Financial technology is evolving rapidly and it is now disrupting the staid insurance sector. This guide explains InsurTech and how investors can get exposure to the fast-growing sector.

What is InsurTech?

The insurance business is an old one. It goes back to as far as the Romans.

Insurance involves, according to Urban Dictionary, “selling people promises to pay later that are never fulfilled.” Wrap these ‘promises’ with twenty-first century technology – voila! – an industry is created out of existing ones, called: “InsurTech”.

What exactly is InsurTech? Well, it is the short form for ‘insurance technology’, just like FinTech stands for financial technology. It is a subset of FinTech. Broadly speaking, InsurTech refers to group of companies harnessing technology to innovate the business practices in the insurance sector. The key here is disruption.

Since 2010, astute entrepreneurs are targeting centuries-old insurance business practices with newfangled tech concepts, such as artificial intelligence (AI), dynamic pricing, and cloud insurance. Moreover, the pandemic has accelerated expectations of digital adoption.

Insurance Basics Explained

Insurance plays an essential role in our daily lives. For example, you can’t drive without a motor insurance. A property lender typically only extends credit with a building insurance. A ship sails only with marine insurance, et cetera. Types of things that can be insured includes, but not limited to:

- property of all kinds and content

- life (life/pet), medical and dental,

- catastrophes like hurricanes

- travel and motor

- business and income (e.g. professional indemnity)

As you can imagine, the insurance market is huge. According to some estimates, property, casualty, and life insurance premiums amount to a staggering USD$5 trillion dollars globally.

Traditional model – ‘Collect upfront, pay later’

A key point about the insurance business model is that insurers rely on ‘collect upfront, pay later’. Premiums (‘float’) are paid to insurers at the beginning of the cover. If the risk event materialises during the cover – say, an accident – money are paid to entities entitled to the payout.

By keeping the float in house, insurers can earn interest on it or invest the sum in low-risk instruments like bonds. Did you know, Berkshire Hathaway (BRKA), partly owned by Warren Buffett, has a huge insurance operation? In 2019, BRKA holds about $129 billion of float.

Successful insurance operations must evaluation premium pricing correctly, invest the float properly, and deal with claims promptly.

Because some insurance contracts have a long cover period, insurers need to hold significant capital reserves for the duration. Unsurprisingly, the solvency of insurers matters. This, in turn, means the insurance sector is heavily regulated – with high barriers to entry.

What’s changing in the insurance world?

A lot.

First, connectivity. We are now more digitally connected than ever before. Streams of data are constantly emitting from our smartphones, smartwatches, smartTV, GPS, to Alexa. Even our cars are now connected, e.g. Tesla. We leave plenty of ‘digital footprint’. With data, comes pattern, and patterns mean better predictability and more accurate risk evaluation.

