Robinhood HOOD US is one of the largest commission-free retail brokers. Historically the firm has operated solely in the US, but more recently it has started to look overseas, returning to London, with a view to expanding into Europe and Asia thereafter.

Robinhood held a capital markets day for investors this week, at which it outlined its plans for both geographic and product expansion, which included a comment about the possibility of branching into sports betting.

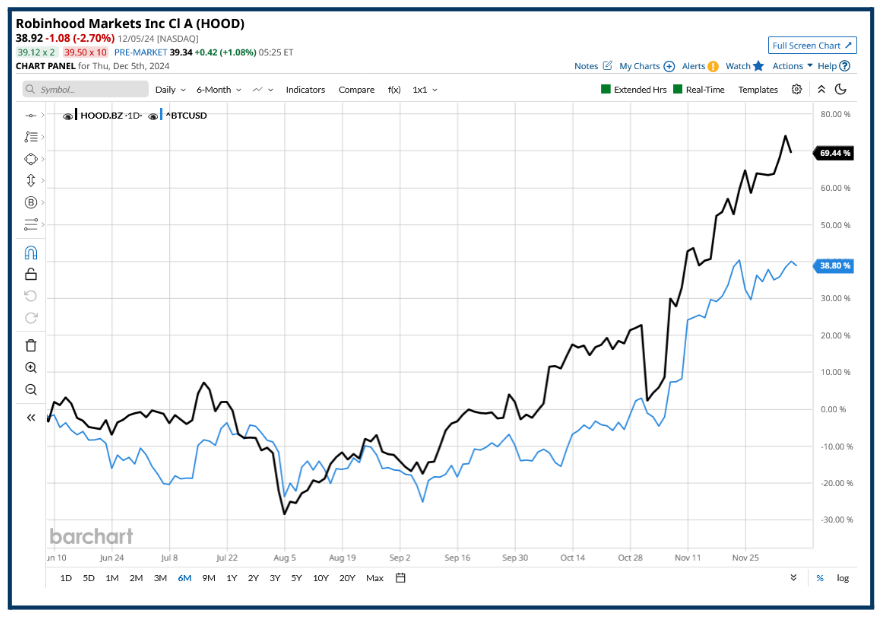

The recent run up in Robinhood stock, which is up almost +56.0%,over the last month, can in part be linked to the rally in Bitcoin, and the explosion of interest in the wider Crypto markets among retail traders.

That’s not always apparent to UK investors thanks to the FCA’s prohibition on crypto derivatives in Great Britain.

Robinhood is thought to have acquired as many as 400,000 new customers during November many of those no doubt drawn to the firm’s crypto offerings.

Brokers and banks liked what they saw and heard at the Capital Markets Day. Deutsche

Bank flagged that Robinhood’s November metrics were much better than anticipated.

Deutsche said that the investor day event bolstered their optimism regarding Robinhood’s long-term revenue and earnings growth potential, leading to our revised price target and reiteration of the Buy rating.

Robinhood saw Q3 2024 revenues grow by +36.0% year over year to almost $640 million.

The trading platform has added index futures and options trading to its product suite, and now trades twenty cryptocurrencies and tokens, and will add additional futures trading in 2025.

Morgan Stanley, who have an overweight recommendation, said the company is aiming to become a leading platform in active trading, and both Piper Sandler and Berntein raised their price targets.

Among the 17 analysts that follow the stock, there are 10 buy recommendations.

However the consensus price target for the stock is $32.70 which is more than $6.0 below the current price of $38.92.

Robinhood recently traded above its IPO price,touching a high of $42.76 before retreating.

Highly rated

Given that Robinhood trades on a trailing PE of 67.80 times, and a forward PE of 52.40, that pull back is hardly surprising.

These multiples are way ahead of rivals like Interactive Brokers IBKR which trades on a forward PE of 27.40 and Charles Schwab SCHW which is on 26.0 times earnings.

