Premium Bonds Customer Reviews

Tell us what you think of this provider.

1-2 months not 3

This article and review suggests in more than one place that you have to save for 3 months to participate in the draw. NS&I says you must save for one whole month to be eligible. So it is 1-2 months before eligibility not 3.

Prize every month

. My capital is 100% safe.With the maximum amount permitted (£50,000), I have a prize every month since I started a year ago. (Once £400!) My investment is 100% safe. I put winnings into a NS & I ISA. I win all ways!

Good

Good

fair.

fair.

Safe and rate ok when…

Safe and rate ok when interest rates are high

Short and sweat opening account…

Short and sweat opening account procedure

Good

Good

No thoughts

No thoughts

A very efficient state web…

A very efficient state web platform with good support

very clear info

very clear info

Simple and effective

Simple and effective

good

good

Used as saving platform so…

Used as saving platform so happy with them

Easy to add

Easy to add

OK

OK

I’m trust on this one…

I’m trust on this one vote

Premium Bonds Expert Review

Premium Bonds are like playing the lottery but you get your money back

Provider: Premium Bonds

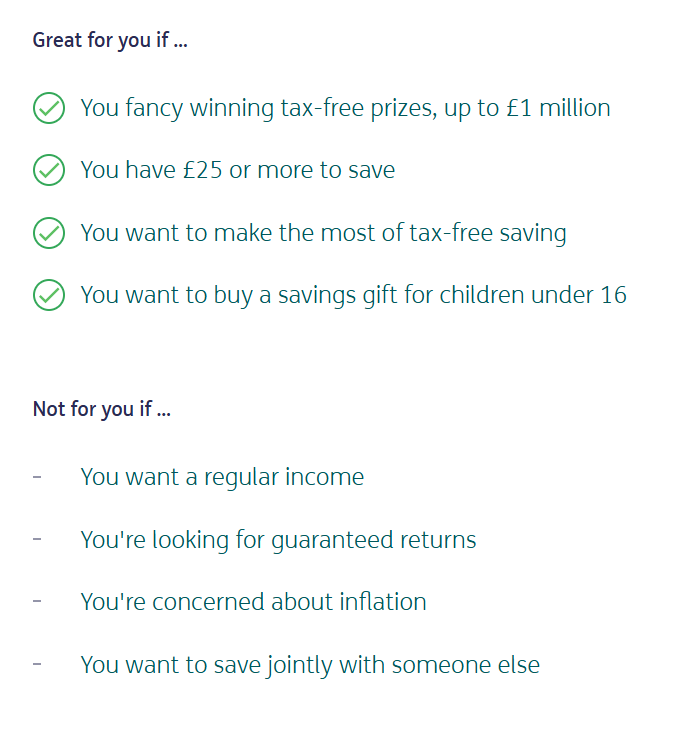

Verdict: Premium Bonds are a government-backed prize draw-based savings account where you can win up to £1m every month. They are a great way to save for a rainy day with the potential to win a lifechanging amount of money.

Is it worth buying Premium Bonds?

Yes, Premium bonds are like the lottery, but you get your money back if you don’t win. If you don’t want to lose money and are happy to sacrifice lower than inflation returns in the hope of winning £1 million, Premium Bonds are a great way to save in short to medium term as your money is guaranteed by the Government.

What Are Premium Bonds?

Premium bonds are a Government-backed savings account where instead of getting interest, you are entered into a monthly draw to win up to £1,000,000. They are a great way to save in the short time (with quick access) and where you are guaranteed not to lose any money.