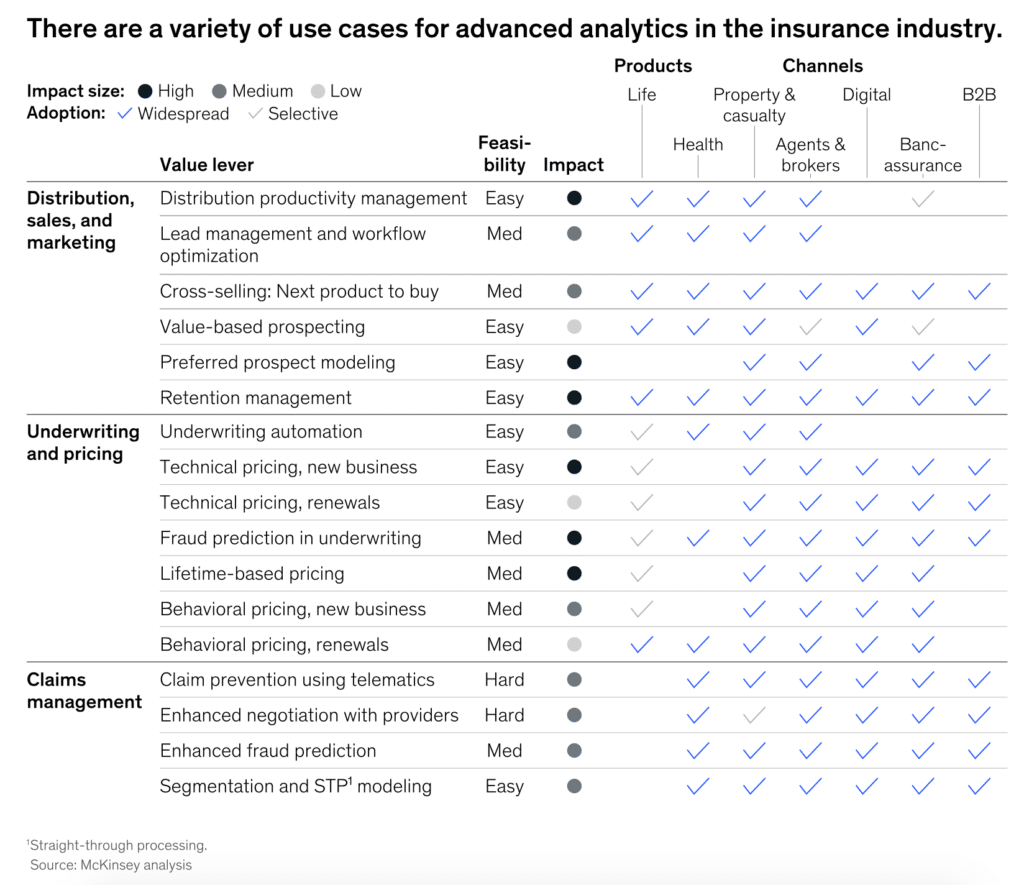

Second, large datasets require advance analytics, which are becoming more prevalent. These powerful algorithms, backed by ever growing data, are slowly replacing humans in claim decisions, fraud detection, and pricing. This means speed, efficiency, and potentially, savings. Sectors of insurance that are heavily using analytics are shown below:

Source: McKinsey

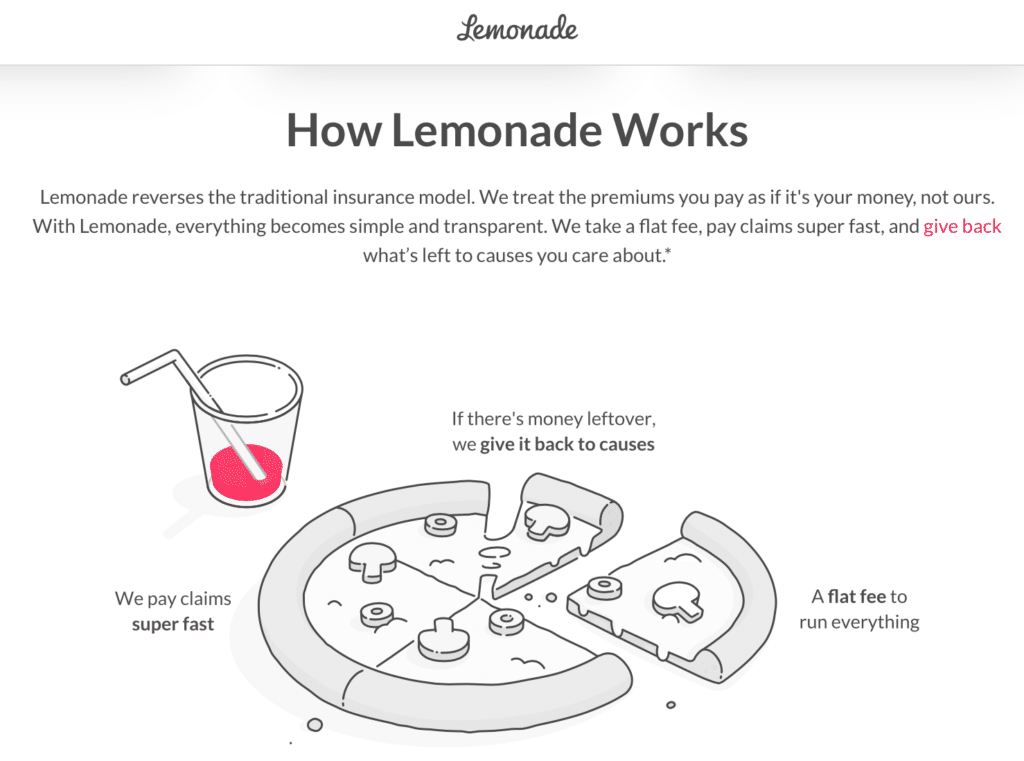

Third, some startups are changing the traditional insurance models. Transparency in premium usage is one. Lemonade, for example, takes a fixed fee and uses the rest to pay claims and reinsures the business.

Fourth, new generation of consumers are expecting insurers to be digitally savvy, including multi-channel engagement (apps/web), online self-service, pay-as-you-go instant pricing, and seamless claims processing. Insurers that fail to keep up will lose customers over time.

Fifth, niche insurance business. Many InsureTech are exploring business areas that are traditionally overlooked by insurance companies, such as pay-as-you-go bike insurance (FT paywall). Others like Zego (www.zego.com) grew out of the idea of insuring delivery drivers while Slice (www.slice.is) and CloudInsurance (www.cloudinsurance.io) offer insurance cloud services.

Taken together, many claim that the insurance sector is ripe for a seismic ‘disruption’ in the years ahead.

