In this expert review, we test Plus500 with real money and explain if it is a good CFD trading platform in the UK.

Plus500 CFD Trading Expert Review

Account: Plus500 CFD Trading

Description: Plus500 offers easy access to CFD trading, including hard-to-borrow shorts with client sentiment indicators. It’s user-friendly but basic, with higher costs and limited features compared to rivals.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Is Plus500 any good for CFD trading?

Yes, I think Plus500 can be good for CFD trading and I’ll tell you why. Reddit has been annoying me for a long time. Every time I search for something on Google, I get a load of outdated single-opinion forum answers thrust in front of me. When what I actually want is for someone who knows what they are talking about to answer my query initially, they back up their answer with a longer explanation, if I feel the need to read it.

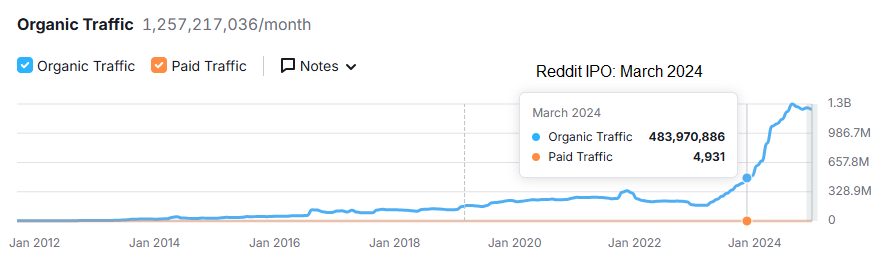

Now, as an SEO, this offends me. As a trader, it offends me even more that Reddit’s IPO coincided with Google giving their forum prominence in search results.

Now, Google is a fickle Master and changes how it’s algorithm works with no notice and from many perspectives no reason. And I expect Reddit will fall foul of a Google update at some point in the future. Or at least I am hoping so, becuase I can’t figure out how to use it and it doesn’t make sense to me.

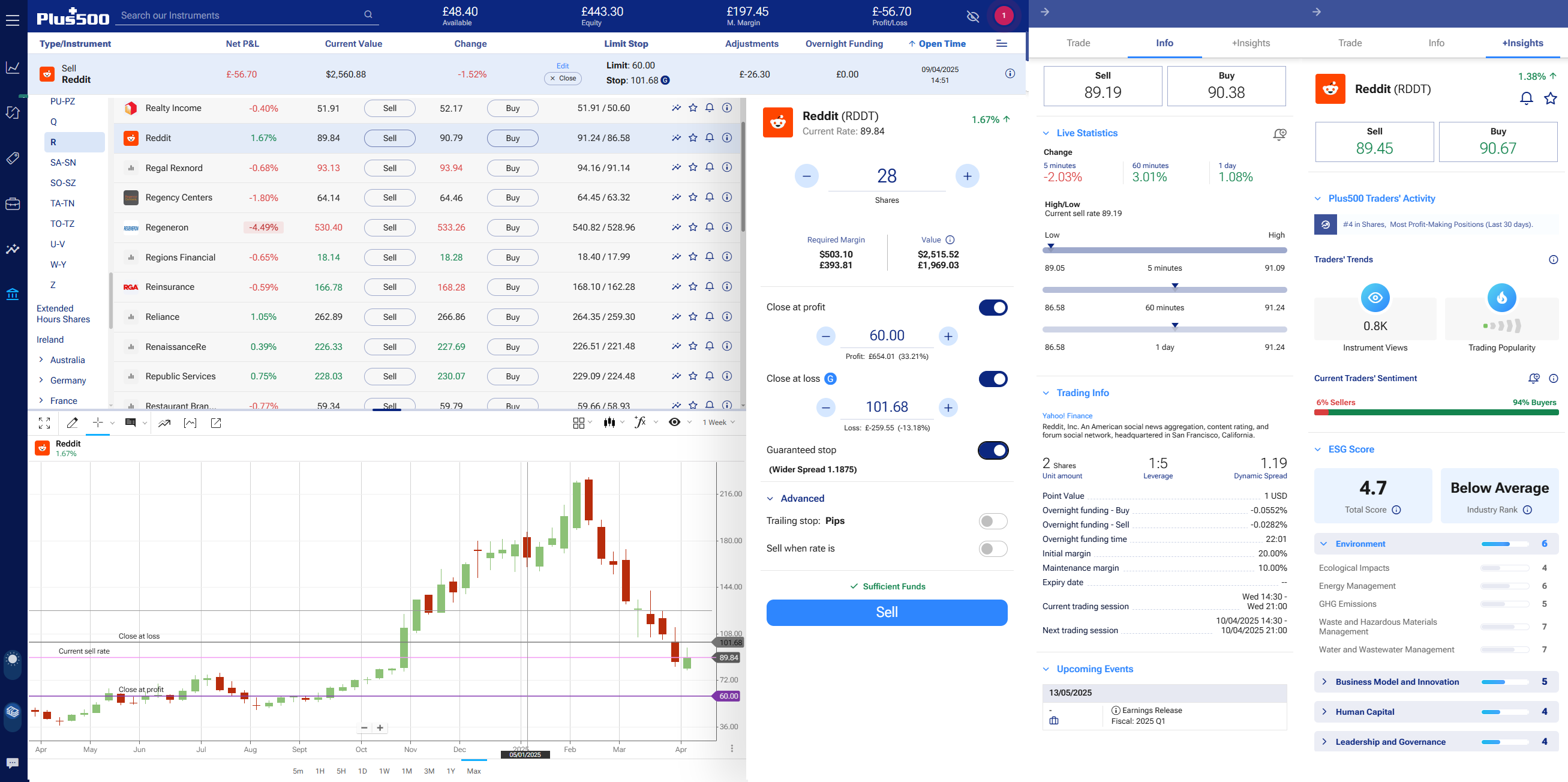

Which is why I want to short the stock and bet on it going down, which you can do with CFDs. But you can’t do it with all CFD brokers because Reddit is what is known as a “hard to borrow” stock, which means that people won’t lend it to you so you can sell it to someone else with a view of buying it back when it is priced lower to give it back. I tried to short sell it as a CFD on Interactive Brokers, XTB, and even IG, and none of them would let me. So I was delighted to see that it was shortable on Plus500.

