Business investing account are simliar in functionality to personal investing accounts but is specifically designed for businesses to manage and grow their investment assets.

| Name | Logo | GMG Rating | Customer Reviews | Account Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 4.3

(Based on 1,123 reviews)

|

Account Fees £59.88 |

Dealing Commission £3.99 |

See Offer Capital at risk |

Features:

|

Interactive Investor: Best Fixed Fee Business Investing Account. Interactive Investor’s business account is suitable for large account balances as the monthly minimum charges (including the additional £30 to cover operational costs in maintaining services for Company Accounts and Trust Accounts) can eat into small account balances quickly.

However, if you business is investing more than £50,000 ii’s corporate account is an excellent one stop shop to invest your businesses surplus cash.

interactive investor (ii) offers fixed fee investing on a wide range of investments Provider: Interactive Investor Verdict: Interactive Investor’s fixed fee account structure make them one of the most cost effective ways for people with large portfolios to manage their investments, ISAs and pensions. ii are expecially good for high value portfolios and those wanting access to small cap stocks. What does interactive investor do? Interactive Investor or II as its known is one of the UK’s largest self-determined investor platforms. II can trace its roots back to 1995 and the startup floated on the London stock exchange back in the year 2000 before being bought by the Australian business Ample in 2002. Today, Interactive Investor is a owned by abrdn with assets under administration of more than £50 billion and 400,000 customers to whom II offers share trading and investment services including, ISAs SIPPs and share dealing, alongside research and analysis. Including model portfolios, selected funds and thematic investments. Interactive Investor differs from other investment platforms as it charges a fixed account fee, rather than a percentage of the funds you have on account. Which, over time, could save you thousands in costs. As a low-cost provider ii competes directly with the likes of Hargreaves Lansdown and AJ Bell offering general investment accounts, ISAs and pensions. Pricing: Brilliant for medium and large investors, expensive for small accounts. Does interactive investor pay interest on cash? Yes, but only 2% for under £10k and you need at least £100k in your account to get their best rate of 3.25%. There are other brokers that offer better rates on uninvested cash, though. interactive investor versus Interactive Brokers interactive broker and interactive investor may sound similar but cater to different investor profiles and operate under different jurisdictions and cater for different types of investors. interactive brokers is a US‑based global brokerage offering a wide spectrum of asset classes and advanced trading tools, often targeting active traders and professionals. interactive investor, by contrast, is a UK‑focused subscription‑based platform offering a fixed‑fee structure suited to medium‑to‑long‑term investors primarily in equities, funds, bonds, Gilts, ISAs, and SIPPs. interactive investor employs simpler platforms with relatively basic charting tools, while interactive brokers features a more complex interface and lower per-trade costs but with more variable fees. interactive investor is better for large longer term investment accounts because of its simplicity, flat monthly fee and broad UK offerings, whereas Interactive Brokers suits users seeking global market access and sophisticated execution tools. Can you buy Gilts on interactive investor? Yes, ii supports investment in government bonds, including UK Gilts, via its platform. This is confirmed on the site, which lists bonds and Gilts as available investments . Pros

Cons

Overall5 |

||

|

GMG Rating |

Customer Reviews 4.8

(Based on 275 reviews)

|

Account Fees 0% |

Dealing Commission £1 |

See Offer Capital at risk |

Features:

