No other stock is associated with the pandemic as closely as Zoom (NASDAQ:ZM). Prior to the covid-lockdown, few had heard of Zoom. Six months into the pandemic, everyone was ‘zooming’ with one another. Even in the illustrious history of Silicon Valley, the rise of Zoom was remarkable.

If you think their shares will zoom to the moon again you can buy shares in Zoom (NASDAQ:ZM) through a UK share dealing account that offers access to US shares.

Follow these three steps if you want to buy shares in Zoom from the UK:

- Decide if you want to buy Zoom shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

- Depsot funds

- Convert GBP to USD

- Search for Zoom Video Communications, Inc. (NASDAQ:ZM) on the platform

- Choose how many shares you want to buy and purchase online

How much does it cost to buy Zoom shares (NASDAQ:ZM)?

Buying one NASDAQ:ZM share costs $92.2. However, as well as the $92.2 cost of buying each share you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

It’s also important to remember that share prices can move quickly, for example, the current NASDAQ:ZM share price is $92.2 which is a change of 3.12 or 3.5% from the last closing price of 92.2 with 1,571 shares traded giving NASDAQ:ZM a market capitalisation of $27,300,510,000. The most recent daily high has been 92.28 and daily low 88.1. The NASDAQ:ZM share price 52 week high has been 97.58 and the 52 week low 64.41. Based on the most recent NASDAQ:ZM share price opening of 92.2, the current NASDAQ:ZM EPS (earnings per share) are 5.15 and the PE (price earnings ratio) is 17.91.

Pricing data automatically updates every 15 minutes

Compare trading accounts for trading and shorting Zoom shares (NASDAQ:ZM) in the UK:

Spreadbetting and CFDs on ZOOM are leveraged trades and highly risky.

Technology stocks are very volatile even in normal market conditions so make sure you fully understand the risks involved before trading. Depending on what margin the broker is offering, you can, for example, buy $1,000 of Zoom stock with $100 on the account. But, this is a big risk. If the Zoom share price halves, which it could do if for example, it’s critical systems and infrastructure were to fail, you would lose $500 with only $100 on account. In theory though if you are classified as a retail client rather than a professional trader you would be stopped out when your account balance reached $100. But, you can still lose your money very quickly day trading. It’s a classic case of return versus risk.

You can compare FCA regulated brokers for trading in our financial spread betting and CFD broker comparison tables.

CFDs & spread betting carry a high level of risk and losses can exceed your deposits.

Compare investing accounts for buying Zoom shares (NASDAQ:ZM) from the UK:

You can buy physical stock in ZM Shares through a stockbroker.

If you are investing in the long term, buying Zoom shares through a stockbroker may be a better option. The costs are lower as you won’t have to pay the financing costs or running a leveraged position, just commission one the trade and selling costs.

With a stockbroker you don’t trade on leverage, you buy the stock outright, so if you buy $1,000 of Zoom shares, you need to have $1,000 (plus commission costs) on account.

Many stockbrokers have reduced their commission rates on US stocks, as there has been a raft of new digital brokers setting up and offering US stocks for free. Although free stockbroker is more of a marketing ploy than anything else, free stockbrokers generally make their money on the GBPUSD conversion rate and by selling orders to market makers in the US.

However, in these uncertain times, it may be sensible to go with an established broker. Most of the new brokers that offer free stock broking services are on a massive grab for new clients with a view to making money in the future. Established brokers like the stockbrokers we feature in our comparison tables offer some very competitive commission rates on US stocks. For example, IG Group is now offering commission-free dealing on US stocks. If you want to take advantage of tax-free investment accounts you can open an investment ISA account with most stockbrokers, rather than a general investment account.

If you want to buy shares in Zoom from the UK, you need an FCA-regulated stock broker that provides access to US stocks. You can use our comparison of UK-based share dealing platforms that offer access to international markets and see what they charge for buying and selling US stocks, plus what the foreign exchange conversion costs are for converting GBP into USD.

Is there still a case for buying Zoom shares post-pandemic (NASDAQ:ZM)

Listed on Nasdaq just six months before covid-19 hit, the stock soared as every household download the Zoom software. In the UK, only 650,000 used Zoom in early 2020. By April 2020, up to 13 million held Zoom meetings. Replicate this sort of growth in other countries – and suddenly investors woke up to the power of the communication company.

In just nine short months, Zoom’s share price skyrocketed from $70 to $560 – a gain of 700 percent! Mind you, this bull run happened during the most difficult phase of the pandemic when uncertainty, confusion and fear reigned supreme.

The problem with Zoom started when the covid vaccine was announced on November 9, 2020. Overnight, the case for buying Zoom vanished. Zoom’s stock plunged 17% that very same day the Pfizer/BioNTech announcement was made. And it has not recovered since.

Is Zoom (ZM) a good investment in the long term?

The biggest catalyst behind Zoom’s share pirce rise – covid19 – has faded. Thus, the stock will not experience the same manic buying pressure it once did in 2020. The other factor to remember is the presence of ‘stale bulls’. Many bought Zoom during its spectacular rise in 2020. They are now sitting on heavy losses – and are likely to sell out on any rebounds. This will cap Zoom’s long-term uptrend.

But Zoom bulls would point out that the pandemic has turned Zoom into a big global business ($1 billion ever quarter). Millions use Zoom now and they will continue to use them in the future (sticky customers). True, but technology changes over time. What will be the the next Zoom? Certainly not the Zoom now.

Overall, I would be cautious about buying Zoom for the long term at present. Perhaps there is a case for going in heavy, but I would wait for better prices.

