Since 2021, the crypto market has been mired in a bear market (crypto winter). Is this industry about to go into a deep freeze or are we looking at a potential recovery later this year? This guide takes an in-depth look at what is in store for the crypto market is dead and if it can recover.

Is crypto trading dead?

“Crypto is dead in America,” screamed a CNBC business headline back in April. The Bitcoin pessimist in question? No other than the longtime Bitcoin bull and businessman Chamath Palihapitiya. To him, it is clear what caused the downbeat outlook: Regulatory crackdown.Since the crypto boom ended in early 2022, the entire crypto industry has been going through a deep convulsion and a major shakeup. The US Securities & Exchange Commission (SEC), in particular, has been taking firm enforcement actions against a number of main crypto actors in the past 12 months.

SEC enforcements

SEC cases against crypto firms include:

- SEC vs Samuel Bankman-Fried of FTX (13 Dec, 2022, summary)

- SEC vs Allison and Wang of FTX (21 Dec, 2022, summary)

- SEC vs Terraform and Do Kwon (16 Feb, 2023, summary)

- SEC vs Sun et al of Tron (22 March, 2023, summary)

- SEC vs Binance (5 Jun, 2023, summary)

- SEC vs Coinbase (6 Jun, 2023, summary)

- SEC vs CelsiusNetwork (13 Jul, 2023, summary)

(See here for a full list of current SEC enforcement actions against crypto businesses)

That’s a hefty list. No wonder investors are left scratching their heads: Is the crypto market entering a wholesale restructuring? Too much regulatory uncertainty is plaguing the market.

Marco markets against crypto

Regulatory fireworks aside, Bitcoin has to contend with unfavourable macro headwinds. High, and still-rising, interest rates is one of the main culprits. Why buy stocks (or another crypto coin for that matter) when you can earn 5% in the short-term risk-free? To combat inflation, the Fed is draining excess monetary liquidity from the market. As liquidity dries up, so did interest in speculative securities. No asset is more speculative than Bitcoin.

Even CZ Zhao, CEO of Binance is worried. “With tightening regulations in the earlier part of this year,” he observed recently, “we’re seeing a lot of traditional institutions that used to provide fiat ramp channels pull away.” Meaning, the next batch of 100 million crypto adopters will not come as soon as he hoped, nor in numbers sufficient to support the industry.

Institutional interest

But not everything is lost on the Bitcoin front, for several reasons. For one, Bitcoin is continuing to receive interest from institutional investors. Many dealers, brokers and Wall Street players are trying to create the first spot Bitcoin ETF (unlike a futures Bitcoin fund). In June this year, Blackrock (BLK) caused a stir in the crypto market when it announced a plan for a Bitcoin ETF. Crypto prices immediately surged. You see, interest is still there. What’s more, some say that a spot ETF is ‘inevitable’.

Market sentiment

Secondly, the fact that BTC is still at just 40 percent beneath its all-time peak at $69,000. This tells us that plenty of buyers are supporting the market. ‘Buy the dips’ is the mantra among these die-hard crypto fans. As a matter of fact, Bitcoin prices rallied nearly 100% this year. Not a bad recovery after its ‘near-death’ decline back in 2022.

Moreover, the macro situation is not all negative for Bitcoin. High inflation causes investors to search for a hedge against the monetary phenomenon. Limited-quantity Bitcoins could be one of these assets to protect investors’ wealth during a period of rising prices.

Many have pronounced Bitcoin ‘dead’ in the past. Well, those Bitcoin obituary predictions have yet to come to fruition. Bitcoin is still alive and kicking. So, no. I believe Bitcoin is not going fade into oblivion just yet.

Can crypto recover to all-time highs?

This depends, obviously, on a few factors.

Adoption of Bitcoin ETFs

One, can Bitcoin continue to appeal to more prospective investors? During the 2020-2021 boom, the crypto industry attracted scores of heavyweight institutional investors. That’s what caused BTC to surge $4,000 to $69,000. Now, it will take much more capital to push it above $100,000. If the adoption of spot Bitcoin ETF is approved, this may lure more traders into regulated exchanges and, eventually, into the underlying Bitcoin market.

Regulation and security

Two, can the crypto industry avoid more blowups? The implosion of FTX in 2022 had caused embarrassment to many institutional CEOs. Singapore’s Temasek had to cut compensation after losing most of its investments in FTX. Memory is long; recriminations deep. These emotions will dictate lower capital allocation to crypto assets – unless the risk-reward is hugely lucrative.

Start-ups

Three, newer crypto firms – startups that typically unencumbered by the current deep drawdowns – may have a better chance to attain new price highs. Why? Look at Coinbase (COIN) below. Deeply underwater from its IPO exuberant highs, many investors are trapped. As soon as prices rebound somewhat, long-suffering holders may choose to bail. This creates new resistance.

- Thinking about using Coinbase? Read our expert Coinbase review first.

