This analysis covers how Rolls Royce, under transformative leadership, is soaring back to profitability with groundbreaking innovations and ambitious goals, despite challenges like Boeing delays and critical supply chain issues.

Rolls Royce is one of Britain’s premier engineering companies, with a world-class presence in aerospace, defence and power systems.

In the firm’s own words

“it’s aiming to create a high-performing, competitive and resilient business, with profitable growth, that generates sustainable free cash flow a strong balance sheet, and shareholder returns”

Laudable aims, however, for much of the last decade, the firm lost sight of those goals and the Rolls Royce (RR) share price suffered as a result.

More recently, under the leadership of CEO Tufan Erginbilic, the RR stock price has been undergoing a renaissance.

Mr Erginbilic did not pull his punches and described the company as “a platform on fire” when he took up his new role in January 2023.

He left the firm’s workforce of 42,000 employees, under no doubt that radical change would follow at the 120-year-old business.

The CEO characterised the changes as a transformation, rather than a restructuring.

The transformation is intended to move the company forward into the future and open up its potential.

How is Mr Erginbilic’s transformational journey progressing?

Well from a Rolls Royce shareholder returns standpoint, there can be few complaints.

Rolls Royce shares have risen by +513.0% over the last two years.

True shareholders have had to support two fundraisings to bolster the firms balance sheet.

However an injection of fresh cash was essential if the business was to right itself.

Headcount has also been trimmed, as have several non-core businesses.

In its recent update to the market, the company reaffirmed its full-year guidance of £2.1bn to £2.3bn in underlying operating profit and it said that large-engine flying hours had grown 18% year-on-year, reaching 102% of their 2019 levels.

Indeed the company expects to reach 100-110% of pre-pandemic engine usage levels by the year-end.

The servicing and maintenance of jet engines it has previously sold to customers, is a key part of the Rolls Royce business model.

Continued Investment and Ambitious Goals

None of this is cheap however, and Rolls-Royce is investing over £1.0bn to improve its Trent engines and increase the firm’s maintenance capacity by 2030.

However, the company continues to face supply chain issues and is focusing on improving the performance among 15 of its key suppliers.

Mr Erginbilic has discontinued the firms electric aircraft businesses and has moved away from its previous investments in the sector. Though encouragingly demand remains strong across its defence and power systems divisions.

Rolls Royce has set ambitious medium-term goals, targeting up to £2.80bn in annual operating profit and up to £3.10bn in free cash flow, by 2027.

This comes amid a robust recovery in the aerospace industry following the COVID-19 pandemic, with airlines increasingly demanding new aircraft and engine services.

Flying in the Ointment

However, ongoing issues at Boeing BA US, are cause for concern for the business, and they are largely beyond Rolls Royce’s control.

Corporate governance, safety, quality control issues, and industrial action have all slowed Boeing’s production of new aircraft over the last year.

A slowdown has knock-on effects for Rolls Royce’s order book and maintenance programs, as airlines are forced to defer jet deliveries, adjust schedules and reduce their flight counts.

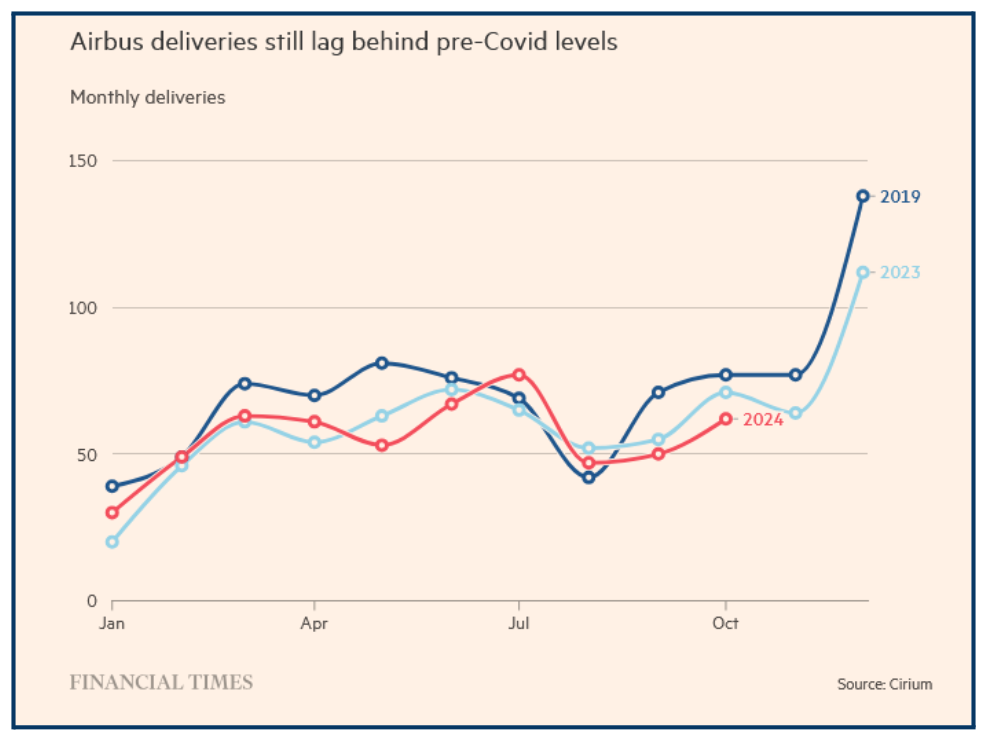

Meanwhile, Boeing’s main rival Airbus has not been able to capitalise on its competitors slow down, and its own deliveries of new planes are still running behind precovid levels as we can see below.

Powering into the Future

Rolls Royce is looking to the future however, and in particular to the future of electricity generation, which it believes lies in Small Modular Reactors or SMRs.

Each reactor, which will built in factory, and then shipped to site for final assembly and connection, should be able to power 1.0 million homes, over a 60-year period.

The company’s SMR designs moved into the final stage of regulatory assessment in the UK this week.

The reactor is being scrutiny by the Office for Nuclear Regulation, the Environment Agency and Natural Resources Wales.

However, it’s quite possible that the first SMR from the company could come online in the Czech Republic, after Rolls Royce partnered with CEZ Group, in a deal that’s expected to finalised during 2025. Though construction and final rollout could take another 5-years thereafter

What happens to Rolls Royce shares from here probably depends on how quickly the issues at Boeing, and to lesser extent Airbus, are resolved.

Rolls Royce is doing its part to become more efficient, both in its manufacturing and maintenance operations and across its balance sheet.

However the gearing that these efficiencies create can only be leveraged to their full extent once the bottlenecks within the aviation and aerospace industries have been resolved, and with FAA scrutiny of Boeing ongoing ,that may not happen for some time yet.

Rolls Royce Share Price Forecast

Outlook

Rolls Royce targets £2.8bn profit by 2027, driven by aerospace recovery, SMR innovation, and operational efficiencies, but faces challenges from Boeing delays, supply chains, and high investment costs.

Pros

- Strong Share Price Recovery

- Ambitious Growth Goals

- SMR Potential

Cons

- Boeing Production Delays

- Costly Investments

- Supply Chain Challenges

-

Outlook

(4)

Overall

4

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.