Can Bitcoin reach $100,000 by end-2024?

Mr Market, we are told, regularly swings from pessimism to euphoria. Prices therefore tumble or surge in accordance to the mood fluctuations. For new investors, this sort of manic behaviour is daunting. For seasoned professionals, violent price swings are a fact and, naturally, to be taken advantage of.

You don’t need to search far and wide for an asset which is currently gripped by extreme greed. One is staring right at you: Bitcoin.

Since the election of Donald Trump as the 47th US president two weeks ago, the entire crypto market has been celebrating wildly. Optimism permeates the sector as investors anticipate a crypto-friendly administration. “We have,” declared Michael Saylor of Microstrategy immediately after the election, “a #Bitcoin President.”

No wonder that Bitcoin, the largest of all crypto coins, just rose and rose. In the two weeks after the US election, prices skyrocketed to an eye-watering $97,000 per digital token. Only last month, it traded at the more subdue level of $68,000 (see below).

Can Bitcoin cross the magical six-digit mark of $100,000? To many, it seems like a foregone conclusion – since we only talking a minuscule $2,500 from the current pricing. Bitcoin’s historical wide volatility means prices can easily traverse that amount in a matter of minutes. Bitcoin bulls will want to smash that psychological mark. In financial markets, strength begets strength.

The more interesting question, though, is what happens when Bitcoin reaches $100,000? There are three potential outcomes.

- Profit taking

- Further buying

- Immediately retracement

Bitcoin is on an uncharted territory here. For all we know, money is still overflowing to the asset. Spearheading this army of Bitcoin stacker is Microstrategy. Under Saylor, the company has transformed its fortunes by adopting Bitcoin for its treasury. Only days ago, the company announced that it owns a staggering 331,200 BTC – with a market value of nearly $33 billion. So large are MSTR’s recent purchases – 51,780 BTC – that it outpaced BTC acquisitions from major Bitcoin ETFs!

Source: X.com

But Saylor’s appetite for Bitcoin, like many others, is still insatiable. As we speak, the company is issuing even more fiat notes (in the form of debt and equity) to buy more Bitcoins. This week, the company promptly increased its 0% convertible notes offering from $1.75 to $2.6 billion in order to satisfy the strong demand for its paper securities (details here). Note this feature: zero coupon. In the world of never-ending inflation, that kind of bond is fast becoming a rarity. Is this a mark of investor confidence, or a sentiment of hubris and irrationality? Hard to know which in today’s febrile crypto climate.

Given its BTC stash, the market now sees MSTR as a leveraged play on Bitcoin. Its share price is outperforming even Bitcoin. Microstrategy’s pole-vaulting share price – 1-year return at a spectacular 827% – is fast creating a $100-billion company, with a market cap now ahead of Intel. When a bull trend is firmly in motion, nothing could shake the trend.

Why am I discussing Microstrategy’s Bitcoin strategy? What has it got to do with Bitcoin prices? After all, it is just one company buying crypto coins (a ‘whale’, in crypto speak).

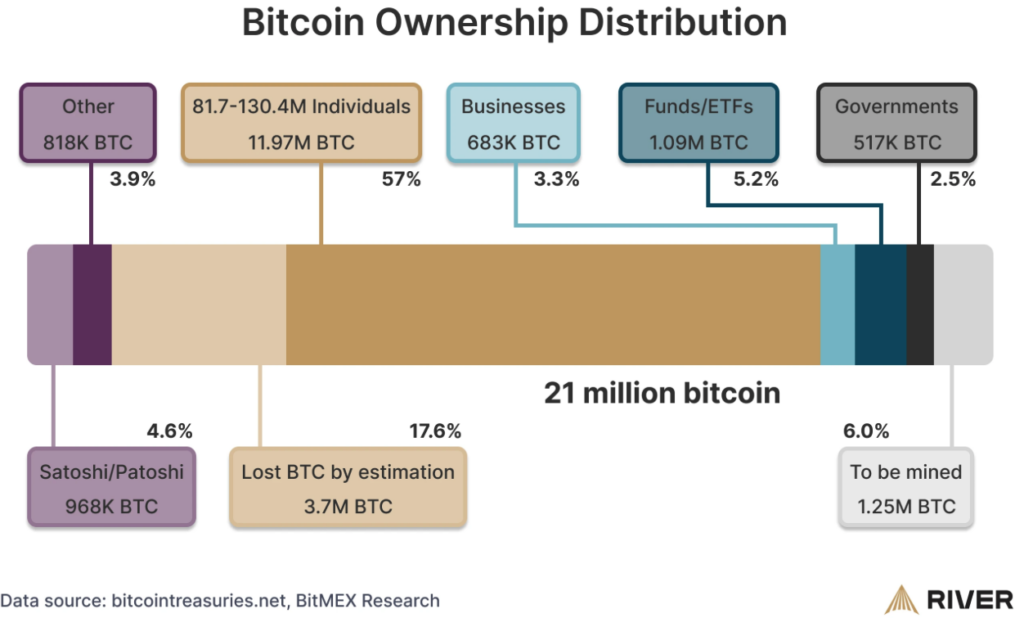

Remember, though, Bitcoin is limited. Only 21 million BTCs are allowed to be created under the original protocol. In essence, the more MSTR hoards, the less BTCs are available in the market. This is a classic supply reduction strategy. Currently, the Bitcoin ownership distribution is as follows:

Source: river.com (Nov 2024)

Amongst the public companies, MSTR is certifiably the largest holder of Bitcoins. The next in line is Marathon Digital (MARA), which holds about 27,000 BTC. The company is also fast aping MSTR’s strategy; it issued debt this month to acquire more BTCs. This behaviour is only natural. As Bitcoin appreciates, investors hoard supply. Prices then go up faster, which leads to further hoarding – et cetera. By design or by chance I do not know, but it seems a supply squeeze is happening. A low BTC price serves no one well.

How will this Bitcoin boom end?

Bull markets are creatures of a well-oiled credit market, unshakeable faiths in the asset, and self-validating price moves. Bitcoin has all three. Its cultish following ensures an ample demand.

Moreover, a booming prices drive a ‘Bitcoin rush’ , where easy profits lured even more unsuspecting investors. Quick profits from ‘Memetraders’, for example, are proliferating on the popular websites (see right). Profits from major coins will flow to riskiest assets – as traders chase bigger and bigger returns. ‘When Lambo?’, after all, is a powerful call-to-action. To the point where even conservative treasurers and investors feel they have to participate in some way. “Nothing,” asserts JP Morgan, “so undermines your financial judgement as the sight of your neighbour getting rich.”

Reality, however, can still bite. Remember FTX? Main actors from that implosion are still in court today for crypto fraud.

The script for Bitcoin is already well rehearsed. Bullish catalysts set fire under Bitcoin prices ($150,000 in 2025?), investors pile in, and use massive debt to enhance returns. Main Street follow profits. Then, macro conditions deteriorate, deeper-than-expected corrections wipe out overleveraged institutions and the boom ends.

Where are we now? As Trump presidency is about to unfold, perhaps the greatest crypto show will go on into 2025. Stay tuned.

Source: cointelegraph.com

Featured Bitcoin Platforms

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.