When is the best time to buy Zoom shares?

According to its short history, the best time to buy Zoom stocks is when the global pandemic just started.

But that’s a once-in-a-century event. It’s over. We now have to stick to the ebb and flow of a normal market which, according to some (like Michael Burry), is bearish. We should not be in a hurry to buy Zoom’s stock yet.

Technically, Zoom’s stock remains in a downtrend (its 12-month return is a ghastly -70%). Prices are just a few dollars above the major support at $70. Should that floor go, another leg down is to the fifties is possible.

Note, too, how Zoom’s share price in recent months has turned less dynamic. Prices are trapped in a very tight range. It appears that the speculative interest has deserted the stock. In the absence of a macro or result catalyst, Zoom will probably stay that way for the time being.

Is the Zoom share price overvalued or undervalued at the moment?

At $24 billion in market cap, Zoom is not a small company. The pandemic saw an explosive rise in Zoom users. While many had left, some remained.

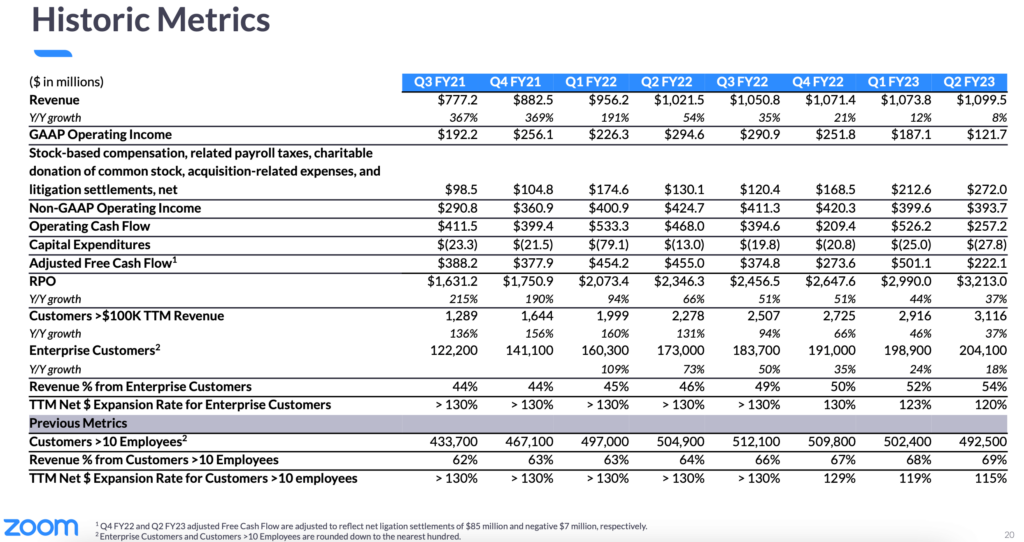

According to Zoom’s 2Q presentation (it will announce 3Q next week), the top-line revenue is relatively steady at $1 billion, as are earnings. But it is the underlying growth rate that concerns the market. It appears to be falling. I suppose this is only natural after the massive surge in 2020.

Source: Zoom Video

Therefore, it is hard to say if Zoom’s share is severely overvalued or undervalued at present. Given the downbeat market conditions, I would say perhaps some overvaluation is noted.

Why has Zoom’s share price dropped recently?

Since early summer, Zoom’s share price has been trading sideways around $70-$125. There are a few reasons for this:

- Tech sell-off – the bursting of the 2021 tech bubble is still in progress, hence most tech stocks are down sharply this year

- Lower valuation – for most companies due to the sharp rise in interest rate. Future profits are now discounted at a higher rates to arrive at a lower present value

- Fading pandemic – many ‘Pandemic Winners’ are now turning into losers because the pandemic is ending (eg, Peloton (PTON))

Therefore, Zoom’s share price has come under increasing pressure this year.

What is Zoom’s share price prediction?

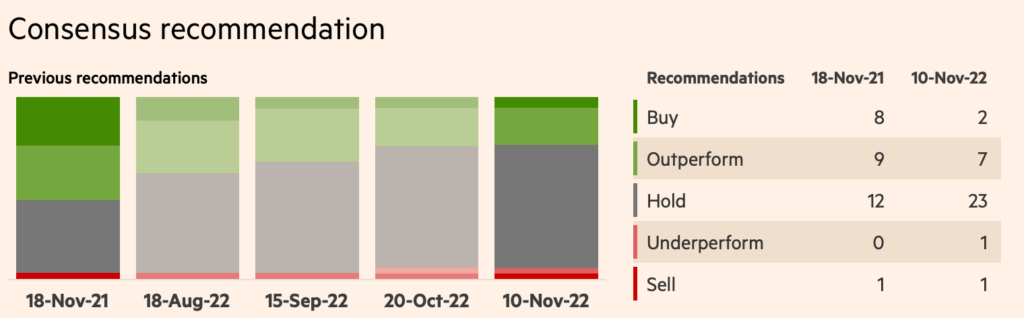

Wall Street is definitely negative on Zoom’s share price. Most brokers are putting out ‘Hold’ recommendations on Zoom – a rare trend on see. In total, 23 brokers are saying ‘Hold’ and only 7 are giving a bullish ‘Outperform’.

Perhaps brokers are dispirited by Zoom’s relentless fall over the past 18 months. Remember, investors are momentum chasers too. If a stock keeps falling, investors will be very unhappy. Brokers will find it hard to put out a positive spin because the narrative is not supported by the chart.

Therefore, as long as Zoom’s share price is stagnant, expect more bearish predictions on the stock.

Source: Financial Times

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.