Virgin Money say their quest is to make bank better and offer Current accounts, Credit cards, Mortgages, Savings, ISAs, Investments and Insurance.

Customer Reviews

Tell us what you think of this provider.

There are no reviews yet. Be the first one to write one.

Virgin Money Stocks and Shares ISA review: 3 investment options and a cash savings bonus offer

Investing within a Stocks and Shares ISA can be a great way to build wealth. But it’s important to find an ISA that matches your needs. In this review, we’re going to look at what the Virgin Money Stocks and Shares ISA has to offer. We’ll dive into its investment options, its past performance, and its fees and charges, and also look at how it stacks up against products from rivals.

Who is Virgin Money?

Virgin Money is a full-service digital bank that is part of the Virgin Group. Serving both individual and business customers, it offers savings products, loans, investments, credit cards, insurance, and more.

Virgin Money was originally founded in March 1995 (as ‘Virgin Direct’) so it has been around for a while now. However, the bank became much larger in 2019 when it was merged into Clydesdale Bank (after a takeover by CYBG plc), and today it serves over 6.5 million customers.

It’s worth noting that Virgin Money is listed both on the London Stock Exchange (LSE) and the Australian Securities Exchange (ASX). Here in the UK, it is a member of the FTSE 250 index.

What can you invest in with Virgin Money’s Stocks and Shares ISA?

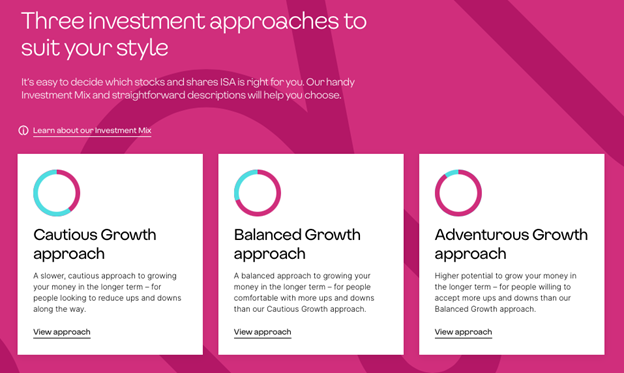

The Virgin Money Stocks and Shares ISA currently offers three different investment options or ‘ready-made portfolios’. These are:

- Cautious Growth

- Balanced Growth

- Adventurous Growth

These portfolios are constructed by Virgin Money’s experts using investment funds from different providers. All portfolios are constructed with a global view and incorporate Environmental, Social and Governance (ESG) investments.

We explore these investment options in more detail below.

Cautious Growth approach

Designed for more cautious investors seeking modest returns, this is the lowest risk choice out of the three investment options. Around 60% of this portfolio is invested in lower-risk assets such as bonds and cash while 40% is invested in higher-risk assets such as shares and property.

Here’s how this portfolio was invested at 30 June 2024.

| Lower risk assets | Higher risk assets | ||

| Cash | 3% | Emerging market shares | 8% |

| Short maturity bonds | 9% | UK shares | 1% |

| UK government bonds | 0% | REITs | 2% |

| Global government bonds | 21% | Global shares | 24% |

| UK corporate bonds | 10% | Emerging market bonds | 0% |

| Global corporate bonds | 20% | High yield bonds | 2% |

Performance of the Cautious Growth approach is shown below:

| Period | June 2019 to June 2020 | June 2020 to June 2021 | June 2021 to June 2022 | June 2022 to June 2023 | June 2023 to June 2024 |

| Return | 2.00% | 7.30% | -8.10% | 2.00% | 7.60% |

Balanced Growth approach

This approach aims to balance caution and adventure and is the middle risk choice out of the three options. Around 70% of this portfolio is invested in higher-risk assets such as shares and property while 30% is invested in lower-risk assets such as bonds and cash.

Here’s how this portfolio was invested at 30 June 2024.

| Lower risk assets | Higher risk assets | ||

| Cash | 4% | Emerging market shares | 12% |

| Short maturity bonds | 2% | UK shares | 5% |

| UK government bonds | 0% | REITs | 4% |

| Global government bonds | 3% | Global shares | 45% |

| UK corporate bonds | 0% | Emerging market bonds | 8% |

| Global corporate bonds | 12% | High yield bonds | 5% |

Performance of the Balanced Growth approach is shown below:

| Period | June 2019 to June 2020 | June 2020 to June 2021 | June 2021 to June 2022 | June 2022 to June 2023 | June 2023 to June 2024 |

| Return | 1.10% | 13.80% | -6.80% | 5.90% | 11.30% |

Adventurous Growth approach

This is the highest risk choice out of the three options and aims for higher returns. Around 90% of this portfolio is invested in higher-risk assets such as shares and property while 10% is invested in lower-risk assets such as bonds and cash.