|

Lightyear: Best Start-up Business Investing Account Account: Lightyear Business Account Description: Lightyear won Best Business Investing App because they simplify the process of opening a corporate investment account. By enabling businesses to invest in the stock market rather than solely holding cash, Lightyear empowers companies to make more from their funds, maximizing potential returns. Is Lightyear a good business investing account? Lightyear won “Best Business Investing Account” in the 2024 Good Money Guide Awards as they have really simplified the process of opening corporate investment accounts. There are no fees to open, bank transfer into, withdraw from, or maintain a Lightyear business account and you can hold currency in either GBP, USD & EUR. Plus, investing in ETFs is completely free of execution fees, and won’t be subject to conversion fees either if you hold money in USD, GBP or EUR. But, if you do convert currency, Lightyear only charges an FX fee of 0.35% Your business can also invest in high-interest-rate treasury products backed by BlackRock. Charlotte Ashdown from Lightyear said after winning the review: We’re honoured to win this award. Most business funds are kept in easy-access accounts with incumbent brokers and banks, earning only 1-2% interest, which leads to billions in potential earnings being lost. We’re addressing this by helping businesses earn the interest they deserve, ultimately contributing to both their success and the economy’s. For retail investors, we advocate a diversified portfolio—US stocks are popular, but UK stocks are also essential for balance. Today’s discussions on making bonds more accessible to retail investors show promising steps toward creating balanced portfolios with lower-risk options alongside higher-risk stocks. Pros

Cons

Overall4.8 |

||

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Account Fees £0 |

Dealing Commission 0.05% |

See Offer Capital at risk |

Features:

|

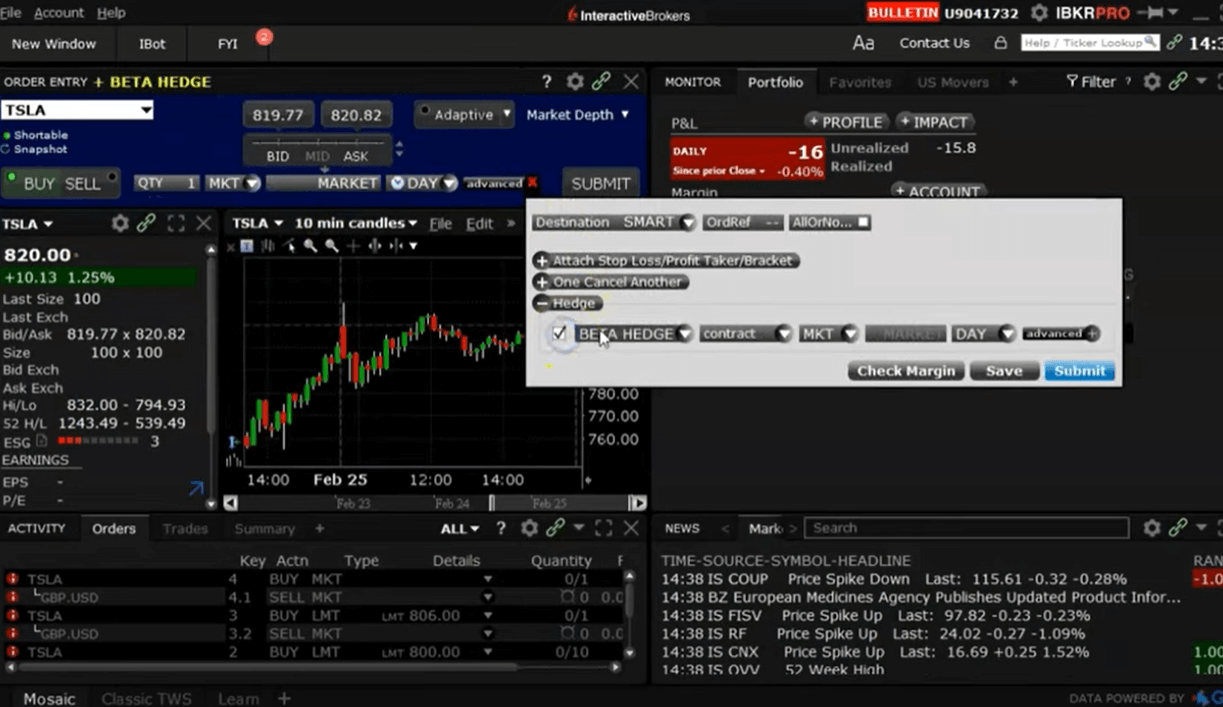

Interactive Brokers: Best Platform For Businesses to Invest Internationally. If your business is serious about investing, Interactive Brokers is the sensible choice. IBKR offers one of the most advnaced trading platforms for corporate accounts ranging from SMEs to boutique, mini and large hedge funds.