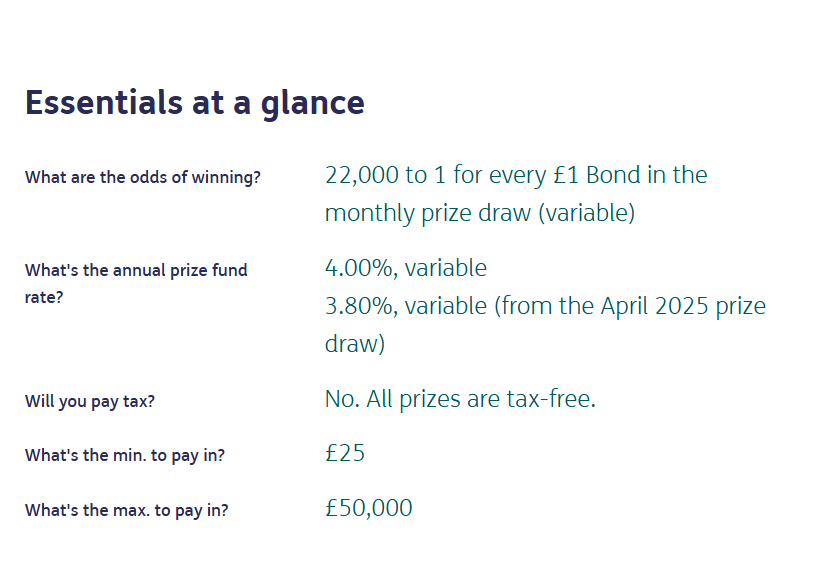

What Are The Chances Of Winning With Premium Bonds?

I’ve never actually won anything massive but Premium Bonds are like playing the lottery, but you get your money back. You’d have to be an absolute idiot to buy £10,000 worth of lottery tickets because the odds are 45 million to 1 to win an average of £6.5m (in 2022). But, if someone told you that you could play the lottery every month, but get your money back, I think you’d be a little more inclined to have a punt.

If you’re interested, this is what I’ve won over the years:

- I’ve personally had lots of small wins and won £500 and spent it on a weekend away

- My family won some and took us around Africa for a month. We went on safari to the Ngorongoro crater and climbed Mt Kilimanjaro

- My middle child won £1,000 from £100 – we reinvested it in premium bonds, put some in her GoHenry JISA and bought her a laptop for her dyslexia.

Should You Buy Premium Bonds?

Yes, you should.

I should first disclose before reviewing premium bonds that I have been one of the lucky ones. I have won, my parents have won and my children have won. I’m sure my review would be different if I’d been saving with NS&I for 30 years and never won, but I have and just like horse racing, if you win it is great, if you lose it is terrible.

Ever since I was born my parents and grandparents have bought me premium bonds. Just £10 every birthday, but we still won every now and again. Nothing major, back in the days when you got letters about how your winnings had been reinvested. It was my first introduction to investing, and to be honest it was great. The message was clear.

If you save instead of spending you will end up with more money than you started with.

Over the years, I’ve dipped in and out of Premium Bonds, because, let’s face it – saving is the most boring thing in the world. Even with interest rates so high and the possibility that you can earn 5% on your money, that is still a pretty dull return. If you put £10,000 of your hard-earned money in a fixed bond at 5% you’ll earn £500 a year. But, if you put £10,000 in Premium Bonds you might just win £1m.

I’ve always used Premium Bonds as a safe place to store money that I might need in a few years. So the interest return is fairly negligible compared to the potential wins and the benefit of winning a million quid.

Here’s why and when you should buy premium bonds…

- If you have a little bit of money – you can’t lose, if you don’t win you can get your money back

- If you have lots of money – you need to spread your risk around lots of savings accounts in case they go bust and have a better chance of winning

- If you might need your savings back soon – sure, you have to save for three months before your bonds are entered into the draw, but you’re still in with a chance and can get your money back quickly

- If you are a long-term saver – to be honest there are better returns elsewhere for long-term savers, but you can’t put a price on dreams, hope, and what-ifs…

Pros

- £1m prize potential

- Government-backed

- Easy access

Cons

- Potentially better returns in the stock market

- One-month ownership needed before entry to the prize pool

- Worse than inflation savings average returns

-

Excellent

(5)

Overall

5What Are The Premium Bond Prize Draw Dates?

The prize draw for NS&I Premium Bonds happens on the first working day of each month, but NS&I don’t release the results until midnight. That means they’re released between the 1st and 3rd of every month, and bondholders can check them the next day.

Premium Bonds Prize Dates 2025:

| NS&I Premium Bond prize draw date |

| Wednesday, 1st January, 2025 |

| Monday, 3rd February, 2025 |

| Monday, 3rd March, 2025 |

| Tuesday, 1st April, 2025 |

| Thursday, 1st May, 2025 |

| Monday, 2nd June, 2025 |

| Tuesday, 1st July, 2025 – Next premium bond draw date |

| Friday, 1st August, 2025 |

| Monday, 1st September, 2025 |

| Wednesday, 1st October, 2025 |

| Monday, 3rd November, 2025 |

| Monday, 1st December, 2025 |

What Happens On The Date The Prize Draw Is Made?

NS&I release the results at midnight on the day they’re drawn. Bondholders can check their results on the NS&I website using their holder number, and many sites will publish the results first thing in the morning.

