eToro has partnered with one of the most high-profile businesses on the planet, Twitter, which of course is now owned by one of the world’s richest men, Elon Musk. The joint venture between the two companies has been marketed as a way for Twitter users to trade stocks, Cryptocurrencies and other assets via the eToro platform. Although in reality, eToro are just featured on the $ stock ticker chart pages, alongside TradingView. The spot was once taken by Robinhood, shortly after Musk took over, but eToro seems to have outgunned, or out affiliated them…

Why has Twitter partnered with eToro?

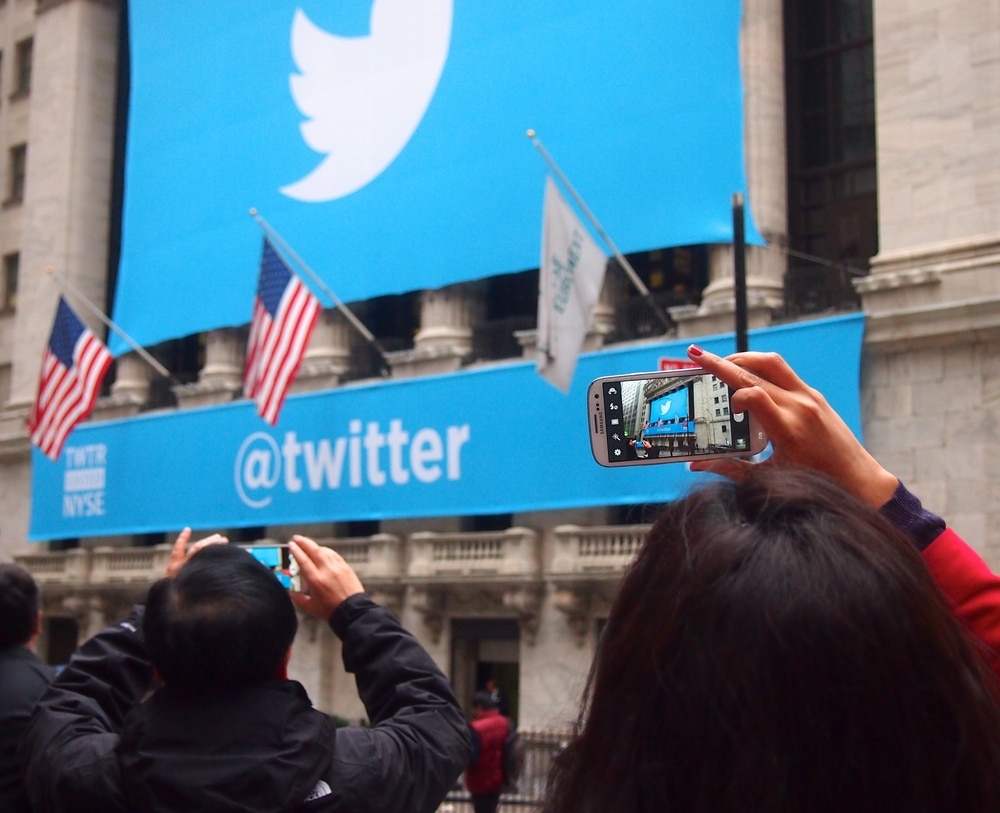

Elon Musk’s acquisition of Twitter has rarely been out of the headlines and not always for the right reasons.

However, one thing the controversial entrepreneur has been consistent about is his desire to turn Twitter into a super App, or one-stop-shop that offers users multiple services in a single application, a concept that has proved very popular in China.

Partnering within eToro is a stepping stone towards that goal.

Elon Musk is known to be a fan of cryptocurrencies and eToro has a well-established and respected franchise in retail crypto trading.

eToro has also been at the forefront of social trading and is one of the world’s largest copy-trading brokers.

When does the new service go live?

The new partnership goes live today with the additional feature being rolled out on the Twitter App.

Once installed, Twitter users can view charts and trade directly from the social media platform.

Twitter users can already use so-called Cashtags to look up the prices of selected financial instruments, by for example, typing “ $TSLA “ for the price of Telsa.

TradingView provides those Cashtag prices – eToro recently announced its own partnership with the Chicago-based charting platform.

- Related guide: Best TradingView brokers compared

There is plenty of interest in stocks among Twitter users

According to data from CNBC, since the start of 2023, there have been more than 420 million Cashtags searches on Twitter, which averages out to around 4.7 million searches per day.

Under the new deal, Twitter users will be able to access a vastly extended range of Cashtags or choose to trade in or view more detailed information about a security via eToro.

Speaking about the tie-up with Twitter, Dan Moczulski, Managing Director at eToro’s UK operations said:

“One of Twitter’s inherent strengths is the sharing of breaking news and analysis, and so it feels only right that eToro helps frame and qualify that investing news by providing charts and stock access in this collaboration.”

Twitter has had its fair share of issues since Elon Musk acquired the business but it remains a social media powerhouse and the go-to tool for breaking news, information on, and opinions from the financial markets for non-professional traders and investors.

It makes perfect sense to us for eToro and Twitter to collaborate, and for both parties to further leverage their relationship with TradingView.

This feels like a template for future collaborations within Fintech and one that will make rival firms sit up and take notice.

One downside of eToro, though is that they do not offer spread betting. You can compare spread betting brokers here, or if you want to spread bet through TradingView see which spread bet platforms connect to TradingView.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please ask a question in our financial discussion forum.