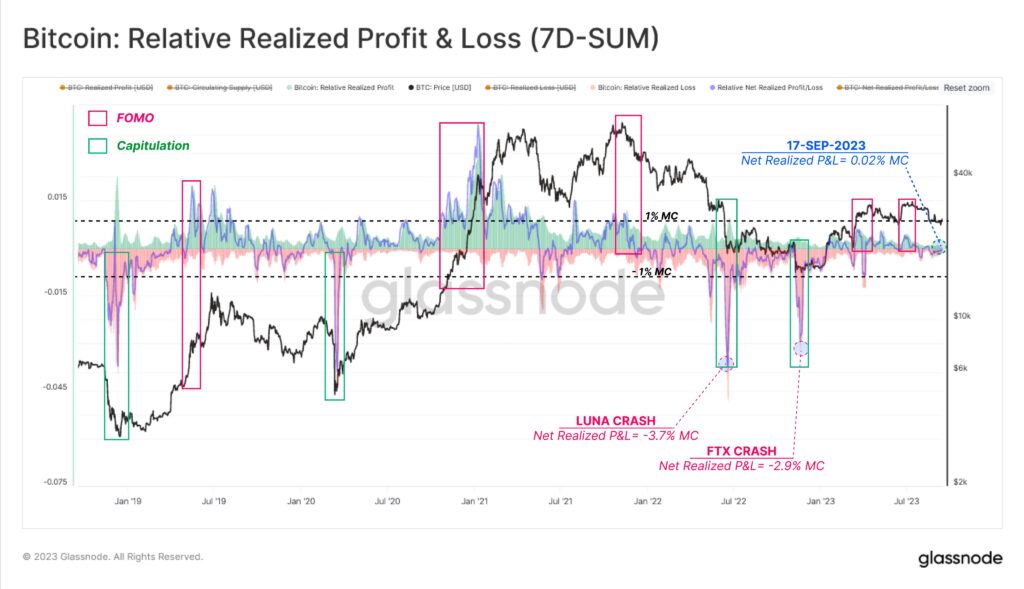

The same outlook is applicable to Bitcoin (BTCUSD) or Ethereum (ETHUSD). There are a large number of underwater Bitcoin positions, created by FOMO traders during 2021. In fact, according to Glassnode, a crypto dataflow analyser, the short-term directional risk for Bitcoin is south, especially after two bouts of FOMO in 2023 (see below).

More buyers than sellers

For Bitcoin to regain new highs, the macro financial conditions have got to be perfect: liquidity, economic and sentiment. With interest rate this high at the moment, it is an uphill struggle.

Moreover, to push through to new highs, the number of new Bitcoin buyers have to outnumber the old stale bulls. Right now, the stars have yet to align for a new crypto bull.

Source: Glassnode (X)

Is crypto a bad investment?

There are no bad bonds, they say, only bad prices.

Anyone who bought Bitcoin back in 2020 and sold 12 months later for a 1,000% gain will tell you, in a heartbeat, that Bitcoin is a wonderful investment. Those ‘Johny-come-lately’ who joined the party in late 2021, however, will tell you otherwise.

Whether crypto is a bad investment depends on when and what you bought.

Unproven tech

Remember, crypto is a new technology. Born in the middle of the last financial crisis (2008), crypto have brought about a few useful things, especially blockchain.

