Please note that since this article was written the FCA has banned retail traders from trading cryptocurrency derivatives. If you would like to speculate on Bitcoin and cryptocurrencies you need to use a cryptocurrency exchange or professional trading account.

What are Bitcoin CFDs?

Bitcoin CFDs allow traders to speculate on the price of Bitcoin without actually owning it. You are entering into an contract with your broker with your profit and loss based on the difference between opening and closing prices of the trade.

Where can you trade Bitcoin CFDs?

Like any other financial instrument you can trade Bitcoin through a CFD broker. You can compare CFD brokers here or view our cryptocurrency broker comparison table to see what brokers offer what cryptocurrency.

The two key things to look out for in a Bitcoin CFD broker are:

- Regulation – never trade with a broker that is not regulated by the FCA. You can search the FCA register for a brokers status here.

- Location – some European counties let local firms passport their regulation over to the FCA. So double check the firm has a real office with real staff in the UK. All Bitcoin brokers in our comparison tables are fully authorised and regulated by the FCA

This is very important because if you are trading with a firm that is not fully authorised and regulated by the FCA you will not be protected if things go wrong.

Main advantages of Bitcoin CFDs

Simple to trade

Simple to trade

- If you have a CFD account already, chances are your broker will already (or shortly) be providing access to Bitcoin. Just like trading forex, shares, commodities or the FTSE you should be able to trade Bitcoin CFDs in the same way.

- You don’t actually own Bitcoins

- Seeing as most people don’t really have a clue what Bitcoin is by trading CFDs the actual Bitcoin risk is with your broker. You are just speculating on the price. With Bitcoin CFDs you don’t have to worry about your Bitcoins being stolen or lost.

- Trade on leverage

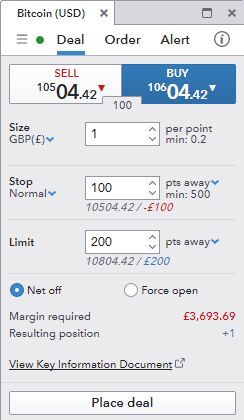

- Trading on leverage means that you can get far more exposure to trade than your account balance. For example, with IG, if you want to bet £1 a point that Bitcoin will continue to go up on the current price that would mean exposure of £10,604.42 But you only put down an initial margin payment which in this case would be £3,693.60. Initial margin is what a Bitcoin CFD broker would expect a days significant move to be.

- You can preset profits and losses

- By using stop losses or profit limits when you trade you can preset the maximum amount you are prepared to lose or set a price at which to take profits. This means that you don’t have to be constantly monitoring the markets to close off your position. There are extra costs for guaranteed stops, which lock in your stop price even if the market crashes right through it.

- Bitcoin CFD brokers are regulated by the FCA

- As FCA regulated CFD brokers have their customer funds protected by the FSCS your money held on account with be refunded by the Government (up to a certain point). Where as Bitcoin exchanges are unregulated and if they go bust when you have funds on account with them it will be much harder to get all, if any of your money back.

Main disadvantages of Bitcoin CFDs

Leverage is very risky

Leverage is very risky

- Leverage is also a disadvantage to trading Bitcoin CFDs because your losses are multiplied. If you buy £10k worth of Bitcoin from an exchange and the price goes to zero you have spent and lost £10k. However, with leverage if you use £10k of margin to buy £30k of Bitcoin CFDs and the price goes to Zero you have lost your £10k plus another £20k. It is very important to understand the risks of margin trading CFDs and that you can lose more than your initial deposit.

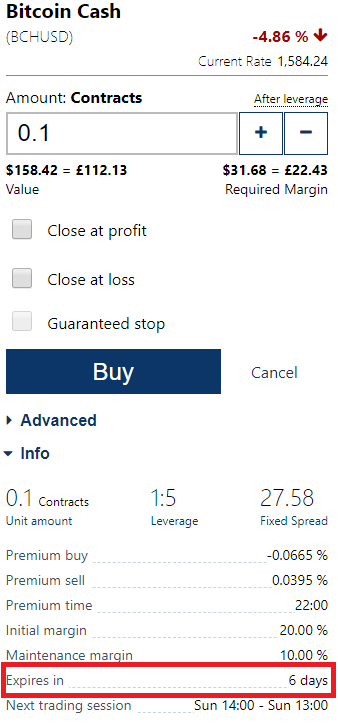

- CFDs have expiry dates

- Bitcoin CFD contracts have expire dates, which means that at expiry your position will automatically close and not rolled over. So, you need to keep an eye on your positions, statements and trading account to ensure that your trades are still open. If you put on a position and don’t check the details you can be sorely disappointment if you think you are making money but your trade has actually expired.

- Bitcoin CFD spreads can be wide

- This means the difference between the buy and sell price can be significant. As with all trading there is a bid (the price at which you can sell) and an offer (the price at which you can buy). The less liquid and more volatile a cryptocurrency, the wider the price will be in the underlying market. This in turn will be reflected in your Bitcoin brokers CFD bid/offer price. This is one way CFD brokers make money, but as more brokers add Bitcoin trading competition will increase and spreads narrow. But as Bitcoin is a fairly new and risky product for CFD brokers to offer the cost to trade will be high.

- Overnight financing charges can be high

- All CFD brokers charge over night financing for holding a CFD position from one day to the next. Overnight financing is normally based on a percentage from the LIBOR rate because your CFD broker is lending you money to trade. You put down an initial margin, the broker lends you the rest (or charges interest on the whole amount). Because if they are hedging the position they will have to buy the underlying asset. The more risky the product the higher the overnight financing charges will be. When it comes to Bitcoin CFDs, overnight financing rates can be very high.

- Tax on profits

- Unlike Bitcoin spread betting where profits are free of capital gains tax, when you trade CFDs you have to pay tax on your profits. The tax benefits of spread betting are unique to the UK, so if you are not a UK resident you don’t get the break. However, if you do lose all your money trading Bitcoin CFDs then as they are eligible for capital gains tax you can offset the loses against your sensible investments. If you want to spread bet on Bitcoin you need a spread betting broker like IG (where you can also trade Bitcoin CFDs).

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com