Investing in dividends requires a different approach to investing for long term capital growth. Although ironically, the literature tells us that up until the new millennium, the reinvestment of dividend income, back into the market, was a major contributor to the total return of key index benchmarks like the S&P 500.

Accounting for up to 30.0% of those returns, over the last 100 years or so, thanks to what’s known as compounding. More recently, investors have looked to growth stocks, and the triple (or even quadruple) digit percentage gains that some of their ilk have generated.

However, dividend paying stocks still have a role to play, particularly for those investors who are looking for income.

How do we go about finding the best US dividend stocks in 2025?

The answer to that question will depend on what your definition of the best dividend stocks is.

From my standpoint I want to see a higher than average dividend yield, the higher the yield the more income that a stock returns per unit of investment.

Such that $10,000 invested into a stock with a 2.0% dividend yield, will provide an income of $200.00 per annum. Whilst the same investment into a stock yielding 8.50% will produce an income of $850.00.

However, a high dividend yield can also be a red flag, especially when it’s out of line with the broader market when it can be an indicator that all is not well.

High dividend yields are often seen after a sharp or extended drop in a share price, when the market could be telling us that the dividend is not sustainable.

Sustainability

Sustainability is an important consideration when it comes to finding the best US dividend stocks.

When I say sustainability, I am not referring to the ESG credentials of a business. Instead I am talking about the ability of a business to pay dividends, over an extended period of time, and the longer that period is the better.

Tenure is not the only measure of dividend sustainability however, another key factor is what’s known as the payout ratio.

That is the percentage of a businesses earnings that are returned to share shoulders via the dividend.

Now you might think that a high payout ratio is a good thing

However, history tells that businesses with high payout ratios can come “a cropper” when the business cycle changes, and that companies with a medium to high payout ratio, of say 60.0% of earnings or under, can fare better in these circumstances.

Dividend investing is often conducted for the longer term. So it’s inevitable that you will encounter the swing from boom to bust, or if you prefer, the move from a growing economy, to one that’s in recession, and everything in between.

There are other metrics that income investors can consider before taking the plunge, including dividend cover.

That is how much cash, or other investments, the business has in reserve, which it could call upon to pay the dividend, if required.

With all that in mind, where could we look for the best US dividend stocks for 2025?

Bigger is often best when it comes to dividend investing, an older, more established, successful business, secure in its industry and operations, can offer stability, alongside the cash flow and earnings necessary to be able to pay and maintain dividends.

But of course, we don’t just want dividends to be maintained. We want them to grow with the business as well.

Consistency matters

I have screened the S&P 500 index looking for stocks with a dividend yield of 2.60% or greater, that’s approximately twice the dividend yield of the S&P 500 index.

The screen also looked for stocks with a positive 5-year dividend growth record, and a payout ratio that is no higher than 60.0%.

Having run the index constituents through those filters, we are left with a list of 66 stocks.

Realistically that’s far too many to consider and research further.

So we need to trim the list somehow.

Screening out stocks, which dont have a track record of positive earnings and revenue growth, over the last 5-years, can help with that, however, it only reduces the list to 48 names.

The table below shows some of those names ranked by their 5-year dividend growth record descending.

