Saxo General Investment Account Review: Superb DMA Access & Service

Account: Saxo General Investment Account

Description: Saxo’s GIA is one of the most advanced accounts for UK long-term investors with access to more than 50 stock exchanges around the world and 22,000 instruments available to invest in. Saxo’s forte is as a trading platform for professional and institutional short and medium-term speculators as it offers direct market access and very low commissions. A good choice for large, active investors. Capital at risk

Is Saxo's GIA a Good Account?

As well as being one of the best trading platforms, Saxo has good accounts for long-term investments. The platform has recently introduced mutual funds for investors who want to quickly build a diversified portfolio. And income investors can access a huge range of retail and institutional-grade bonds.

On balance, though, I’d say that Saxo remains more of a trading platform than an investing account. So if you’re primarily a high-risk trader and you want to incorporate some longer-term “safer” investments into your portfolio, Saxo is a good place to invest alongside your shorter-term speculation. Saxo is also one of the best brokers for earning interest on your uninvested cash.

Compared with other retail investing accounts like eToro, Saxo is a much better option because of market range, customer service and tax-free products like ISAs and SIPPs.

Fees

Saxo charges €10 a month or 0.12% a year (whichever is higher) based on the value of your portfolio. If you have a VIP account this fee drops to 0.08%. Dealing charges, which are a percentage of transaction size, are competitive – and UK shares trading commission starts at 0.1% (£100 if you buy £100,000 worth of stock) and drops to 0.05% for more active traders.

Special Offers

Platinum. If you have £200,000 or more on account, you can apply for 30% lower transaction and account costs.

VIP. For accounts with portfolios over £1m, you get even better pricing, direct connection to experts, 1:1 SaxoStrats access and event invitations.

What is Saxo’s Platform Like to Use?

Saxo’s investment platform provides exceptional access to the global markets.

Pros

- Direct market access

- Excellent platform

- Low commissions

Cons

- May be too complicated for beginners

- Subscription fees for live pricing

-

Excellent

(5)

Overall

5SaxoInvestor UK First Look – Is it good for beginner investors?

30th September 2024

To answer your question straight away, as I know that is probably all you want to know, yes, I think SaxoInvestor is good for beginner investors. If you’re interested in knowing why, read on. If you don’t care why, just click here to open an account (capital at risk, I have to say that in case you lose money as it’s an affiliate link and we get a referral fee for introducing new customers to Saxo). But more importantly, if you do go on to open an account, please come back and tell us what you think of Saxo here.

However, what if you want to know why SaxoInvestor is good for investors I schlepped all the way to Canary Wharf in the pouring rain last week to sit down with Jeff Clarke (who’s been with Saxo in the UK for six years now) to have a first look at the new SaxoInvestor platform – which is aimed squarely at those that want to invest, rather than trade.

There has been a growing trend for trading platforms to offer investment services; as I am sure you will know from watching our interview with the UK Saxo CEO, Andrew Bresler, that’s what people want, it’s what the regulators want, and overall it’s good for you too.

Trading is not for everyone; it’s high risk, but also high reward. However, you just have to compare risk warnings on all CFD brokers’ websites to see how many people make money from it.

But investing is different; one of the things I discussed with Jeff was how easy people nowadays have it, and if we’d had all this tech and ability to invest on a regular basis with such low commissions, we’d all be rich from compounding returns from the simplest of globally diversified funds.

But anyway, after I’d finished chucking at the American Football sculpture in reception, titled “F*$k You Art Lovers” we sat in the lovely corner office that Saxo has in it’s Canary Wharf HQ, to demo the platform. I’ve been there years before to demo the main trading platform TraderGo, and wow, has Canary Wharf grown upwards, buy-to-lets as far as the eye can see…

But, the platform was reassuringly familiar, as obviously, because what Saxo has done is essentially reskin the excellent TraderGo platform they offer traders. Becasue the feedback they had got from investors (not traders) is that it’s too daunting. Black backgrounds, flashing prices and derivative products that are far too complex for the majority of investors was putting them off.

So, SaxoInvestor is built on robust and institutional grade technology, but will all the bells and whistles taken out. It’s clean, simple and easy to use. Ideal for any investors just starting out. The app is the same too, a trimmed-down version of what the professionals get.

