In this review, we look at the Lightyear Cash ISA and compare it with the Cash ISAs offered by other providers in 2026.

What is the Lightyear Cash ISA?

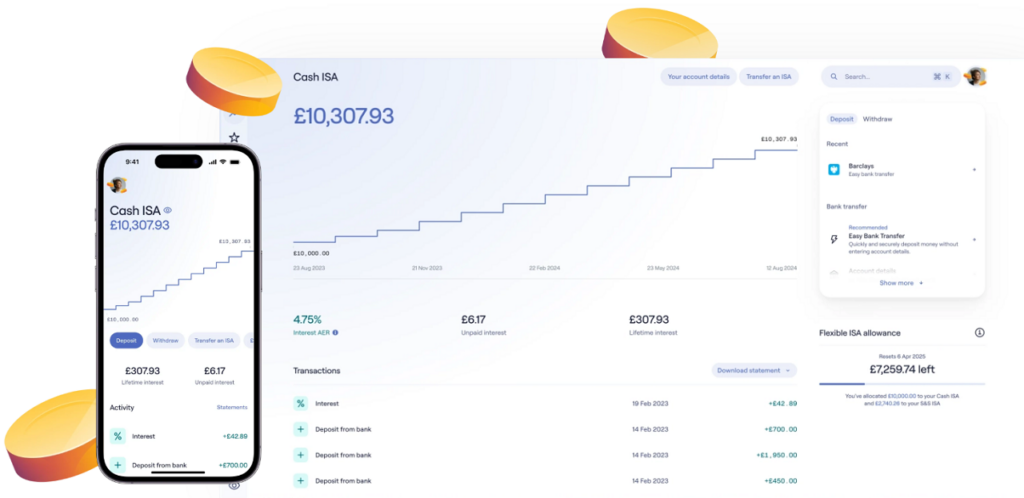

Lightyear, the investment platform founded by former Wise executives Martin Sokk and Mihkel Aamer, offers both a Cash ISA and a Stocks & Shares ISA as part of its UK investing app.

ISAs allow you to save up to £20,000 per tax year (6 April to 5 April) without paying tax on the interest you earn. A Cash ISA is designed for holding savings rather than investing in markets, making it a lower-risk option, although long-term returns are typically lower than investing.

Lightyear Cash ISA Review: Interest paid based on the Bank of England’s base rate

Account: Lightyear Cash ISA

Description: Lightyear’s Cash ISA currently pays 3.75% AER, designed to closely follow the Bank of England base rate. The account is fully flexible, has no account fees, no withdrawal penalties and no minimum deposit, and avoids short-term bonus rates that later drop. Savings are held across UK banks and qualifying money market funds, with FSCS protection applying to cash held in partner banks.

How does the Lightyear Cash ISA compare with rivals?

The Lightyear Cash ISA remains competitive thanks to its simple pricing, flexible terms and rate that tracks the Bank of England base rate, currently 3.75% AER (variable). You can withdraw and replace money without affecting your £20,000 ISA allowance, and there are no account fees, transfer charges or short-term bonus rates that later drop.

While the rate is solid, it now sits more in the middle of the market in 2026, with some rivals like Tembo offering slightly higher easy-access ISA rates. However, many of those come with bonus periods, withdrawal limits or tiered rates that can fall after the first year. Lightyear’s appeal is its straightforward approach: one variable rate that follows the base rate and no penalties for withdrawals.

Lightyear UK is authorised and regulated by the Financial Conduct Authority (FCA). FSCS protection applies to cash held with partner banks (typically up to £85,000 per person per bank), though this protection does not apply to money held in qualifying money market funds.

Pros

- Interest rate tracks Bank of England base rate

- Fully flexible

- No hidden charges

Cons

- Not the highest rate

- Lightyear is a new provider

- No fixed rate

-

Cash ISA Rating

(5)

Overall

5

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.