| Name | P/E fwd | Div Yield | 5Y Div% | Div Payout% | 5Y Rev% | 5Y Earn% |

| Mosaic Company | 11.83 | 3.31% | 900.00% | 36.65% | 42.86% | 68.40% |

| Devon Energy Corp | 7.07 | 2.61% | 856.67% | 39.99% | 42.15% | 342.64% |

| Eog Resources | 11.46 | 2.88% | 663.16% | 42.39% | 40.00% | 111.01% |

| Coterra Energy Inc | 9.40 | 3.20% | 368.00% | 50.62% | 170.27% | 93.81% |

| Conocophillips | 12.51 | 3.12% | 237.07% | 35.17% | 51.25% | 93.60% |

| Morgan Stanley | 16.27 | 2.88% | 195.45% | 48.61% | 35.00% | 18.44% |

| Newmont Mining Corp | 10.82 | 2.65% | 128.57% | 45.76% | 62.86% | 19.26% |

| Best Buy Company | 13.72 | 4.44% | 104.44% | 56.97% | 1.34% | 19.74% |

| Dollar General Corp | 13.19 | 3.11% | 103.45% | 38.83% | 50.99% | 26.47% |

| Regions Financial Corp | 10.41 | 4.21% | 91.30% | 44.40% | 42.75% | 64.71% |

| Fifth Third Bancorp | 11.85 | 3.45% | 83.78% | 38.02% | 58.55% | 39.76% |

| PNC Bank | 13.15 | 3.27% | 79.41% | 43.33% | 59.47% | 31.65% |

| Darden Restaurants | 19.33 | 3.04% | 74.67% | 59.18% | 33.84% | 52.58% |

| T Rowe Price Group | 11.99 | 4.34% | 74.29% | 53.70% | 20.25% | 6.15% |

| Target Corp | 16.19 | 3.22% | 73.02% | 46.61% | 42.54% | 65.86% |

| Ford Motor Company | 5.79 | 6.05% | 71.23% | 44.71% | 9.89% | 54.62% |

| Mondelez Intl Inc | 17.29 | 3.23% | 68.75% | 47.43% | 38.85% | 31.28% |

| Nextera Energy | 19.42 | 2.89% | 68.47% | 58.77% | 68.08% | 64.25% |

| Abbvie Inc | 14.67 | 3.44% | 64.90% | 56.91% | 65.84% | 40.46% |

| Conagra Brands Inc | 10.95 | 5.21% | 64.71% | 55.17% | 26.34% | 32.84% |

| Amgen Inc | 12.71 | 3.48% | 61.36% | 45.81% | 18.71% | 29.51% |

| State Street Corp | 10.51 | 3.09% | 48.31% | 23.29% | 41.57% | 6.09% |

Source: Darren Sinden

Looking at the table it’s clear that cyclical stocks such as miners, oil and gas companies, and investment banks have the highest dividend growth.

Whilst defensive, Consumer Staples names, in retail, casual dining and food production have lower scores for the most part.

Price performance

We may be looking for the best US dividend stocks and therefore a source of income. However, we can’t and shouldn’t ignore stock price performance.

The money that’s invested for income should ideally grow in value too.

Preservation of capital should be just as important a consideration to a dividend investor as it is to a shorter term trader.

Because if the capital dwindles away then we won’t have the ability to adjust our holdings to reflect market conditions and events. And, in the worst case scenario we may not have anything left to invest for future dividend income.

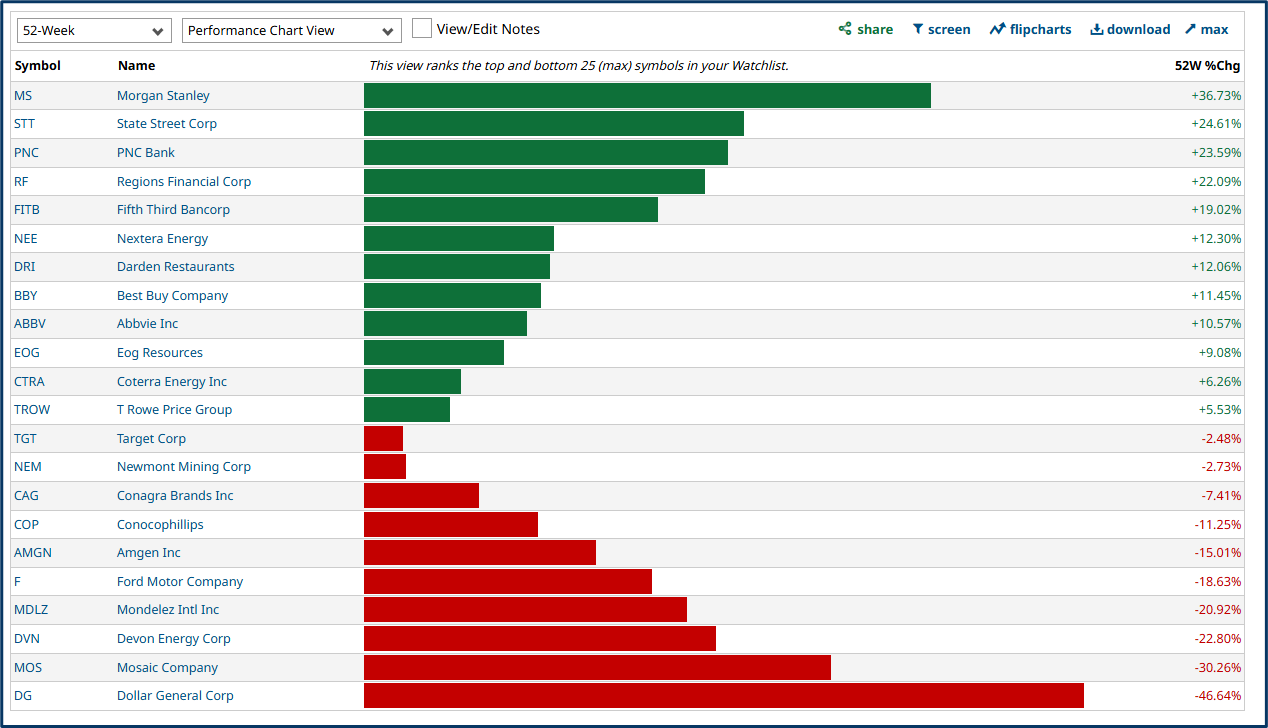

The chart below visualises the stock price performance of the names in the table above, over the last 12 months.

Source: Barchart.com

Past returns are no guarantee of future performance of course. However, they do say something about market sentiment and the performance of the underlying businesses. After all, the share prices of companies that are doing well rarely depreciate on their own.

On that basis the stocks that have a positive share price performance in the chart above are certainly candidates for the Best US dividend stocks in 2025 and beyond.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please ask a question in our financial discussion forum.