Premium Bond prizes range from £25 to £1 million. If you’re lucky enough to win the big one, you won’t have to wait to check your results. Instead, someone from NS&I will get in contact on the day of the draw.

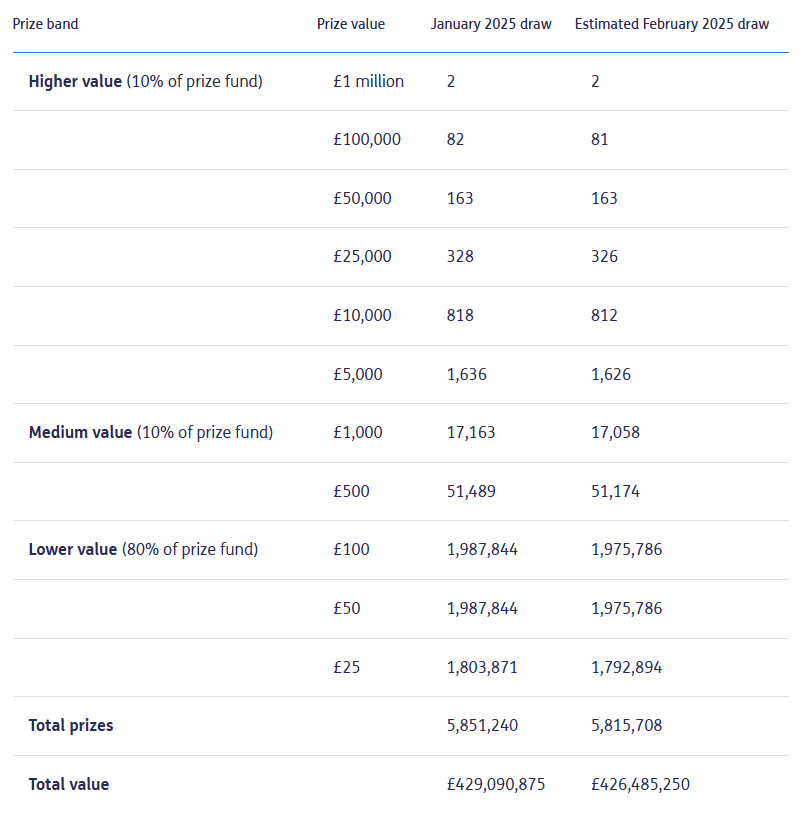

Premium Bond Prize Amounts

Here’s an outline of the recent prize amounts on offer, and the changes in the prize fund rate since 2008.

| Prize band | Prize value | August 2023 draw | September 2023 draw |

| Higher value band | £1 million | 2 | 2 |

| £100,000 | 77 | 77 | |

| £50,000 | 154 | 154 | |

| £25,000 | 307 | 309 | |

| £10,000 | 769 | 770 | |

| £5,000 | 1,538 | 1,540 | |

| Medium value band | £1,000 | 16,182 | 16,211 |

| 500 | 48,546 | 48,633 | |

| Lower value band | £100 | 1,874,218 | 1,877,450 |

| £50 | 1,874,218 | 1,877,450 | |

| £25 | 1,700,728 | 1,703,721 | |

| Total prizes | 5,516,739 | 5,526,317 | |

| Total value | £404,560,900 | £405,263,025 |

Do They Contact You If You Win Or Do You Have To Check It Yourself?

Yes, NS&I will contact you if you’ve won a Premium Bonds prize. This might be via email or letter, depending on which you’ve selected. With that said, if NS&I don’t have up to date contact information, they might not be able to get hold of you.

That’s why there are currently over two million unclaimed prizes worth over £80 million. There’s even two prizes worth £100,000 waiting for their owner.

You can check your results on the NS&I website by entering your bond holder number. That holder number is attached to all the bonds you’ve purchased, even old paper bonds, so you can login and see all your bonds in one place.

If you don’t want to use the online or phone service, you can also write to NS&I to request a record of the bonds you own.

Premium Bond Alternatives

I don’t think there are any comparable savings products on the market. Premium Bonds are unique, because they are government-backed, have a sense of humour (numbers are picked by ERNIE), and, amazingly for the UK Government, customer service is fantastic. You can call them, live chat, and email, or if you are that way inclined you can send a letter.