Fees are low, there is a huge range of markets to invest in (both in the UK and in the US) and there is plethora of research and analysis to help you choose the right investments for your company.

Interactive Brokers has a platform for everyone with very low costs Provider: Interactive Brokers Verdict: Interactive Brokers is an exceptional trading platform that offers institutional-grade trading capabilities to private clients around the world. IBKR has some of the lowest trading and investing fees and the widest market range in the industry. Interactive Brokers is a major US online automated electronic broker company. The financial broker is listed on the Nasdaq Exchange with ticker IBKR. The firm operates in 150 electronic exchanges in 34 countries, and offers trading in 28 currencies. Interactive Brokers has more than 3.19 million institutional and retail customers. Is Interactive Brokers any good?

The proof they say is in the pidding and IBKR, has increased it’s market share in the UK dramatically over the past few years. In 2024 alone, they increased the number of accounts by 142%. An amount I suspect will continue to rise, of all the brokers we cover, they provide the most updates, most platforms and are always looking to offer new markets, that investors actually want. 2025 Awards: Best Professional/DMA Broker 2025 Pricing: Top marks as IBKR don’t charge a custody (account) fee and commission are the cheapest around Market Access: Top marks again for the widest selection of markets available App & Platform: Hard to beat – excellent range of institutional grade execution tools and simple apps for beginners Customer Service: IBKR let themselves down a bit here. If you are a big customer you get an account manager, otherwise online support is slow Research & Analysis: Some of the best education, screeners and market data for free on their website and integrated into IBKR platforms. I’ve used Interactive Brokers for about 20 years now. I’ve interviewed their founder (Thomas Peterffy), their UK MD (Gerry Perez), they’ve been a competitor (when I was a broker myself), a customer and a partner over the years. I’ve traded live with real money when thoroughly testing their platforms. This included an in-depth conversations with their Head Of Product (Steven Sanders) to get inside insights on the best parts of the platform and services that some clients may not know about. In this review, I lay out my verdict on Interactive Brokers as an industry expert so you can decide if they are the right investing and trading platform for you. There is one thing that Interactive Brokers gives you above all other brokers, and that is control. You can invest and trade in pretty much anything you want, in pretty much any account type, pretty much how you want. If you are not familiar with Interactive Brokers (IBKR) they are American, but global, as most American things are, with the notable exception of their news, which always seems to be local. But I digress, IBKR was one of the first brokers to offer electronic trading to the masses. They were founded in 1978 and if you want to know more about the man who founded them and is still running the show, read my interview with Thomas Peterffy, the founder and chairman. Highlights: The key things to focus on if you are considering opening an account with Interactive Brokers is that: They are cheap: No other investment or trading platform can match their discount commissions, FX rates and zero account charges Huge market range: IBKR offer by far the best access to global stock exchanges around the world They innovate and create :You can invest in so many different ways through IBKR, from their beginner IBKR LITE apps, to their institutional-grade desktop workstation trading platform. They have some of the most advanced and easy-to-use features available to private investors. Interactive Brokers Account Types: IBKR offer by far the most types of accounts globally including regular investing account, active trader accounts, direct market access, futures, options and fractional stock trading You can also earn money on your cash, you can buy bonds (high and low yielding), buy warrants, partake in placings, vote on company corporate actions. You can convert currency at 0.2%, which is cheaper than most specialist currency brokers or money transfer apps. Foreign Exchange: Which actually segues me nicely to prove my control point. With most brokers you have to choose an account base currency (if you are in the UK that is probably going to be GBP) and when you trade, no matter what currency an asset is traded in your P&L will be converted to that base currency. But with Interactive Brokers you can run your account in multiple currencies. So, if you put in GBP and trade the S&P for example, your P&L will be in USD. If you buy USD stock you get the option to attach a currency conversion to the transaction so you can convert exactly the right amount to cover the purchase, or you can choose to run a deficit in USD. It’s not such an issue for small traders, as currency exposure, whilst important to be aware of, isn’t the most pressing matter. But if you are running a net flat long/short global macro portfolio, then keeping on top of your currency exposure could be the difference between making money or not. Desktop Trader: Through ScaleTrader, (one of the founder’s favourite features) IBKR also gives you some very advanced order functionality, the sort you usually only get with professional trading systems like Fidessa (for stocks) or TT (for futures). If you’re building a big position and don’t want the market to know you’ve got a big order to work, IBKR’s order ticket will let you gradually feed that into the market (but only charge you for the single order). You can automatically drop bids and offers into the market based on time and price to take advantage of volatile markets. You can also set it to scalp for quick profits in choppy markets.