This was good to see, because when CMC Markets started to offer CMC Invest alongside their CFD and financial spread betting products, they built their investing app from scratch. Now I always thought their platform was great, so thought it was an odd move. If you must know, it’s to do with a healthy dose of inter-regional corporate competitiveness.

But with Saxo, your SaxoInvestor account is linked to the SaxoGo platform, so as you become a more sophisticated investor and your portfolio grows, you can utilise more complicated products like options or futures for hedging your long-term portfolio in the short-term.

In line with Saxo’s recent commission reductions, it’s cheap too. As I noted from my journey home into the depths of Canary Wharf tube station, it costs $1 a trade to buy US stocks, versus AJ Bell’s £5 and Hargreaves Lansdown’s £11.95. Plus, the account fee is lower too, 0.12% for stocks, ETFs and bonds in a classic account. Although this is not capped, but if your account gets bigger, you can upgrade to a VIP account where fees are reduced to 0.08%. Interestingly enough, Saxo’s advert was on the big screen in rotation with CMC Markets (and a musical), which I thought was quite apt, considering the similarities.

Also, if you are just planning on buying US stocks (as most people are), then you’ll also save on conversion fees. Saxo only charges, 0.25% on FX, which is cheaper than low cost apps like Lightyear’s 0.35%, or the whopping 1.5% that Interactive Investor charges. It’s still not the cheapest though, that crown belongs to Interactive Brokers.

Plus, if you are invested in US stocks you can have a USD account and a GBP account, which can reduce the amount of currency conversions you need to do.

There are a few downsides though. Firstly, you have to subscribe to live prices becuase the stock exchanges charge all brokers for them. And in Saxo’s case, they pass that on to clients, which is understandable for high-frequency derivative traders because level-2 pricing is fairly essential. But for smaller and beginner investors, I’d say free live pricing is a basic platform requirement these days.

Also, for such a giant broker, I’d expect them to offer mid and smaller cap stocks on the AIM market online for investors. Which Saxo doesn’t. You can still buy them over the phone, but that costs a bit more. However, if you ask nicely, they’d probably add it to the platform for you…

There is also no auto investing where you can buy regular investments to “set and forget”.

