It’s easy to get caught up in the excitement of how the Nvidia share price has almost stratospherically risen nearly 2,000% over the last five years. But unlike Gamestop, Nvidia is not a meme stock, even though it has at times experienced volatility similar to meme stocks, especially during periods of heightened interest in AI and tech.

Nvidia is actually a pioneering company with solid fundamentals, strong leadership, a market leader with significant institutional support.

Strong Fundamentals

Nvidia is a leading semiconductor company known for its high-performance GPUs, widely used in gaming, AI, data centers, and autonomous vehicles. Its success is driven by real demand and innovation.

| YoY Change | Jan-24 | Jan-23 | Jan-22 | |

| Total Revenue | 125.85% | 60,922 | 26,974 | 26,914 |

| Operating Revenue | 125.85% | 60,922 | 26,974 | 26,914 |

| Cost Of Revenue | 43.06% | 16,621 | 11,618 | 9,439 |

| Gross Profit | 188.49% | 44,301 | 15,356 | 17,475 |

Market Leadership

Nvidia holds a dominant position in graphics and AI technology, making it a core stock in the tech industry rather than a speculative play like most meme stocks.

Nvidia is the top designer of discrete graphics processing units that enhance the experience on computing platforms. The firm’s chips are used in a variety of end markets, including high-end PCs for gaming, data centers, and automotive infotainment systems.

In recent years, the firm has broadened its focus from traditional PC graphics applications such as gaming to more complex and favorable opportunities, including artificial intelligence and autonomous driving, which leverage the high-performance capabilities of the firm’s products.

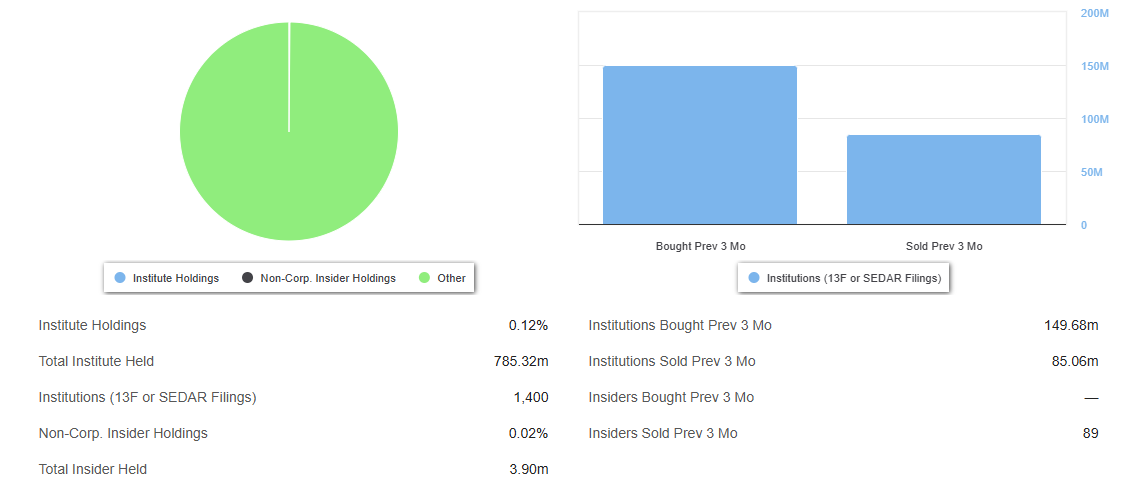

Nvidia has institutional shareholders.

Unlike meme stocks (e.g., GameStop or AMC), which rely heavily on retail hype, Nvidia is a favourite among institutional investors and is frequently included in major stock indices.

Valuation Driven by AI Boom

Nvidia’s valuation surged significantly in 2023-2024 due to its pivotal role in AI technology, including supplying GPUs for companies like OpenAI and Google.

Meme Stock-Like Behavior

Nvidia’s stock has occasionally seen rapid spikes and corrections, leading to comparisons with meme stocks. For example, its valuation hit historic highs as retail investors jumped on the AI trend.

But, there are those that believe it still has a future, we spoke a top UK fund manager about where he thought the Nvidia share price will be in fives years time.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.