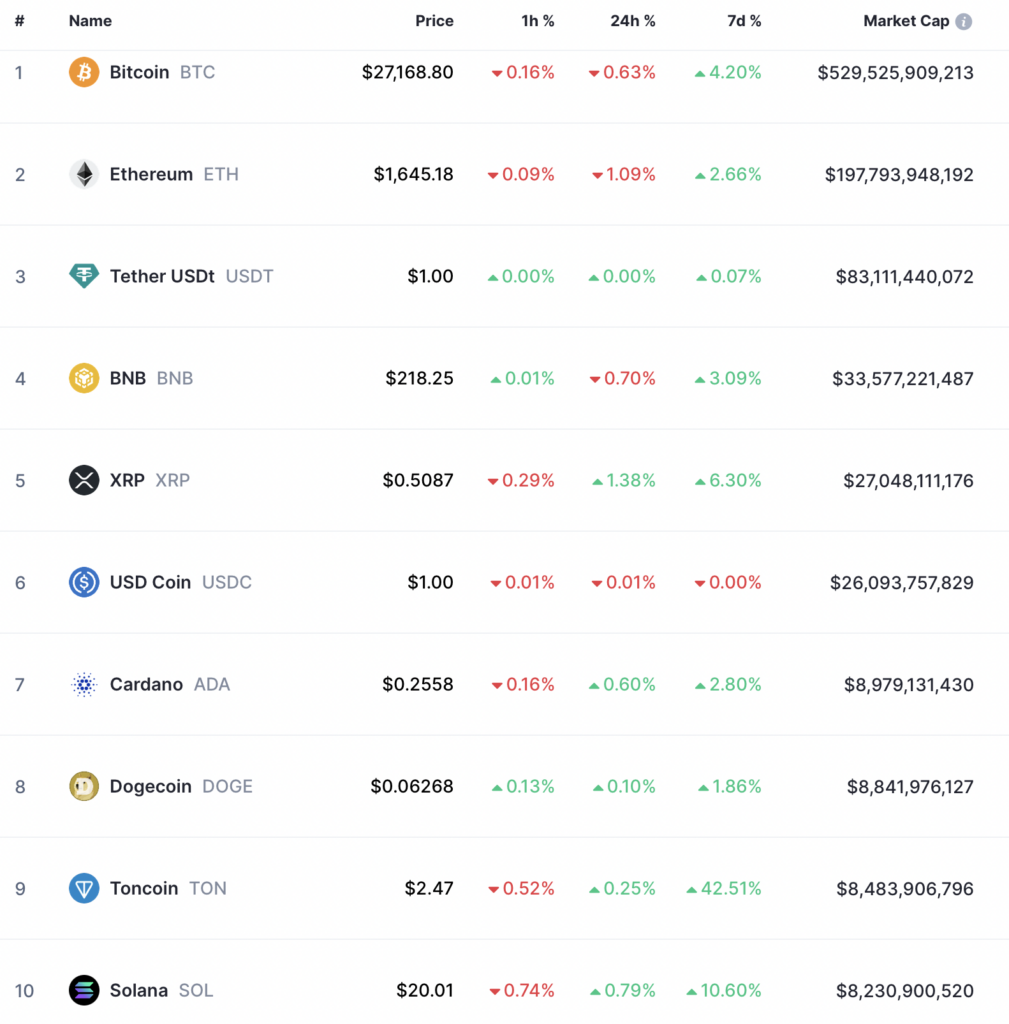

If you are just an investor starting out on this industry, perhaps sticking to the more well known crypto is the preferred route. Go to CoinMarketCap.com and check out the largest crypto coins (see below).

Try to understand what makes these digital coins move. Study their past behaviour; observe their technical levels. Take note of important events. Did you know, for example, Bitcoin is halving in 2024? Past instances of halving episodes have led to a bull market.

All this study will improve your odds of success later.

Timing

Crypto is not a bad investment as such. It is only a bad investment if you buy blindly. Chase at the wrong time; or take outsized risk for a small reward. Risk, as Warren Buffett sees it, comes from not knowing what you’re doing.

Source: CoinMarketCap.com

The future of crypto?

Crypto, despite being mired in a winter, is still a vibrant industry.

Numerous crypto projects are being invented, funded and rolled out globally. Of course, not all these projects will survive into the future. Many will fall by the wayside when revenue or users fail to reach projected levels. It is a bit like those early internet companies back in the nineties. For every Google, there are many (defunct) Alta Vista.

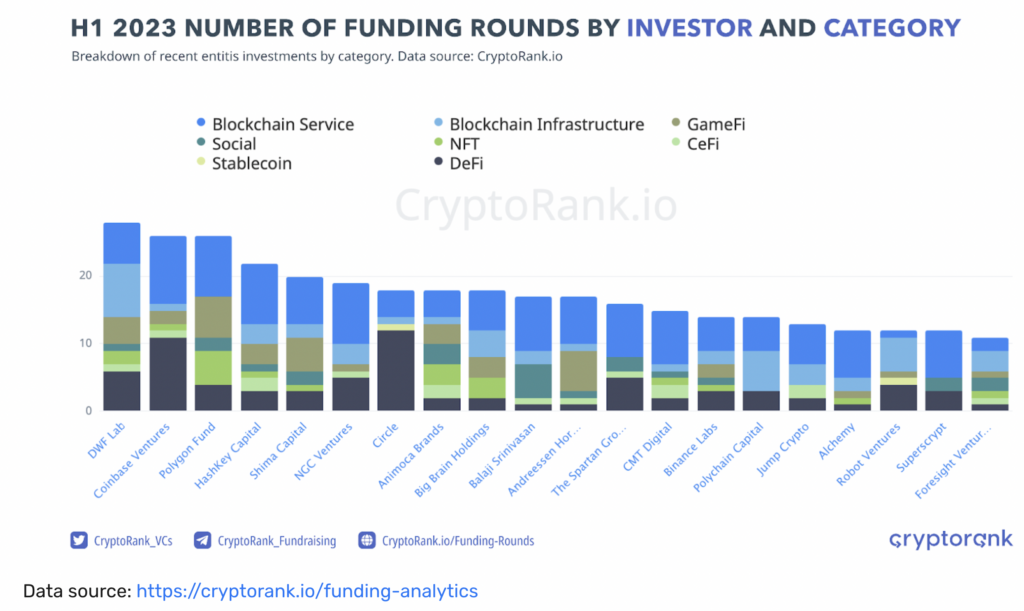

Smart money

To see where the crypto industry is heading, follow the ‘smart money’. In H1 of 2023, many capital providers have invested in Blockchain Service or Blockchain Infrastructure (see below). Web3, DeFi, NFT Gaming – are all still making some headway.

Many of these projects may eventually survive and grow into healthy entities.

Source: cryptorank.io

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com