Here’s how this portfolio was invested at 30 June 2024.

| Lower risk assets | Higher risk assets | ||

| Cash | 3% | Emerging market shares | 18% |

| Short maturity bonds | 0% | UK shares | 7% |

| UK government bonds | 0% | REITs | 5% |

| Global government bonds | 0% | Global shares | 60% |

| UK corporate bonds | 1% | Emerging market bonds | 0% |

| Global corporate bonds | 3% | High yield bonds | 3% |

Performance of the Adventurous Growth approach is shown below:

| Period | June 2019 to June 2020 | June 2020 to June 2021 | June 2021 to June 2022 | June 2022 to June 2023 | June 2023 to June 2024 |

| Return | 1.70% | 21.40% | -6.40% | 8.20% | 14.70% |

How have Virgin Money’s portfolios performed?

Looking at the returns from the Adventurous Growth portfolio, a £1,000 investment in this portfolio would have grown to about £1,430 over the five years to the end of June 2024 (before account fees of 0.30% per year). That’s not a bad return.

However, one could have potentially achieved higher returns with other products. Over that period, the iShares Core MSCI World UCITS ETF (a simple global tracker fund) rose about 75%. So, had one invested in this ETF through a platform like Hargreaves Lansdown (which has low annual fees for ETFs), they could have generated significantly more wealth.

What are the fees and charges for Virgin Money’s Stocks and Shares ISA?

Charges for Virgin Money’s Stocks and Shares ISA are 0.75% per year, based on the value of your account. This is made up of two charges – an account charge of 0.30% for managing your account and an annual management charge of 0.45% for managing your investments.

In terms of how these fees compare to those of competitors, they are reasonable and on par with those of a lot of other providers. However, there are cheaper options out there. For example, Vanguard, which also offers ready-made portfolios (its LifeStrategy funds) has an annual charge of just 0.15% (investors need to pay fund charges on top of this). And these annual charges are capped at £375 per year.

What is the cash interest rate bonus?

One big advantage of opening a Stocks and Shares ISA with Virgin Money is that it is currently offering a cash savings interest rate bonus.

If you contribute £5,000 or more to a Stocks & Shares ISA before 30 September 2024 and leave the money invested for a year, you can get a bonus rate of 2.0% (AER/Gross PA) on a 1-Year Fixed Rate E-Bond. Given that this E-Bond currently pays 4.65% (AER/Gross PA), that takes the total rate to a high 6.65%.

Note that the company’s fixed rate E-Bond interest rate may change in the future. When you apply for the bond, the company will let you know the rate that’s available.

Who can open a Stocks and Shares ISA with Virgin Money?

To open a Stocks and Shares ISA with Virgin Money, you need to be:

- A UK resident

- Aged 18 and over

- Happy making your own investment decisions (Virgin Money is not able to offer financial advice for ISA customers)

Does Virgin Money offer a Cash ISA?

Yes, it does. It actually offers several different Cash ISAs including a:

- Easy Access Cash ISA Exclusive (open to eligible current account holders)

- 1-Year Fixed Rate Cash ISA Exclusive (open to eligible current account holders)

- 1-Year Fixed Rate Cash E-ISA

- Defined Access Cash E-ISA

All of these ISAs have different interest rates (and terms and conditions). You can find the latest interest rates on the website.

Alternatives to the Virgin Money Stocks and Shares ISA

If you’re looking for alternatives to Virgin Money for a Stocks and Shares ISA, you may want to check out:

- Moneybox – Moneybox is a robo-advisor that offers a Stocks and Shares ISA and a selection of ready-made portfolios. These portfolios have performed very well over the last five years.

- Nutmeg – Nutmeg is another robo-advisor that offers a range of different ready-made portfolios. With Nutmeg, you have access to fully-managed portfolios, socially responsible investing portfolios, fixed allocation portfolios, and more.

- Vanguard – With Vanguard, you can invest in ready-made portfolios (LifeStrategy funds) inside a Stocks and Shares ISA for a very low fee.

- Hargreaves Lansdown – Hargreaves Lansdown offers far more investment options, and its fees can be very reasonable if you invest in ETFs.

Pros and Cons

Pros include:

- Virgin Money is a trusted, well known digital bank

- Its Stocks and Shares ISA is simple and straightforward

- A bonus interest rate is available on cash savings

Cons include:

- There are only three investment options

- You can’t invest in shares or investment funds directly

- Its funds haven’t performed as well as some other products

Summary

- Virgin Money is a full-service digital bank.

- With its Stocks and Shares ISA, you can invest up to £20,000 per year tax-free.

- The Virgin Money Stocks and Shares ISA offers three investment options.

- There is a cash savings interest rate bonus on offer for those who invest £5,000 or more in a Virgin Money Stocks and Shares ISA before 30 September 2024.

- Fees for the ISA are 0.75% per year.

- The Virgin Money Stocks and Shares ISA could be a good option for those looking for a simple, hassle-free investment platform.

FAQ

What is the minimum investment?

The minimum investment with the Virgin Money Stocks and Shares ISA is £25.

Can you choose more than one investment approach?

No, you can only choose one investment option at a time with this ISA.

Can you change your investment choice once your account is open?

Yes, it’s easy to switch all or part of your money to a new approach. Just sign in and follow the on-screen instructions. It’s worth pointing out that it’s a good idea to review your investments regularly and make changes if necessary.

Can you buy shares or funds with this ISA?

No, with the Virgin Money Stocks and Shares ISA, you can only invest in ready-made portfolios. You can’t buy individual shares or invest in funds.