Investment in InsurTech Companies steadily rising

Expectations are high that some InsureTech companies will eventually replace a few of the current insurers.

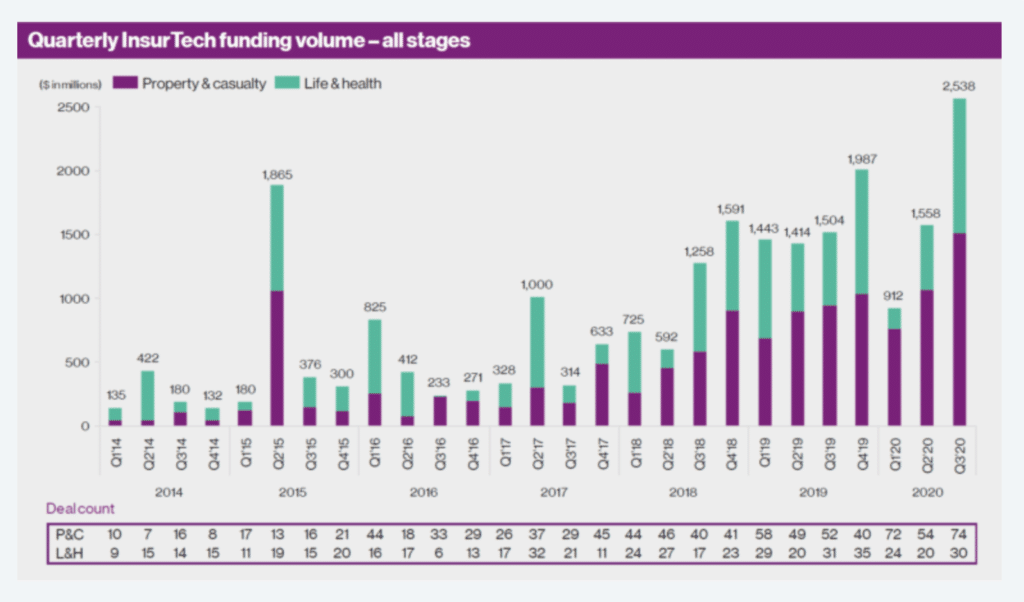

According to CBInsights, nearly $5 billion is invested in these InsurTech companies in 2020 (see below). Some capital went to ‘full-stack insurance’ (companies that absorb risk on to own balance sheet), some to pure analytics firms, some funding went to app-based insurance brokers housed within a large conglomerate (such as Tencent) etc.

Source: CBInsights

InsureTech Example: Lemonade Inc (LMND: NYSE)

One of the most prominent InsurTechs to make it to the public arena is Lemonade (LMND). Founded in 2015 in the US, the company went through multiple rounds of funding to develop its property and casualty business on homes.

Early backers like Sequoia Capital and Softbank made a partial exit in July this year when Lemonade sold shares to the public. After five months on NYSE, the firm draws a market capitalisation of $3.6 billion. Not bad for a 60-month old company. Premiums in 2020 is estimated at $200 million; revenue about $90 million; and GAAP losses? About $100 million.

How is Lemonade’s current operations differ from that of traditional insurance companies? Lemonade’s website says it keeps a portion of the premium – 20% – as a fee and uses the rest to buy reinsurance and pay claims. Its competitive pricing and superior claim management process are underpinned by advance technology. You can submit a claim via phone and the claim is resolved quickly. The company even says to own a ‘world beating’ claim handling record of just 3 seconds!

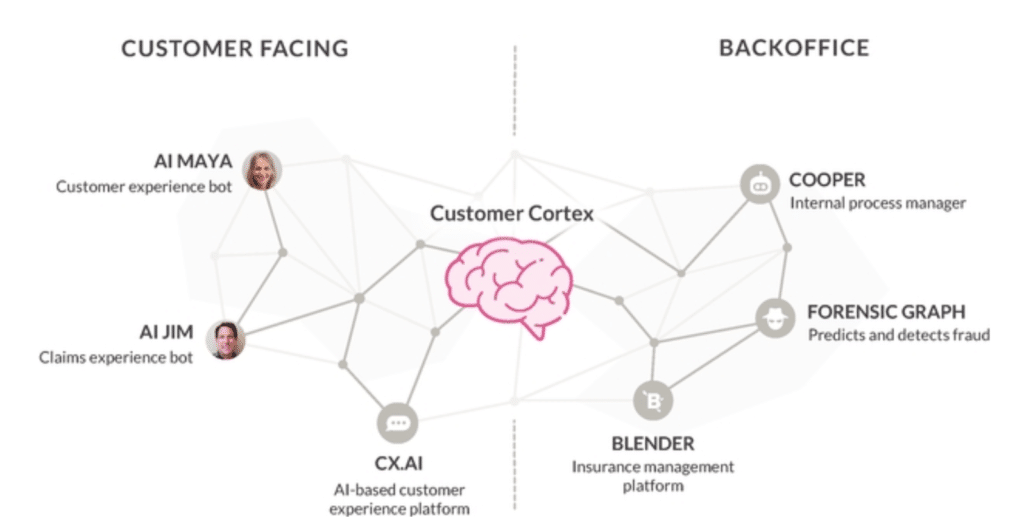

The company said it was able to handle insurance claims that fast because it uses technology pervasively in their operations, as this graph shows. Customer bots and claims experience bots deal with customers, while AI detects fraud.

