Leading FX and CFD broker CMC Markets announced this week that it is to extend its product range with the introduction of a dozen bespoke currency indices or baskets.

The new instruments have been built on a trade-weighted basis, but CMC Markets is also going to be monitoring what they term the stability and liquidity of the underlying components of each of the baskets to ensure their relevance and maintain pricing transparency.

Trade weighted baskets are nothing new, in fact, the most well known and widely traded of these baskets, the Dollar Index can trace its roots back to 1973

A time when modern FX markets were in the early stages of their formation. FX has been irrevocably linked to global trade since then, the growth of the former boosted the latter and as barriers to trade came down and markets were de-regulated, they grew hand in hand. Though in today’s markets speculative flows outweigh those generated by commercial activities and investments.

None the less the relationship between the valuation of a national currency and the level and composition of overseas trade from within that country are intrinsically linked, and it’s these relationships that trade-weighted currency baskets and indices are trying to isolate or reflect.

The value of a trade-weighted currency index reflects the value of a national currency compared those of its trading partners. Any changes in the relative values of those currencies are totalised, weighted, indexed and compared against the starting value of the index.

For example, the initial value of the US dollar index in 1973 was 100, since when it has had a range between 70.69 and 164.72.

The price of a traditional FX pair or cross is influenced by the levels of and balance of trade between the two component-currencies nations states, however, the price is also subject to a multitude of other influences

The new currency indices created by CMC Markets are designed to allow their customers to gain direct exposure to the purely economic elements within a specific currency a point that was reinforced by spread betting broker CMC’s group head of trading Simon Campbell, who said that

“The increasingly complicated geopolitical landscape is creating a range of trading opportunities, and these new indices give CMC clients the potential to gain broad-based exposure to a number of distinct economies, from the eurozone or US to countries like Sweden, Norway or Singapore.”

The CMC baskets are not only going be trade-weighted, but they will also have an internal cap weighting limit of 40% so that no one currency within the basket has excessive influence over that basket’s valuation.

The new trade-weighted indices will be available on the following currencies

The British pound, Euro, US dollar, Canadian dollar, Japanese yen, Chinese yuan, Singapore dollar, Australian dollar, New Zealand dollar, Norwegian kroner, Swedish kroner and the Swiss franc.

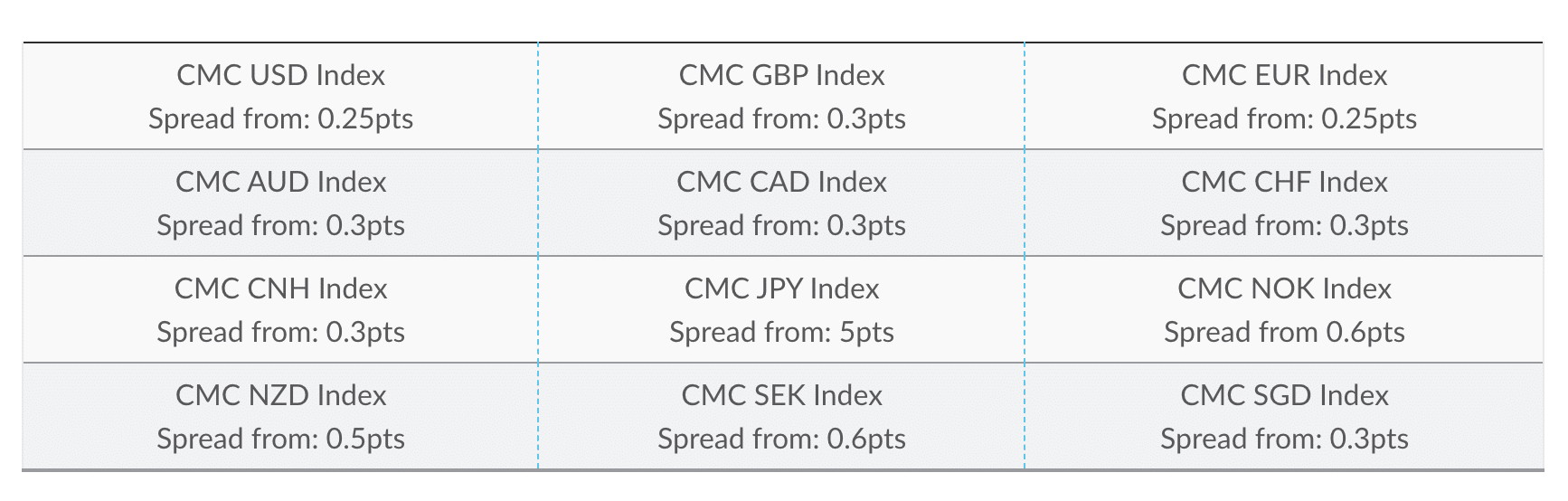

CMC Markets Forex Index Spreads

We can immediately see two benefits arising from their introduction

Firstly, of course, retail traders are once again being provided with a wider choice of instruments to trade and the ability to create additional trades and strategies using these new baskets. Assuming of course that they remain liquid and efficiently priced by CMC.

