-

Jackson Wong PhD

Jackson Wong PhD

- Updated

In this guide, we will explain the best ways to send money to Japan using currency brokers for large amounts and money transfer apps for smaller amounts. Use our comparison of what we think are the best accounts for sending money to Japan to compare how many currencies they offer, what the minimum and maximum transfer sizes are, or if they offer currency forwards and currency options. You can also see how established a company is by comparing when they were founded, how many customers they have and how much money they transfer abroad.

Best ways to send money to Japan from the UK

- Use a currency broker like OFX for large JPY money transfers

- Use a money transfer app like Wise for smaller JPY money transfers

- Never use your bank for JPY money transfers as it is very expensive unless you are with a new fintech bank like Revolut that has discounted exchange rates

| Currency Broker | Number of Currencies | Min Transfer | Forward Contracts | Same Day | Customer Reviews | Get Quote |

|---|---|---|---|---|---|---|

| 40 | £100 | 24 months | ✔️ | 4.9

(Based on 2,603 reviews)

| Request Quote |

| 40 | £100 | 12 months | ✔️ | 4.8

(Based on 910 reviews)

| Request Quote |

| 55+ | £250 | 12 months | ✔️ | 4.4

(Based on 49 reviews)

| Request Quote |

| 30+ | £3,000 | 24 months | ✔️ | 4.7

(Based on 91 reviews)

| Request Quote |

Methodology

We have chosen what we think are the best ways to send money to Japan based on:

- over 17,000 votes in our annual awards

- our own experiences testing the currency brokers

- an in-depth comparison of the money transfer app features that make them stand out compared to alternatives.

- interviews with the international payment company CEOs and senior management

Compare exchange rates for sending money to Japan

Use our Japanese Yen exchange rate comparison tool to request quotes from multiple providers and see how you could save up to 4% on large JPY currency transfers versus using your bank when you send money to Japan.

Please note: The rates displayed in this currency conversion quote tool are supplied to us directly from the currency brokers as a percentage mark-up. Please ensure you read our guide to getting the best exchange rates guide.

History of the Japanese Yen (JPY)

The Japanese Yen is the national currency of Japan. The currency was constructed at the end of WW2 at Y360 to the dollar under the Bretton Wood System. When that system broke down, the Japanese Yen was ushered into a free-float regime. Its FX abbreviation is JPY.

As one of the largest economies in the world, the Japanese Yen is highly valued by other countries. According to the Bank of International Settlements, the Yen is the third most traded currency in the foreign exchange market. The currency comprises about 6% of all reserve currency globally as calculated by IMF, ranking just behind the US Dollar and the Euro.

The issuance of the Japanese Yen is controlled by the Central Bank of Japan. The nine-member Policy Board determines the overall monetary policy of Japan and sets the policy rate. The board meets eight times a year. The current BoJ chairman is Mr Kuroda Haruhiko.

In March 2001, Japan was the first country to implement unconventional monetary policy (QE) in the world. This pinned interest rate to zero. During 2002-06, Japan was the favourite source of funding rate for the famous “carry trade“, a strategy of borrow from low interest currency to invest in high interest currency.

Factors affect the Japanese Yen (JPY) exchange rate

Historically, the Japanese Yen was one of the most volatile currencies in the market. This is related to the rise and fall of Japan’s bubble economy during the eighties and nineties, followed by the ground-breaking quantitive easing during the noughties.

Moreover, the Bank of Japan has a history of intervening in the FX market to control the movements of the Yen. Traders should be aware of this possibility whenever the Yen trends to extreme levels.

The Japanese Yen was one of the safe haven assets during the Global Financial Crisis. As a result, the value of JPY surged. For example, USDJPY soared from 120 in 2007 to 76 in 2013 (see below). But the Yen’s role as a safe haven asset is limited these days due to excess monetary easing by the BoJ.

