Moving average crossovers indicate long-term momentum shifts. These trading signals scan for the popular 50 and 200 day crossover. “Golden” crosses show the 50 day rising above the 200, and “Dead” the opposite. Typically used as a confirming indicator.

UK Shares With Moving Average Crossovers

How to Use Moving Averages Effectively

One observable market fact is that prices are pretty much random. Random in trends; random in changes. No surprise, then, a best-selling market book is called ‘A Random Walk Down Wall Street.’

Such randomness makes financial prices notoriously ‘noisy’. It makes markets harder to read and trading much more difficult. So much so that any analytical tools that can reveal, track, or determine price trends becomes immensely popular. One such tool is the moving average.

In its simplest form, a moving average is just a running sum of prices divided by a number (the ‘parameter’ M). The most popular parameters are 50, 150 or 200. Simply, a moving average smooths prices; follows the price trend; and create reference points for visual analysis.

How ‘smooth’ a moving average depends on the parameter M. Generally, a larger M equals a smoother moving average. So a smaller M = a noisier moving average. If M = 1, then it becomes the actual price – and will be meaningless.

How exactly does one use a moving average? Many ways. For example:

- Trend determination. If prices are higher than a long-term moving average (MA), the stock is said to be in an uptrend. If prices are below the MA, the stock is in a downtrend. We can, for example, use this to separate stocks within a universe into bullish and bearish camps.

- Uptrend = Prices above MA

- Downtrend = Prices below MA

- Trading signals. If a stock is in an uptrend, buy. If a stock is in a downtrend, sell.

- Contrarian reference. If a stock is significantly above its long-term MA – say 20% – label it ‘risky’. Stop trading the instrument as it is vulnerable to a sharp correction back to its long-term MA.

- MA as support and resistance. A long-term MA often acts as support or resistance during a trending phase. (see last week’s piece on S/R)

How good is a moving average? To some, they are indispensable. Because it is a widely-used indicator, easy to compute, and reasonably useful, many variations of the MA have been devised. One such variation is the so-called Golden Cross – a cross generated when an instrument’s 50-day MA crosses the 200-day MA from below.

Note that since the long-term MA of major stock indices is a closely watched indicator, it can create a self-reinforcing loop.

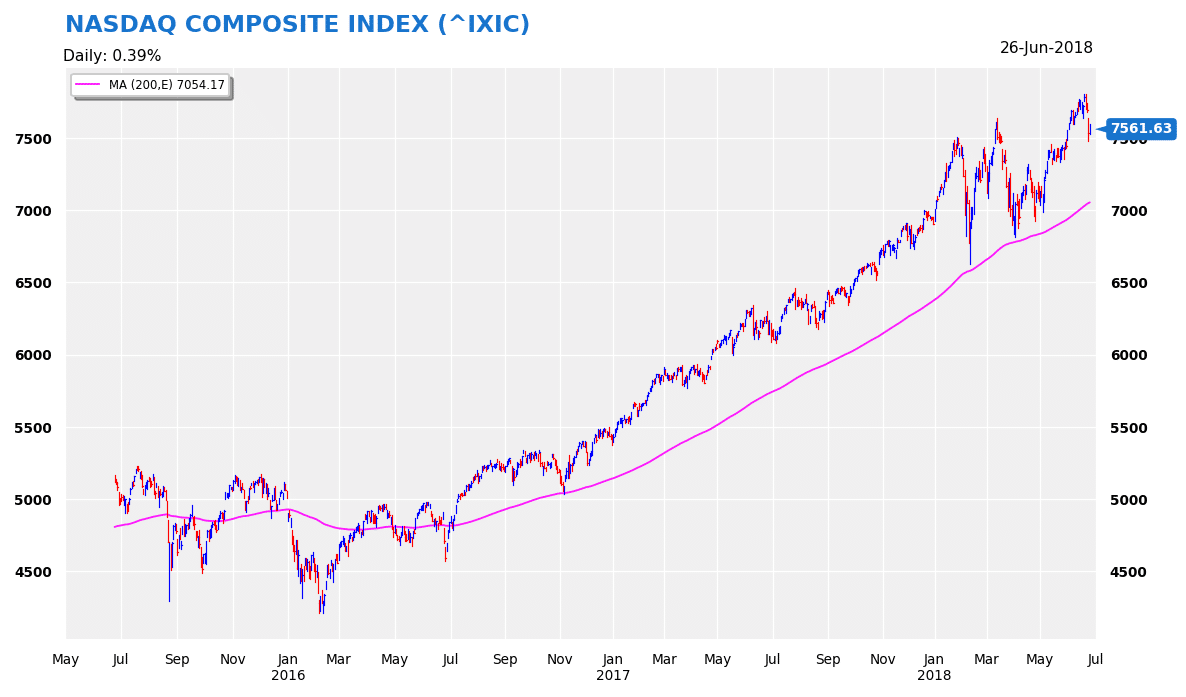

Example – Nasdaq Composite

To show how a moving average can be used, let’s take a look at the Nasdaq Composite Index (featured above). Since mid-2016, prices have been traded consistently above its 200-day MA. So any investor who took the buy signal in Jun ’16 and long IXIC would be in-the-money. [MA as buying signal]

Nasdaq’s smooth uptrend lasted for some months. But the moment prices accelerated away from the MA, eg in January this year, the index was slammed back down to the indicator shortly after. [MA as a contrarian indicator]

More remarkably, the index’s correction paused right at the 200-day MA. Prices bounced off this MA several times before picking up upward momentum again to new all-time highs. [MA as technical support]

What more can you ask from an indicator?