Secondly, the creation of these type of instruments suggests to us that spread betting forex brokers and FX is moving further down the path towards factor investing, which has been a driving force in the equity markets for much of the last decade and which is now starting to influence bond trading as well.

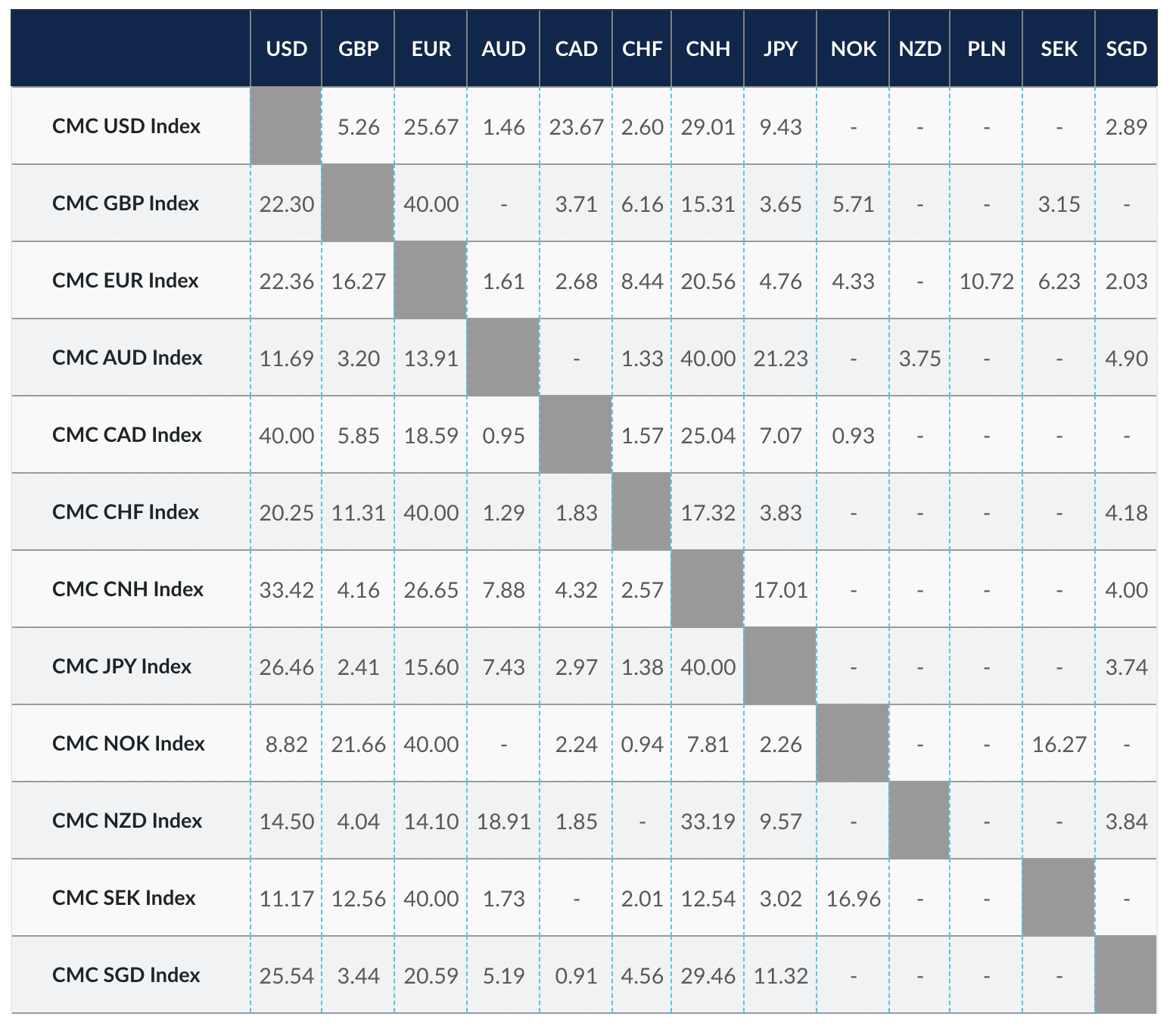

CMC Markets forex index and currency percentage weightings

Factor investing seeks to identify those instruments with specific attributes that are associated with higher returns.

A factor investor will seek to isolate and own these in preference to other instruments, which they may even go short of.

If retail traders can understand these types of longer-term and nuanced strategies and the risks involved in their use, then the ability to implement them is surely a good thing.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.