The answer to whether or not you have to pay tax on forex trading depends on how you trade forex. For the majority of forex trading, you do have to pay tax, but there is a way to trade forex in the UK without having to pay capital gains tax on your profits.

- Want to trade forex? See our picks of the best forex trading platforms in the UK

Forex trading and tax in the UK

Paying tax in the UK on forex trading profits is a question that is asked quite often and one of the most searched for questions regarding profitable forex trading. Here I’ll run through the ways you can trade forex without having to pay tax.

Types of forex trading in the UK and if you have to pay tax

Below are the different types of forex trading and whether or not you have to pay tax on profits

- Spot forex – yes you have to pay tax

- Forex CFD – yes you have to pay tax

- Forex Futures – yes you have to pay tax (you can trade these through a futures broker)

- Forex Options – yes you have to pay tax

- Financial forex spread betting – no you do not currently have to pay capital gains tax

Why don’t you pay tax on forex trading with financial spread betting?

Trading forex as a financial spread bet means that the trade is structured as a bet. So instead of trading forex via CFDs or spot where you buy an actual amount, with forex spread betting you are betting a certain amount per point (or pip) the market moves.

Brokers that offer tax-free forex financial spread betting

You can compare all financial spread betting brokers in our comparison table, but the major UK brokers that are regulated by the FCA for forex financial spread betting are:

An example of a tax-free forex trade:

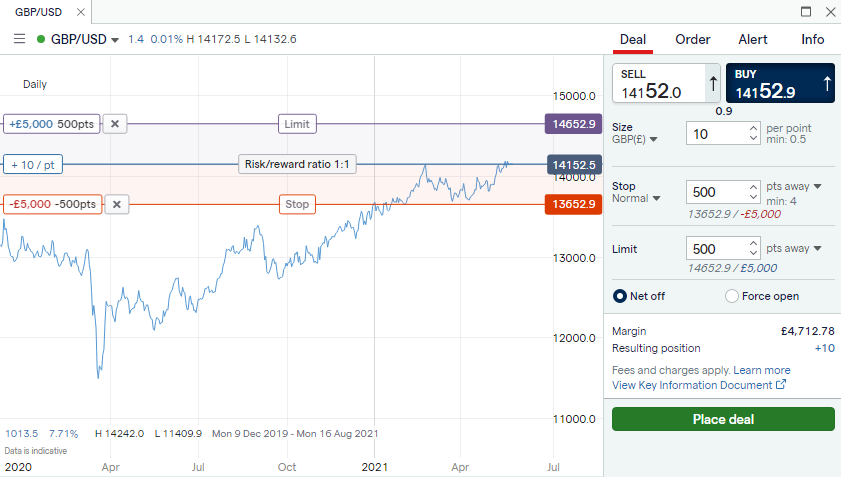

If you were to bet £10 per point that Cable (GBPUSD) is going to rise, and the current price was 14152.9 you would be buying the equivalent of £141,529 with a 5% margin requirement of 3.33% (£4712.78).

For every pip GBPUSD goes up you make £10, for every pip it goes down you lose £10. In this case we have put a stop and limit 500 points away from the opening price. If the market rallies and you exit the trade at your limit, you have made 500 points which is a bet win of 500 times £10 per point (£5,000).

As the trade is structured as a bet and you do not currently have to pay tax on gambling profits you do not have to pay tax on your profits.

However, if the market goes down and your stop is hit, then you lose £5,000.

With financial forex spread betting you will also note that profits are in GBP. Usually with forex trading P&L is in the back currency (in this case USD). This does help keep costs down as you don’t have to pay currency conversion fees on your profit and loss.

This example is taken from financial spread betting broker IG’s trading platform.

The downside of trading forex as a tax-free spread bet

There is of course a downside to trading forex and not having to pay tax on the profits.

The first is that all forex trading is notoriously difficult. The majority of retail traders (private clients) lose money. So if tax efficiency is your most pressing issue, then forex trading may not be the best place to start. For more information read our guide on how to trade forex.

If you do lose money it also means that you cannot offset forex trading losses against your other capital gains from property or other investments. Which you would be able to do if you were trading forex and lost money as a CFD or spot.

It is also worth reading our article on why spread betting is tax-free for some anecdotal stories as to why you don’t have to pay tax on forex trading profits.

One final note is that everyone’s tax circumstances are different so please consult a tax specialist for the most relevant information that applies to you.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com