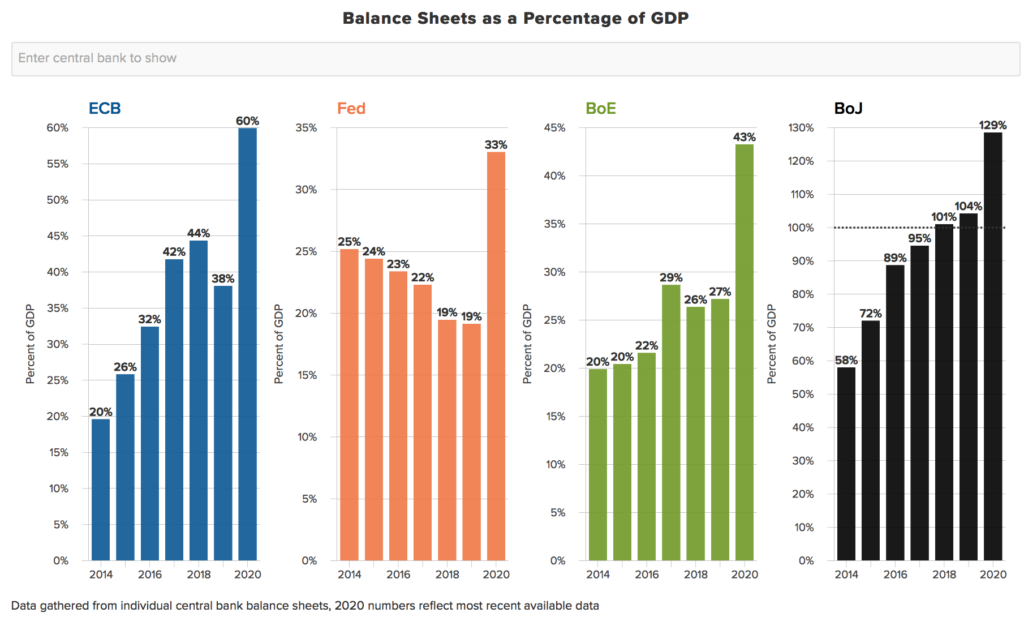

In 2013, the Bank of Japan implemented a massive monetary stimulus program known as ‘quantitative and qualitative monetary easing (QQE) with yield curve control‘. One goal of this program is to achieve the Price Stability Target at 2%. Under this program, the balance sheet of the Japanese central bank swelled. This program continues to this day.

In addition, during the pandemic in 2020, deflationary pressure forced the BOJ to enlarge its QE program. By 2020, the BoJ’s balance sheet is almost 130% of Japan’s GDP (see below). As a result, the Yen remains weak.

Another factor that sometimes impact the Yen is the ‘carry trade’. This is due to the large interest rate differential between Japan (low rate) and other countries (high rates). These days, nearly all policy rates are low. Hence the lack of interest arbitrage.

Source: AtlanticCouncil

Other drivers of the Yen include the data flow on GDP, inflation, trade data, and Tankan surveys. However, these factors are secondary because of the outsized influence of the BoJ’s QQE program.

Bottom line – The Yen is heavily influenced by the BOJ monetary policy over the years. Since 2013, the Yen has been pinned down by the continuing monetary easing. This trend looks set to continue in the foreseeable future.

Live Japanese Yen (JPY) exchange rates

The current best Japanese Yen (JPY) exchange rate versus other G10 currencies is the mid-market price which is:

| Australian Dollar (AUD) | 0.01031162 |

| Canadian Dollar (CAD) | 0.009279874 |

| European Union Euro (EUR) | 0.005799559 |

| New Zealand Dollar (NZD) | 0.01128772 |

| Norwegian Krone (NOK) | 0.068695 |

| United Kingdom Pound Sterling (GBP) | 0.005025 |

| Swedish Krona (SEK) | 0.064851 |

| Swiss Franc (CHF) | 0.005407744 |

| United States Dollar (USD) | 0.006787714 |

Sending money to Japan FAQ:

The best way to send money to Japan is to use a currency broker.

As well as getting the best exchange rates, if you send money to Japan with a currency broker you also get:

- Expert help and advice to reduce your risk and exposure

- Dedicated account managers every step of the way

- Convert funds online and platform access 24/7

- Same day and forward currency exchange contracts

- Zero service charge, commission or transfer fees

- Transfer money direct to single or multiple beneficiary accounts

When you convert and transfer Japanese Yen (JPY) with a currency broker your fixed exchange should be a maximum of 0.5% from the mid-market for currency transfers. To put this in perspective, banks traditionally charge 3-5% which means that if you are sending £100,000 worth of Yen you could save up to £4,500 with a currency broker versus the banks.

Request a quote to see how much you can save – you’ll find a better JPY exchange rate than by using your bank.

Our comparison tables and JPY exchange rate quote request forms will help you find the best Japanese Yen exchange rate. Our exchange rate comparison tables highlight the key features of currency transfer providers whereas JPY exchange rate quote request forms will make currency brokers compete for your business by offering the best exchange rate.

Here are a few tips on getting the best JPY exchange rate when sending money to Japan

- Always compare (read our guide to comparing exchange rates here)

- Never go with your bank

- Understand the fees

- Use a currency forward to lock in the current exchange rate

If you think the JPY exchange rate is going to go in your favour you should wait. Or, if you are worried the rate will move against you, it is possible to lock in the current rate for up to a year in advance with a currency forward.

Yes, you can send money using PayPal, but it is very expensive. If you are only planning on sending a small amount of money to Japan a money transfer app is much cheaper.

With a currency broker, you can send an unlimited amount of money to Japan. Money transfer apps are good for sending under £10,000. Banks are the worst way to send money to Japan because of the high fees.

The three main ways to send money to Japan are:

- Large amounts – currency brokers like Key Currency, Global Reach and OFX

- Medium amounts money transfer apps Like Wise and XE

- Small and cash amounts – wire transfer providers like Western Union (WU)

Yes, the best way to get the currency exchange rate if you want to send money to Japan is to use a currency forward where you buy the currency now by putting down a small deposit and pay the balance when you make the transfer.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the JPY money transfer providers via a non-affiliate link, you can view them directly here: