Copper miner Antofagasta’s (LON:ANTO) revenue shrank by a fifth in 2022 on weak copper prices. But given the long-term bullish outlook for the base metal should we buy the stock on weakness?

Antofagasta’s earnings were eroded by volatile copper prices

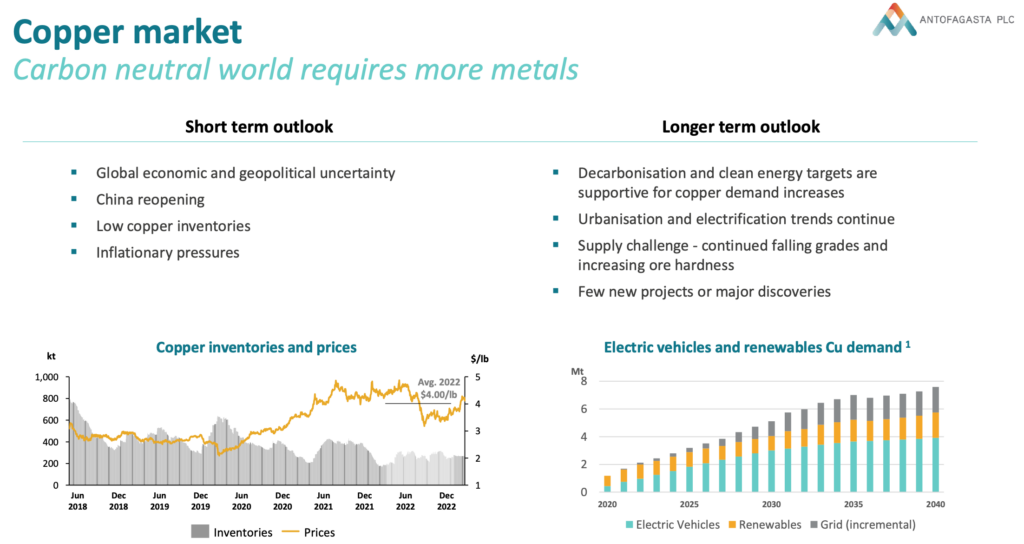

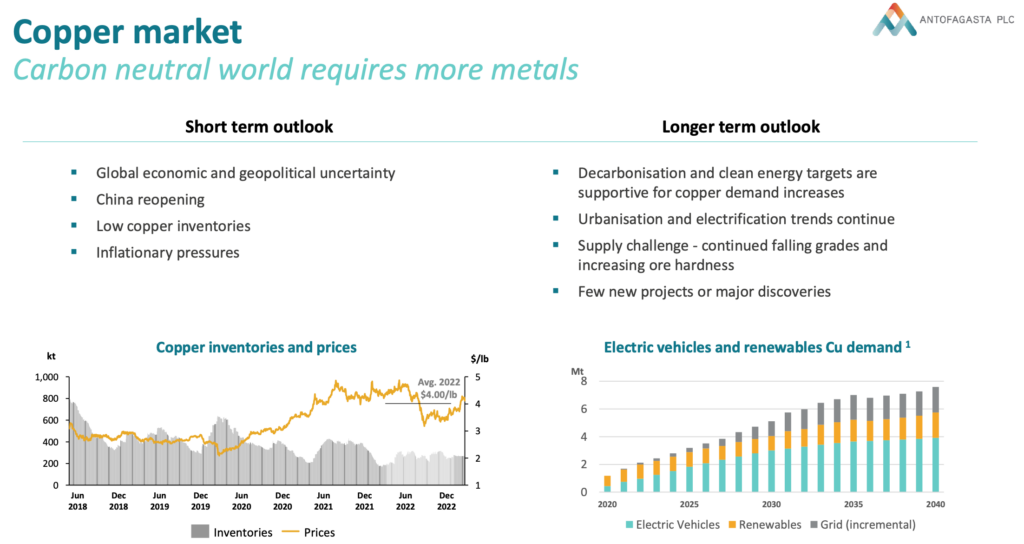

Last year was a particularly volatile year due to the protracted war in Ukraine, surging inflation and a weakening economy. A volatile economy translates into a choppy business environment.

Even within the commodity space, some commodities did extraordinarily well, while a few saw prices plunge. Take copper. Prices slumped by more than 30% from its peak as demand wilted. Energy prices, on the other hand, surged. Natural gas price more than tripled.

As a result, full-year results from copper miner Antofagasta (LSE:ANTO) today reveals a 22% drop in revenue to $5,862 million and a 26% fall in pre-tax profits to $2,559 million. By maintaining the dividend, Antofagasta is bringing the payout ratio of 100%, which is “reflecting the positive outlook for 2023.”

Unlike diversified miners like BHP or Rio Tinto, Antofagasta is a pure-play on copper. Its fortune is tied materially to copper prices. If you intend to buy and hold Antofagasta’s shares for the long term, then you will need to pay attention to that market (and Chile’s political situation, too).

According to Antofagasta, the miner is optimistic on the metal in the next few quarters.

‘Dr Copper’ as it is known as, has rebounded from its 2022 lows. Prices are now trading at the lower side of its prior trading range. As a matter of fact, at $4.15 (per pound) copper is at the upper range of its long-term price. A further rally from here may push copper back to the record high of $5. But does copper have the strength to break new highs?

Copper: Ongoing recovery rally

Will Copper rebound to new highs in 2023?

We are in a new energy world – a world to be marked by low carbon emissions.

In this world, electrification plays a major role. And copper’s place in this transition is central. New EV cars, for example, require 3x more copper than ICE cars. Now, imagine this scenario that in a decade, all ICE cars were to be replaced by EV cars. How much more copper will we need? A lot – is the short answer. Plus, copper is needed in other clean applications.

Moreover, big copper mines are becoming harder to find, especially ones with good-quality ores. The world currently relies heavily on two countries – Chile (27%) and Peru (10%) – to supply a vast quantities of copper to the world. No other country comes close to Chile’s production figure. This supply concentration is akin to a monopolistic hold on a key sector.

Accordingly, the many long-term bulls of the metal are highlighting Antofagasta’s attractiveness in this sector. It already has an operable mine and recurring revenue. Yes, copper demand over the medium term may be weaker than expected. Still, over the long term it pays to stay in the stock due to the above supply gap. Furthermore, you are getting paid to hold the stock (yield – 5.9%).

After a 80% rally in three months, however, we would wait for a correction to add.

EV market powering copper market, Source: Antofagasta