When we talk about mining, we immediately conjure images of dirty miners digging holes in the middle of nowhere. For BHP, however, all they can see is profits. Lots of it.

Is BHP a good investment in the long term?

Formed 20 years through BHP (Aus) and Billiton (UK), the mining powerhouse is now one of the largest material companies in the world with a market capitalisation north of A$200 billion. BHP’s largest production are in coal, iron ore, nickel and copper. In addition, BHP also extracts uranium, potash and oil. The company spun off its oil assets recently and merged them into Woodside (ASX:WDS). BHP is now a pure play on mining.

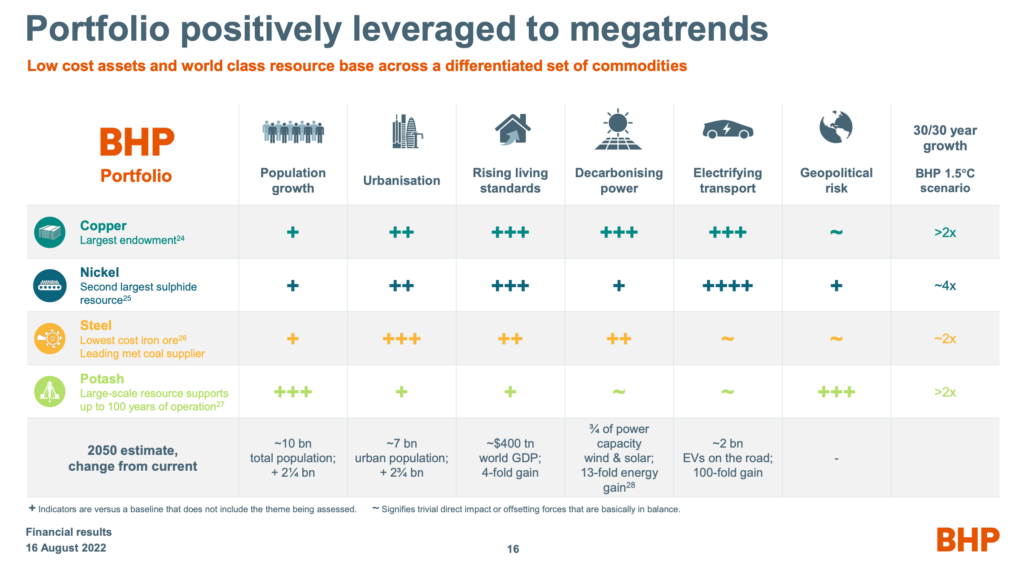

What makes these miners like BHP valuable? In a recent representation by BHP Chief Technical Officer, she pointed out this:

“Copper discoveries have decreased in frequency as the resources are more remote. They may be deeper, lower-grade, under cover, or in countries with more challenging operating conditions. That makes the resource we already control in copper, which for BHP is the largest in the world, and nickel, even more valuable and technology’s role in helping to unlock this potential even more critical.”

In a sentence, basic resources are depleting. Those easy-to-mine and profitable-to-extract minerals are harder to find, which makes the big mines critical in today’s resource-hungry world. The clean energy transition can not survive without these critical materials. Did you know that an electric car requires 2.5x more copper than an internal combustion one?

