CMC Markets have launched a series of indices for spread bet and CFD traders to speculate on. The indices cover the energy, agriculture, precious metals, and commodities sectors.

Sector trading is especially good for spread betting and CFD arbitrage when you think the market will move one way, but a particular section will out or underperform another.

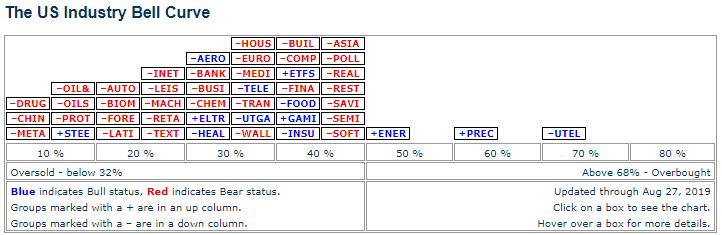

We used to cover equity sectors in the Sector Rotations report at Investors Intelligence. It’s always worth a look, particularly the US Industry Bell Curve:

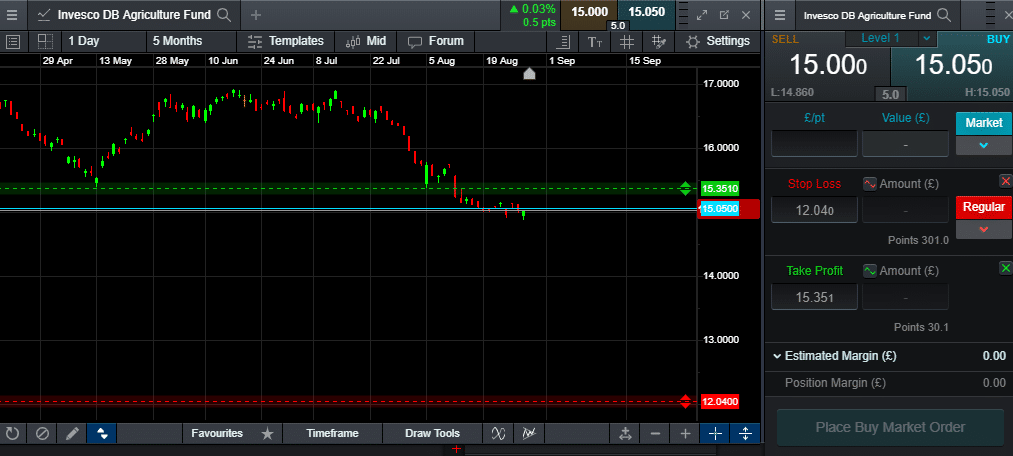

Sector trading isn’t really a new thing, I remember way back in the day CMC Markets used to bundle stocks together so you could speculate on sectors. Plus there are loads of ETFs, where you can speculate on sectors, the DBA:US NYSE Arca Invesco DB Agriculture Fund for example. But searching for ETFs, can be a pain some times, plus there can sometimes be issues shorting them. Which is also available on CMC’s trading platform…

Here’s what Simon Campbell, Group Head of Trading, had to say about the new sector indices:

“Gold and oil in particular have moved more and more into traders’ focus in recent weeks. While precious metals are being hailed as a safe haven during turbulent times on the stock markets, the oil price is reacting to the recent rise in geopolitical risks. However, since oil prices and other energy commodities such as natural gas do not generally react equally well or in the same direction, our new Energy Index offers a good opportunity to spread risk across multiple commodities. In addition, our Precious Metals and Agricultural indices offer similar diversification benefits for these commodity sectors”

The Energy Index is composed of two types of crude oil, West Texas and Brent, as well as heating oil, natural gas, gasoline and diesel. The Agricultural Index consists of a total of 12 commodities, including wheat, corn, soybeans, sugar and coffee. As a rule, the individual commodities are weighted according to their average daily trading value of the nearest six futures contracts (tradable through futures brokers). Gold and silver are each weighted at 35% in the Precious Metals index, with platinum and palladium weighted at 15%.

A few key points:

- Each index provides exposure to a different area of the commodities market

- The Energy Index includes crude oil, natural gas and other refinery products; the Agricultural Index comprises the 12 of the most important agricultural commodities, and the Precious Metals index contains gold and silver, as well as platinum and palladium

- Commodity indices are a cost-effective way to diversify and cushion the volatility risk of individual commodities

Find out more about CMC Markets in our CMC Markets review here

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.