How to invest in InsurTech?

Most InsurTech startup seek funding in the millions. So deep-pocket angel investors are required.

Through stocks

For the average investors, the best way to buy these stocks is through public listings, such as Lemonade (LMND). But there is a catch. These InsurTech companies may have already experienced the high-growth days in private hands. So more research is needed. For example, when looking at InsurTech companies, ask these questions:

- How long has the InsurTech firm remained in private hands?

- Do you understand the niche of the InsurTech firm? Some deals with health insurance, some property/casualty, some on motor etc.

- How scalable is the business?

- What is the strength of the InsurTech – Is it data, marketing, or analytics?

- Are they using some proprietary tools that others can’t buy or develop?

Through ETFs

In the US, where the financial technology sector is growing rapidly, some ETFs are starting to cater for the niche FinTech market.

Note, however, that InsurTech is currently a very small part of the FinTech market. There is no dedicated ETFs on InsurTech companies yet.

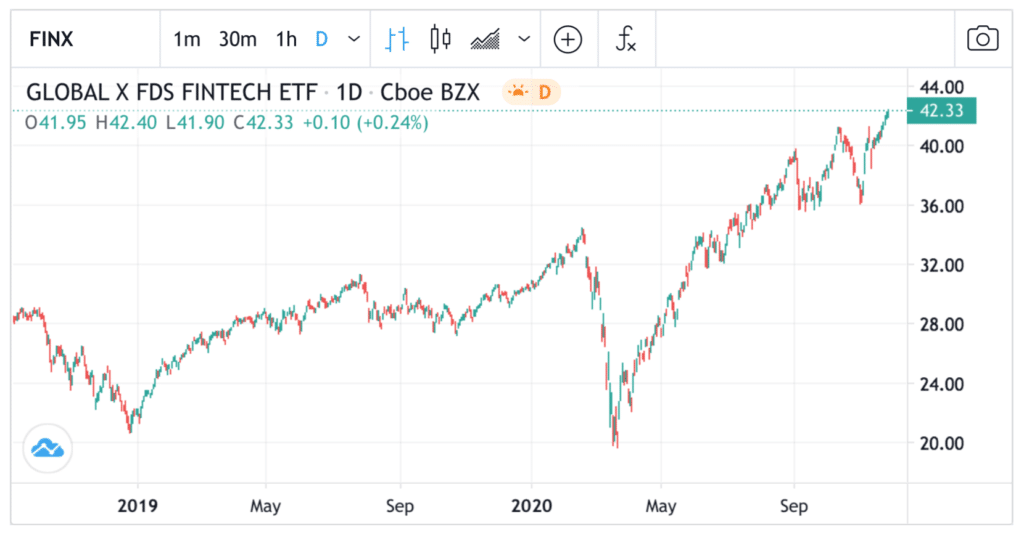

For example, Global X FinTech ETF (FINX) incepted in 2016 and now holds about $850mln in AUM. According to its factsheet, the fund “seeks to invest in companies on the leading edge of the emerging financial technology sector, which encompasses a range of innovations helping to transform established industries like insurance, investing, fundraising, and third-party lending through unique mobile and digital solutions.” It has a portfolio of 33 stocks. Prices reached new highs just recently.

Another US FinTech ETF is the Ark Invest Fintech Innovation ETF (ARKF) (factsheet) which has $675 men in AUM.

In the UK, you can consider the Invesco KBW NASDAQ Fintech UCITS ETF (FTEK LN) which follows the KBW Nasdaq FinTech Index.

Through Seedrs

In the UK, many InsurTech companies are still in the incubation period. Some are seeking capital through crowdfunding.

Seedrs is one such crowdfunding site. Some InsurTech firms like Wrisk and Laka have raised significant pots of money through seedrs. You may want to have a look at these firms.

InsurTech UK 100

Lastly, below are some of top 100 InsurTech – as compiled by fintechglobal. The full list is accessible here (https://fintech.global/insurtech100/)

In the UK, you can find out more about investment opportunities from the website www.insurtechuk.org (https://insurtechuk.org/members).

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com