You can see hope Robinhood compares in valuation terms to a selection of its peers and competitors in the stable below

| Symbol | Name | P/E fwd | Div Yield | Price/Sales | Price/Cash Flow | Book Value | Price/Book | 5Y Div% |

| HOOD | Robinhood Markets Inc Cl A | 52.36 | 0.00% | 18.96 | N/A | 8.15 | 4.74 | 0.00% |

| BLK | Blackrock Inc | 24.00 | 1.96% | 8.98 | 25.22 | 271.75 | 3.82 | 65.43% |

| GS | Goldman Sachs Group | 16.21 | 1.99% | 1.73 | 14.68 | 386.10 | 1.75 | 233.33% |

| IBKR | Interactive Brokers | 27.41 | 0.54% | 10.11 | 112.09 | 37.88 | 4.93 | 0.00% |

| JEF | Jefferies Financial Group Inc | 16.60 | 1.80% | 1.82 | 42.88 | 49.23 | 1.58 | 438.18% |

| MKTX | Marketaxess Holdings | 35.64 | 1.13% | 12.44 | 29.65 | 36.72 | 7.16 | 71.43% |

| MS | Morgan Stanley | 17.81 | 2.84% | 2.18 | 15.51 | 64.41 | 2.23 | 195.45% |

| NAVI | Navient Corp | 6.10 | 4.24% | 0.34 | 4.77 | 25.09 | 0.60 | 0.00% |

| NMR | Nomura Holdings Inc ADR | 10.25 | 4.25% | 1.70 | 11.81 | 7.66 | 0.82 | 140.00% |

| PIPR | Piper Jaffray Companies | 29.13 | 0.78% | 4.41 | 27.62 | 76.95 | 4.35 | -28.71% |

| RJF | Raymond James Financial | 15.27 | 1.09% | 2.27 | 14.94 | 56.65 | 2.94 | 48.35% |

| SCHW | The Charles Schwab Corp | 25.99 | 1.23% | 7.70 | 17.26 | 26.55 | 3.79 | 117.39% |

| SF | Stifel Financial Corp | 17.66 | 1.48% | 2.67 | 14.41 | 54.21 | 2.39 | 350.00% |

| VIRT | Virtu Financial Cm A | 14.02 | 2.53% | 2.54 | 15.00 | 9.18 | 4.13 | 0.00% |

| WT | Wisdomtree Inc | 17.63 | 1.05% | 4.81 | 22.96 | 2.47 | 4.62 | 0.00% |

Source: Darren Sinden

Robinhood is priced for growth and it can certainly deliver that

However what it has struggled with in the past is consistency, after all it’s probably the most cyclical business in a highly cyclical industry.

Robinhood’s more established peers have diverse income streams that aren’t so closely correlated to market and trader sentiment.

For example, fee income from wealth management and assets under management. Rather than commissions and fees from assets under administration, which are far less sticky.

Perhaps the trick for Robinhood will be to offer a wider range of complementary services to its 24.30 million customers, services that could offer the platform a higher margin and which shift the business model from being purely volume and activity based.

Robinhood’s quarterly operating costs are also a source of concern to this analyst at least, rising by +12.0% in Q3 year over year to US $397.0 million though that is below the US$407.0 million it racked up in expenses during Q2 2024.

Of course if cost reductions and increased income can be generated at the same time, then that should provide a significant boost to the bottom line.

Robinhood Share Price Outlook

Forecast

Robinhood is the archetypal disruptor in a sector that’s full of longstanding incumbents however firms like Schwab and Interactive brokers were disruptors themselves back in the day so Robinhood has its work cut out.

Retail traders especially those in the Millenial and Gen Z cohorts love Robinhood and have flocked to the broker in their millions.

However, these are often low value accounts from which the firm generates only modest revenue, what’s more in the past these accounts have often “blown up” through over trading in meme stocks and alike.

The real challenge for Robinhood is to show that it’s relevant to a more affluent, longer term customer base, whether that’s high worth individuals or even institutional customers.

Though retail order flows apart it’s hard to see what the appeal of Robinhood to institutional traders would be.

It’s probably best to think of Robinhood as a proxy for investor sentiment whilst remembering that irrational exuberance can lead to bubbles.

Don’t chase the stock at these levels if you want to own them, maybe buy Robinhood shares on dip.

Pros

- Cyclical stock that’s geared towards retail trading activity in multiple assets classes in the world’s largest financial services market. A bull market stocks in every sense luckily we are in one.

- Client numbers are growing again as cryptocurrencies enjoy a renaissance, revenues grew by +36.0% year over in Q3 24.

- Future growth likely from new geographies and products.

Cons

- Robinhood trades on multiples that are way ahead of the peer group, very hard to justify this valuation premium based on the current business model, or without additional higher margin services and products.

- Cyclicality is inherent in the stock and its business and that’s very difficult to hedge against as a holder.

- Highly rated and trading above Wall Street analyst’s consensus price target. Robinhood needs to maintain its growth trajectory and keep costs in check if investors are to be kept happy, making it far easier to disappoint the market from here on in.

-

Outlook

(3)

Overall

3

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.