I don’t like to go crazy when reviewing platforms so put in £500 and maxed out my leverage which is capped at 20% by the regulators, to take a $2,500 position on Reddit’s demise.

There are some quite cool features on Plus500 for when you are thinking of taking a position. For instance, their +Insights tab tells you where Plus500 clients are positioned in a stock, which in Reddit’s case is 92% long, and amazingly Reddit is number 4 on the list of most profit-making positions in the last 30 days.

So I am significantly going against the grain here. It is, however, not a very popular stock on Plus500 with only 8k views over the last 24 hours from their 30 million users. But you can also see that Reddit has a below-average ESG score, which sort of means I’m a responsible trader by shorting non-sustainable companies???

Anyway, I sold at $90 and put a guaranteed stop on (for an extra $1.19 on the spread) just above $100 in case a bonkers billionaire decides to buy them, and it gaps above. I also put a take profit exit order in at $60, which was triple my stop loss distance.

Compared to other platforms, trading CFDs on Plus500 is pretty basic; there are no different order types, so you can’t really work a proper limit order, only trade at market. But that’s fine if you are just tapping away at the market, taking positions. Plus, overnight funding is pretty expensive, at 20% a year for longs and 10% for shorts. Spreads are dynamic which means that it changes based on market volatility and liquidity, so a bit wider (0.5% either side) than the underlying bid/offer, compared to other CFD brokers like IG and IBKR, where the spread is about 0.3%.

But one thing I do quite like about Plus500 is that when you are setting up a trade, it tells you the value in both USD and GBP so you know your exact exposure, which is pretty important so you don’t get any nasty surprises whilst trading on margin in foreign currencies.

So it’s a bit more expensive and not quite as advanced as other platforms, but at least if you want to short a stock, you can when other brokers won’t let you!

I also should say that I have massive respect for Plus500 from a marketing point of view. They obviously looked at the online trading industry and thought to themselves, “this is ripe for disruption” and to be fair, they did disrupt the CFD trading (not the financial spread betting) industry.

Before Plus500 came along, most CFD platforms asked you to deposit a minimum of £5,000 to open an account. You had to prove that you had the relevant experience to trade high-risk derivative products, pass credit checks and wait at least a week before compliance, accounts and sales had checked your account and allocated you an account number. And in some cases, you didn’t even get an account number until you’d BACS’d money over to fund your account.

But, that was about 15 years ago and Plus500 asked me during their compliance checks of my review to point out that “the information regarding the account opening gives the impression that the process is simple and fast, which could be misleading. Due to the document approval procedure and the questionnaire, the creation of the account can take some time. Also, if the approval requirements are not met, some users are unable to create a real trading account”.

Which, of course, is true because, now for AML, you have to submit some personal documents, there are several term documents to read and you have to answer (and pass) a suitability questionnaire.

It’s not now harder to open an account because a. CFDs have become more appealing to the mass market and b. CFDs are definitely not a mass-market product.

Innovation

What Plus500 did was create a basic trading platform that offered the major instruments that people wanted to trade. After all, the majority of revenue generated for CFD trading platforms is from the top ten traded instruments like FTSE, Wall Street, EURUSD, Gold and Oil.

Then they made the account opening process the most simple it could possibly be. Instead of having to get a notarised copy of your passport and post in bank statements, Plus500 clients could open an account online and start trading with real money relatively quickly (in less than a few minutes for a demo account). For other brokers, it was still taking a week. They could do it because normally new clients have to provide ID when opening an account to prevent money laundering. Because the rules at the time were generally geared towards withdrawals, not deposits, you didn’t have to provide ID until you wanted to take money out. Plus500 eventually got ticked off for it and had to start front-loading ID checks. But it completely turned the industry on its head making it very simple for anyone to open a trading account. Cough cough, the mega marketing machine that is eToro.

Soon after that, all the other trading platforms tried to catch up but legacy technology still makes them a lot slower than Plus500 to this day.

Disruption

But, whilst Plus500 have disrupted the CFD industry, it’s not necessarily for the good. Trading is a high risk, most people lose money. Just because you can do something, should you?

I know that things that are bad for you are often enjoyable, this isn’t a debate about whether or not CFDs are good or bad. I have been in the CFD industry for 20 years and I think they are good, but then I have always dealt with professional clients, hedge funds, and traders who understand the risk. CFDs can be used to hedge portfolios, increase diversification, build a stake in a company without declaring it, making money when the markets fall by shorting stocks.

The debate is more about who they are appropriate for, and CFDs are not appropriate for everyone, but they are there if you want them.

Pros

- Easy account setup

- Shorting availability strong

- Client sentiment insights

Cons

- Limited order types

- Higher trading costs

- Basic trading tools

-

Pricing

(4)

-

Market Access

(5)

-

App & Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.476% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.