You can see a list of some other prize draw savings accounts below, but they are mainly marketing gimmicks. Or you can save money in high-interest accounts through one of these savings platforms.

| Prize Savings Account | Top Prize | Minimum Deposit | Equivalent Interest Rate | Odds of Winning |

|---|---|---|---|---|

| NS&I’s Premium Bonds | £1,000,000 | £25 | 3.8% prize fund rate | 22,000 to 1, per £1 bond |

| The Halifax Savers Prize Draw | £100,000 | £5,000 | Varies | Varies monthly based on participants |

| Family Building Society’s Windfall Bonds | £50,000 | £10,000 | Pays 3.5% (Bank of England base rate minus 1%) in addition to draw | 1 in 714 each month |

| Chip Prize Savings Account | £10,000+ | Minimum average balance of £100. | Prize rate varies. No interest. | Varies monthly based on participants |

| Kent Reliance | £1,000 | £100 | Up to 5.1%. Prize rate varies | Varies monthly based on participants |

| Serve and Protect Prize Saver | £5,000 | £1 | Prize rate varies. No interest. | Varies monthly based on participants (must be employee of emergency services, military or prison service) |

Historical Interest Rate Payments For NS&I Premium Bond Draws

Even though the payments from Premium Bonds are a prize, and not an interest rate, the amount of the total prize pool still moves broadly in line with rates. That means that the total prize pool for these savings accounts has been increasing as the Bank of England has been raising rates.

| Draw Month | Prize Fund Rate |

| Mar-24 | 4.40% |

| Sep-23 | 4.65% |

| Aug-23 | 4.00% |

| Jul-23 | 3.70% |

| Mar-23 | 3.30% |

| Feb-23 | 3.15% |

| Jan-23 | 3.00% |

| Oct-22 | 2.20% |

| Jun-22 | 1.40% |

| Dec-20 | 1.00% |

| Dec-17 | 1.40% |

| May-17 | 1.15% |

| Jun-16 | 1.25% |

| Aug-14 | 1.35% |

| Aug-13 | 1.30% |

| Oct-09 | 1.50% |

| Apr-09 | 1.00% |

| Dec-08 | 1.80% |

| Nov-08 | 2.85% |

| May-08 | 3.40% |

- Related guide: Compare prize draw accounts to premium bonds

Premium Bonds Compared To The Stock Market📈

Traditionally, the stock market has provided some of the best investment returns compared to premium bonds. However, you should be aware that even though you have a better chance of making more money by investing in the stock market, there is also a chance that you could lose money.

So, if you are prepared to take on some risk in the hope of better returns and have time on your side the stock market could be a better alternative.

However, if you definitely don’t want to lose any money and just want a safe haven for your money, Premium Bonds are a great option.

You can invest in the stock market through one of our recommended investment platforms.