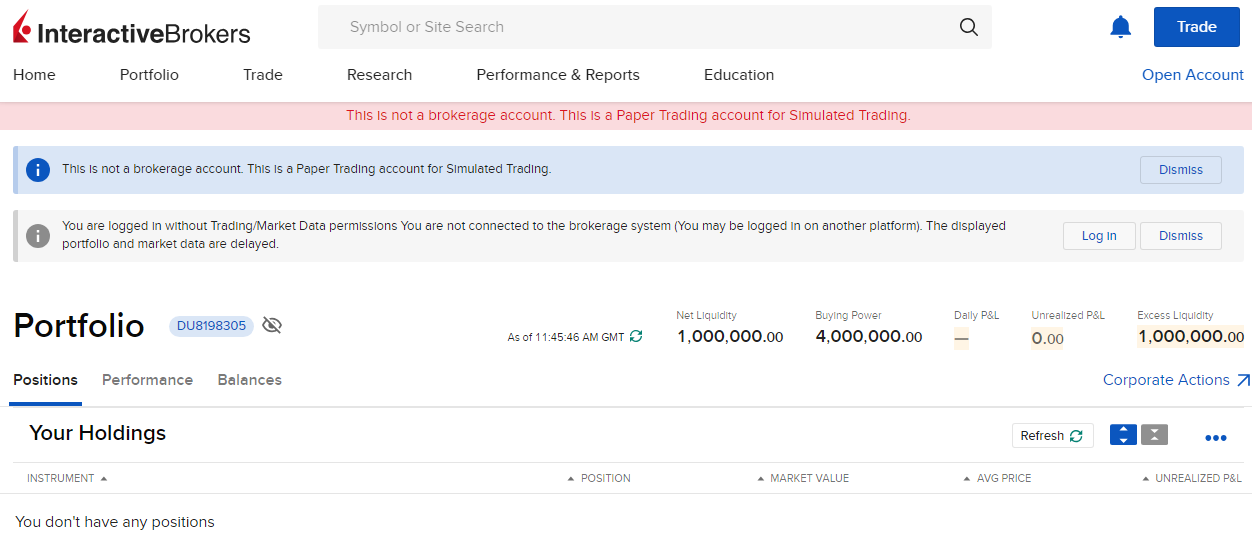

Pairs Trading: You can trade one stock against another automatically by spread, percentage or price. Why is that important? Because it can help you build a market-neutral portfolio and when we asked the boss of IBKR the habits he saw in his most profitable customers, (referring back to our interview with him for the third time) he said the ones that traded one stock against another, often did well. Interactive Brokers Universal Account: You can of course do these things with other brokers, but what you can’t do is do them all in one place. For this review, I spent a while talking to Steven Sanders, IBKR’s head of Marketing & Product Development, and he said in the twenty years, he’s worked for Interactive Brokers the thing he’s most proud of (other than it being founder lead and therefore very little red tape when you want to get things done) is the implementation of the Universal Account, where everything is done from one account. What’s amazing to me is that nobody else really offers it. Ten years ago when I was a derivatives broker at Man Financial, we offered everything that IBKR did, but all on separate platforms. We have a couple of big accounts, £20m upwards, that we were always trying to lure back from IBKR with our personalised voice brokerage where you could phone us up we’d take care of your complicated orders for you. But times change, there is still demand for bespoke voice brokerage, but not as far as Interactive Brokers are concerned. They do offer it from specialists desks if needed, but most trading and investing is done online. Demo Account: Interactive Brokers does have a demo account, but they call it a free trial instead. This is odd, because you don’t actually have to pay to have an account with IBKR. In fact, Interactive Brokers is one of the only trading platforms that does not have a custody fee for investing in a GIA, SIPP and ISA. If you want to know more about that, you can listen to my podcast with Gerry Perez, the UK MD, who explains, how they offer such amazing market access for such little cost. You get a cool $1m to paper trade with on the Interactive Brokers demo account or ‘Paper Trading version’ as they call it. You get access to the easy-to-use investors portal and the more complex IBKR TWS provides delayed market data, simulated trading and access to all of our unique tools and offerings, including the IBKR Risk Navigator, the Volatility and Probability Labs, Portfolio Builder, Research and News. But, to be honest, I didn’t find the demo account very good. Lots of information was missing and I couldn’t place a trade. I’m not sure why, and actually, that’s going to be a bit of an issue for Interactive Brokers because demo accounts are a great way to get client’s interest. In a world where so many brokerages a vying for the same business, even small hiccups like that can cause a massive drop off rate in opening an account.

Usually, IBKR’s technology is first-rate, but the demo account isn’t up to scratch. I didn’t use the paper trading account, just the live trading platform with real market orders. Customer Service At Interactive Brokers: It’s not all great, it takes a while to get through on the phone to customer service, and it has a slightly outsourced feel about it (if you know what I mean). The desktop trading platform, despite its exceptional functionality, is also a bit ‘Windows 95’. But if you don’t need all the bells and whistles, the web based platform, or app has a more modern feel to them. Options Strategy Builder: Options trading is gaining in popularity in the UK, mainly because of the press attention they derived from