Of course, during a trendless, sideways range, a MA is less likely to do well. Simply because prices are meandering sideways, cutting through the MA several times from above or below, without leading to any meaningful trends. ‘Whipsaw’ is what traders call this phenomenon. To prevent such whipsaws from decimating your equity account, make sure each trade is small enough as not to cause too much damage to the overall portfolio if it goes awry. Also, you might want to look MA filters before deciding on a trade.

Trading is a tough game. Any indicator that could give you an edge should reused and incorporated into your analysis. In this respect, a moving average is an extremely useful tool that should be investigated thoroughly by traders. Indeed it has. But how to use it in your actual portfolio decision will depend on your preferences. Once the setup is tested and done, you can run the analysis/trading on an auto-pilot mode – and free up your time for other things.

Applying moving averages to investing and trading

Moving averages (MA) are a superb indicator that is widely used by both amateur and professional alike. Simple to compute; easy to use.

Here, we highlight two more applications of the MA for investment and trading. The first is the so-called Ivy Portfolio – introduced by Mebane Faber. The second is the Coppock Indicator. In both, the critical component is the MA.

Ivy Portfolio

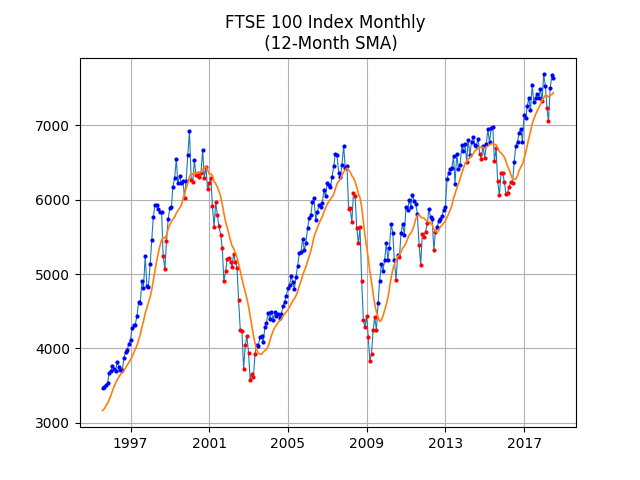

This is an investment strategy that uses the monthly MA as the guiding point. Simply, you buy the market index (e.g. FTSE 100 or S&P 500) when it advances above its 12-month MA and sell into cash when the index drops below the MA.

By restricting the rebalancing frequency to a monthly basis, you have only twelve chances per year to change your portfolio. Low trading activity reduces transaction costs.

How did the strategy perform?

A cursory look at the FTSE 100 Index and its 12-month MA shows clearly that the strategy kept you in bull markets and, more importantly, out of devastating bear markets. For example, you would have been out of the market during the global financial crisis in 2007-8 when the index plunged from 6,500 to 4,000.

This is an important point. Avoiding big bear markets is as important as – if not more important than! – riding bull markets. It is a fact that you accumulate capital faster when you don’t lose too much money during a downturn.

Of course, you will point out that, since 2009, the strategy had generated a few whipsaws – meaning that the trend shows a buy signal then a sell signal two months later, and then another buy signal shortly after – so on. This is unavoidable. Simply because UK’s equity market did not product a clear runaway trend after the ’08 crisis like it did in 2003-’07.

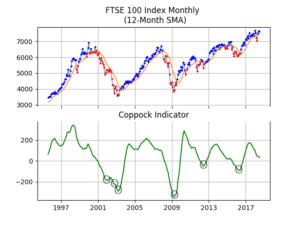

Coppock Indicator

The second application of the MA is the Coppock Indicator, namely after the author ES Coppock. It was first published in 1962.

Calculations of the indicator are very simple. It uses monthly prices. And sums two rate of change (of closing prices) and apply an weighted moving average method to it. You can read about this here.

What is this indicator use for, you wonder? To find entry signals for long-term buys.

To show how this is used, we compute the Coppock indicator of the FTSE 100 Index and plot it below the monthly closing prices. The conditions for the buy signal are: (1) A turning point at the bottom (e.g., -50, -100, -20) and (2) The turning point must occur at negative levels.

Coppock buy signals do not come by every month. For example, in the last twenty years we saw only six such signals. The last three signals were May-2009, Jul-2012, and May-2016.

How did these signals do? Quite well. In each signal, the FTSE 100 Index rallied shortly after and was kept in uptrend for months. Profits were sizeable.

An important point worth mentioning about the timing of the signals. They emerged when the market sentiment was still very negative. In May’09, for instance, stock markets around the world were reeling from the banking crisis. In May’16, uncertainties about Brexit were very high. But if you had followed the Coppock signals you would have bag plenty of gains.

Conclusion

Now, we show you how derivatives of the moving average are used. They are simple – but highly effective. You could use the monthly MA to determine your positions in the market and use the Coppock to add or confirm positions.

On a last note, when using MA indicators you must be discipline enough to use each signal, simply because you will never know how profitable the signal will be. Using stops is crucial when the signal is not working. When the signal is working, simply let the position run.

Other UK shares trading signals:

- Shares that have recently had a daily breakout

- Shares that have recently climaxed (either at the top or bottom of a range)

- Shares that have recently displayed a “hi-lo” pole

- Shares with an overextended point and figure spike or tail

- Shares that have a short or medium-term reversal signal

- Shares that are trading at 52-week highs

- Shares that a trading a 52-week lows