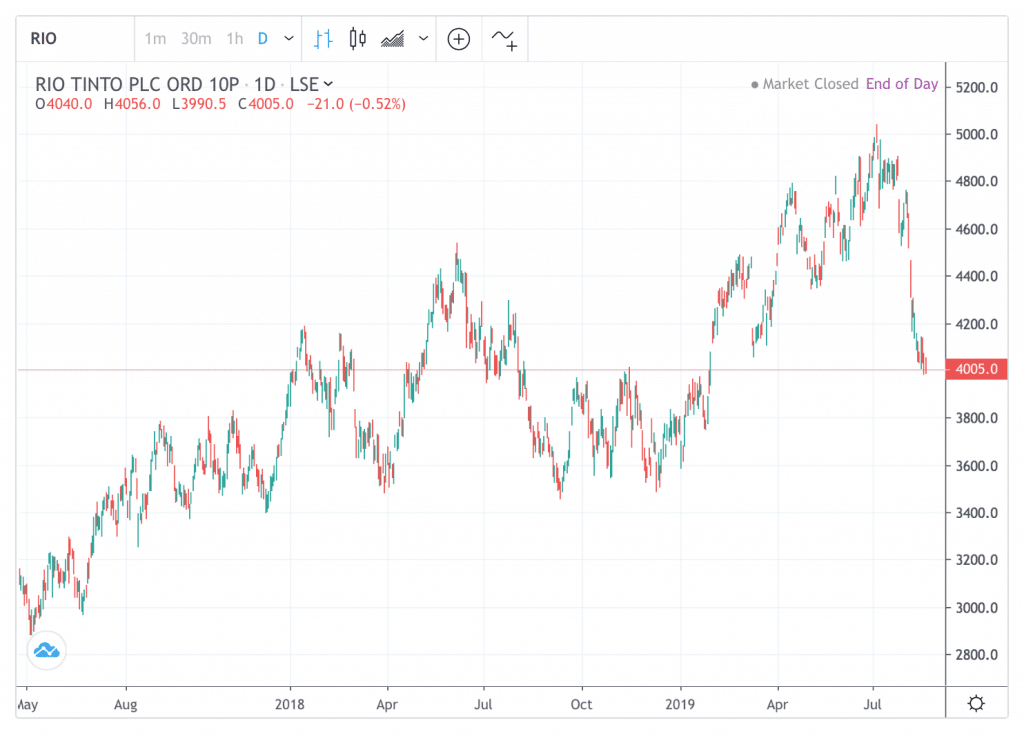

No wonder investors are piling into big miners. Look at BHP’s 20-year chart. Its share price rebounded strongly after each cyclical decline. The BHP share price is now currently close to its all-time highs.

Is there a case for buying BHP shares? The answer is yes. The energy revolution is ongoing and will take many years to complete. In the meantime, the company is geared to many mega-trends like decarbonisation, urbanisation or electrification of transport.

Source: BHP

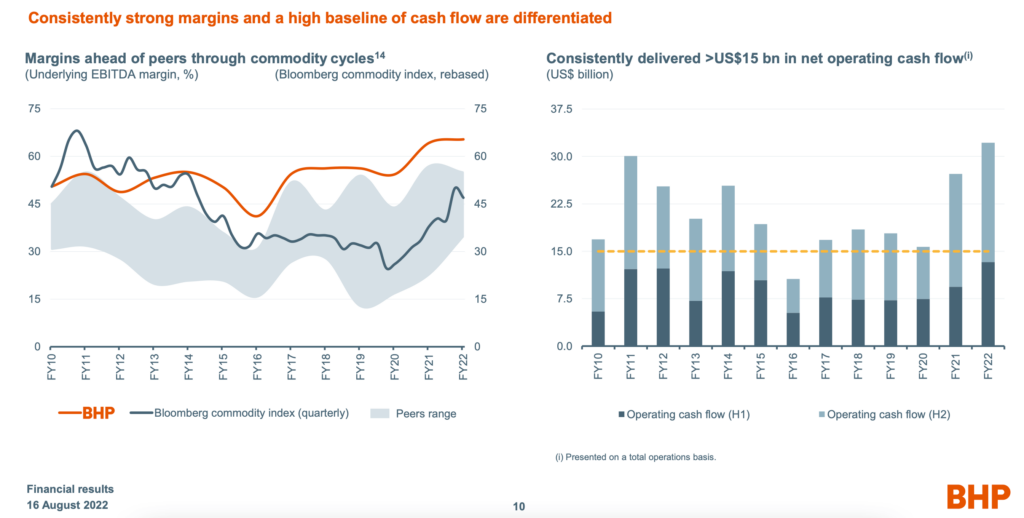

Financially, BHP is financially strong. It earned US$40 billion in the previous year (ending Jun-22); free cash flow totalled more than $20 billion. Dividends are generous, too. Hence the stock is heavily invested by institutional investors.

When is the best time to buy BHP shares (LON:BHP)?

The mining industry is cyclical. There are boom times and there are lean periods. The driver of these cycles is the global economy.

When the global economy is humming along, profits roll in for the miners as commodity prices rise. When the world economy slumps into a recession, commodity price plummet. So do miners’ profits.

The key is to wait for the outlook on the mining industry to be negative to start buying. An example is during the 2020 pandemic. At that time, few expected the economy to rebound quickly. Expectations were subdue and share prices low. That was a good time time to buy shares in BHP.

Now, profits are high, meaning that we are potentially near a cyclical high. Therefore, if holding BHP shares I would stick with the position but not add too heavily.

Is the BHP share price overvalued or undervalued at the moment?

Judging from BHP’s yield, it seems the stock is undervalued. BHP’s results appear to be running ahead of its peers. Profits, cash flow and dividends are all rising simultaneously.

Source BHP

However, in the face of the heightened market uncertainty, there is a distinct lack of ‘animal spirits’. No exuberance is found in the stock market no matter how good the fundamentals are. Investors are more concerned about the looming recession, stagflation, or war in Ukraine.