meme stocks (where US traders punt via options). But they are still a very complicated product. So what Interactive Brokers has down is create a Strategy Builder product, that essentially reverse the process of putting on options strategy trades. You tell Strategy Builder what you think the market is going to do. For example, either, go up, stay still, not move for a while, or volatility will increase and it will create an options strategy around that. Instead of you having to know what strategy to put in place or working out the individual options legs. IMPACT Ethical Investing: In tune with moving with the times, Interactive Brokers has also released the IMPACT app to help people investing in ESG and impact sectors, so they can put their money to good. You can see the IMPACT dashboard on desktop, but it also operates as a standalone app that connects directly to your IBKR account and scores your portfolio based on how ethical the stocks you hold in it are. Ratings come from FactSet and Refinitiv, and there is this excellent feature that allows you to swap into more ethical stocks. If one of your holdings is flagged as not that ethical, the app will suggest another one and at the click of a button, it will sell your shares and calculate how many new shares of a more ethical but similar company to buy and do it all for you. If you’re in the US, you can also make charitable donations directly on the app. Interactive Brokers For Beginners: There is no doubt that Interactive Brokers is a proper trading platform, for those who know what they are doing and cater mainly to the more sophisticated investor. But they are making an effort to open their services up to the newer breed of investor and trader. It’s standard now among many fintechs, but IBKR were actually the first to offer no commission trading. They also offer fractional shares through IBKR LITE and IBKR Pro accounts and have removed the monthly minimum account charge. The hope of course is that by onboarding investors when they just start, they can look after their investments for the next 40 years, just as they have been doing for their existing clients for the last 40. Interactive Brokers runs a Student Trading Lab where students from 600 schools and universities take part in a $1m paper trading account for the purposes of getting a better understanding of the markets. No broker these days can tell you what to buy or sell, but IBKR GlobalAnalyst helps you hunt out undervalued opportunities, across the world, not just in the US. IBKR offer a Trading Academy, podcasts, webinars and blogs for beginners and experienced traders so that new customers survive the markets to become long-term clients. Plus, they are cheap. 24-Hour ETFs At Interactive Brokers:Interactive Brokers has a list of 24 selected ETFs available to trade around the clock from Sunday evening, east coast time, through to the close on Friday, by adding these funds to its US overnight trading facility. Clients who are permissioned to deal in US stocks, are able to trade these ETFs 23.50 hours a day, five days per week, allowing them to react to news stories, macroeconomic and geo-political events as they happen, rather than waiting for US markets to open. The trading hours and ETFs are available to both retail and institutional clients alike and are traded via the firm’s IBEOS system. Trades can be submitted using multiple order types. The range of ETFs is pretty broad and includes firm favourites such as SPY, QQQ, DIA and IWM, which track the S&P 500, Nasdaq 100, Dow 30 and Russell 2000 indices respectively. You can also short those indices by trading the SH, PSQ, DOG, and RWM inverse ETFs. Pros

