Interactive Brokers founded in 1977 as one of the pioneers of online trading, is now available on TradingView having become a partner of the charting and market information service that’s used by more than 30 million traders around the globe each month, and which by some measures is the world’s most used financial website.

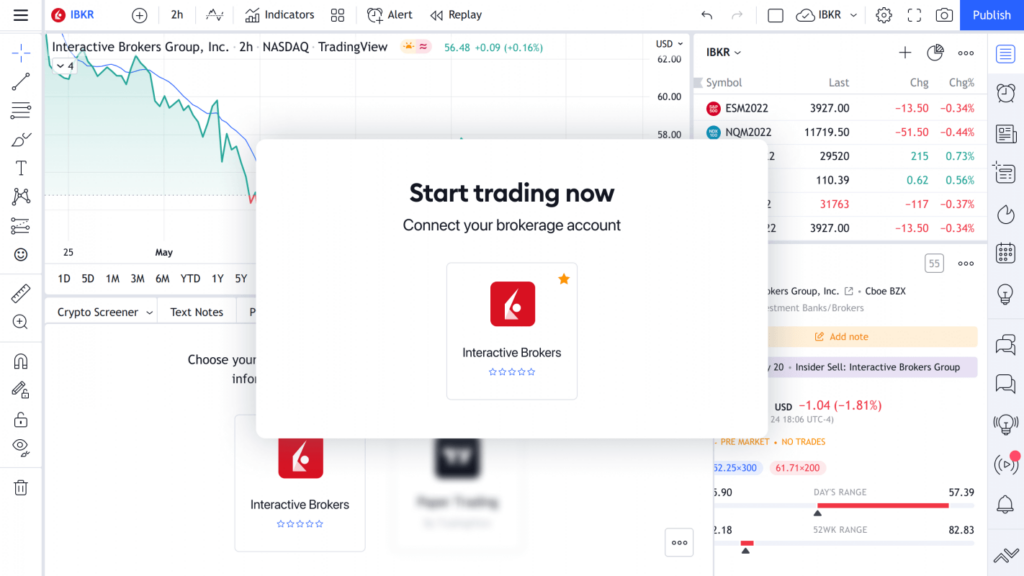

Interactive Brokers’ CFD trading clients will now be able to deal through the broker from their TradingView screens by simply connecting to the broker, via the dedicated trading panel, on the TradingView system.

TradingView offers brokers a range of services that covers charting and price display and analytics, through to market access and the ability to advertise to its user base.

- Related guide: Best TradingView brokers compared

Interactive Brokers has clients in 200 countries and offers trading in stocks, options, futures, currencies, bonds, gold, cryptocurrency, ETFs and mutual funds.

Interactive Brokers executes over 2.0 million trades per day on behalf of their customers.

Initially, clients will be able to trade futures and stocks via the TradingView link, however, other asset classes will be introduced shortly thereafter.

TradingView has become very popular with traders by offering them the chance to customise their experience, by writing scripts for indicators and alerts in its dedicated Pine programming language. Those scripts can then be shared with the wider TradingView community, and to date, more than 8.0 million scripts have been coded.

- In the UK and want to trade on TradingView tax-free profits? Compare spread betting brokers on TradingView

The platform offers free and paid plans that give access to a wide variety of chart types and screeners, and it has extensive coverage of equities, stock indices, and other futures and CFDs, alongside FX and cryptocurrencies. TradingView has recently introduced fundamental analysis and features such as heat maps and video news.

The new partnership looks like a win-win for all parties, and particularly for Interactive Brokers’ clients who will now be able to trade directly from their TradingView workspaces and charts.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.