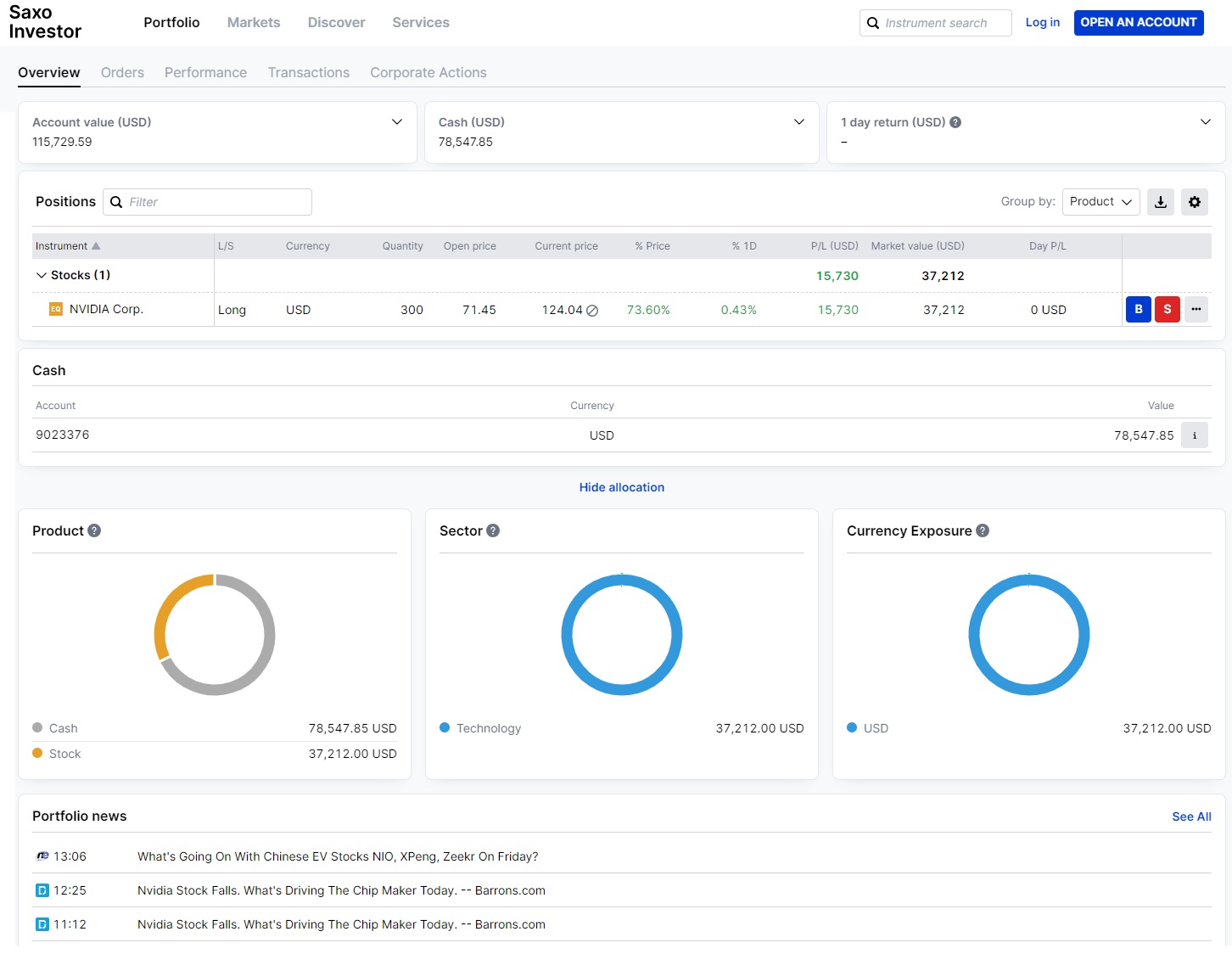

But overall, I’ve always liked Saxo, I like the pies (which is the Gen Z term for Pie Chart) that show where your portfolio is based graphically by product, sector and currency. Saxo has a full suite of account types, including a general investment account, SIPPs and stocks and shares ISAs, so you can manage the majority of your investments in one place.

One great feature is the education tab, which includes thematic guides on sector investing, a good corporate action section so you can vote at AGMs for companies you own, and a discover tab for stimulus if you’ve run out of investing ideas. And if you are interested in index investing, you are shown a list of index-related stocks and ETFs, to help build a more diverse portfolio.

Overall, I think SaxoInvestor is an excellent choice for beginner investors who want to start small but have ambitions of managing a larger portfolio.

Compare Saxo against other general investment accounts below:

| GIA Account | Good For | Account Fees | Dealing Fees | FX Fees | Customer Reviews | More Info |

|---|---|---|---|---|---|---|

| Active Investors | £24 - £0 Quarterly | £0 | 0.5% | (Based on 678 reviews)

| Start Investing Capital at risk |

| Fixed Fees | £4.99 Monthly | £3.99 | 1.5% - 0.25% | (Based on 1,119 reviews)

| Start Investing Capital at risk |

| Regular Investing | 0.6% | n/a | n/a | (Based on 2,564 reviews)

| Start Investing Capital at risk |

| Everything | £0 | £3 | 0.02% | (Based on 934 reviews)

| Start Investing Capital at risk |

| Portfolios | 0.75% - 0% | £3.95 | 0.7% | (Based on 235 reviews)

| Start Investing Capital at risk |

| Low Costs | 0.25% - 0% | £5 - £3.50 | 0.75% - 0.5% | (Based on 1,094 reviews)

| Start Investing Capital at risk |

| Customer Service | 0.45% - 0% | £11.95 - £5.95 | 1% - 0.25% | (Based on 1,758 reviews)

| Start Investing Capital at risk |

| Professionals | 0.4% – 0.08% | £1 - 0.08% | 0.25% | (Based on 73 reviews)

| Start Investing Capital at risk |

| US Investing | £0 | £0 | 1.5% - 0.75% | (Based on 277 reviews)

| Start Investing Capital at risk |

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com