Cons

Overall4.8 |

||

|

GMG Rating |

Customer Reviews 4.2

(Based on 1,094 reviews)

|

Account Fees 0% – 0.25% |

Dealing Commission £3.50 – £5 |

See Offer Capital at risk |

Features:

|

AJ Bell: Best Platform For Low-Cost Investing For Businesses. AJ Bell’s corporate share dealing accounts offers a lot more than just the ability to invest in other companies. Your business can also invest in over 2,000 funds, 450 investment trusts and thousands of ETFs that cover domestic and international sectors, themes and commodities.

Overall, AJ Bell’s business investing account is one of the cheapest and comprehensive around.

AJ Bell Review: A low cost full service investing platform Provider: AJ Bell Verdict: AJ Bell is an award-winning, low-cost online investing platform for UK DIY investors. Founded in 1995, AJ Bell has grown to become one of the UK’s leading investment platforms. Today, it has more than 488,000 customers and assets under administration (AUA) of over £180 billion as of January 2026. Is AJ Bell good for investing? AJ Bell is an excellent full-service stock broker that offers a wide range of services for investors, including share dealing, fund investing, cash-saving services, and mobile dealing. It also offers a range of accounts including Stocks and Shares ISAs, Lifetime ISAs, Self-Invested Personal Pensions (SIPPs), dealing accounts, and investment accounts for children. Pros

Cons

Overall4.8 |

Our experts chose what we think are the best business investment accounts based on:

- Over 30,000 votes and reviews in the coveted Good Money Guide annual awards

- Our own experiences testing the company investment accounts with real money

- An in-depth comparison of the features that make them stand out compared to alternative investing platforms for businesses

- Our exclusive interviews with the business investment account company CEOs and senior management

Pros & Cons Of Business Investing Accounts

Opening a business investing account helps manage company funds, diversify investments, optimize returns, and enhance financial growth while benefiting from professional management and potential tax advantages.

Here is a round-up of the advantages and disadvantages of your business using a corporate investment account:

Pros

- Capital Growth: Your businesses excess cash can be invested in the stock market and potentially increase in value

- Hedging: You can use investment tools to hedge against currency exposure and regional growth/decline

- FSCS protection: Business accounts in the UK still get FSCS protection up to £85,000

Cons

- Risky: If the market moves against you, your company can lose money

- Access: When your company money is invested, it can take time to get it back if you need it urgently

- Fees: If you are only investing a small amount and choose the wrong account, your company funds can be eaten away in fees

What can companies invest in with a business investing account?