Therefore, I would expect BHP shares to range trade for a while (2,000p-2,600p).

Why has BHP’s share price dropped recently?

The BHP share price had corrected during the summer of 2022. Prices did peak near 3,000p in the days following the Ukraine invasion back in April. But that was a brief rally. Reasons for its setback included:

- Markets anticipate a fall in demand for materials – due to a contracting economy in 2023 and beyond

- A fall in base materials prices – which reduce miners’ margins. Look at the price of copper below, currently significantly below its spring highs. ‘Dr Copper’ is a leading macro indicator and should be watched carefully.

- Weak stock market – which pulls share prices lower generally

What is BHP’s share price prediction?

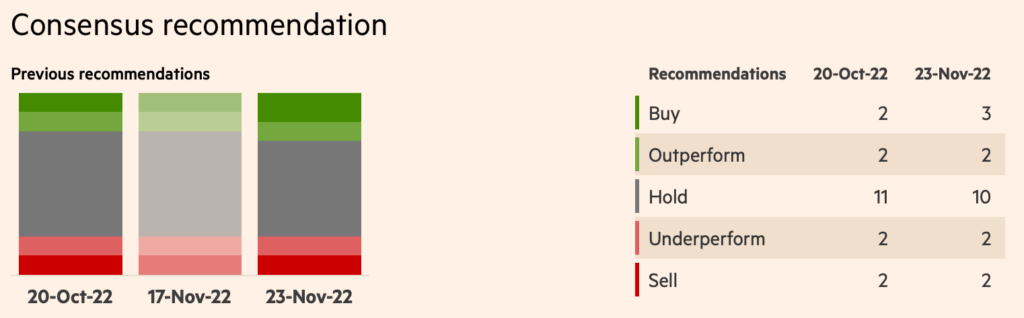

Wall Street is surprisingly bearish on BHP. Out of 19 analysts, 10 are saying ‘Hold’ and 4 are on ‘Sell/Underperform’. What is going on?

Well, miners are cyclical, and Wall Street is expecting the full force of a recession to hit major economies soon. They are probably implying that investors should sell or trim positions now while prices are good.

Should we? Only if you wish to book profits and watch to buy back later.

Source: Financial Times

How do you buy BHP (LON:BHP) shares:

To buy shares in BHP (LON:BHP), you need a trading or share dealing account. Follow these three steps if you want to buy shares in BHP:

- Decide if you want to buy BHP shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

How much does it cost to buy BHP shares (LON:BHP)?

Buying one LON:BHP share costs 1,915p. However, as well as the 1,915p cost of buying the shares you will also have to pay stamp duty, dealing and custody account fees for holding your shares with a broker. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

It’s also important to remember that share prices can move quickly, for example, the current LON:BHP share price is 1,915p which is a change of 3 or 0.16% from the last closing price of 1,915 with 1,151,646 shares traded giving LON:BHP a market capitalisation of £n/a. The most recent daily high has been 1,951.5 and daily low 1,901.5. The LON:BHP share price 52 week high has been 2,382 and the 52 week low 1,559.5. Based on the most recent LON:BHP share price opening of 1,915, the current LON:BHP EPS (earnings per share) are n/a and the PE (price earnings ratio) is n/a.

Pricing data automatically updates every 15 minutes

BHP share price FAQ (LON:BHP):

The answers to our frequently asked questions by people interested in buying BHP shares about BHP’s share price are automatically updated every 15 minutes.

What is the live BHP share price?

The current BHP share price is 1,915p

How much has BHP’s share price moved today?

BHP’s share price has moved 3p or 0.16% today.

How much was BHP’s share price yesterday?

Yesterday, BHP’s share price closed at 1,915p

How many BHP shares are traded each day?

There were 1,151,646 shares traded in BHP yesterday.

What is BHP’s market capitalisation (market cap)?

BHP has market cap of £96,809,550,350

What has been BHP’s share price most recent daily high?

BHP’s most recent daily high has been 1,951.5p

What has been BHP’s share price most recent daily low?

BHP’s most recent daily low has been 1,901.5p

How high has the BHP share price been in the last year?

The BHP share price 52 week high has been 2,382p

How low has the BHP share price been in the last year?

The BHP share price 52 week high has been 1,559.5p

What is BHP’s earnings per share?

BHP’s current earnings per share (EPS) is n/a

What is BHP’s price-earnings ratio (PE)?

BHP’s current price-earnings ratio (PE) is n/a

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com