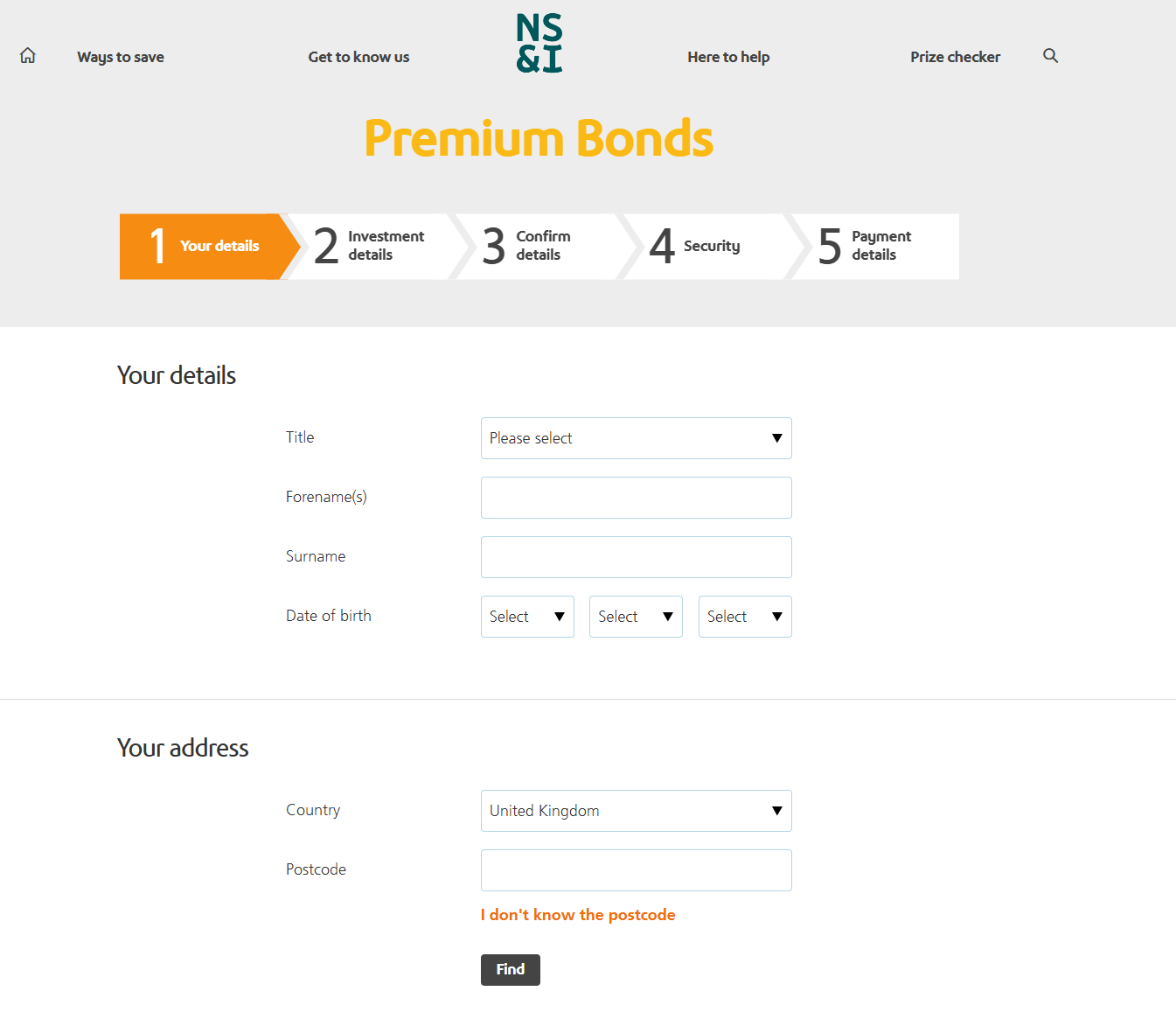

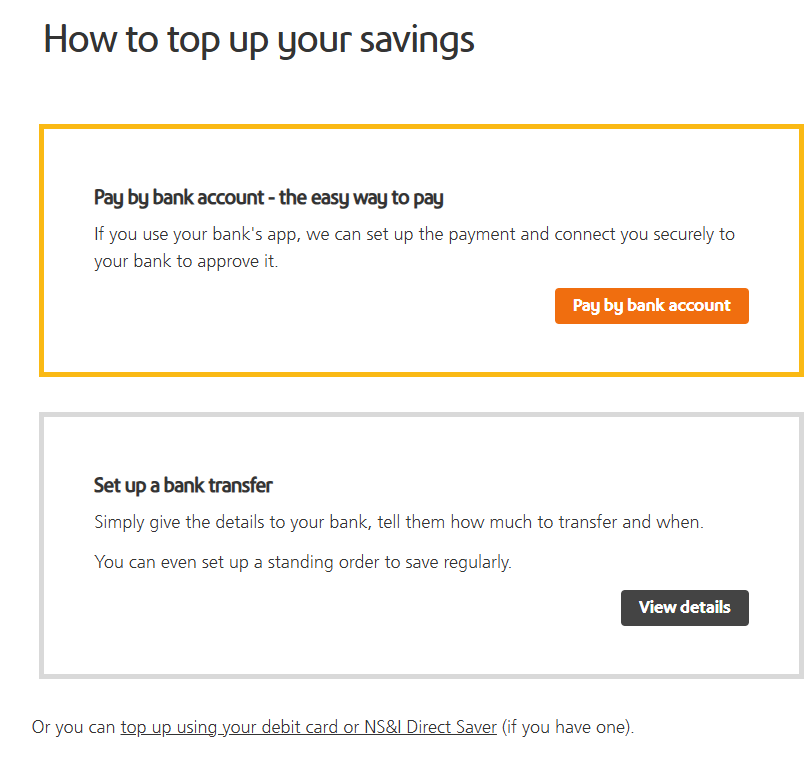

How to buy Premium Bonds

In this guide, we'll take you through the process of buying premium Bonds. How to do it, what you'll need and give you some tips on how to make more of your money.

Basic Requirements:

Specific Requirements:

Steps to buying Premium Bonds