Business investment accounts generally have access to the same types of investments as personal investment accounts. In some circumstances they can also access ghigher risk types of investments like corporate bonds or illiquid off exchange assets, but only if the company directors qualify.

Here are the main things business can invest in:

- Stocks: Public companies traded on stock exchanges like the LSE or NYSE

- Bonds: Essentially IOUs from governments or companies that generate income through interest coupon payments

- Funds: Investment trusts or investment funds managed by professional investment managers.

- ETFs (Exchange-Traded Funds): Funds that trade on stock exchanges, representing a sector, commoditity, currency or diversified portfolio.

- Money Market Instruments: Short-term, lower-risk investments that pay interest on cash.

What different types of account can businesses invest with?

Account Types:

- Stock Brokerage Accounts: For trading and holding various types of investments like stocks, bonds, ETFs or funds.

- Business Savings Accounts: For getting paid interest on cash with a focus on liquidity and safety, although sometimes to get the best interest rates there is a time limit

- Treasury Management Accounts: For managing cash flow and short-term investments.

How to open a business investment account?

If you have a simple business ownership structure you should be able to open a corporate investment account online. However, if there are multiple owners and sibsiduries, you may still have to fill in paperwork and send in certified documentation.

But in general to open a business investing account you should follow these steps:

- Choose a provider: Select a bank or brokerage firm that offers business investment accounts.

- Apply for an Account: Provide necessary documentation, including business registration details, tax identification number, and corporate resolution authorizing the account.

- Set Objectives: Define investment goals, risk tolerance, and asset allocation.

- Manage and Monitor: Regularly review and adjust the investment portfolio to align with business goals and market conditions.

Should businesses open an investing account?

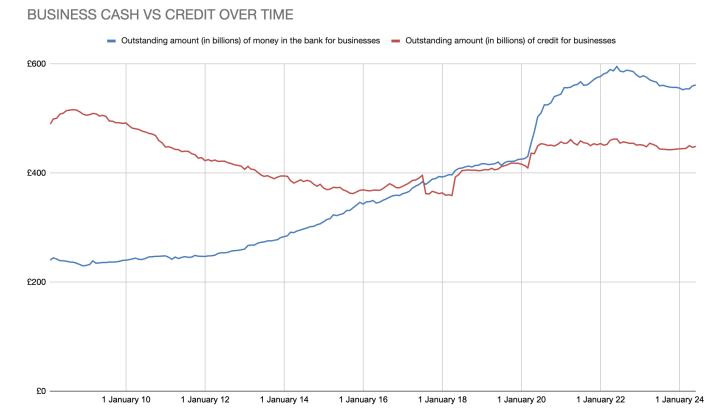

According to Lightyear’s analysis of Bank of England data, businesses in the UK have over half a trillion pounds between them, but £426 billion of it (76%) is sitting in savings or current accounts with an average interest rate of just 1.7%.

According to Lightyear’s analysis of Bank of England data released on the 1st July, businesses hold more cash than credit; the total amount of money held in deposits by private businesses in the UK has been rising since 2008 (when reporting started) – with a spike since COVID – and is continuing to trend upwards. It overtook the amount lent to businesses in 2017. The recent release of May’s figures reveals that businesses now hold £562 billion in deposits, vs £449 billion in credit.

But, whilst businesses have over half a trillion pounds that could be put to work, £426 billion of it (76%) is sitting in savings or current accounts with an average interest rate of just 1.7%

⚠️ FCA Regulation

All Business Investment Accounts that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK GIAs are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature Corporate Investment Accounts that are regulated by the FCA and where your businesses funds are protected by the Financial Services Compensation Scheme (FSCS).

Yes, Interactive Brokers is simply unmatched in terms of market access, account types and execution options for retail traders. It always has been and remains one of the cheapest trading and investing platforms globally.

Yes, Interactive Brokers is simply unmatched in terms of market access, account types and execution options for retail traders. It always has been and remains one of the cheapest trading and investing platforms globally.