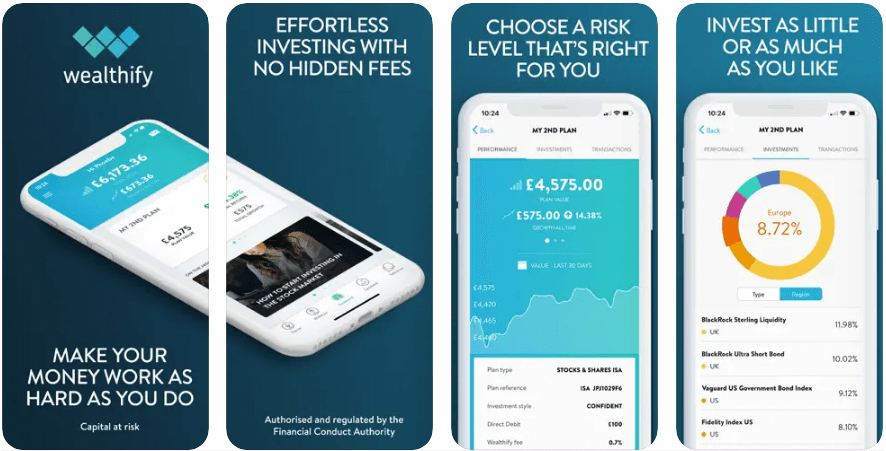

Wealthify's Investing App is Excellent for Beginners To Get Started

Account: Wealthify investing app

Description: Wealthify lets you invest in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments. The platform is a robo-advisor and it’s part of the Aviva Group. Capital is at risk.

Is Wealthify a Good Investing App?

Yes, Wealthify is an excellent app but it’s not as good as the web version, because it’s easier to explore the risk and performance tables and choose a portfolio on a bigger screen.

Fees

It costs 0.6% to start investing with Wealthify, which is one of the cheapest robo-advisor account fees. There are also investment costs of, on average, 0.16% for original plans and 0.7% for ethical plans.

Special Offer:

£50 when you refer a friend. You can get a unique link when you have a funded Wealthify account. If you use it to recommend the platform to friends, you could each get £50. To qualify, your friend must invest at least £1,000 in a Wealthify Plan in the first six months, and maintain at least that level for six months.

Pros

- Managed portfolios

- Low minimum deposit of £1

- Low account fee of 0.6%

Cons

- Cannot trade individual shares or ETFs

-

Pricing

(5)

-

Market Access

(4)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4.5)

Overall

4.7- Expert opinion: Wealthify reviewed & rated