Trading platforms that accept PayPal are now more common than ever. Here’s a list of stock brokers that let you buy stocks with PayPal & accept deposits & withdrawals from PayPal. Compare brokers that accept PayPal payments.

If you prefer to trade by making payments and send money online without compromising any of your sensitive financial information, PayPal is an ideal solution.

If you prefer to trade by making payments and send money online without compromising any of your sensitive financial information, PayPal is an ideal solution.

Today, many forex brokers as well as CFD trading brokers accept PayPal as a funding method for trading accounts, giving you the ability to make instant, secure deposits and withdrawals at the touch of a button.

If you require a forex broker that accepts PayPal as a payment method and is also regulated by the UK Financial Conduct Authority (FCA), take a look at these brokers below or see our comparison tables for Skrill or Neteller.

For many forex brokers PayPal can be hugely beneficial as it attracts new clients that want to be able to fund their currency trading accounts efficiently at low cost. Many forex brokers don’t charge for PayPal transactions, although you may find that PayPal charges a fee for receiving or transferring funds.

Here’s a list of brokers that accept PayPay:

- City Index – Great for share trading and signals

- FOREX.com – Good option for forex trading

- eToro – Good for US stocks and copy trading

- IG – A large international broker that accepts PayPay

- CMC Markets – Great for high-frequency traders

- XTB – Some good long-term investing features

- Capital.com – Simple but basic method to use.

You should note though that PayPal is an expensive and slow way of depositing and withdrawing money from a trading platform, so it’s worth considering some of the other options below, especially if you are trading with a large account balance.

Why use PayPal, Neteller or Skrill to fund your trading account?

The advantages of using these third party payment providers are that they can speed up deposits and of course mean you don’t have to have your card and bank details to hand.

The disadvantage of Skrill, Neteller and PayPal is that you are increasing your counter-party risk. So if you’ve got a large transaction you are relying on the stability of three partners (your broker, payment provider and your bank).

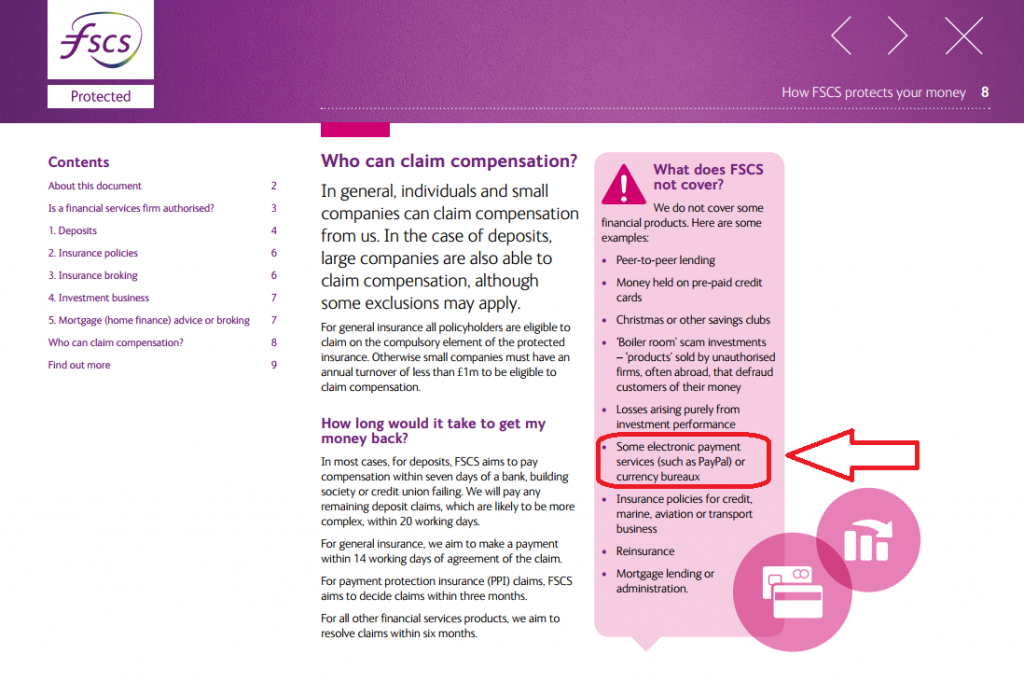

This means that whilst some of your money in accounts at your bank and broker are covered by the FSCS, your funds are not covered when they are with Skrill, PayPal or Neteller. Something to be mindful if you are moving very large amounts of money to and from your broker.

Although to be fair, PayPay, Skrill and Neteller are probably bigger than your broker…

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com