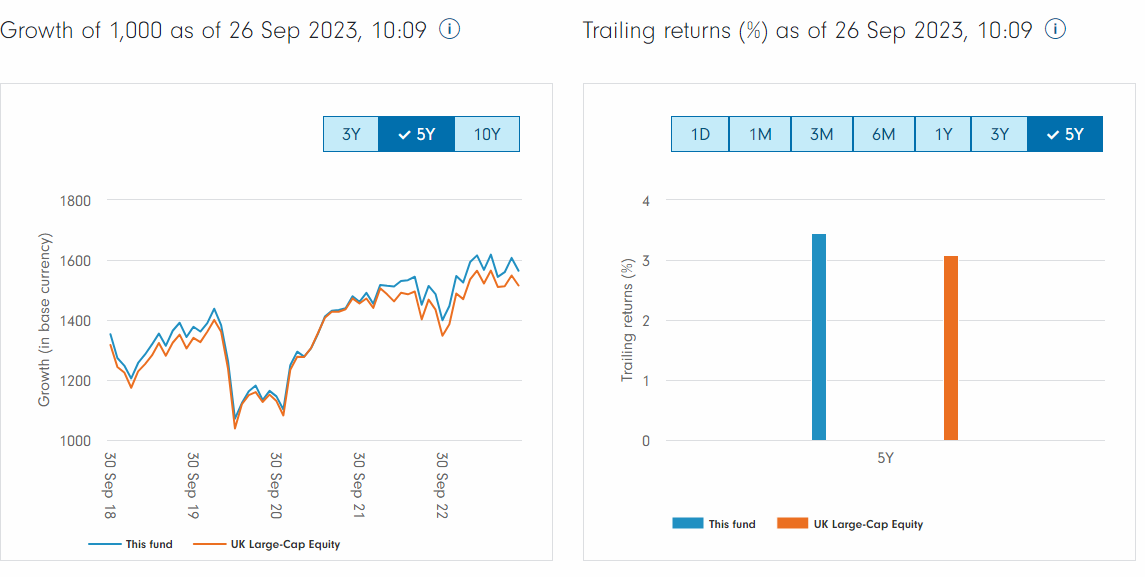

Year to date FTAL is up by +5.87%. However, over the last three years, the fund’s stock price is up by almost 42%, and over a ten-year period, it has returned just over 70.0%.

In the last three months, the ETF has seen 12 new highs, 11 of which were posted in the last month, as it rallied strongly from 21/8/2023.

The share price is not overbought on the RSI 14 indicator, at the time of writing, with a reading of 64.88%.

The overbought boundary for the RSI 14 indicator sits at 70.0% or higher.

Currently trading at 61.66p per share, the ETF price is sitting just below the year-to-date high, which was posted on the 11th of April at 63.00p.

Listings and make-up of the fund

The ETF is quoted on the London Stock Exchange, as well as Deutsche Borse and the Swiss Six Exchange, where it’s quoted in Euros and Swiss Francs respectively.

The largest holdings in the fund are heavyweight names from the FTSE 100 index.

- Related guide: How to invest in the FTSE 100?

Oil company Shell accounts for 7.2% of the funds weighting, drug maker Astra Zenenca contributes 6.95%, international bank HSBC makes up another 5.13%, while Consumer and Household goods group Unilever accounts for 4.47% and oil major BP makes up another 3.71% of the fund.

In terms of sector weightings within the ETF, Financials make up 22.71% of the fund, and Consumer Staples 15.7%. Industrials and Consumer Discretionary stocks make up another 24% between them, with the energy sector representing 11.30% of the fund.

Technology, Telecoms and Real Estate have the smallest sector weightings in the ETF and in terms of geographic weightings, 99.98% of the fund is UK-focused.

FTAL has a minimal tracking area – that’s the deviation between the fund and the FTSE All Share Index which it tracks, of just 0.07% over the last three years that’s lower than the tracking error in a rival fund managed by Aviva Investors.

Should you buy it?

In summary, the SPDR® FTSE UK All Share UCITS ETF does exactly what it says on the tin which is to accurately track the performance of the FTSE All-share index in a low-cost fund wrapper.

If those are the investment returns that you want to capture then this could be the fund for you. However, if you specifically want to capture the retunds from UK-listed overseas earners then you may wish to consider a FTSE 100 index tracking fund, or if you want exposure to companies that earn their living from the UK domestic economy then a FTSE-250-focused fund might be a better bet.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.